First, let me put some crucial numbers and concepts into perspective. You often hear the media, politicians, and financial analysts casually toss around the word “trillion” without appreciating what it means. A trillion is a massive, almost unfathomable number.

The human brain has trouble understanding something so huge. The image below shows stacks of $100 bills and a human for reference.

Suppose you had a job that paid you $1 per second, or $3,600 per hour. That amounts to $86,400 per day and about $32 million per year. With that job, it would take you 31.5 years to earn a billion dollars. With that job, it would take you over 31,688 YEARS to earn a trillion dollars.

Suppose you earned $75,000 a year, which is the typical household income in the US. It would take you over 13 million years to make a trillion dollars. If you had a trillion one-dollar bills, you could cover the surface area of Delaware twice over. If you stacked a trillion one-dollar bills on top of each other, it would reach 67,866 miles high, about one-fourth of the distance from Earth to the moon. If you took that same trillion one-dollar bills and instead stacked them end-to-end, the length would exceed the distance between the Earth and the sun.

So that’s how enormous a trillion is.

When politicians carelessly spend and print money measured in the trillions, they are in dangerous territory. And that is precisely what the fiat currency system has enabled the US government to do.

Today, the US federal debt has gone parabolic and is over $35 TRILLION. To put that in perspective, if you earned $1 a second 24/7/365—about $31 million per year—it would take over 1,109,080 YEARS to pay off the US federal debt. And that’s with the unrealistic assumption that it would stop growing.

In short, the US government can’t repay its debt. It can’t even pay the interest expense without going into further debt. Default is inevitable.

It Will Not Be an Explicit Default

The US government is out of options and cannot repay what it has borrowed. Therefore, the question is not whether the US government will default but how.

Consider the recurring debt ceiling farce in the US Congress, which has been raised over 100 times since 1944 to avoid an explicit default. When faced with a choice, politicians always choose the most expedient option.

In this case, that means issuing more debt rather than making tough budget decisions or explicitly defaulting. That raises an important question: who will buy all this debt (Treasuries)?

Historically, there has been a vast foreign appetite for Treasuries, but not anymore. In the wake of Russia’s invasion of Ukraine in 2022, the US government has launched its most aggressive sanctions campaign ever.

The US government and its allies froze around $300 billion of the Russian central bank’s reserves—the nation’s accumulated savings.

It was a stunning illustration of the political risk associated with the US dollar and Treasuries. It showed that the US government could deny access to another sovereign country’s reserves at the flip of a switch.

Then, in April 2024, President Joe Biden signed the REPO Act into law. It allows the US government to seize frozen Russian state assets and transfer the funds to Ukraine.

In short, the US dollar and Treasuries have become weaponized in a way they had not before. They are now clearly not neutral assets worthy of forming the bedrock of the international financial system but political tools for Washington to coerce others.

The rising political risk attached to Treasuries has made them even less attractive as a store of value. Many countries are undoubtedly wondering if the US government will seize their savings if they run afoul with Washington in even the most trivial ways.

China is one of the largest holders of US Treasuries, and it indeed took note of what is happening. Since 2022—when the US froze Russian state assets—China has sold about 25% of its Treasuries, an enormous change in such a short period.

Even US allies, like Japan, have cut their Treasury holdings. There are numerous other examples. The bottom line is that it’s clear the world isn’t hungry for US debt right now as supply is exploding.

In the bond market, when demand for a bond falls, the interest rate rises to entice buyers and holders. However, the US government cannot allow interest rates to rise because the skyrocketing interest expense has become an urgent threat to its solvency.

The interest expense on the federal debt is already bigger than defense spending and is set to become the largest item in the US government’s budget in months.

If higher interest rates are off the table and cannot entice more natural buyers, who will buy all this debt? The only entity capable of doing this is the Federal Reserve, which buys Treasuries with dollars it creates out of thin air.

Here’s the bottom line.

The US government can’t pay off its debt. They won’t explicitly default. They can’t entice a meaningful amount of new Treasury buyers by allowing interest rates to rise. That means currency debasement is their only practical option.

Fed Chair Powell’s recent pivot to monetary easing and rate cuts is compounding the situation. That means the Fed has given up on bringing inflation down… even though it remains well above their target. It’s an incredible failure and will have ENORMOUS investment implications for the US dollar and gold.

If the gold price is already hitting record highs, imagine what will happen when the Fed flips back to easing with even more currency debasement than the previous rounds of stimulus.

I think the gold price could skyrocket. The last time the US experienced runaway inflation was in the 1970s. Then, gold skyrocketed from $35 per ounce to $850 in 1980—a gain of over 2,300% or more than 24x.

I expect the percentage rise in the price of gold to be at least as significant as it was during the 1970s. While this megatrend is already well underway, I believe the most significant gains are still ahead.

]]>If the current administration remains in power, the Treasury’s own estimates predict an additional $16 trillion increase in debt by 2034, without accounting for any recession or slowdown in tax receipts. According to the Congressional Budget Office, Vice President Kamala Harris’ economic plan would add another $1.9 trillion to $2.2 trillion to the national debt.

