Minimum wage laws are politically popular. According to the narrative, benevolent politicians raise the minimum to force greedy businesses to pay their workers a decent wage. It sounds great, doesn’t it? It seems like a victory for the little guy.

The problem is you can’t suspend economic laws by government edict.

One of the biggest enduring economic myths is the notion that the minimum wage laws only help workers and have no real negative effects. The fallacy inherent in this line of thinking becomes immediately clear if we simply propose a $ 1,000-per-hour minimum wage. After all, if $20 is good, $1,000 would be fantastic, right?

Of course, nobody would pay a worker $1,000 per hour to perform a low-skill task. You’d never get any kind of return on that investment, and it’s obviously unaffordable. A $15 per hour minimum is just slightly less unaffordable. It’s only a matter of scale.

The smaller scale of a hike to $15 makes the effects much less obvious – sometimes completely invisible. But the same fundamental economic reasons a $1,000 per hour minimum wage would never work make a $15 minimum just as economically unviable.

Nevertheless, as long as we have politicians, they will pander to “workers” and pass these economically damaging laws. And as long as there are minimum wage laws on the books, some low-productivity workers will go without jobs.

A wage is nothing more than the price of labor. And labor is subject to the laws of supply and demand. When you raise the price of something, demand falls. That means raising the price to hire somebody will ultimately mean fewer people get hired.

It’s critical to understand that governments can force employers to pay you minimum wage. But they can’t force a company to hire you.

CALIFORNIA: A REAL WORLD EXAMPLE

California workers are going to learn this economic lesson the hard way.

A $20 per hour minimum wage for restaurant workers in California will go into effect in April. To cope with the increased cost of labor, two Pizza Hut operators plan to eliminate delivery service. That means some 1,200 delivery drivers will go from making their current wage to earning zero.

“PacPizza, LLC, operating as Pizza Hut, has made a business decision to eliminate first-party delivery services and, as a result, the elimination of all delivery driver positions,” the company said in a statement.

Southern California Pizza Co. also gave notice that it will discontinue delivery service.

Restaurant industry analyst Mark Kalinowski told Business Insider that he expects “more harm to come” from the law as fast food chains “take action in an attempt to blunt the impact of higher labor costs.”

Some of that pain will fall on customers. Pizza lovers will now have to pick up their orders or depend on third-party delivery services such as DoorDash and Uber Eats. Meanwhile, McDonald’s and Chipotle have already indicated that they will raise menu prices.

Gov. Gavin Newsome signed the FAST Act into law in 2022. The original plan would have raised the fast food industry minimum wage to $23 per hour. In a compromise, a law passed last year set the wage at $20. The wage applies to California-based fast-food chains with 60 or more locations nationwide.

WHAT’S WRONG WITH A MINIMUM WAGE?

Nick Giambruno did a good job of explaining the problem with minimum wages in an article published by the International Man. He points out that minimum wage laws are simply price controls.

In this case, a control on the price of labor. And price controls always create destructive distortions in the market. Here, that means unnecessary unemployment and artificially high prices passed on to consumers. Even the Congressional Budget Office admits that 500,000 jobs would be lost if the US government raised the federal minimum wage from $7.25 to $10.10.”

Giambruno illustrates this point by making a comparison that’s easy to wrap your head around. Imagine if the government set the minimum price for an aluminum can at $5. In that scenario, Coca-Cola would have to charge over $5 for a can of Coke. Would you shell out more than five bucks for a can of Coke?

Me neither.

In this scenario, we’d end up with a glut of Coke cans sitting on store shelves.

In this scenario, the problem isn’t that people don’t want Coke. They do. The problem is the artificially high price of aluminum cans… which leads to the artificially high price of Coke… that just sits on shelves, gathering dust, until eventually, Coca-Cola drastically cuts back production because of lack of demand.”

In all likelihood, Coca-Cola would just switch to exclusively using glass or plastic containers. The $5 minimum can price that was supposed to help the can companies would actually hurt them over the long term.

Now, just substitute aluminum cans for labor and you have the same scenario.

A similar dynamic plays out when the government mandates the price of labor. But instead of Coke cans, potential employees sit on the shelves while employers eliminate jobs they otherwise wouldn’t, and are forced to pass on higher prices to consumers when they otherwise wouldn’t. The plain truth is, not every job generates $15 an hour worth of output. And some workers would much rather accept jobs that pay less than $15 than have no job at all.”

Minimum wage advocates seek to solve a legitimate problem facing American workers: their dollars buy less and less every year. But simply mandating employers fork over more dollars is a little like putting a band-aid on an amputation. It doesn’t do anything to address the underlying problem. We don’t have a wage problem. We have a money problem.

]]>Over the last month, loans outstanding in the Federal Reserve bank bailout program increased by $17.24 billion. It was the second month we’ve seen borrowing from the Bank Term Funding Program (BTFP) surge. And the pace of borrowing is increasing.

Between December 13 and December 20, the balance in the BTFP grew by $7.57 billion.

As of Dec. 20, the balance in the BTFP stood at just under $133.34 billion. It’s the largest balance since the program was created in March.

The increase in banks tapping into the BTF started in November. As you can see from the chart, borrowing had leveled off in August before the sudden spike in November. Keep in mind that banks were still tapping into the bailout even as the total balance in the program plateaued. Some banks were paying off loans as others borrowed.

