The National Federation of Independent businesses on Monday released the survey, which showed small business uncertainty rose last month to the highest level ever recorded by NFIB.

“Small business owners are feeling more uncertain than ever,” NFIB Chief Economist Bill Dunkelberg said in a statement.

Small businesses have been crushed by inflation in recent years, with prices rising more than 20% since President Joe Biden took office. Pandemic-era shutdowns and supply chain issues also put many businesses in debt or drained their savings.

Many larger businesses had more reserves or access to capital to help them survive COVID while smaller businesses went under.

“Twenty-three percent of owners reported that inflation was their single most important problem in operating their business (higher input and labor costs), down one point from August but remaining the top issue,” NFIB said.

Inflation has slowed from its feverish pace earlier in Biden’s term, but prices remain elevated.

“A net negative 17% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down one point from August and the lowest reading of this year,” NFIB said. “The net percent of owners expecting higher real sales volumes rose nine points to a net negative 9% (seasonally adjusted).”

Small business owners have also reported difficulty with the labor market.

“Uncertainty makes owners hesitant to invest in capital spending and inventory, especially as inflation and financing costs continue to put pressure on their bottom lines,” Dunkelberg continued. “Although some hope lies ahead in the holiday sales season, many Main Street owners are left questioning whether future business conditions will improve.”

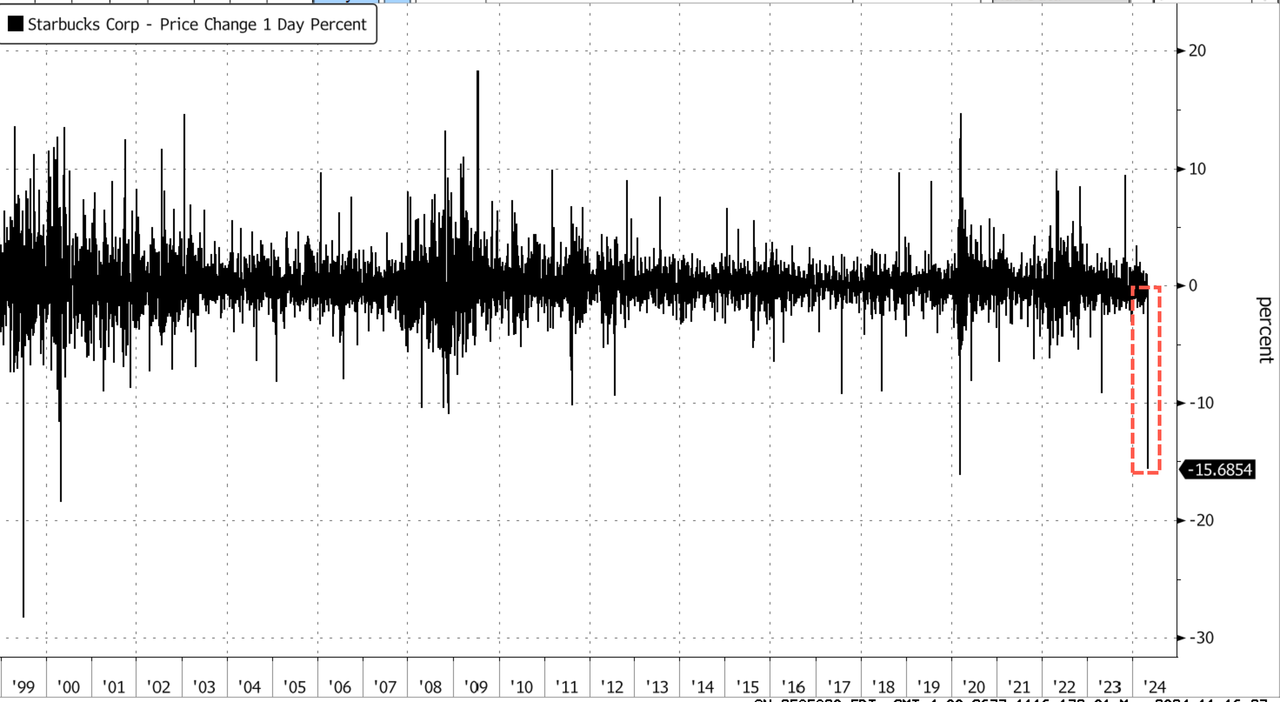

]]>Starbucks shares plummeted by 16% during the early cash session, approaching the -16.2% level last seen during the Covid crash. If intraday losses surpass 16.2% and remain above this level at closing, it would mark the company’s worst single-day loss since the Dot Com crash in early 2000.

“Starbucks reported what’s perhaps the worst set of results of any large company so far” this quarter, analyst Adam Crisafulli of Vital Knowledge wrote in a note. William Blair downgraded the coffee chain, citing last quarter’s “stunning across-the-board miss on all key metrics.”

“Starbucks reported what’s perhaps the worst set of results of any large company so far” this quarter, analyst Adam Crisafulli of Vital Knowledge wrote in a note. William Blair downgraded the coffee chain, citing last quarter’s “stunning across-the-board miss on all key metrics.”

Starbucks reported a 4% drop in same-store sales in the second quarter compared with the same period last year, while analysts tracked by Bloomberg were expecting growth. In China, same-store sales plunged 11%. The company’s top geographic segments are showing a pullback in consumer spending.

On Tuesday evening, CEO Laxman Narasimhan started the earnings call with investors by clarifying his unhappiness with last quarter’s results.