The Harris campaign has not even bothered to discuss a plan to balance the budget. She just said that “efficiency” and the old fallacy of higher taxes on the rich would pay for the increase in spending—two things that have proven to do nothing to the ballooning debt and that do not even start to scratch the already unsustainable $2 trillion annual deficit.

This reckless increase in debt is happening in an economic growth period. However, if we adjust for government debt accumulation, 2021 to 2024 were the worst years of growth, adjusted for debt, since the 1930s.

In a recent article, economist Claudia Sahm stated that we shouldn’t worry about debt. “Debt is neither inherently good nor bad,” she wrote in an opinion column for Bloomberg back in January. “As such, the question is not what’s the right level of borrowing, but rather what’s the economic return on the borrowing or the societal goals it advances.”

She went on to say that “the government can easily service its debt because of its unlimited taxing authority and ability to issue more U.S. Treasury securities to repay maturing securities.”

Now you must worry. A lot.

Unproductive Borrowing ‘Inherently’ Bad

Let us start with the benign idea of “economic return on borrowing and societal goals.” The evidence from the United States indicates that the economic return is extremely low. Entitlement spending has not strengthened the economic growth path, and debt continues to rise faster than gross domestic product.

It’s true that debt is not inherently bad, but unproductive borrowing is. It’s a massive transfer of wealth from the productive sector to the bloated bureaucratic state.

Furthermore, the societal goals cannot be unlimited. The government must administer and not just add expenditures to previous expenditures, particularly when there is no realistic analysis of the success or failure of government programs.

The idea that a particular government program is beneficial is not enough to add it to the budget without reducing other expenses. Not even a benign view of government spending as Sahm’s can justify that every government expenditure item today is essential.

Furthermore, we must always understand that governments do not give money for free. They tax the productive sector and borrow, which means printing a currency that is constantly losing purchasing power. Therefore, the government is not advancing societal goals by borrowing without control. It is implementing a profoundly regressive policy that creates a dependent subclass and makes it increasingly difficult for the middle class to thrive.

Economic, Fiscal, and Inflationary Limits

It’s false that the government has “unlimited” taxing authority and the ability to issue more debt, i.e., print money.

The government has economic, fiscal, and inflationary limits: Economic, because constantly increasing taxation leads to stagnation and more debt; fiscal, because expenditures are consolidated and annualized, while tax receipts are cyclical; and inflationary, because the constant issuance of new currency, which is what happens when more debt is issued, leads to the loss of confidence in the currency and the erosion of its purchasing power.

If what Sahm states were true, the euro area and Japan would be examples of high growth and economic strength, but they are examples of stagnation, high debt, and rising social discontent.

The government does not set taxes to fund its incessant spending habits. Taxes should be set according to the economic reality of an economy. The fallacy of taxes on the rich and corporations does not even address the ballooning deficit and erodes economic growth and productive investment.

When someone tells you not to worry about record debt, you should be extremely concerned. When they say that the government has unlimited resources, they mean that you will pay by becoming poorer with more taxes, more inflation, lower growth, or all three at the same time.

When they tell you that $35 trillion of debt is peanuts compared with $142 trillion of American wealth, they are saying that the government will be pleased to absorb the wealth of the economy. You will pay.

Private Sector Isn’t an ATM

When they tell you that tax cuts are the problem, it comes from the perspective that the private sector is an ATM at the disposal of governments.

Tax cuts do not reduce revenues, just as tax hikes do not raise them forever. Tax cuts adjust the taxable base to the real economy in order to encourage more investment and growth.

Tax cuts are not a loss for the government. They are a win for the economy. It is simply a return of funds to those who have earned them. The idea that funds are better in the hands of the government than in the pockets of those who earned them is confiscatory.

It’s ludicrous to think that the government knows better than the private sector where and how to spend money. Additionally, it’s insane to believe that the government will not squander the funds and bloat the administrative costs.

Furthermore, it’s foolish to assume that corporations and the affluent will hoard unused funds. There’s no such thing as idle money. Capital markets and the private banking sector invest all of their earnings in a productive economy.

If Sahm is concerned about economic returns and social advancements, she should advocate for the private sector to retain a larger portion of the earned money, as it will allocate it to the most advantageous investments.

Inflation Is Regressive Form of Taxation

Inflation is a form of default, in which the government transfers its imbalances to those who receive their salaries in currency. This is the most regressive form of taxation, primarily affecting the poorest. When governments ignore the real demand for the money they issue, confidence in the currency disappears.

Developing countries do not issue debt in foreign currency because they are stupid, but because there is no international demand for their local currency.

Economists such as Sahm assume that the U.S. dollar will have eternal and unlimited demand, and, as such, the U.S. government can export inflation to the rest of the world through the loss of the purchasing power of the currency it issues.

However, global central banks are reducing their holdings of U.S. dollars (U.S. treasuries). International demand is declining, and the limits I mentioned before are already evident.

The U.S. is showing its economic limits, as evidenced by the significant slowdown despite a record deficit and government so-called stimulus. The U.S. is also demonstrating its fiscal limits as the government persists in raising taxes, resulting in significantly lower tax receipts than anticipated and an interest expense bill that has escalated to $3 billion daily.

