The economic shift that we have witnessed since the turn of the decade has been nothing short of epic.

According to Zillow, the average monthly mortgage payment for Americans buying a home now is nearly double what it was in January 2020…

The real estate firm Zillow reports that since January 2020, the monthly mortgage payment on a typical U.S. home has nearly doubled. It’s up 96% in just four years.

According to Zillow, a typical buyer will now pay nearly $2,200 a month, with a 10% down payment. Meaning, homeownership now costs well above the 30% of median income that was once thought to equate to “affordable” housing cost in America.

And with the 30-year fixed-rate mortgage hovering around seven percent right now, there’s not a whole lot of light at the end of this tunnel.

If home buyers have to shell out twice as much for their mortgage payments compared to four years ago, they are going to have a lot less money to spend on other things. And this is the primary reason why so many of our young people simply cannot afford to purchase a home right now.

At this point, you need to earn approximately $106,000 a year in order to “afford the median home in the United States”…

“After the surge in home-buying demand and mobility during the pandemic, and the doubling of mortgage rates, home-shoppers now need to earn $106,000 to afford the median home in the United States,” said Divounguy.

Back in 2020, the salary needed to afford the median monthly mortgage payment was just $59,000.

Of course it isn’t just housing that has become extremely unaffordable.

For the first time I can ever remember, the cost of burgers has become a major national issue…

I can’t imagine paying more than 20 dollars for a burger, fries and drink at a fast food restaurant.

But this is life in America in 2024.

Our leaders have created an inflationary nightmare.

The Biden administration continues to insist that inflation is a low, but that is a lie.

Another lie that we have been told is that the unemployment rate is low.

How can that be possible when we just witnessed the worst February for layoffs since Challenger, Gray & Christmas started keeping records?…

The pace of job cuts by U.S. employers accelerated in February, a sign the labor market is starting to deteriorate in the face of ongoing inflation and high interest rates.

That is according to a new report published Thursday by Challenger, Gray & Christmas, which found that companies planned 84,638 job cuts in February, a 3% increase from the previous month and a 9% jump from the same time last year.

It marked the highest layoff total for the month of February in data going back to 2009.

The Biden administration keeps telling us that there are plenty of good jobs available.

So why are so many highly qualified workers having such difficulty finding work? Here is one example…

Since leaving a university research administration job last May, Kyle Clark has cast an ever-widening net in his search for a new position.

First the 30-year-old sought jobs in technical editing, a skill he honed at the university. Then he leveraged his administrative experience, applying for openings in insurance and project management. Finally, he tossed his hat in the ring for a job posting at a local big-box retailer, only to be told the store wasn’t hiring.

After fruitlessly job hunting in the Portland, Oregon, area, Clark moved in with his parents in Tennessee with no better results. Now he’s heading to Chicago to try his luck in the Windy City.

Why can’t Kyle Clark find a job?

He has submitted applications for approximately 250 jobs, and he hasn’t received a single offer…

The tally so far: about 250 applications, 14 positive responses, 12 interviews. No job offers.

“I am losing my mind,” Clark says, noting he has a four-year college degree and seven years of work experience. “I am just burned out. … I just want to be employed. I have skills, I want to work, and that’s what’s frustrating. I want to. Just let me.”

I have heard from so many others that are in the exact same boat. So something is not adding up.

The rosy picture of the economy that the Biden administration is giving us simply does not match reality at all.

And now we have reached a breaking point.

Last year, the total number of bankruptcy filings in the United States was 18 percent higher than the year before…

U.S. bankruptcy filings surged by 18% in 2023 on the back of higher interest rates, tougher lending standards and the continued runoff of pandemic-era backstops, data published Wednesday showed, although insolvency case volumes remain well below the level seen before the outbreak of COVID-19.

Total bankruptcy filings – encompassing commercial and personal insolvencies – rose to 445,186 last year from 378,390 in 2022, according to data from bankruptcy data provider Epiq AACER.

Based on what we are seeing so far this year, I fully expect the final number for 2024 to absolutely crush the final number for 2023.