“Let me be clear from the beginning. Our performance this quarter was disappointing and did not meet our expectations,” Narasimhan said.

He said major headwinds originate from a “cautious consumer,” adding, “A deteriorating economic outlook has weighed on customer traffic and impact felt broadly across the industry.”

Here’s a snapshot of the second quarter’s earnings results (list courtesy of Bloomberg):

- Comparable sales -4%, estimate +1.46% (Bloomberg Consensus)

- North America comparable sales -3%, estimate +2.05%

- US comparable sales -3%, estimate +2.31%

- International comparable sales -6%, estimate +1.36%

- China comparable sales -11%, estimate -1.62%

- Adjusted EPS 68c, estimate 80c

- Net revenue $8.56 billion, estimate $9.13 billion

- Operating income $1.10 billion, -17% y/y, estimate $1.35 billion

- Adjusted operating margin 12.8%, estimate 14.5%

- Operating margin 12.8%, estimate 14.4%

- North America operating margin +18%, estimate +19.5%

- International operating margin 13.3%, estimate 15.2%

- Channel development operating margin 51.7%, estimate 43.6%

- Average ticket +2%, estimate +2.41%

- North American average ticket price +4%, estimate +4.15%

- International avg. ticket -3%, estimate +0.1%

- North America net new stores 134, estimate 144.33

- International net new store openings 230, estimate 429.23

- Comparable transactions -6%, estimate -0.27%

- North America comparable transactions -7%, estimate -1.86%

- International comparable transactions -3%, estimate +1.37%

Goldman analysts Eric Mihelc and Scott Feiler told clients, “Expectations were for a clear sales miss and a modest EPS miss, but both came worse than the lowered bar.”

They added, “The miss was across geography and was as bad, if not worse, than worst fears.”

Other Wall Street analysts shared the same gloom and doom about the coffee chain (list courtesy of Bloomberg):

Deutsche Bank analyst Lauren Silberman cuts Starbucks to hold from buy

- Says the “challenging” results was a sign “headwinds are more pervasive and persistent than we expected, and we have limited visibility into the pace and magnitude of a recovery”

- Had thought comparable sales deceleration in the US was more transitory and isolated to a specific cohort

- However, with the decline in 2Q traffic and what seems to be limited improvement from Lavender and Spicy Refreshers, Silberman sees it being difficult to “underwrite a meaningful reacceleration,” which is key to the bull case

William Blair, Sharon Zackfia (cuts to market perform from outperform)

- After healthy demand over the past three years, Zackfia says the “tide has turned quickly,” with Starbucks posting the weakest traffic performance outside the pandemic or Great Recession

- China now “looks more fragile,” with comparable sales down 11%, and even Starbucks Rewards members “took a rare dip,” she adds

Jefferies, Andy Barish (hold)

- There was a “notable” miss on US and international comparable sales as well as EPS, and Barish says there is “no easy fix in sight to reaccelerate SSS near-term”

- Notes that international comparable sales was “similarly weak,” with traffic and comparable transactions both declining; China’s comparable sales miss and Middle East volatility more than offset positive comps seen in Japan, APAC and Latin America

- PT cut to $84 from $94

Citi, Jon Tower (neutral)

- Starbucks is “putting a lot of oars in the water to try and paddle” its way back to a stable comparable sales outlook that investors would be willing to underwrite

- However, Tower expresses concern that there is not enough “coxswain keeping oarsmen working in unison/with accountability”; adds that it ignores the “true leak in the bottom of the boat,” flagging broad consumer pushback to cumulative transaction growth and the value equation

- Notes China store margins are still in the double digits and the segment is profitable despite top-line declines

- PT cut to $85 from $95

Cowen, Andrew Charles (hold)

- “We believe 2024 guidance has been derisked as we model 0% NA comps & 3% EPS growth, the high end of the range”

- Expects shares to be in a “holding pattern” as Starbucks restores credibility while competition and tough macroeconomic conditions present headwinds

- PT cut to $85 from $100

Bloomberg Intelligence, Michael Halen and Jennifer Bartashus

- “Starbucks slashed fiscal 2024 same-store sales, revenue and EPS guidance and lacks a cogent plan to boost demand”

- “We believe several initiatives, including targeting overnight sales, dozens of new products and a four-week mobile- app upgrade cycle are overkill — a distraction unlikely to boost traffic”

On Tuesday, a similar story occurred at McDonald’s when the burger chain reported lower-than-expected quarterly sales growth.

Notably, working-poor consumers are pulling back spending in a period of stagflation (read here & here).

]]>From coast to coast, retail locations are being permanently shut down because there is no end in sight to this madness.

This is particularly true in our largest urban areas. In San Francisco, a Macy’s store that had been open for 77 years is being closed down, and employees are telling the press that shoplifting was the primary factor behind the decision…

Employees at Macy’s flagship San Francisco store in Union Square have blamed its planned closure on shoplifting – despite mayor London Breed claiming crime was not a factor.

The Union Square store announced earlier this week it will be closing its doors after 77 years as part of a plan to close 150 locations across the nation over the next three years.

It isn’t just a few things that are going missing at that Macy’s store.

According to one employee, the men’s department is being systematically looted on a daily basis…

“It happens every day,” employee Steve Dalisay said.