Declining Purchasing Power of Dollar

Furthermore, the inflationary limit is evident due to a 20% increase in inflation over the past four years, a 30% increase in the cost of basic groceries, and persistent inflation, which is exemplified by the constant decline in the purchasing power of the U.S. dollar.

What Harris is doing as vice president and intends to continue doing if she becomes president is to continuously test the patience of the world and U.S. citizens when it comes to accepting a constantly depreciated purchasing power of the currency.

Saying that nothing will happen if debt continues to rise and deficits continue to drive government policy is, literally, like saying that an alcoholic should drink more vodka because cirrhosis has not killed him yet.

The dollar is the credit of the U.S. economy. If the U.S. government loses its credibility, domestic agents will begin to reduce their use of the dollar, while international agents will decline the currency due to its constant fiscal excess and its tendency to push the limits of global patience.

Thinking that the U.S. dollar will never lose its reserve currency status is simply reckless and ignores history.

Harris is threatening the dollar, and you should be very concerned when someone says that the government has unlimited taxation and printing resources. That means it has unlimited ways of making you poorer.

]]>Unfortunately, conditions won’t be relatively stable for long. Global events have started to accelerate significantly, and that is really going to shake things up in the months ahead.

According to a report that was just released by the Institute of International Finance, the total amount of debt in the world has reached a grand total of 315 trillion dollars…

The world is mired in $315 trillion of debt, according to a report from the Institute of International Finance.

This global debt wave has been the biggest, fastest and most wide-ranging rise in debt since World War II, coinciding with the Covid-19 pandemic.

“This increase marks the second consecutive quarterly rise and was primarily driven by emerging markets, where debt surged to an unprecedented high of over $105 trillion—$55 trillion more than a decade ago,” the IIF said in its quarterly Global Debt Monitor report released in May.

We are in the midst of the greatest global debt binge in the history of the world.

Household debt is at a level we have never seen before, business debt is at a level we have never seen before, and government debt is at a level we have never seen before…

Of the $315 trillion debt stock, household debt, which includes mortgages, credit cards and student debt, among others, amounted to $59.1 trillion.

Business debt, which corporations use to finance their operations and growth, stood at $164.5 trillion, with the financial sector alone making up $70.4 trillion of that amount. Public debt made up the rest at $91.4 trillion.

For the moment, conditions are at least somewhat relatively stable, and so everything seems fine.

But it won’t take much to push us over the edge.

For example, during a recent interview with Greg Hunter, Chris Martenson suggested that a Chinese invasion of Taiwan could trigger a sudden meltdown of the bond market…

In a new market meltdown, Dr. Martenson sees chaos and gives a hypothetical example: “China attacks Taiwan, and there is a 10 sigma move in the bond market. Oh no, all these derivatives have blown up. These people are supposed to be winners, and these people are supposed to be all losers. No, no, they don’t have any money for that stuff. It’s too complicated. I don’t think anybody understands how this works anymore. I could not find anybody who could tell me the whole thing. I could find people who knew bits and pieces, but they knew their slice. . . . I am trying to stitch this thing all together. I get uncomfortable when I can’t answer the most basic questions, and that is how much risk is there in the system and where is it?”

In short, Dr. Martenson is worried about the whole financial system going down. Dr. Martenson says, “Yes, I am worried about the whole system going down, and that leads to all sorts of speculation. . . . Imagine this, we wake up one day, and the markets are not open on Monday. Oh no, glitch. Problem. Then, it’s two days and not open, three days not open. People are getting worried. Friday, and the markets are still not open. Monday comes, and they say it’s a super big problem, and we don’t know how to resolve it. . . . They offer you 100% value today in a Central Bank Digital Currency (CBDC) account or you can wait it out and hope it gets resolved, and it might take a decade.”

The moment that the Chinese invade Taiwan, the U.S. and China will be at war.

This is one of the three major wars that I have been warning about for a long time.

Unfortunately, the Chinese continue to become more aggressive toward Taiwan. In fact, late last week they conducted the biggest practice run that we have seen so far…

China wrapped up a two-day, large-scale military exercise Friday after its forces deployed 111 aircraft and 46 naval vessels to areas around Taiwan.

Taiwan’s National Defense Ministry said 82 Chinese military aircraft crossed the median line of the Taiwan Strait and some got very close to the 24-nautical-mile line that Taiwan uses to define its contiguous zone.

The military drills, branded as a “punishment” for Taiwan’s new president, Lai Ching-te, who China views as separatist, focused on conducting joint sea-air combat-readiness patrol, joint seizure of comprehensive battlefield control and joint precision strikes on key targets involving China’s army, navy, air force and rocket force.

Meanwhile, both sides just continue to escalate matters in Ukraine.

It is being reported that French forces will soon be heading to Ukraine to help “train” Ukrainian troops, and that is a very ominous development…

Ukraine’s military says it is ‘welcoming’ French trainers in Ukraine, in new remarks which strongly suggest that for the first time France is deploying its troops to Ukraine soil. This marks the beginning of major ‘boots on the ground’ escalation in a formal, public capacity by a NATO state.