This surge in bank bailout borrowing would seem to indicate more banks are struggling in this high interest rate environment, and the financial crisis that kicked off in March continues to boil under the surface.

But thanks to the Fed bailout, the crisis remains “out of sight, out of mind.”

WHAT IS THE BTFP?

After the collapse of Silicon Valley Bank and Signature Bank, the Fed created the BTFP, allowing banks to easily access capital “to help assure banks have the ability to meet the needs of all their depositors.”

The BTFP offers loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. Banks can borrow against their assets “at par” (face value).

According to a Federal Reserve statement, “the BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

The ability to borrow against the face value of their bond portfolios is a sweetheart deal for banks given the big drop in bond prices over the last year-plus.

Fed interest rate increases to fight price inflation decimated the bond market. (Bond prices and interest rates are inversely correlated. As bond prices fall, bond yields increase.) With interest rates rising so quickly, banks could not adjust their bond holdings. As a result, many banks have become undercapitalized on paper.

According to the FDCI, unrealized losses on securities climbed to $683.9 billion in Q3. That represented a 22.5% jump from the second quarter. Rising mortgage rates reducing the value of mortgage-backed securities drove the increase.

The BTFP gives banks a way out, or at least the opportunity to kick the can down the road for a year. Instead of selling bonds that have dropped in value at a big loss, banks can go to the Fed and borrow money at the bonds’ face value.

PAPERING OVER THE PROBLEM

The creation of the BTFP allowed the Federal Reserve to paper over the banking crisis its interest rate hikes created. But what happens when the loans come due?

In the first week of the BTFP, banks borrowed $11.9 billion from the program, along with more than $300 billion from the already-established Fed Discount Window.

The Discount Window requires banks to post collateral at face value and loans come with a relatively high interest rate and must post collateral at fair market value. While Discount Window borrowing surged in the weeks after the collapse of SVC and Signature Bank, the balances were quickly paid back down, and Discount Window borrowing returned to normal levels.

One would expect borrowing from a bailout program to slow down considerably once the crisis passed. But banks never stopped tapping into the BTFP. And borrowing suddenly accelerated in November.

Notably, the sudden spike in bailout borrowing happened even as the bond market rallied and bonds regained some of their value as the Fed eased off the rate hike accelerator. This ostensibly provided some relief on banks’ balance sheets.

Granted, the $133 billion outstanding appears insignificant compared to the $22.8 trillion in commercial bank assets held by the 4,100 commercial banks in the US. The fact that some troubled banks are still tapping into a bailout program nine months after the crisis doesn’t necessarily mean the banking system is on the verge of collapse. But while the bailouts might not be a fire, it’s at least smoke. There are still problems in the banking system bubbling under the surface.

This is a predictable consequence of the Fed raising interest rates to battle price inflation.

Artificially low interest rates and easy money are the mother’s milk of this bubble economy. With everybody from corporations, consumers, and the federal government buried in debt, this economy and the financial system simply can’t function long-term in a high interest rate environment. The banking crisis earlier this year was the first thing to break as a result of rising interest rates. Other things will follow. We’ve already seen some tremors in the commercial real estate market.

While you might be tempted to blame the Fed’s recent rate hikes for these issues, the real problem started years ago.

After the Great Recession, Federal Reserve policy intentionally incentivized borrowing to “stimulate” the economy. It cut rates to zero and launched three rounds of quantitative easing. After an unsuccessful attempt to normalize rates and shrink its balance sheet in 2018, the Fed doubled down on easy money policies during the pandemic. This monetary inflation inevitably led to price inflation. That forced the Fed to raise interest rates. The central bank appears to have cooled price inflation (for now), but it also broke the financial system.

In effect, the Fed managed to paper over the financial crisis with this bailout program. It basically slapped a bandaid on it. But it has not addressed the underlying issue – the impact of rising interest rates on an economy and financial system addicted to easy money.

And it’s only a matter of time before something else breaks.

]]>In Missouri, Rep Doug Richey filed HB1867 on Dec. 11. Rep. Bill Hardwick filed HB1955 on Dec. 15. The bills are companions to SB735 filed in the Senate by Sen. William Eigel earlier this month.

In Oklahoma, Sen. Shane Jett filed SB1507 and Sen. Nathan Dahm is running SB1508.

The enactment of any of these bills would eliminate state capital gains taxes on the sale and exchange of gold and silver bullion.

Both of these states are already among the 42 that do not levy sales taxes on gold and silver bullion.

Exempting the sale of gold and silver bullion from taxes lowers the investment cost of precious metals. It also takes a step toward treating gold and silver as money instead of commodities. Taxes on precious metal bullion erect barriers to using gold and silver as money by raising transaction costs.

Imagine if you asked a grocery clerk to break a $5 bill and he charged you a 35-cent tax. Silly, right? After all, you were only exchanging one form of money for another. But that’s essentially what a sales tax on gold and silver bullion does. By eliminating this tax on the exchange of gold and silver, Missouri and Oklahoma would treat specie as money instead of a commodity. This represents a small step toward reestablishing gold and silver as legal tender and breaking down the Fed’s monopoly on money.

“We ought not to tax money – and that’s a good idea. It makes no sense to tax money,” former U.S. Rep. Ron Paul said during testimony in support of an Arizona bill that repealed capital gains taxes on gold and silver in that state. “Paper is not money, it’s fraud,” he continued.