Hanging up blazers in the Macy’s sixth-floor men’s department, Dalisay said blazers, wallets and boxer briefs are the items most frequently stolen from his department. He said thieves take at least four blazers every day, adding that he typically sees about 10 wallets and 20 briefs stolen daily.

Another employee says that most of the shoplifting is being done by drug users and groups of teens…

Shoplifters, he said, tend to be in two categories: drug users going after specific items for fences or teens entering the store in teams on brazen shoplifting blitzes.

“I’m not in charge of making the estimates of how much we lose in a day, but last year we were told the losses were in the millions,” the employee said.

“It’s a big thing,” he added. “What we have learned is a lot of drug users have deals with the fencers. They’ll give the drug users a list of stuff from the store, and they’ll go try to execute the list.”

Our national shoplifting crisis and our national drug crisis are very closely related.

Drug users need money to fund their habits, and shoplifting is one of the easiest ways to obtain things to sell.

At this point, it would be difficult to overstate the severity of the drug crisis in the state of California. According to Governor Gavin Newsom, authorities in his state seized enough fentanyl last year “to potentially kill the global population nearly twice over”…

Roughly 62,000 pounds of fentanyl smuggled into California was confiscated by authorities in 2023. The total amount of the potent synthetic opioid seized last year “is enough to potentially kill the global population nearly twice over,” Gov. Gavin Newsom’s office announced Tuesday.

In 2023, the California National Guard supported other law enforcement agencies in counter-drug operations across the state, seizing a record 62,000 pounds of fentanyl at ports of entry, according to a news release from Newsom’s office.

That is certainly a lot of fentanyl.

If you can believe it, the amount of fentanyl that was seized in the state in 2023 was more than 10 times greater than the amount that was seized in 2021…

Compared with just a few years ago, the amount of fentanyl seized by authorities has dramatically surged. In 2021, California authorities seized more than 5,300 pounds of the drug, with a street value of $64 million. In 2022 that rose to 28,000 pounds, with a street value of $230 million, based on the U.S. Department of Justice evaluation of illegal-drug values in the Los Angeles region.

We have never seen anything like this before.

A lot of that fentanyl comes from Mexico, but a lot of it also comes from China.

The streets of California cities are flooded with addicts, and they are going to do whatever they have to do to feed their addictions.

So this shoplifting crisis is not going away.

At one hardware store in San Francisco, employees are now escorting customers around the store in a desperate attempt to reduce the level of shoplifting…

A longtime San Francisco business is trying something new to curb what it says has been “rampant shoplifting.”

Fredericksen’s Hardware and Paint in Cow Hollow is now offering a one-on-one shopping experience. The idea is to separate actual customers from those looking to steal from the store.

During certain hours, Fredericksen’s blocks off part of the store’s entrance and has people wait for an employee to help them instead of allowing people to just roam the store. The store’s longtime manager says it’s a move that was worth trying for the sake of the business, their employees, and their customers.

I think that we will soon see many more retailers offer “one-on-one shopping experiences” to their customers.

UNREAL. This store in San Francisco now has a barrier when you walk in and shoppers need to be accompanied by staff as they shop through the store because crime has got so bad.

Welcome to @GavinNewsom’s California pic.twitter.com/c2bixYEUbO

— Libs of TikTok (@libsoftiktok) February 25, 2024

Major retailers just can’t keep losing inventory like they have been.

The amount of retail “shrink” in the United States has more than doubled in recent years, and it just continues to explode higher…

Shrink is the industry term for inventory loss often attributed to theft, damage, or errors. Once simply considered a cost of doing business, shrink resulted in retail profit losses exceeding a staggering $100 billion in 2022.

What’s more problematic, the trend of shrink appears to be far from reversing course, with losses more than doubling over the past five years. In an industry where margins and profitability are already under significant pressure, the rise in retail shrink is capturing the attention of all levels within retail organizations.

Sadly, there are some parts of the country where the looting of retailers has essentially become a way of life.

In fact, this has even been happening in our nation’s capital…

A Washington D.C. CVS store is shutting its doors after being repeatedly ransacked by thieves, the chain has confirmed.

The pharmacy, located in the Columbia Heights neighborhood, went viral last October when videos emerged of it totally stripped of all its products after being targeted by a teen gang.

Staff claim more than 45 schoolkids would go into the store and steal chips and drinks in the morning, after their classes and late at night. It will close on February 29, according to WTTG-TV.

Those kids wouldn’t have been able to loot that store multiple times per day if they had been put in prison the first time they did it.

But our politicians don’t want such harsh laws.

They want to coddle the criminals, and as a result much of the rest of the population is living in fear.

This is just another example of how upside down our society has become.

The solutions to our national shoplifting crisis are simple enough, but I doubt that we will see things turn around any time soon.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

]]>The U.S. national debt was put ahead of other top risks for CEOs, including the potential for an increase in cyberattacks, war in the Middle East, higher energy prices and risks associated with decoupling from China, according to The Conference Board. The U.S. national debt exceeded $34 trillion for the first time in the country’s history on Dec. 29, 2023, following huge government deficits and spending under the Biden administration.

“For U.S. CEOs, the biggest risk is right at home — the mushrooming US national debt and deficit,” The Conference Board said in its report. “The US fiscal outlook continues to deteriorate, with the deficit for FY2023 topping estimates at $1.7 trillion. The increasing practice of issuing U.S. Treasury securities to finance deficit and debt places tremendous strain on the financial system, potentially raising business borrowing costs and limiting access to capital.”