“Ukraine’s top commander said on Monday he had signed paperwork allowing French military instructors to visit Ukrainian training centers soon,” Reuters reported Monday, referencing head of the armed forces Col. Gen. Oleksandr Syrskyi.

“I am pleased to welcome France’s initiative to send instructors to Ukraine to train Ukrainian servicemen,” Syrskyi said following video link talks with French defense minister Sebastien Lecornu.

We are getting closer and closer to the day when western forces will be in direct conflict with Russian forces, and this is something that I have been warning about for many years.

The third major war that will greatly shake the entire planet is the war that has erupted in the Middle East. Israeli forces keep going even deeper into Rafah, and the IDF and Hezbollah continue to exchange fire along the northern front.

Eventually this war is going to escalate to an extremely dangerous level, and we could potentially see that happen by the end of this calendar year. In addition to military conflict, major pestilences are also a factor that could turn the global financial system upside down.

Earlier today, we learned that over 4 million chickens at just one farm in Iowa will have to be destroyed because of a bird flu outbreak there…

More than 4 million chickens in Iowa will have to be killed after a case of the highly pathogenic bird flu was detected at a large egg farm, the state announced Tuesday.

Crews are in the process of killing 4.2 million chickens after the disease was found at a farm in Sioux County, Iowa, making it the latest in a yearslong outbreak that now is affecting dairy cattle as well. Last week, the virus was confirmed at an egg farm west of Minneapolis, Minnesota, leading to the slaughter of nearly 1.4 million chickens.

Overall, 92.34 million birds have been killed since the outbreak began in 2022, according to the U.S. Department of Agriculture.

Please keep in mind that the figure that the U.S. Department of Agriculture is quoting is just for the United States.

Overall, hundreds of millions of birds have been killed around the globe since the beginning of this pandemic.

Let’s just hope that H5N1 does not mutate into a form that can spread easily from human to human, because if that happens our planet will be paralyzed by fear on a much higher level than we experienced during the last pandemic.

It is also being reported that a hemorrhagic fever that can cause “Ebola-like bleeding” is rapidly spreading among rodents in northern Europe…

A potentially deadly virus that can jump from animals to humans is already sweeping through northern Europe, putting the UK highly at risk.

The horrifying virus can be transmitted from rodents to humans and cause Ebola-like bleeding, according to new research.

Bank voles in Sweden carrying the pathogen have already infected two people, causing them to come down with a Viral Hemorrhagic Fever (VHF) – the same type of illness as Ebola.

I will be closely watching for any human cases of that disease, because any type of hemorrhagic fever that starts spreading widely among humans would cause a tremendous amount of panic.

On top of everything else, I believe that we should brace ourselves for unexpected natural disasters in the months ahead.

For example, our sun has been exceedingly active lately, and we are being warned that more coronal mass ejections may soon be heading our way…

Earth could be hit by another powerful solar storm this week that is predicted to trigger radio blackouts and incredible northern light displays.

Earlier this month, the sun unleashed the most powerful streams of plasma, known as coronal mass ejections (CMEs), in 20 years, causing communication disruptions worldwide.

The sunspot that caused the chaos has swung back around and released a powerful flare toward Earth’s region on Monday.

The National Oceanic and Atmospheric Administration (NOAA) a 60 percent chance of radio blackouts on Tuesday and throughout the rest of the week.

Before this current solar cycle is over, I believe that solar activity will make a lot more headlines.

So much is happening right now, but what we have experienced so far is just the tip of the iceberg compared to what is coming.

It won’t be too long before we are being hit by one catastrophic event after another, and that is going to cause tremendous chaos for the global financial system.

So take advantage of this period of relative stability while you still can, because we are moving into a time when everything that can be shaken will be shaken.

Sound off about this article on the Economic Collapse Substack.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

]]>As a society, we are on the greatest debt binge in the history of the world, and it just gets worse every single year. Previous generations handed us an economy that provided us with an incredibly high standard of living, but we always had to have more. So we have been borrowing and spending with no end in sight, and now our day of reckoning is fast approaching.

According to the New York Fed, U.S. household debt surged to another record high during the first quarter of this year…

In the first three months of 2024, total household debt surged to a fresh record of $17.69 trillion, an increase of $184 billion, or 1.1% from the previous quarter. The increase mostly stemmed from a jump in mortgage balances, which rose $190 billion from the previous quarter to $12.44 trillion at the end of March.

If we could handle all that debt, there wouldn’t be much cause for alarm. Unfortunately, delinquency rates are rising.

In fact, the proportion of credit card balances in serious delinquency has risen to the highest level since 2012…

A growing number of Americans are falling behind on their monthly credit card payments as they continue to battle high inflation and interest rates, according to New York Federal Reserve data published Tuesday.

Credit card delinquencies, which have already surpassed their pre-pandemic levels, continued to rise in the three-month period from January to March.

The flow of credit card debt moving into delinquency hit 8.9% in the first quarter at an annualized rate, compared with an 8.5% rate the previous quarter and 5.87% at the end of 2023. In fact, the percentage of credit card balances in serious delinquency climbed to its highest level since 2012.