The impact of enacting this legislation will go beyond mere tax policy. During an event after his Senate committee testimony, Paul pointed out that it’s really about the size and scope of government.

“If you’re for less government, you want sound money. The people who want big government, they don’t want sound money. They want to deceive you and commit fraud. They want to print the money. They want a monopoly. They want to get you conditioned, as our schools have conditioned us, to the point where deficits don’t matter.”

GOLD AND SILVER AS LEGAL TENDER

Under provisions in the Missouri bill, gold and silver in physical or electronic form would be accepted as legal tender and would be receivable in payment of all debts contracted for in the state of Missouri. The state would be required to accept gold and silver for the payment of public debts. Private debts could be settled in gold and silver at the parties’ discretion.

Practically speaking, this would allow Missourians to use gold or silver coins as money rather than just as mere investment vehicles. In effect, it would put gold and silver on the same footing as Federal Reserve notes.

Oklahoma took a similar step in 2014. Utah and Arkansas also consider gold and silver legal tender.

The proposed Missouri law also includes provisions authorizing the state to invest in gold or silver “greater than or equal to one percent of all state funds” and to expressly bar any state agency, department, or political subdivision from seizing gold or silver bullion.

BACKGROUND

The United States Constitution states in Article I, Section 10, “No State shall…make any Thing but gold and silver Coin a Tender in Payment of Debts.” Currently, all debts and taxes in the US are either paid with Federal Reserve Notes (dollars) which were authorized as legal tender by Congress, or with coins issued by the US Treasury — very few of which have gold or silver in them.

The Federal Reserve destroys this constitutional monetary system by creating a monopoly based on its fiat currency. Without the backing of gold or silver, the central bank can easily create money out of thin air. This not only devalues your purchasing power over time; it also allows the federal government to borrow and spend far beyond what would be possible in a sound money system. Without the Fed, the US government wouldn’t be able to maintain all of its unconstitutional wars and programs. The Federal Reserve is the engine that drives the most powerful government in the history of the world.

Tax repeals knock down one of the tax barriers that hinder the use of gold and silver as money, and could also begin the process of abolishing the Federal Reserve’s fiat money system by attacking it from the bottom up – pulling the rug out from under it by working to make its functions irrelevant at the state and local levels, and setting the stage to undermine the Federal Reserve monopoly by introducing competition into the monetary system.

In a paper presented at the Mises Institute, Constitutional tender expert Professor William Greene said when people in multiple states actually start using gold and silver instead of Federal Reserve Notes, it would effectively nullify the Federal Reserve and end the federal government’s monopoly on money.

“Over time, as residents of the state use both Federal Reserve notes and silver and gold coins, the fact that the coins hold their value more than Federal Reserve notes do will lead to a “reverse Gresham’s Law” effect, where good money (gold and silver coins) will drive out bad money (Federal Reserve notes). As this happens, a cascade of events can begin to occur, including the flow of real wealth toward the state’s treasury, an influx of banking business from outside of the state – as people in other states carry out their desire to bank with sound money – and an eventual outcry against the use of Federal Reserve notes for any transactions.”

Once things get to that point, Federal Reserve notes would become largely unwanted and irrelevant for ordinary people.

These bills make up part of a broader movement at the state level to support sound money.

]]>Chinese investors sold $21.2 billion in US assets in August alone – primarily US Treasury bonds. Meanwhile, the Chinese government has been buying gold at a steady pace.

Writing at FXEmpire, analyst Vladimir Zernov said there are two dynamics driving the Chinese to sell US assets. The first is an effort to boost the yuan.

China’s currency has struggled against the dollar of late due to softness in the Chinese economy and recently hit multi-year lows. Selling dollar-denominated assets for yuan boosts the local currency at the expense of the dollar. Zernov said, “Selling dollar-denominated assets to provide support to yuan makes perfect sense.”

The second potential reason to sell US dollar-denominated assets is for further de-dollarization. In other words, the Chinese may be trying to minimize their exposure to the US currency for economic and geopolitical reasons.

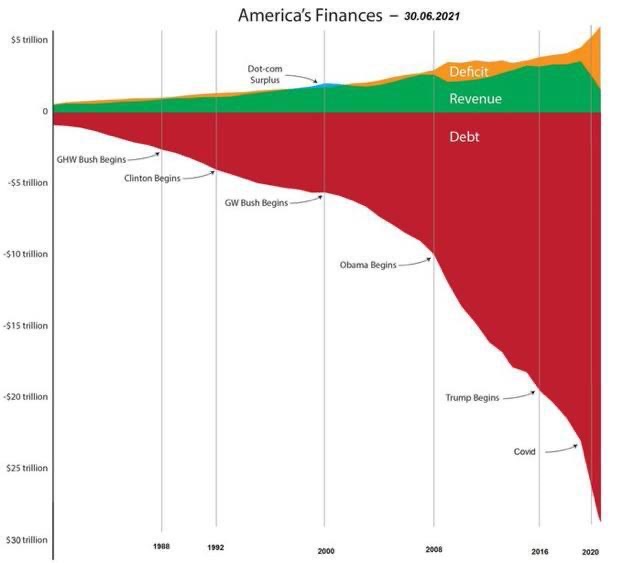

From an economic standpoint, the Chinese have to be keenly aware of the US government’s budget problem. The US ran a $1.7 trillion deficit in fiscal 2023 and has a national debt north of $33.5 trillion. Why would any country want to be exposed to that kind of risk?