American CEOs are also particularly concerned about an economic downturn/recession, noting that it and inflation are the external factors that are most likely to have the greatest impact on their organizations in 2024, according to The Conference Board. Financial institutions and analysts are mixed with their predictions of the economy in 2024, with banks like Goldman Sachs and JP Morgan Chase forecasting a risk of a recession while Deutsche Bank and Société Générale both predicting a recession.

Global political instability, higher borrowing costs and labor shortages are also among the top five most concerning external factors for U.S. CEOs, which all fuel inflation, according to The Conference Board. Inflation remains elevated, rising 3.1% year-over-year in November, far above the Federal Reserve’s 2% target, after decelerating from its peak under Biden of 9.1% in June 2022.

The national debt has ballooned under Biden following a number of costly initiatives pushed by the president. In March 2021, Biden signed the American Rescue Plan, which authorized $1.9 trillion in new spending, and in August 2022, the president signed the Inflation Reduction Act, which approved $750 billion in spending.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>- 38% of companies say they are likely to have layoffs in 2024

- 52% are likely to implement a hiring freeze in 2024

- Half say anticipation of a recession is a reason for potential layoffs

- 4 in 10 say layoffs are due to replacing workers with artificial intelligence (AI)

- 3 in 10 companies reducing or eliminating holiday bonuses this year

If you currently have a job that you highly value, try to hold on to it as tightly as you can.

Because the employment market is starting to shift in a major way.

In recent weeks, so many large U.S. companies have been announcing layoffs…

Nike has announced a $2 billion cutback over the next three years, with an uncertain number of job cuts included. Toy giant Hasbro will cut nearly 20% of its workforce in 2024, according to reports from the Wall Street Journal. Music service Spotify announced a third round of layoffs. A recent email from CEO Daniel Ek says the company plans to cut its workforce by nearly 20%. Roku is going to be limiting new hires, and laying off about 10% of its workforce, while Amazon layoffs are effecting its new gaming division (all 180 jobs there are being eliminated). Citi CEO Jane Fraser announced layoffs in September, and sources have told CNBC that the bank could let go of at least 10% of its workforce, across several business lines. Flexport Logistics plans to cut up to 30% of its employees, and financial services company Charles Schwab is cutting back by 5-6% of its workforce, according to reports from Business Insider.

Unfortunately, this is just the tip of the iceberg.

Many more layoffs are on the way.

Meanwhile, retailers continue to close stores at an astounding pace…

With the continued rise of online shopping, along with record inflation, it’s no wonder that retailers are suffering steep financial losses. Unfortunately, this means that companies all across the U.S. are downsizing brick-and-mortar storefronts to make ends meet. In 2023, we’ve seen closures from big-name retailers and local shops alike—and the shutdowns don’t appear to be easing up anytime soon.

More than 3,000 retail locations were shut down in 2023, but that is nothing compared to what is coming…

According to UBS equity analyst Michael Lasser, the U.S. remains over-retailed. Lasser estimated that the U.S. will shed almost 50,000 retail stores by 2028. He cites rising operating costs and a higher proportion of e-commerce sales, causing retailers to look closely at store locations and performance.

Can you imagine what our communities will look like if that projection is even close to accurate?

As economic conditions deteriorate, people are going to get more desperate and the conditions in our streets will become even more chaotic.

You may not have heard about this yet, but earlier this week a giant mob of more than 100 young people savagely looted a bakery in Compton, California…

A mob of over 100 looters purposefully crashed a Kia into a small bakery in Compton, Calif., before they flooded in and ransacked the store during a night of rampage on the streets earlier this week.

The thieves had gathered in the area for an illegal street takeover around 3 a.m. Tuesday before making the mile-long trek to Ruben’s Bakery & Mexican Food.

When they got to the locked store, a white Kia backed into the front doors, clearing an entryway for the crowd of pillagers to get to their loot.

We aren’t talking about a handful of lawless individuals.

Literally dozens and dozens of lawless young people looted this small store, and they did not hesitate to take whatever they wanted.

Most of you are probably not even aware that this happened, and that is because this story barely made a blip in the news cycle.

And the reason why it barely made a blip in the news cycle is because this sort of thing has become quite common in our country.

The thin veneer of civilization that we all take for granted on a daily basis is rapidly disappearing. Let me give you another example.

One couple in California that thought it would be a good idea to use an online marketplace to sell an iPad ended up deeply regretting that decision…

This is the moment a California couple was robbed of their iPad at gunpoint in broad daylight by two teenagers.

Eduardo Reyes and his wife had listed the device on OfferUp on December 23.

The teens contacted them and asked to meet in a residential neighborhood in Pomona.

‘They wanted to meet in a public street which I usually don’t do, but he sounded like he was a kid and he’s like, “Oh, I’m going to have my mom come out with me”,’ Reyes told KTLA.

These days it is so hard to know who you can trust, and that is because a very large portion of the population is no longer trustworthy.

If things are this bad now, what do you think is going to happen once economic conditions become extremely harsh in the United States? The chaos that we are currently seeing in the streets is nothing compared to the chaos that is coming.

Our society really is coming apart at the seams right in front of our eyes. And now we are headed toward the most hotly contested presidential election in our history, and that will bring societal tensions to a boiling point.

Leave your thoughts about this story on the Economic Collapse Substack.