In 2012, we were just coming out of the Great Recession.

Now a new economic crisis has begun, and millions of U.S. households are teetering on the brink of financial disaster.

If you use credit cards, it is so important to pay them off in full every month. Unfortunately, approximately 44 percent of all cardholders do not do that…

Overall credit card balances totaled $1.115 trillion in the first quarter of the year, $129 billion more than last year. For card users who pay their balance in full every month, that’s not a problem. But according to Bankrate, roughly 44% of borrowers carry credit card debt over from month to month.

It has always been financial suicide to carry credit card balances from month to month, and that is especially true today because interest rates are so ridiculously high…

The rise in credit card usage and debt is particularly concerning because interest rates are astronomically high. The average credit card annual percentage rate, or APR, hit a new record of 20.72% last week, according to a Bankrate database that dates to 1985. The previous record was 19% in July 1991.

If people are carrying debt to compensate for steeper prices, they could end up paying more for items in the long run. For instance, if you owe $5,000 in debt, which Americans do on average, current APR levels would mean it would take about 279 months and $8,124 in interest to pay off the debt making the minimum payments.

I always encourage my readers to pay off high interest debt as soon as possible.

If you have credit card debt, eliminating it should be your number one financial goal. Sadly, the New York Fed’s new report tells us that an increasing number of Americans are getting behind on their credit cards and their auto loans…

The Fed’s report showed 6.9% of credit card debt transitioned to serious delinquency last quarter, up from 4.6% a year ago. And for credit card holders aged 18–29, 9.9% of balances were in serious delinquency.

Auto loan delinquencies are also higher as the average monthly car payment jumped to $738 in 2023. Close to 2.8% of auto loans are now 90 or more days delinquent — that equates to more than 3 million cars. Auto loans are the second-largest debt category following mortgage debt, with $1.62 trillion outstanding.

Tens of millions of U.S. households have severely overextended themselves financially.

When you get to a point where you are so far in debt that you can barely make the minimum payments, it can feel like you are “trapped” with no way out…

High interest rates are pushing low- and moderate-income Americans who have fallen behind on credit card payments and auto loans to the brink, according to a new report.

“It’s crazy,” 43-year-old Army veteran Ora Dorsey told The New York Times. “It does make it hard to get out of debt. It seems like you’re only paying the interest.”

“We don’t have the credit to be able to buy a house, and we have a bunch of debt, either student loans or credit card debt,” 31-year-old Chris Nunn, who drives for the DoorDash delivery app, told the Times. “So we’re trapped.”

Dorsey told the outlet she has been trying to cut down debts accrued following various health issues for years. She is working three jobs to cut down her substantial debt.

Today, Americans are more pessimistic about the economy than they have been in a very long time.

It can be absolutely soul crushing to work as hard as you possibly can and still not have enough money for all the bills.

If you are feeling a tremendous amount of stress about your finances, you are certainly not alone.

According to one recent survey, approximately half of the entire population is struggling with mental health issues due to financial stress…

About half of U.S. adults are struggling with their mental health because of their financial situation.

Forty-seven percent of adults say concerns about money have, at least occasionally, caused anxiety, stress, worrisome thoughts, loss of sleep, depression or other effects, according to Bankrate’s latest Money and Mental Health Survey.

About 65% of them say their biggest concern is inflation and rising prices, and nearly 60% say their stress derives from paying for everyday expenses such as groceries and utilities. About 56% say they are worried about having enough emergency savings, and 47% are most concerned about being in debt, according to the survey.

After seeing numbers like that, how in the world can anyone possibly claim that the U.S. economy is in good shape?

The level of economic pain that we are already witnessing is absolutely staggering, and conditions are only going to get worse during the chaotic months and years that are ahead of us.

But even though our leaders continue to make incredibly reckless decision after incredibly reckless decision, many people out there continue to be convinced that everything is going to work out just fine somehow.

Join the free Economic Collapse Substack and get occasional emails while joining the conversation.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

]]>We are talking about the nation’s unhinged monetary politburo domiciled in the Eccles Building, of course. It is bad enough that their relentless inflation of financial assets has showered the 1% with untold trillions of windfall gains, but their ultimate crime is that they lured the nation’s elected politician into a veritable fiscal trance. Consequently, future generations will be lugging the service costs on insuperable public debts for years to come.

For more than two decades these foolish PhDs and monetary apparatchiks drove the entire Treasury yield curve to rock bottom, even as public debt erupted skyward. In this context, the single biggest chunk of the Treasury debt lies in the 90-day T-bill sector, but between December 2007 and June 2023 the inflation-adjusted yield on this workhorse debt security was negative 95% of the time.

That’s right. During that 187-month span, the interest rate exceeded the running (LTM) inflation rate during only nine months, as depicted by the purple area picking above the zero bound in the chart, and even then by just a tad. All the rest of the time, Uncle Sam was happily taxing the inflationary rise in nominal incomes, even as his debt service payments were dramatically lagging the 78% rise of CPI during that period.