Meanwhile, it is being reported that corporate bond defaults were up by a whopping 80 percent last year…

Consumers aren’t the only ones defaulting on their debts: Corporate bond defaults were up massively in 2023, especially for high-risk junk debt, and the trend is continuing this year at a pace not seen since the 2008 global financial crisis. Unsurprisingly, companies selling low-rated junk debt are being hit the worst.

Last year, according to S&P Global Ratings, corporate bond defaults increased by a disconcerting 80%. High interest rates coupled with high inflation have made it a struggle for companies to make good on their commitments even as waves of new bond buyers continue to arrive, eager to lock in higher yields before rates go down.

Many have pointed out that corporate bond defaults spiked like this just prior to the financial crisis of 2008 too.

We have entered such dangerous territory, and it appears that things will get even worse throughout the rest of this year.

Our leaders were able to delay the inevitable for a while by flooding the system with trillions upon trillions of dollars.

But now an economic nightmare has arrived anyway, and the days ahead are going to be exceedingly challenging for most U.S. consumers.

Voice your opinions about this article on our Economic Collapse Substack.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

]]>Demand is constrained by the ability to produce goods. The more goods that an individual can produce, the more goods he can acquire. The same can be said for the economy at large because what drives an economy is not demand but rather the production of goods and services.

Producers, not consumers, are the engine of economic growth. Obviously, a producer must produce goods and services in line with what other producers require.

According to James Mill,

When goods are carried to market what is wanted is somebody to buy. But to buy, one must have the wherewithal to pay. It is obviously therefore the collective means of payment which exist in the whole nation that constitute the entire market of the nation. But wherein consist the collective means of payment of the whole nation? Do they not consist in its annual produce, in the annual revenue of the general mass of inhabitants? But if a nation’s power of purchasing is exactly measured by its annual produce, as it undoubtedly is; the more you increase the annual produce, the more by that very act you extend the national market, the power of purchasing and the actual purchases of the nation. . . . Thus it appears that the demand of a nation is always equal to the produce of a nation. This indeed must be so; for what is the demand of a nation? The demand of a nation is exactly its power of purchasing. But what is its power of purchasing? The extent undoubtedly of its annual produce. The extent of its demand therefore and the extent of its supply are always exactly commensurate.

Can Government Really Grow an Economy?

The idea that the government grows the economy originates from the belief that increases in government outlays expand the economy’s output by a multiple of the initial government increase.

John Maynard Keynes, who popularized this idea, wrote,

If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coal mines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is.

Given Keynes’s influence, it is not surprising that most economists today believe that it is possible via government spending to prevent a recession. Countering that notion requires that we examine the effect of an increase in the government’s demand on an economy’s wealth formation.

Take an economy comprised of a baker, a shoemaker, and a farmer, and assume a government enforcer enters the scene who demands goods by means of force. The baker, the shoemaker, and the farmer are forced to part with their products in exchange for nothing, weakening the flow of production of final consumer goods. The increases in government outlays do not raise overall output by a positive multiple; on the contrary, they undermine the process of wealth generation.

Through taxation, the government forces producers to part with their products for government services that are likely a low priority. According to Ludwig von Mises, “There is need to emphasize the truism that a government can spend or invest only what it takes away from its citizens and that its additional spending and investment curtails the citizens’ spending and investment to the full extent of its quantity.”

Monetary pumping and government spending cannot remove the dependence of demand on the production of goods. On the contrary, loose fiscal and monetary policies impoverish real wealth generators and reduce their ability to produce goods and services, thus weakening effective demand for other goods.

Therefore, curbing government spending is required to revive the economy, not increasing spending and monetary creation to boost aggregate demand. Limiting government spending enables wealth generators to revive the economy. Hence, by strengthening the economy’s ability to produce goods and services, we also strengthen overall demand.

What Causes Recessions?

Keynesians believe that recessions are the result of unexpected events that push the economy away from a trajectory of stable economic growth. Shocks weaken the economy and cause lower economic growth.