Michael’s new book entitled “Chaos” is now available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

]]>Bank executives can see what is happening, and so they are feverishly trimming costs.

During the first 10 months of this year, banks in the United States closed a total of 2,118 branches…

U.S. banks closed 2,118 branch locations between January and the end of October, according to data from S&P Global Market Intelligence.

Sadly, branches continue to get shut down at a staggering rate.

For example, it is being reported that Bank of America has decided to permanently shut down “nearly two dozen Bay Area branches or ATMs”…

Bank of America has shuttered or plans to shutter nearly two dozen Bay Area branches or ATMs, according to recent filings.

Banks are legally required to report closures to the Office of the Comptroller of the Currency at least 90 days before their scheduled shuttering, so customers will know if they’ll be impacted.

Another way that banks are cutting costs is by laying off workers.

According to Zero Hedge, twenty of the largest banks have combined to eliminate 61,905 jobs so far this year…

A new report from the Financial Times shows twenty of the world’s largest banks slashed 61,905 jobs in 2023, a move to protect profit margins in a period of high interest rates amid a slump in dealmaking and equity and debt sales. This compared with the 140,000 lost during the GFC of 2007-08.

“There is no stability, no investment, no growth in most banks — and there are likely to be more job cuts,” said Lee Thacker, owner of financial services headhunting firm Silvermine Partners.

FT noted that corporate disclosure data and its independent reporting did not include smaller regional bank cuts, indicating total job loss could be much higher.

The banks are not okay.

In fact, I expect the big banks to make lots of headlines in 2024.

Meanwhile, problems continue to pile up for the retail industry.

CNN says that Nike is “a bellwether for the global economy”, and so the fact that the company is planning to cut costs by about 2 billion dollars is not a good sign at all…

Nike, a bellwether for the global economy, sounded a warning sign Thursday as the sneaker giant sees consumers becoming more cautious.

Nike slashed its revenue outlook for the year and announced cost cuts amid growing concerns that consumers are slowing their spending around the world. The company said it’s looking for as much as $2 billion in cost savings in the next three years, which includes laying off employees.

But at least Nike is still in business.

2023 was a year when U.S. retailers closed thousands of stores, and a number of well known chains actually had to file for bankruptcy…

Twenty major retailers axed 2,847 locations between them in 2023, according to Business Insider – as more and more shoppers buy their products online

The issue has been exacerbated by rampant spates of crime which have forced many companies to lock up their products. Earlier this year, Target alone said it was losing as much as $500 million a year to theft.

It is little wonder then that retailers are struggling to cope. Bed Bath & Beyond, Rite Aid and Party City are among the major chains to have filed for bankruptcy in the last 12 months.

Some of you may be thinking that those retailers are hurting because of the growth of the online retail industry.

But online retailers are going belly up too. For example, Zulily just announced that it will be permanently going out of business…

Online retailer Zulily is shutting down.

The company announced on its website it has made the “difficult but necessary decision to conduct an orderly wind-down of the business.”

Zulily said it will “strive to continue to provide everyone with the best service possible during the holiday season” and it will try to fulfill all pending orders and ensure that orders that could not be filled are canceled and refunded.

Of course the mainstream media will continue to insist that these are just isolated incidents and that the overall economy is doing just fine.

One of the primary reasons why they try to slant economic news in such a positive direction is because most of them are Democrats…

A new study from Syracuse University’s Newhouse School of Public Communications found that just 3.4% of American journalists are Republicans.

The study is based “on an online survey with 1,600 U.S. journalists conducted in early 2022” and is the latest in a series of studies stretching back to 1971 that take the temperature of the fourth estate’s partisan lean, job satisfaction, and professional attitudes.

When the first iteration of the study came out over 50 years ago, 35.5% of respondents said they were Democrats, 25.7% said they were Republicans, and 32.5% said they were Independents.

Since a Democrat is currently in the White House, they want you to feel good about the economy so that you will vote for Democrats in 2024.

But everyone can see that the economy is coming apart at the seams all around us, and most Americans do not have a good feeling about what is coming during the year ahead.

I am entirely convinced that the economic trends that we have witnessed in 2023 will greatly accelerate in 2024. Needless to say, that will not be good news at all.

Sound off about this story on the Economic Collapse Substack.

Michael’s new book entitled “Chaos” is now available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

]]>Among the casualties are a growing number of plant-based meat substitute companies that initially garnered substantial investor interest but have since grappled with low and diminishing consumer demand. In June of this year, UK-based Meatless Farm shut its doors not long after Heck, a maker of meatless sausages, announced that it would substantially reduce its consumer offerings. Nestlé-owned Garden Gourmet also pulled its vegan offerings from UK shops in March 2023. Canada’s Very Good Food Company, a vegan food producer which soared 800 percent on the day of its public offering in 2020, recently collapsed after revealing it had never been profitable.

By far the biggest turnabout has occurred in the most prominent plant-meat substitute enterprise, Beyond Meats. The corporate flagship of the sector conducted its IPO in May 2019 priced at $25 per share, opening at $46 and rising to as high as $72 on its first day of trading. By July 2019 the stock price briefly surpassed $230 per share, spiking above $150 per share several times during the pandemic. But since mid-2021, the stock price fell from over $100 to recently close below $6. For six consecutive quarters, the company has reported negative sales growth amid not only a loss of market share but a contraction in the size of the fake meat market. Nearly one-fifth of the firm’s non-production workforce was laid off early in November 2023. Financial analysts have characterized the firm as in survival mode, with its financial deterioration bringing about a “going concern” risk.