Furthermore, the US has a long history of using the dollar’s position as the reserve currency as a foreign policy hammer. By minimizing dependence on the greenback, countries can blunt America’s ability to control their foreign policy decisions.

This is why many countries are trying to minimize their exposure to the dollar. Confidence in the greenback continues to erode thanks to the profligate borrowing, spending, and money creation by the US government, while America’s use of the dollar as a foreign policy weapon also makes many countries wary of relying solely on dollars.

Zernov said that if China is trying to shift some of its money away from the US-controlled, dollar-dominated global financial system, there aren’t many options other than gold.

Gold is one of the few markets that has sufficient liquidity to absorb billions of dollars of China’s funds.”

The Chinese central bank has been on a gold-buying spree. As of the end of August, the People’s Bank of China had bought gold for 10 straight months and ranked as the largest central bank gold buyer this year. The Chinese central bank has increased its official reserves by 166 tons since the beginning of the year and 217 tons since it resumed official purchases last November. As of the end of August, the People’s Bank of China officially held 2,165 tons of gold, making up 4% of its total reserves.

China has a history of adding to reserves and then going silent. The People’s Bank of China accumulated 1,448 tons of gold between 2002 and 2019, and then reported nothing for more than two years before resuming reporting last fall. Many speculate that the Chinese continued to add gold to its holdings off the books during those silent years.

In fact, there has always been speculation that China holds far more gold than it officially reveals. As Jim Rickards pointed out on Mises Daily back in 2015, many people speculate that China keeps several thousand tons of gold “off the books” in a separate entity called the State Administration for Foreign Exchange (SAFE).

Last year, there were large unreported increases in central bank gold holdings. Central banks that often fail to report purchases include China and Russia. Many analysts believe China is the mystery buyer stockpiling gold to minimize exposure to the dollar.

Zernov pointed out that the Chinese tend to move slowly and it remains to be seen if the recent selloff in dollar-denominated assets translates to even more gold demand.

]]>We will see whether the country decided to boost its gold holdings sometime in the first half of the next year. Any signs showing China decided to increase its gold reserves will be bullish for gold and may send its price toward new highs.”

The big increase in debt occurred despite tightening credit conditions, and it is an increasingly worrisome problem because the “free lunch” of artificially low interest rates is over.

Over the last decade, global debt has increased by a staggering $100 trillion.

Combined government, household and corporate debt hit 336% of global GDP in the second quarter of this year. The global debt-to-GDP ratio has increased by 2 percentage points this year. Prior to 2023, the global debt-to-GDP ratio had declined seven straight quarters after reaching a record of 360% at the height of the global pandemic government lockdowns.

About 80% of the new global debt was piled up by developed nations, with Japan, the US, Britain and France leading the way. Among emerging markets, the largest economies saw the biggest debt increases, including China, Brazil and India.

“As higher rates and higher debt levels push government interest expenses higher, domestic debt strains are set to increase,” the IIF said in a statement.

Peter Praet served as chief economist at the European Central Bank. He told Reuters that the debt levels are still sustainable, but the outlook is worrying given the fact that spending needs aren’t going to decline.

You can take many, many countries today, and you will see that we are not far away from a public finances crisis.”

Praet seems over-optimistic.

The US government is over $33 trillion in debt. In fact, the Biden administration managed to add half a trillion dollars to the debt in just 20 days. Meanwhile, with rising interest rates, the federal government is now spending as much to make interest payments on the debt as it is for national defense.

And there is no end to the borrowing and spending in sight.

More than a decade of interest rates pushed artificially low by central banks worldwide incentivized a tidal wave of borrowing. This was intentional. The thinking was that borrowing and spending would “stimulate” a global economy dragged down first by the Great Recession and then by government-instituted pandemic policies. Nobody ever stopped to think the easy-money gravy train might run out of track.

But as Fitch Ratings managing director Edward Parker put it, “That free lunch is over and interest payments are now rising faster than debt or revenue.”

The US economy in particular was built on borrowing and spending. Easy money is its lifeblood. It simply can’t run without artificially low interest rates. The global economy is in much the same boat.

That puts the Federal Reserve and other central banks between a rock and a hard place. They need to keep interest rates high to counteract the trillions of dollars they created and injected into the global economy as stimulus causing a rapid increase in price inflation. But these higher rates will ultimately break things in the borrow-and-spend economy.

]]>Gaetz made the comment while explaining why Republicans have had more public infighting than the Democrats. His recent motion to vacate led to the ouster of former House Speaker Kevin McCarthy.

Gaetz said it is Pelosi’s control of House Democrats which allows them to stay in lockstep.

After Jim Jordan was elected Speaker-Designate on Friday, Speaker Pro Tem @PatrickMcHenry made us take Saturday off, Sunday off, and now MONDAY OFF!

The Swamp is trying to delay a vote on the House floor as long as possible, hoping conservatives will move backward to Kevin… pic.twitter.com/Z9SjqiNRz0

— Rep. Matt Gaetz (@RepMattGaetz) October 15, 2023

“By the way, she’s still the one in charge of that conference,” Gaetz continued on Newsmax’s “Sunday Agenda.” “I mean, Hakeem Jeffries is the front man, but the person who’s really calling the shots among the Democrats is Nancy Pelosi.”

Pelosi, who served multiple stints as House speaker beginning in 2007, stepped down as speaker after the Democrats lost their House majority in 2022, at which point McCarthy began his ill-fated tenure. After Pelosi stepped down, Jeffries took the lead of House Democrats as minority leader in the next session of Congress.