Inflation-Adjusted Yield On 90-Day T-bills, 2007 to 2022

The above was the fiscal equivalent of Novocain. It enabled the elected politicians to merrily jig up and down Pennsylvania Avenue and stroll the K-Street corridors dispensing bountiful goodies left and right, while experiencing nary a moment of pain from the massive debt burden they were piling on the main street economy.

Accordingly, during the quarter-century between Q4 1997 and Q1 2022 the public debt soared from $5.5 trillion to $30.4 trillion or by 453%. In any rational world a commensurate rise in Federal interest expense would have surely awakened at least some of the revilers.

But not in Fed World. As it happened, Uncle Sam’s interest expense only increased by 73%, rising from $368 billion to $635 billion per year during the same period. By contrast, had interest rates remained at the not unreasonable levels posted in late 1997, the interest expense level by Q1 2022, when the Fed finally awakened to the inflationary monster it had fostered, would have been $2.03 trillion per annum.

In short, the Fed reckless and relentless repression of interest rates during that quarter century fostered an elephant in the room that was one for the ages. Annualized Federal interest expense was fully $1.3 trillion lower than would have been the case at the yield curve in place in Q4 1997.

Alas, the missing interest expense amounted to the equivalent of the entire social security budget!

So, we’d guess the politicians might have been aroused from their slumber had interest expense reflected market rates. Instead, they were actually getting dreadfully wrong price signals and the present fiscal catastrophe is the consequence.

Index Of Public Debt Versus Federal Interest Expense, Q4 1997-Q1 2022

Needless to say, the US economy was not wallowing in failure or under-performance at the rates which prevailed in 1997. In fact, during that year real GDP growth was +4.5%, inflation posted at just 1.7%, real median family income rose by 3.2%, job growth was 2.8% and the real interest rates on the 10-year UST was +4.0%.

In short, 1997 generated one of the strongest macroeconomic performances in recent decades—even with inflation-adjusted yields on the 10-year UST of +4.0%. So there was no compelling reason for a massive compression of interest rates, but that is exactly what the Fed engineered over the next two decades. As shown in the graph below, rates were systematically pushed lower by 300 to 500 basis points across the curve by the bottom in 2020-2021.

Current yields are higher by 300 to 400 basis points from this recent bottom, but here’s the thing: They are only back to nominal levels prevalent at the beginning of the period in 1997, even as inflation is running at 3-4% Y/Y increases, or double the levels of 1997.

US Treasury Yields, 1997 to 2024

Unfortunately, even as the Fed has tepidly moved toward normalization of yields as shown in the graph above, Wall Street is bringing unrelenting pressure for a new round of rates cuts, which would result in yet another spree of the deep interest rate repression and distortion that has fueled Washington’s fiscal binge since the turn of the century.

As it is, the public debt is already growing at an accelerating clip, even before the US economy succumbs to the recession that is now gathering force. And we do mean accelerating. The public debt has recently been increasing by $1 trillion every 100 days. That’s $10 billion per day, $416 million per hour.

In fact, Uncle Sam’s debt has risen by $470 billion in the first two months of this year to $34.5 trillion and is on pace to surpass $35 trillion in a little over a month, $37 trillion well before year’s end, and $40 trillion some time in 2025. That’s about two years ahead of the current CBO (Congressional Budget Office) forecast.

On the current path, moreover, the public debt will reach $60 trillion by the end of the 10-year budget window. But even that depends upon the CBO’s latest iteration of Rosy Scenario, which envisions no recession ever again, just 2% inflation as far as the eye can see and real interest rates of barely 1%. And that’s to say nothing of the trillions in phony spending cuts and out-year tax increases that are built into the CBO baseline but which Congress will never actually allow to materialize.

What is worse, even with partial normalization of rates, a veritable tsunami of Federal interest expense is now gathering steam. That is because the ultra-low yields of 2007 to 2022 are now rolling over into the current market rates shown above—at the same time that the amount of public debt outstanding is heading skyward. As a result, the annualized run rate of Federal interest expense hit $1.1 trillion in February and is heading for $1.6 trillion by the end of the current fiscal year in September.

Finally, even as the run-rate of interest expense has been soaring, the bureaucrats at the US Treasury have been drastically shortening the maturity of the outstanding debt, as it rolls over. Accordingly, more than $21 trillion of Treasury paper has been refinanced in the under one-year T-bill market, thereby lowering the weighted-average maturity of the public debt to less than five- years.

The apparent bet is that the Fed will be cutting rates soon. As is becoming more apparent by the day, however, that’s just not in the cards: No matter how you slice it, the running level of inflation has remained exceedingly sticky and shows no signs of dropping below its current 3-4% range any time soon.

What is also becoming more apparent by the day is that the money-printers at the Fed have led Washington into a massive fiscal calamity. It is only a matter of time, therefore, until the brown stuff hits the fan like never before.

Sound off about this article on The Economic Collapse Substack.

International Man Editor’s Note: The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming.

That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

]]>In fact, Uncle Sam’s debt has risen by $470 billion in the first two months of this year to $34.5 trillion and is on pace to surpass $35 trillion in a little over a month, $37 trillion well before year’s end, and $40 trillion some time in 2025. That’s about two years ahead of the current CBO (Congressional Budget Office) forecast.