In contrast, we suggest that recessions occur because of the central bank’s monetary policies in which monetary authorities first inflate the currency, then pull back on money growth. Loose monetary policies lead to a strong money growth rate which ultimately leads to inflation, prompting the central bank to reverse course.

These activities cannot support themselves; they survive because the increased money supply provides support for them. The increased supply diverts money from wealth-generating activities to unproductive ones, weakening the wealth-generating process. From there, the tight-money stance ends the malinvestment of resources, leading to the recession.

Thus, nonproductive and unprofitable activities cannot support themselves once the growth rate of money supply declines. Aggressive fiscal policies, which are enacted to support nonproductive activities, continue to undermine the wealth-generation process, thereby damaging the prospects for an economic recovery.

Conclusion

During an economic crisis, the government should not intervene. When there is no monetary or fiscal tampering, wealth generators can retain their wealth, allowing them to expand the pool.

A larger pool of wealth makes it much easier to absorb various unemployed resources and eliminate the crisis. Aggressive fiscal policies, however, damage the process of wealth generation and make things even worse.

About the Author

Frank Shostak‘s consulting firm, Applied Austrian School Economics, provides in-depth assessments of financial markets and global economies. Contact: email.

Article cross-posted from Mises.

]]>#1 This year, only 74 percent of Americans will celebrate Thanksgiving because so many people are skipping the holiday in order to save money…

In 2021, researchers note that an IPSOS survey found that nine in 10 Americans planned to celebrate Thanksgiving. This year, the new poll of 1,000 people found that number has fallen to just 74 percent. In fact, 47 percent say they’re celebrating “Friendsgiving” because of its more budget-friendly menu. Specifically, just 24 percent of Friendsgiving celebrations will even have a turkey on the table, with 33 percent opting for a pizza instead!

#2 Used vehicle prices have just plunged at the fastest pace that we have seen since 2008.

#3 A Dollar General assistant manager named Travis Bennett recently posted a video on TikTok that showed unsold inventory at his store literally piling up to the roof…

In a video with over 380,000 views addressed to “anyone inside this company that actually cares,” TikTok user Travis Bennett shows the conditions of his Dollar General. This includes boxes filling the aisles and numerous crates that have not been unpacked. Bennett says this is typical for “most Dollar General stores across the country.”

#4 Consumer confidence in the housing market just hit an all-time record low.

#5 All over America, companies are seeing depressingly low sales numbers. In fact, it is being reported that the Net Rising Index “is getting close to a level which corresponds to several past recessions”…

A closely watched survey from the National Association for Business Economics has shown a decline in sales for companies that hasn’t been this sharp since the mid-2020 Covid crash and is getting close to a level which corresponds to several past recessions. The Net Rising Index (NRI) for sales — the percentage of survey respondents reporting rising sales minus the percentage reporting falling sales — peaked at 74% of firms in April 2021. As of October, it’s down to 36%.

#6 CNN is reporting that Facebook could start laying off thousands of workers “as early as this week”.

#7 Other large tech companies are also conducting mass layoffs, and many believe that what we have experienced so far is just the tip of the iceberg.

#8 Credit card debt growth has fallen to the lowest level in 4 months.

#9 20 million U.S. households are behind on paying their power bills.

#10 37 percent of all small business owners were not able to pay their rent on time during the month of October.

#11 A poll that was just released found that a whopping 73 percent of Americans will be “thinking a lot about the economy” when they vote.

The fact that voters are so focused on the economy right now appears to be really bad news for Democrats.

The guy in the White House always gets most of the credit or most of the blame for how the economy is performing, and right now Joe Biden’s approval rating is downright dismal…

Voters’ approval of President Joe Biden remains deep in negative territory and 70 percent of voters say the country is on the wrong track — both results that bode ill for Democrats as Election Day approaches.

Fifty-five percent of registered voters said they disapprove of the job Biden is doing as president, and just 42 percent said they approve in the last POLITICO-Morning Consult poll conducted in advance of Tuesday’s election.

Of course Joe Biden is still going to be in the White House no matter what happens during the midterm elections.

In fact, either he or Kamala Harris will be residing there until at least January 2025.