In the same interview, Gaetz speculated that on the Republican side, the vote on Republican Ohio Rep. Jim Jordan was delayed to Tuesday in order for moderate Republicans to reinsert McCarthy into the speaker position. Gaetz supports Jordan in his bid for the House speakership.

“We should not go backward with Kevin McCarthy,” Gaetz said. “We should go forward with Jim Jordan.”

Pelosi and Jeffries did not immediately respond to requests for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>The prevailing attitude is that the US government can borrow and spend indefinitely. After all, it hasn’t caused a problem so far. But a long fuse can burn for a long time before it finally reaches the powder keg.

I don’t know how long we have before the debt bomb explodes, but I do know we get closer and closer every day. And sadly, very few people care enough to address the problem. The recent government shutdown drama is a case in point.

A stopgap spending deal swept the shutdown threat out of the headlines, but it’s still there lurking in the shadows of the halls of Congress. If lawmakers don’t figure something out by Nov. 17, the government will be forced to shut down.

There isn’t much talk about a shutdown right now, but when people do discuss the possibility, they almost always focus on the mythical crisis that shuttering the federal government might cause. That sidesteps the real problem — out of control government spending.

Conventional wisdom is that Congress needs to do whatever it takes to avoid a shutdown. If that means maintaining spending at current levels or even increasing spending, so be it. The handful of intransigent members of Congress who want to hold out for spending cuts are always cast as the bad guys in this kabuki theater. As economist Daniel Lacalle put it in a recent article published by Mises Wire, “The narrative seems to be that governments and the public sector should never have to implement responsible budget decisions, and spending must continue indefinitely.”

But the whole government shutdown charade is merely the symptom of a much deeper problem. The US government is over $33 trillion in debt. In fact, the Biden administration managed to add half a trillion dollars to the debt in just 20 days.

It’s hard to overstate just how bad the US government’s fiscal situation has become. We have a trifecta of surging debt, massive deficits, and declining federal revenue, and the federal government’s spending addiction is at the root of the problem. Lacalle summed it up this way.

The problem in the United States is not the government shutdown but the irresponsible and reckless deficit spending that administrations continue to impose regardless of economic conditions.”

In August alone, the Biden administration spent over $527 billion. In fact, the federal government has been spending an average of half a trillion dollars every single month.

And there is no end in sight. There is no political will to substantially cut spending. Meanwhile, the federal government is always looking for new reasons to spend even more money. With war raging in the Middle East, there is already a proposal to send aid to Israel and possibly add more aid to Ukraine to that deal.

As Peter Schiff said in a recent podcast, the US can’t afford peace, much less war. Lacalle summarizes the current fiscal condition of the United States government. It’s not a pretty picture.

In the Biden administration’s own projections, the accumulated deficit between 2023 and 2032 would be over 14 trillion US dollars, assuming that there would be no recession or employment decline. Public debt has risen above 33 trillion US dollars, and the budget deficit in a period of growth and strong job creation is over 1.7 trillion US dollars. As of August 2023, it costs $808 billion to maintain the debt, which is 15% of the total federal spending, according to the U.S. Treasury. Interest rates are rising at the same time as the government rejects all budget constraints. This is a monetary timebomb.”

And as Lacalle pointed out, the government keeps spending no matter what’s happening in the economy. According to government people and their academic support staff, there is never a good time to cut spending.

When the economy grows and there is almost full employment, governments announce more spending because it is ‘time to borrow,’ as Krugman wrote. When the economy is in recession, governments say that they need to spend even more to save the economy. In the process, government size in the economy increases, and record tax receipts are fully consumed in no time because expenditures always exceed revenues.”

The constant borrowing and spending is fueled by the myth that borrowing doesn’t really matter, and the rise in popularity of Modern Monetary Theory (MMT) put that myth on steroids.

MMTrs claim that spending doesn’t matter. As Lacalle notes, they even go as far as to claim that the world could “run out of dollars” if the federal government took significant steps to rein in deficit spending causing a “monetary meltdown.”

It is so ludicrous that it should not even have to be discussed. The world does not run out of dollars if the United States government cuts its imbalances. Global dollar liquidity is a result of central bank swaps between monetary institutions. There is no such thing as a global dollar liquidity crisis because of a United States surplus, as we saw when it happened in 2001. Furthermore, the idea that the dollar supply is created only by government deficit spending is insane. This distorted view of the economy places government debt at the center of growth instead of private investment. It tries to convince you that a deficit is always positive and that the only creation of currency must come from unproductive spending, not from productive investment credit growth. Obviously, it is wrong.”

But no matter how loudly contrarians sound the warning, people in the mainstream continue to shrug their shoulders at the mounting debt and ever-growing deficits. They seem to believe that since it hasn’t mattered yet, it won’t matter ever.

The dollar’s status as the global reserve currency enables the US government to get away with a lot. As Lacalle explains, global demand for dollars is still high. The dollar index (DXY) is rising because the monetary imbalances of other nations are larger than the United States’ challenges.

This has lulled Americans into a false sense of security. A lot of Americans, including most in positions of power, seem to think the US can do whatever it wants when it comes to borrowing and spending.