On the current path, moreover, the public debt will reach $60 trillion by the end of the 10-year budget window. But even that depends upon the CBO’s latest iteration of Rosy Scenario, which envisions no recession ever again, just 2% inflation as far as the eye can see and real interest rates of barely 1%. And that’s to say nothing of the trillions in phony spending cuts and out-year tax increases that are built into the CBO baseline but which Congress will never actually allow to materialize.

So when it comes to the projection that the 2034 debt will come in at just $60 trillion, we’ll take the wonders any day of the week. The fact that it will likely be much higher also means that the Washington UniParty’s prevailing fiscal policy path will lead to $100 trillion of public debt sometime in the early 2040s. And that means, in turn, that annual interest expense will then be greater than the entire federal budget during 2019.

Needless to say, neither Trump nor Biden has said, “Boo,” about this looming calamity. Sleepy Joe has even had the audacity to brag that he has reduced the federal deficit by more than half.

Then again, the starting point for that ludicrous proposition is the Trumpian lockdown/stimmy fueled disaster of 2020 when the deficit hit an astounding 16% of GDP. That figure represented a larger burden on the US economy than the peak WWII deficits when America was actually fighting two real enemies, as opposed to Dr. Fauci’s hyped-up super-flu.

To be sure, ever since Nixon’s perfidy at Camp David, when the US dollar’s link to gold was canceled, the public debt and its share of GDP has been trending steadily skyward. But now it is literally going parabolic.

In 1970 the figure stood at $378 billion of public debt outstanding, which represented 34.9% of GDP. The latter percentage had peaked at about 120% at the end of WWII but had steadily marched downhill during the quarter century thereafter.

Yet since the dollar’s anchor to gold was severed, the debt spree has been unstoppable. Massive and persistent Fed monetization of the public debt caused interest rates to be deeply repressed and falsified, thereby transforming the partisan battles over public debt that had contained fiscal deficits prior to 1971 into a complacent Uniparty consensus that the public debt doesn’t matter much.

Accordingly, since then the public debt (purple line below) has increased by 90X to the aforementioned present level of $34.5 trillion — a gain far higher than the 25X rise of nominal GDP during the last 53 years. The burden on GDP (black line below), therefore, has returned to peak WWII levels, at 120%.

Public Debt Outstanding and % of GDP, 1970 to 2023

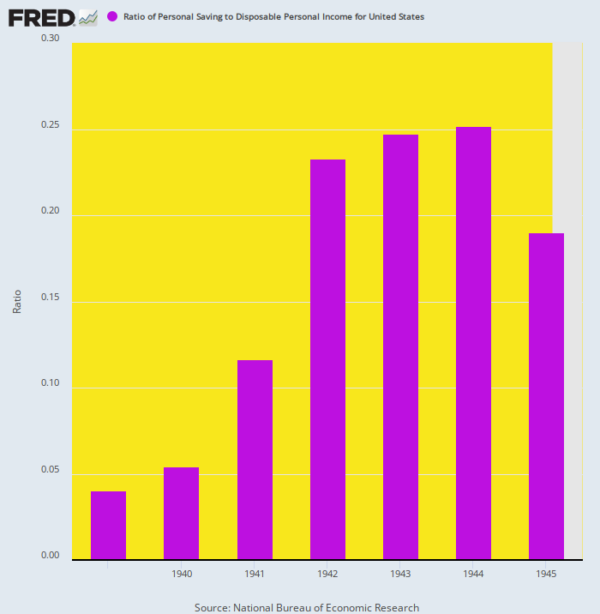

But the hoary idea floating around Washington that we lived to tell about it once, so we can do so again, is utter tommyrot. The great difference is that in 1945 there were virtually no consumer goods or services to buy, owing to the US economy’s total mobilization for war. In fact, wartime rationing and conversion of industry to military production resulted in a soaring household savings rate that reached 25% of disposable income during the peak years of the war.

What happened, therefore, is that consumer debt got paid off, dropping by two-thirds during the course of the war. Business debt was also reduced sharply. Consequently, America essentially saved its way through the huge government spending and borrowing increases generated by the war effort.

In all, during the five war budgets of 1942 through 1946, the federal government spent $370 billion in mainly war outlays, of which nearly half or $180 billion was financed by a huge increase in forced savings (aka federal taxation). The federal tax take from national income actually tripled from 8% of GDP to 24% during the course of the war.