So why are so many plant-based “alternative” meat companies faltering at the same time? Part of the answer, we propose, may derive from a pattern of noisy market signals that we dub Conspicuous Production.

Conspicuous Production refers to the creation of goods that are not necessarily sought by a large consumer base, but that are thought to convey certain social signals when they are marketed to the public. It’s a supplier’s counterpart to the more famous concept of Conspicuous Consumption, wherein consumers purchase products to show off the status, wealth, tastes, or social desirability that ownership of a good is perceived to convey. In the case of conspicuously produced goods, the supplier offers a product that caters to certain social trends and causes, whether or not people are willing to purchase it.

It is not difficult to see how artificial “meat” companies fall into a pattern of Conspicuous Production. These plant-based alternatives are presented as more environmentally friendly alternatives to meat. They ostensibly facilitate the reduction of meat-based diets, which is an increasingly vocal political demand of climate activists. Many of these products are also marketed as vegan under an ideological presumption that eating plants is more ethical than eating animals. A retailer might accordingly choose to carry large selections of plant-based “meat” products out of the belief that it will gain them reputational accolades from their shoppers by signaling social responsibility, sustainability, and similar sentiments. Similarly, a restaurant may add a meat-colored congealed vegetable patty to their burger lineup, hoping to garner goodwill from diners who perceive this offering as environmentally ethical.

But what happens if very few people buy these same conspicuously produced food items?

We suspect that many vegan food companies have mistakenly interpreted the social signaling of “alternative meat” store displays and menu items as indicative of a much larger consumer base than they actually possess. It’s only when they unexpectedly encounter financial difficulties due to sluggish sales that the true state of affairs becomes evident. Furthermore, the prolonged shelf life of plant-based alternatives to meat, attributed to the numerous chemicals and binding agents used in their production, could be convenient for those seeking to showcase their company’s social consciousness by stocking their freezers. As we’ve witnessed during events such as hurricanes, COVID-induced grocery store rushes, and similar natural or political crises, what Pete Earle has termed “Magness Effects” are undeniably real.

To elaborate, even in situations where there is a glaring and widespread shortage of essential food items due to emergency circumstances, the vegan section of the freezer aisle often remains largely untouched. The majority of consumers simply have no desire to consume such products (and the small minority that does may already have well-stocked freezers filled with these items, again benefitting from their long shelf lives).

Yet, there is an underlying economic rationale behind the existence of these Magness Effects. Rather than aligning their product offerings with genuine consumer preferences, most grocery stores seem to allocate prime shelf space to faux-meat products as a way of projecting a particular image of social responsibility. They hope that when customers pass by a prominently displayed shelf of vegan goods, they may infer that the store is actively promoting values like saving the planet or protecting animals. It’s akin to establishments that prominently place recycling bins in public view, even though, in reality, the recyclables often end up mixed with regular trash once they’re out of sight.

While the vast majority of shoppers are unlikely to open the vegan freezer door and select a package of artificially colored and molded celery stalks masquerading as chicken tenders, a substantial minority perceives this shelf as a testament to the store’s corporate social responsibility toward the environment. Meanwhile, the subset of the population that does consume these products maintains an ongoing oversupply relative to their market share. Since there’s little demand from others, they can walk into the store during a hurricane, blizzard, or other run on groceries and the artificial meat shelf will appear virtually unchanged from a typical Tuesday.

The news is not encouraging for plant-based meat entrepreneurs. A November 18th Telegraph UK article reports that the plunging fortunes of vegan food makers have occurred alongside the resurgence of interest in real meat. “Smashed burgers” account for a substantial part of the renewed interest, with eateries offering twists on the recipe in towns all across the UK. (Unsurprisingly, it’s a style that originated in the United States.) As for meat consumption trends in the US, the USDA estimates per-capita retail weight consumption of 224.6 pounds of red meat and poultry in 2022: 10.3 pounds higher than the average observed from 2012 to 2021.

The desperation of the grass-meat constituency is clear in the headlines of ideologically aligned media supporters. A widely-syndicated16 November Associated Press article implored readers: “Plant-based meat is a simple solution to climate woes — if more people would eat it.”

Yet despite consumers speaking about as clearly as they ever do, an arrow remains in the quiver of the grass-burger constituency. Impossible Foods CEO (and former Stanford University biochemist) Pat Brown recommends a meat tax, drawing comparisons with the levies currently charged on tobacco, marijuana, and sugar products in various jurisdictions. If consumer tastes won’t salvage the market for animal-part-shaped blocks of dyed soy extract, its boosters and beneficiaries are hoping that government interventions will.

In the meantime, the plant-based alternatives industry appears to be facing its first true market test and doing poorly. True, the consumer base for fake meat is not zero. It’s simply a much smaller market than producers perceived, due to the noisy signals and political distortions of Conspicuous Production. The result is a plant-based alternative food industry that far outpaced the interest in what it had to offer, and is now seeing a rapid contraction as the consumer sovereignty corrects those misread signals.