So there won’t be any major policy changes for the foreseeable future.

Meanwhile, economic conditions are just going to continue to deteriorate.

As this new downturn accelerates, a lot of Americans are going to lose their jobs.

In fact, Bank of America is projecting that job losses in this country will soon hit 175,000 a month…

As pressure from the Fed’s war on inflation builds, nonfarm payrolls will begin shrinking early next year, translating to a loss of about 175,000 jobs a month during the first quarter, the bank said. Charts published by Bank of America suggest job losses will continue through much of 2023.

“The premise is a harder landing rather than a softer one,” Michael Gapen, head of US economics at Bank of America, told CNN in a phone interview Monday.

Sadly, that is a wildly optimistic projection.

During times like these, you will want to be carrying as little debt as possible, and you will want to have a sizable emergency fund so that you can continue paying the bills if something happens.

In 2008 and 2009, millions of Americans ended up losing their homes because they couldn’t continue paying the bills once they lost their jobs.

Don’t let that happen to you.

The times that we are moving into won’t be pleasant. Eventually, they will be far worse than anything that we experienced in 2008 and 2009.

But that doesn’t mean that we have to be depressed about what is coming.

When I was growing up, I was often told that “when times get tough, the tough get going”.

Those that choose to be bold and tough are going to have a much better chance of making it through what is ahead.

Unfortunately, boldness and toughness are in short supply in our society today, and the coming economic slowdown is likely to cause a massive national emotional breakdown.

***It is finally here! Michael’s new book entitled “End Times” is now available in paperback and for the Kindle on Amazon.***

About the Author: My name is Michael and my brand new book entitled “End Times” is now available on Amazon.com. In addition to my new book I have written six other books that are available on Amazon.com including “7 Year Apocalypse”, “Lost Prophecies Of The Future Of America”, “The Beginning Of The End”, and “Living A Life That Really Matters”. (#CommissionsEarned) When you purchase any of these books you help to support the work that I am doing, and one way that you can really help is by sending copies as gifts to family and friends. Time is short, and I need help getting these warnings into the hands of as many people as possible.

I have published thousands of articles on The Economic Collapse Blog, End Of The American Dream and The Most Important News, and the articles that I publish on those sites are republished on dozens of other prominent websites all over the globe. I always freely and happily allow others to republish my articles on their own websites, but I also ask that they include this “About the Author” section with each article. The material contained in this article is for general information purposes only, and readers should consult licensed professionals before making any legal, business, financial or health decisions.

I encourage you to follow me on social media on Facebook and Twitter, and any way that you can share these articles with others is definitely a great help. These are such troubled times, and people need hope. John 3:16 tells us about the hope that God has given us through Jesus Christ: “For God so loved the world, that he gave his only begotten Son, that whosoever believeth in him should not perish, but have everlasting life.” If you have not already done so, I strongly urge you to invite Jesus Christ to be your Lord and Savior today.

Article cross-posted from The Economic Collapse Blog.