Lacalle makes a sobering point — “All empires believe that their currency will be eternally demanded, until it stops. ”

When confidence in the currency collapses, the impact is sudden and unsurmountable. Global citizens may start to accept other independent currencies or gold-backed securities, and the myth of eternal U.S. debt demand vanishes. Unfortunately, governments are always willing to push the limits of fiscal responsibility because another administration will face the problem. The United States’ rising debt and deficit irresponsibility means more taxes, less growth, and more inflation in the future. Government debt is not a gift of reserves for the private sector; it is a burden of economic problems for future generations. Sound money can only come from fiscal responsibility. Currently, we have none.”

The bottom line is the dollar is not invincible. The fuse is burning.

]]>So why are recession warning signs still flashing?

Most major financial institutions and high-profile economists have abandoned or significantly downgraded their recession projections. Those that still still forecast an economic downturn predict it will be short and shallow.

For instance, during the last FOMC meeting, the Federal Reserve upped its economic forecast, characterizing economic activity as “expanding at a solid pace.” It increased its GDP projection for 2023 to 2.1%, more than double its 1% projection in June. Fed economists do expect growth to slow to 1.5% next year, but any talk of a recession is completely out of the discussion.

But one major financial institution still sees a recession in America’s future — Deutsche Bank.

The German bank was the first major financial institution to project a recession in the US, and it’s sticking to its guns.

Deutsche Bank isn’t just making a calculated guess. It has solid data to back up its projection. The bank’s head of global economics and thematic research Jim Reid and a team of economists recently analyzed 34 US economic downturns dating back to 1854 and identified four macroeconomic “triggers” common to past recessions.

Bad news — all four are flashing red.

In its analysis, the Deutsche Bank team calculated the percentage of times these four events led to a recession. They call this the “hit ratio.” Based on their analysis, they determined that no single trigger can predict a recession. Nevertheless, all four of the triggers most commonly associated with US recessions are in play now.

Reid cautioned that it’s impossible to accurately predict every recession using macro triggers.

But it’s fair to say that the most significant ones [triggers] have been breached this cycle and that the US tends to be more sensitive to these historically.”

The Four Triggers

Following are the four triggers identified by the Deutsche Bank team and their hit rates.

An Inflation Spike (77%) — There’s no question that this trigger is in play. Price inflation soared to a four-decade high in the summer of 2022. While it has cooled in recent months, the CPI began creeping up again in July and continued to rise in August.

Reid said the US economy “seems to have the most sensitivity to inflationary spikes.” Since 1854, a 3% rise in price inflation over a 24-month period caused a recession within three years 77% of the time.

Note that there can be a significant lag in time between the initial inflation shock and the recession.

And while price inflation might be down, it isn’t out. During a recent podcast, Peter Schiff said, “It’s obvious to anybody who opens their eyes that inflation is not topped out and coming down. It’s bottom out and going up. And the people who are blind to this, who are asleep, they are in for a rude awakening.”

An Inverted Yield Curve (74%) —Typically, longer-term bonds offer higher yields than short-term bonds. A 10-year Treasury generally features a lower yield than a 30-year. This is because investors typically factor in more risk on a longer-term loan. When this flips and short-term bonds start yielding more than long-term bonds, it’s called a yield curve inversion.

The US Treasury yield curve has been inverted since July 2022.

Yield curve inversions have preceded a recession 74% of the time since 1854. If you consider a more modern period since 1953, the hit rate increases to 79.9%.

A Rapid Rise in Interest Rates (69%) — To fight price inflation, the Federal Reserve has hiked rates by more than 5% in just 18 months.

Since 1854, a 2.5% increase in short-term interest rates over a 24-month period led to a recession 69% of the time. As Reid put it, interest rate hikes haven’t ended well for the economy. He said, “The US seems to have the most sensitivity to interest rates. The US cycle has historically been more boom and bust than others in the G7.”

That’s likely because the US economy runs on borrowing and spending. It can’t function for very long in a high interest rate environment. Schiff summed it up in another podcast.

The economy is built on a foundation of cheap money. It’s not just the economy; it’s every facet of it. The government, the deficits, the government budget is built on cheap money. And it’s not just the federal government that’s been gorging on this cheap money. A lot of the state governments, municipalities — they’ve all issued a tremendous amount of debt over the last 15 years.”

The last time rates were at this level was in 2006. We know how that ended. But there’s a big difference between then and now. There is even more debt in the economy. Consider that in 2006, the national debt pushed above $10 trillion for the first time. Today, it is more than three times that level.

Oil Price Shock (45%) — The price of Brent crude has spiked by about 33% since June. This has thrown cold water on the “disinflation” narrative.

When oil prices have spiked 25% over a 12-month period, the US economy has gone into a recession 45.9% of the time.

Conclusion

As you can see, all four of these triggers are in play today. This is yet another reason to question the mainstream’s sanguine view of the economy.

As Schiff explained, most people in the mainstream don’t seem to grasp the gravity of the situation. They don’t realize that we are at the beginning of the end of this whole phony economy. He said Fed chair Jerome Powell could put off the implosion in the short run by doing something drastic to change the narrative. That would entail at least hinting at interest rate cuts.

]]>Otherwise, this is going to happen. Whether it’s tomorrow, the next day, or the next week is hard to tell. But what seems apparent to me is that we’re about to go over a cliff. I just don’t know how much more distance there is between where we are now and the edge of that cliff. But we’re going there.”