About the Author

Phillip W. Magness is Senior Research Faculty and F.A. Hayek Chair in Economics and Economic History at the American Institute for Economic Research. He is also a Research Fellow at the Independent Institute. He holds a PhD and MPP from George Mason University’s School of Public Policy, and a BA from the University of St. Thomas (Houston). Prior to joining AIER, Dr. Magness spent over a decade teaching public policy, economics, and international trade at institutions including American University, George Mason University, and Berry College. Magness’s work encompasses the economic history of the United States and Atlantic world, with specializations in the economic dimensions of slavery and racial discrimination, the history of taxation, and measurements of economic inequality over time. He also maintains an active research interest in higher education policy and the history of economic thought. His work has appeared in scholarly outlets including the Journal of Political Economy, the Economic Journal, Economic Inquiry, and the Journal of Business Ethics. In addition to his scholarship, Magness’s popular writings have appeared in numerous venues including the Wall Street Journal, the New York Times, Newsweek, Politico, Reason, National Review, and the Chronicle of Higher Education.

Image by Marco Verch via Flickr, CC BY 2.0 DEED.

]]>The total percentage of American organizations with a DEI budget dropped 4 percentage points, from 58% in 2022 to 54% in 2023, while the number of organizations with a DEI strategy fell 9 points in that same time frame, according to a report from consulting firm Paradigm. DEI initiatives in the workplace gained huge traction following the death of George Floyd, which encouraged companies to divert resources to the practice, but now “external forces,” including tightening economic conditions as well as public and judicial pressure, are pushing back on those efforts.

“After two years of unprecedented investment sparked by 2020’s racial justice movement, this year, global momentum around DEI slowed,” according to the report from Paradigm. “There are a number of headwinds contributing to this shift: the first is economic uncertainty that not only led to reduced spending across the board, it also firmly shifted the power balance back to employers.”

Despite the decline in funding, there was a 6-point increase in the number of companies that had a senior DEI leader and an 8-point increase in organizations that had goals related to representation for women in leadership from 2022 to 2023, according to Paradigm. A total of 20% of companies in 2023 had goals related to increasing employment related to race or ethnicity, which is a 4-point increase year-over-year.

The shift follows concerns from companies that the Supreme Court could target DEI and race-based hiring in the workplace the same way it struck down race-based admissions at colleges and universities earlier this year. A pair of decisions by the Supreme Court in June involving Harvard and the University of North Carolina cumulatively ruled that using race as a factor in college admissions is not permissible under the Fourteenth Amendment of the U.S. Constitution.

“Over the past several months, we’ve heard from a number of HR leaders who are de-emphasizing data and analytics as a part of their DEI efforts, in response to the changing legal landscape and increased scrutiny on DEI efforts,” according to the report from Paradigm.

Only 26% of companies examine the final results of hiring by race or ethnicity, while 33% analyze promotions in the same manner, according to Paradigm. Around 36% of organizations measured the attrition rate of their employees by race or ethnicity.

Businesses pulled back from hiring in October, adding only 150,000 jobs for the month compared to 297,000 in September, while unemployment ticked up to 3.9% from 3.8%. The Leading Economic Index predicted that 2024 will only see 0.8% in the U.S. economy due to a possible recession.

Sound off about this article on The Liberty Daily Substack.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>Despite weeks of negotiations, the union was unable to come to an agreement over contract negotiations with General Motors, Ford, and Stellantis—known as the big three—before current contracts expired, prompting thousands of its members to walk out of three factories across the country in Missouri, Michigan, and Ohio.

The strikes are taking place at Ford’s Bronco assembly plant in Wayne, Michigan, GM’s mid-sized pickup truck assembly plant in Wentzville, Missouri, and Stellantis’s Jeep assembly plant in Toledo, Ohio.

It is unclear how long the strikes will last, however UAW—the largest union in the nation—has an $825 million strike fund that will compensate workers $500 a week while out on strike.

Video footage shared online showed some of the strikes began promptly after midnight, with dozens of workers taking to the streets and holding posters stating “end tiers” and “record profits, record contracts,” and chanting in support of the strikes and higher pay.

“This fight is our generation’s defining moment,” UAW said in a press release announcing the strike late Thursday. “Not just at the Big Three, but across the entire working class. We will stand up for ourselves. We will stand up for our families. We will stand up for our communities.”

UAW represents some 150,000 workers at General Motors, Ford, and Stellantis, however approximately 12,700 workers will be taking part in the strike, UAW President Shawn Fain said at a press conference Thursday night; 3,600 at GM, 3,300 at Ford, and 5,800 at Stellantis.

“Leading into the final hours of the strike deadline, we’ve been working hard trying to reach a deal for economic and social justice for our members. We have been firm. We are committed to winning an agreement with the big three that reflects the incredible sacrifice and contributions UAW members have made to these companies,” Mr. Fain said.

The strikes are expected to have significant business and economic implications. According to Anderson Economic Group (AEG), a work stoppage of 10 days could result in a total economic loss of more than $5 billion. The strike also has the potential to lead to higher car prices amid lower inventories, according to AEG.

Strikes Will Have ‘Wide-Ranging Consequences’

Meanwhile, the plants involved in the strikes are also critical to the three automakers’ productions. Some of their most profitable vehicles include the Ford Bronco, Jeep Wrangler, and Chevrolet Colorado pickup truck.

A full strike at each of the automakers could see losses of around $400 million to $500 million per week assuming all production was lost, Deutsche Bank has estimated.

Despite weeks of negotiations, union members and the big three have failed to reach an agreement over pay, enhanced benefits, and pensions.