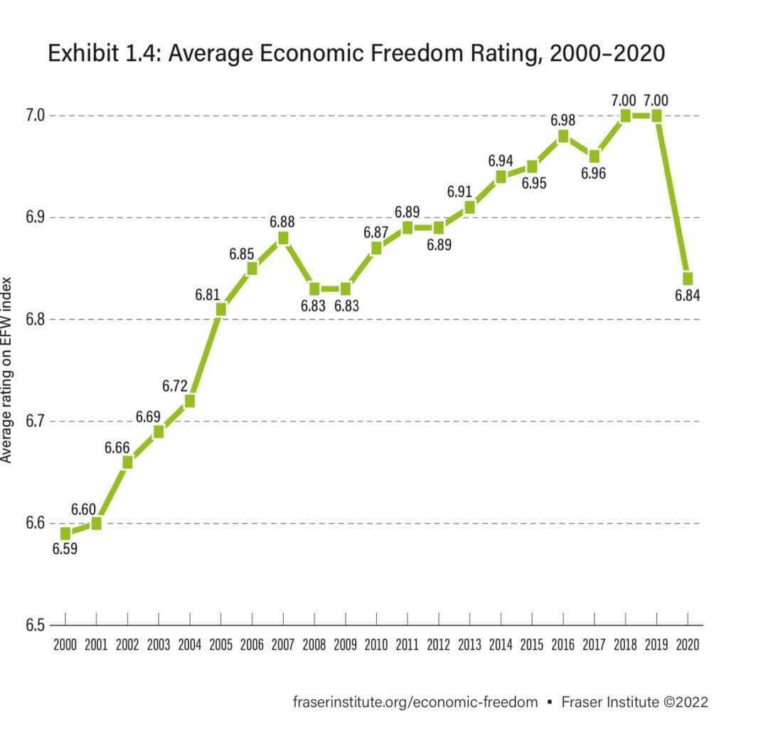

]]>When additional years of data from the COVID era are added, we fully expect that economic freedom around the world will continue to falter. But let’s not get ahead of ourselves. The 2020 data is bad enough. The global average economic freedom rating fell .14 points in 2020, erasing a decade’s worth of improvements.

But first, some notes on what the Fraser Institute measures.

The Economic Freedom of the World report comprises measurements across five categories and 165 jurisdictions: size of government, legal system and property rights, sound money, freedom to trade internationally, and regulation. Perhaps the most important facet of the report is that we can look at the data in absolute terms, asking, for example, how well the United States has been doing over time. We can also look at the data in relative terms, asking how well the United States has been doing compared to the other nations of the world.

We have become accustomed to seeing a steady climb to better lives. Indeed, many of us could not comprehend living as our grandparents did. But thanks to the Fraser Institute, we now have detailed data from 1980-2020, detailing two generations. How do we stack up?

Many will be surprised that the United States is not at the top of the list of most-free countries. In 2020 the US was seventh, behind Hong Kong, Singapore, Switzerland, New Zealand, Denmark, and Australia. And while seventh in the world is nothing to sneeze at, the US trajectory has been downward for quite some time, if only moderately so. In 1980 and 1990, the US was the second economically freest nation in the world. In 2000, it was third. In 2010 and 2015 it was fifth and sixth, respectively. And by 2020, it was seventh.

But that only tells part of the story. It’s when we look at ratings rather than rankings that things get interesting. While the United States has been kicking around in the top ten, even if falling, for decades, it is not doing all that well when compared to itself over time. Indeed, the US’s cumulative rating of 7.97 is considerably lower than its 1980 rating of 8.34. Digging into the recent data, the United States dropped in rank across all five indexed categories from 2019 to 2020. The most significant changes have been in the size of government and regulation categories, where the United States fell 7.32 to 6.79, and 8.68 to 8.11, respectively. Both measures directly reflect the COVID era’s unprecedented expansions of government, as federal spending was unleashed from any semblance of fiscal constraint and draconian regulatory intrusions on daily economic life reached every single American.

In short, the United States finished 2020 less economically free than we were at the tail end of the Carter years.

In the time since COVID, these problems have only continued to compound. The United States appears to be entering the same economic malaise of bloated bureaucracy, excessive taxation, and spiraling inflation that typified the Carter years. Back then we had to wait in line, sometimes for hours, just to buy gas. Now we have rolling blackouts and energy crises in some states, impending electric vehicle mandates, perpetual budget-busting deficits that were unheard of even two decades ago, and – yes – a return of inflation that tops 8 percent for the year. Perhaps the most telling fact of all is that our elected officials and policymakers haven’t a clue how to reverse these trends. Indeed, they are still feeding them.

So where is all this going? Well, 2021 is a full year of COVID lockdowns, so you can bet that data will be worse. We will know then, though, if 2022 shows a reversal of the decline – assuming that the present trends do not continue to compound the problems that COVID lockdowns started.

The real question now is whether we have learned any lessons about economic freedom and lockdowns. These new data provide us an unwelcome warning of what happens when the power of government becomes unmoored from any restraint, but the trend may yet be reversible.

Article cross-posted from AIER.

]]>