It took the Biden administration just three months to add another $1 trillion to the debt. It eclipsed $32 trillion back on June 15. The debt has gone up at a dizzying pace. The government has added $1.58 trillion to the national debt since the end of the fake debt ceiling fight. In just one year, the Biden administration has added $2.16 trillion to the debt.

It’s hard to fathom $33 trillion. To put things into some perspective, every US citizen would have to write a $98,446 check in order to pay off the debt, and every American taxpayer is on the hook for $254,961. Or to look at it another way, $33 trillion is more than the total economies of China, Japan, Germany and the UK combined.

Yes, It’s That Bad!

It’s hard to overstate just how bad the US government’s fiscal situation has become. We have a trifecta of surging debt, massive deficits and declining federal revenue.

That means there is no end in sight to this upward-spiraling national debt. The biggest issue is the federal government spending addiction. In August alone, the Biden administration spent over $527 billion.

And there is more spending coming down the pike. Last month, the president asked Congress to appropriate $40 billion in additional spending, including $24 billion for Ukraine and other international needs, $4 billion related to border security, and $12 billion for disaster relief.

That won’t be the end of it. There is always something the government needs to spend money on and now it has a credit card with no limit.

Last year, robust tax receipts helped to paper over the spending problem as the federal government enjoyed a revenue windfall in fiscal 2022. According to a Tax Foundation analysis of Congressional Budget Office data, federal tax collections were up 21%. Tax collections also came in at a multi-decade high of 19.6% as a share of GDP. But CBO analysts warned it won’t last. We’re already seeing receipts fall, and government tax revenue will decline even faster if the economy spins into a recession.

The debt-to-GDP ratio currently stands at 122.41%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt-to-GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

A Ticking Time Bomb

With interest rates climbing, the national debt is a ticking time bomb. Uncle Sam’s interest expense is already rising at an astronomical rate, and it’s set to explode.

The federal government has paid well over half a trillion dollars ($630 billion) on interest payments alone in fiscal 2023, with one month left to go. Interest on the debt paid in July exceeded the amount spent on national defense that month. Uncle Sam is well on the way to spending more on interest payments than any line item other than Social Security and Medicare.

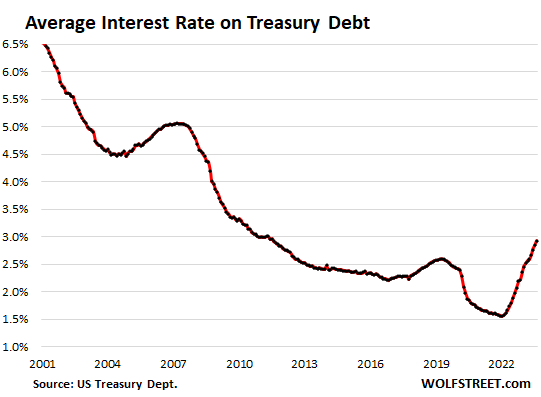

The average interest rate on the debt is now at the highest level since 2011, coming in at 2.92% as of the end of August. But that’s still relatively low, and the debt is more than double what it was back in the olden days of 2011.

Meanwhile, the average interest rate is poised to climb rapidly. A lot of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates. That means interest payments will quickly climb much higher unless rates fall.

To give you an idea of where we’re heading, T-bills currently yield about 5.5%, the two-year yield is over 5% and the 10-year currently yields around 4.3%.

This has driven interest payments as a percentage of total tax receipts to over 35%. In other words, the government is already paying more than a third of the taxes it collects on interest expense.

If interest rates remain elevated, or continue rising, interest expenses could climb rapidly into the top three federal expenses. (You can read a more in-depth analysis of the national debt HERE.)

If the national debt climbs to $40 trillion (and given the current deficits it won’t take long) and interest rates remain at 5% (which Jerome Powell says will be necessary to tackle inflation) interest payments on the debt alone would skyrocket around $2 trillion per year. That means that even if the US government balanced the budget so receipts covered all spending minus interest payments, we’d still be facing a $2 trillion annual deficit.

Of course, there won’t be a balanced budget. So, let’s assume the federal government can maintain the current deficit level of around $1 trillion annually (minus interest expense). Even with this overly optimistic scenario, the Treasury would be running a $3 trillion annual budget deficit. (That’s the current $1 trillion deficit plus $2 trillion in interest expenses.)

And the most likely scenario is spending will continue to climb, along with the budget deficits. There’s no telling how high the annual deficits could run.

This is a fiscal powder keg. All it needs is a match.

The national debt has been growing for so long that most people just shrug when we talk about it. Nobody seems particularly concerned outside of a handful of contrarians. Sure, most everybody recognizes that it might be a problem “down the road.” But they believe the road is long, so we can get away with continuing to kick the can. But mark my words, eventually, they will run out of road.

Sound off about this story on the Economic Collapse Substack.

]]>In most instances, a business bleeding red ink has a big problem and could ultimately go under. Not so for the Fed. In fact, losing money isn’t a problem for the central bank at all. But it is a big problem for the US government.

According to the Federal Reserve’s quarterly report for Q2, the central bank reported a loss of $57.3 billion through the first half of the year. The Fed is on pace to lose over $100 billion in 2023.

Rising interest rates are a big problem for the Fed, as they are for other banks. The central bank earns interest income on the bonds it holds on its balance sheet. But the Fed also pays out interest to other financial institutions that park money there. The bonds it bought during multiple rounds of quantitative easing (QE) and still holds on its balance sheet were relatively low-yielding. But with rates much higher today, it is paying out interest at a much higher rate.