The union has proposed a four-year contract with 40 percent pay increases, a reduced 32-hour work week, the elimination of compensation tiers, a restoration of cost-of-living adjustments, and the restoration of traditional pensions, among other items.

The automakers, which have all recorded record or near-record profits, have so far declined to meet that rise, instead offering 20 percent without key benefits demanded by the union, citing concerns that such pay hikes could effectively put them out of business.

Hours before the deadline passed, Ford said it had bargained “in good faith” in an effort to avoid a strike, which the company said “could have wide-ranging consequences for our business and the economy.”

The company said the last offer it submitted to the union was “historically generous, with large wage increases, cost of living adjustments, more paid time off, additional retirement contributions, and more.”

“Unfortunately, the UAW’s counterproposal tonight showed little movement from the union’s initial demands submitted Aug. 3. If implemented, the proposal would more than double Ford’s current UAW-related labor costs, which are already significantly higher than the labor costs of Tesla, Toyota, and other foreign-owned automakers in the United States that utilize non-union-represented labor,” the company said.

Ford said it remains “absolutely committed to reaching an agreement that rewards our employees and protects Ford’s ability to invest in the future as we move through industry-wide transformation.”

Union Prepared to ‘Go All Out’

General Motors said it was “disappointed by the UAW leadership’s actions.”

“Despite the unprecedented economic package GM put on the table, including historic wage increases and manufacturing commitments. We will continue to bargain in good faith with the union to reach an agreement as quickly as possible for the benefit of our team members, customers, suppliers, and communities across the U.S. In the meantime, our priority is the safety of our workforce,” the automaker said in a statement Thursday.

Stellantis has not yet commented on the strikes. The Epoch Times has contacted a Stellantis spokesperson for comment.

The “stand-up strikes”—effectively staggered strikes across the various automakers’ factories—are a nod to the historic “sit-down” strikes UAW members held in the 1930s, and avoid a full walkout.

UAW President Mr. Fain said during Thursday’s press conference that the strategy will “keep the companies guessing,” and give its national negotiators “maximum leverage and flexibility in bargaining.”

However, Mr. Fain warned that the UAW will go “all out” if it needs to, adding that “everything is on the table.”

He also clarified that workers who have not yet been called to join the strike will continue to work under the expired contract.

Speaking to reporters outside the Ford facility in Wayne minutes after the strike began Thursday, the union head criticized the three companies for allegedly failing to negotiate in good faith.

“They waited until the last week to want to get down to business, shame on them,” he said. Mr. Fain also said he believes it is a complete “joke” that the companies have suggested the strikes may bankrupt them.

“The cost of labor that goes into a vehicle is 5 percent of the vehicle, they could double our wages and they could not raise the price of vehicles and they could still make billions of dollars, it is a lie like everything else that comes out of their mouths.”

The union head also hinted that more strikes could take place at further facilities if the three companies are unable to meet the union’s demands.

The last time there was a UAW strike was in 2019 when the union went on strike for six weeks against General Motors. It cost the automaker $3.6 billion.

]]>Target’s products are going to get more expensive this fall. The company’s CEO is warning about tougher conditions for shoppers and also raising the alarm about the state of the U.S. economy. The retailer is one of the biggest general merchandise companies in America, and its household goods, groceries, and clothing are about to face some of the steepest price increases since 2019.

If you are a frequent shopper at other retail giants, you probably have noticed that Target’s prices are already notably higher. Even after offering deep discounts to get rid of inventory in 2022 and bearing a 90% profit drop, the company still had to pass higher supply chain costs to shoppers over the past year. And now, it is trying to stabilize its balance sheet by introducing significant price markups on thousands of products.

The Minneapolis retailer’s chief executive officer has issued a dire warning to U.S. consumers for the second half of the year. Brian Cornell said he expects rising interest rates, which makes credit cards more expensive to use, and higher prices on food and energy to continue to put a strain on shoppers.

The big-box store chain missed sales expectations in the second quarter, and according to its latest earnings report, revenue also came lower than expected. Executives pointed to a growing economic malaise, and uncertainty from the restart of student loan repayments as some of the reasons for the deteriorating outlook for the months ahead. Despite falling sales volumes and a tighter environment for consumer spending, Target says it will have to continue hiking prices to improve profitability and meet its financial goals.

Fiddelke noted that price increases are “always the last lever” the retailer pulls, but “external conditions led us to raise prices across a broad set of items in multiple categories,” he added.

Other retailers are doing the same. Home Depot, the nation’s largest home improvement retailer, reported declining sales in its second-quarter earnings results. The company noted that it’s seeing weak sales volumes in several big-ticket items like patio furniture and appliances. For that reason, it has decided to raise the price of smaller home-improvement items to offset its losses.

At this point, Target is considered as one of the highest-priced retailers of 2023. A Business Insider comparison between Target and other major retailers found that Target’s prices are on average 15% to 25% higher than some of its competitors. With consumers having to cover for the company’s financial losses via higher prices, it’s understandable why Wall Street isn’t seeing a bright future for the retailer in the months ahead.

Americans are sick and tired of price increases, and they are likely to search for better deals at other stores instead of going to Target. Even though the markups may help Target to boost revenue in the short term, it will hurt consumer confidence, and ultimately, do more harm than good to its bottom line in the long run. At a time when big retailers are facing a heightened risk of bankruptcy, Target should be actively considering better strategies to bolster its performance and avoid experiencing even more hardships in the future.

Video and article via Epic Economist.

]]>