According to the Fed report, as of June 30, the central bank held roughly $5.5 trillion in US Treasuries with an average yield of 1.96%. It also held $2.6 trillion of mortgage-backed securities with an average yield of 2.20%. Meanwhile, the average interest rate the Fed paid on money it held, along with repo agreements and other operations averaged around 5%.

It’s also important to note that the Federal Reserve has shed almost $1 trillion from its balance sheet in quantitative tightening.

The results were predictable. Through the first half of the year, the Federal Reserve reported $88.4 billion in interest income. But it paid out $141.8 billion in interest expense. That adds up to a lot of red ink.

It’s also interesting to note that like many commercial banks, the Fed has substantial unrealized losses. If you mark all of the bonds held by the Fed to market value, the loss on paper is over $1 trillion. That’s more around 23 times the value of the central bank’s stated capital.

Bond portfolio losses are exactly what kicked off the financial crisis last March. But none of this matters to the central bankers at the Fed.

Big Losses! So What?

The last time the Fed reported net operating losses was in 1915.

To put this net loss in perspective, the largest yearly gain over the last 10 years was in 2021 when the Fed reported a $104 billion net income. In other words, the central bank is on pace for a loss as large as the biggest gain in at least a decade.

Who suffers when the Federal Reserve loses money? In most cases, a business feels the pain when a business loses money. But when the Fed loses money, the US government feels the pain. And ultimately, you and I foot the bill.

Under the Fed’s charter, the Fed remits its profits to the US Treasury. This helps pay down the massive federal budget deficits. When the Fed loses money, the Treasury loses its payday. That means even bigger budget deficits.

Bigger deficits mean the government has to raise taxes or borrow even more money. Either way, we pay. You either get a bigger tax bill or you pay the inflation tax when the Fed prints money to monetize the debt.

But what about the Fed? Isn’t losing money a problem for the central bank? It certainly would be for a normal bank. But the Fed isn’t a normal bank.

As Mises Institute Senior editor Ryan McMaken put it, “The de facto reality of the Federal Reserve is that it is a government agency, run by government technocrats, that enjoys the benefits of being subject to very little oversight from Congress.”

If a normal business loses money, it must cut costs, sell assets, borrow money, or take other actions to stop the losses. If it loses enough money, it will eventually eat away at the company’s assets. If this goes on long enough, the company will become insolvent. Sustained losses ultimately mean bankruptcy.

The Fed doesn’t have to do any of these things. In fact, it can lose money year after year and go right on doing business as if there were no losses.

How? Because we live in a world where the Federal Reserve gets to make its own accounting rules. And according to its own accounting rules, any net loss magically turns into a “deferred asset.”

[I]n the unlikely scenario in which realized losses were sufficiently large enough to result in an overall net income loss for the Reserve Banks, the Federal Reserve would still meet its financial obligations to cover operating expenses. In that case, remittances to the Treasury would be suspended and a deferred asset would be recorded on the Federal Reserve’s balance sheet.”

Under this scheme, an operating loss does not reduce the Fed’s reported capital or surplus. The bank simply creates an “asset” on its balance sheet out of thin air equal to the loss and business continues as usual. (This is kind of like money printing.) As losses mount, the size of this “asset” will grow.

There is no limit to the size of this “deferred asset” and no time limit on its existence.

Once the Fed returns to profitability, it will retain profits in order to reduce the amount of this imaginary asset. In other words, the US government won’t get any money from the Fed until this “asset” is zeroed out. At that point, the Fed will resume sending money to the federal government.

This has no real impact on the Fed, but it does mean the US government will see a long-term reduction in revenue resulting in a budget deficit higher than it otherwise would have been as long as the Fed is losing money.

A recent article by Alex Pollock published by the Mises Wire breaks it down using the Fed’s most recent balance sheet.

The CQFR reports a total capital of about $42 billion ($35.6 billion of paid-in capital from the member commercial banks and $6.8 billion of retained earnings, called “surplus”). But note: This total capital is much less than the $57 billion reported loss for the six months of 2023, to which must be added the loss for the later months of 2022 of $17 billion. This total $74 billion of accumulated losses by June 30 must be subtracted from the retained earnings and thus from total capital. But the Fed does not do this—it misleadingly books its losses as an asset (!), which it calls a “deferred asset”– a practice highly surprising to anyone who passed Accounting 101. Why does the Fed do this? Presumably it does not wish to show itself with negative capital. However, negative capital is the reality.

Here are the combined Fed’s correct capital accounts as of June 30, based on Generally Accepted Accounting Principles. They result in a capital of negative $32 billion:

Paid-in capital $36 billionRetained earnings ($68 billion)Total capital ($32 billion)

I sure do wish I could use my own accounting system when doing my taxes. But alas, I’m not special.

Conclusion

This isn’t good news for a government already buried in debt and running massive budget deficits month after month. It means the US government will have to borrow even more money that the Fed will ultimately have to monetize.

This is yet another reason the Fed’s inflation fight is doomed to fail. Raising rates and shrinking its balance sheet to tame the inflation dragon means more federal government debt. That puts more pressure on the central bank to prop up the government’s borrow-and-spend policies. At some point, the Fed will be forced to cut rates and return to QE in order to manipulate the bond market so the government can keep borrowing. In other words, it will have to create more inflation.

]]>