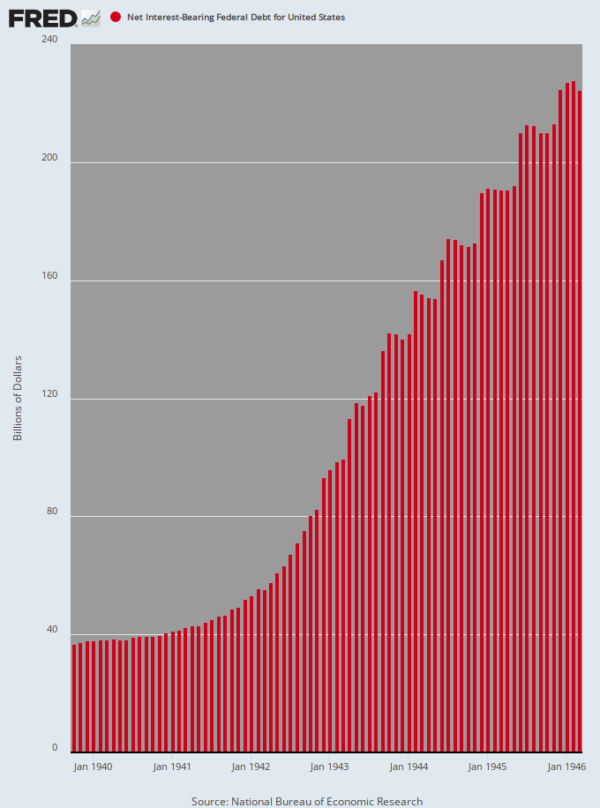

On top of that another $110 billion was financed from the huge increase in private savings depicted below and which was channeled into massive war bond sales to the public. Accordingly, just $80 billion or 21% of the massive war budgets were actually monetized by the Fed.

Household Savings as % of Disposable Income, 1939 to 1945

As a result of these factors, the $180 billion increase in war debt during 1939 to 1946 was accompanied by a virtual financial miracle. That is to say, the ratio of total public and private debt-to-GDP stood at 210% in 1938 but by the end of the war it had actually shrunk considerably to just 190% of GDP.

That’s right. The greatest government borrowing spree in history until then was accomplished with an actual reduction of the debt burden on the US economy!

What happened, of course, was that wartime economic controls caused enormous amounts of private debt to be paid off, leaving immense headroom for absorption of the public debt by private savers.

Specifically, household debt shrunk from 60% of GDP in 1938 to just 20% by 1945, while corporate business debt dropped from about 90% of GDP to 40%. In all, therefore, private debt vacated a huge space on the national balance sheet, dropping from 150% of GDP in 1938 to only 60% by the end of the war.

And that’s how the war debt was financed without massive monetization of the public debt. It was a one-of-a-kind wartime feat that is utterly irrelevant in today’s financial setting.

Growth of Federal Debt During WWII

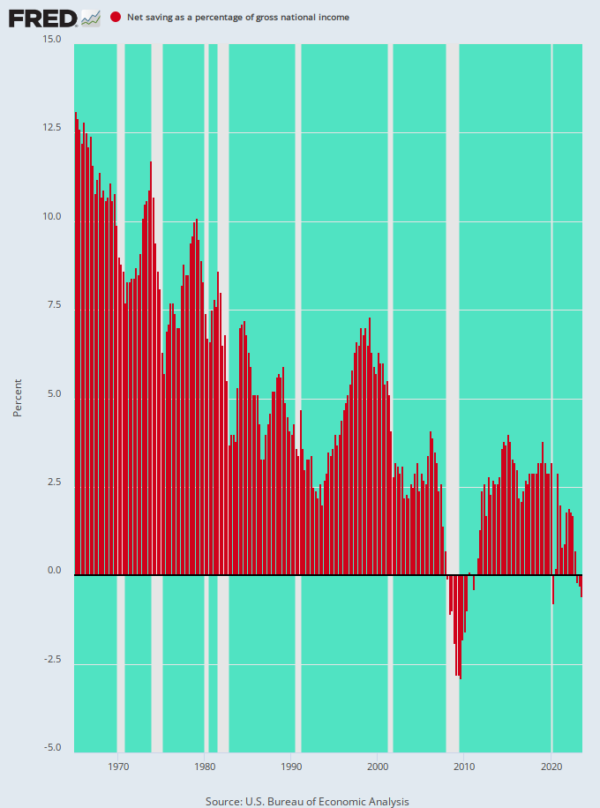

Compared to the WWII savings spree, America’s current economy is actually built on the opposite — endless and rising accumulation of debt in all economic sectors. Among households, for instance, the savings rate is now at a rock-bottom post-war level of just 2.9% of GDP.

Aside from the aberration of the pandemic lockdown/stimmy period in 2020–2021, when households were flooded with government cash but had limited venues to spend it, the current savings rate is barely one-third of the level that prevailed prior to 1980.

Net Household Savings Rate, 1970 to 2023

Needless to say, when private savings are falling and government deficits are continuous and rising, you can’t escape the devastating math. To wit, the net national savings rate (private savings minus government borrowing) has been negative for the past three quarters, and will likely get far worse from here as annual government deficits once again head back toward the $3 trillion to $4 trillion mark.

Stated differently, unlike WWII, there is no headroom available on the nation’s balance sheet to accommodate further chronic and large-scale increases in the public debt. And unlike during the early post war years when the net national savings rate was 10–12%, and thereby accommodated robust increases in private investment and real GDP growth, there is no chance whatsoever of “growing out” of current soaring deficits and debt.

Instead, what we have amounts to a financial doom-loop of ever lower economic growth and ever rising public debts from which there is no escape. And yet for all intents and purposes, that is the implicit fiscal policy of Washington’s sleep-walking UniParty.

Net National Savings Rate, 1965 to 2023

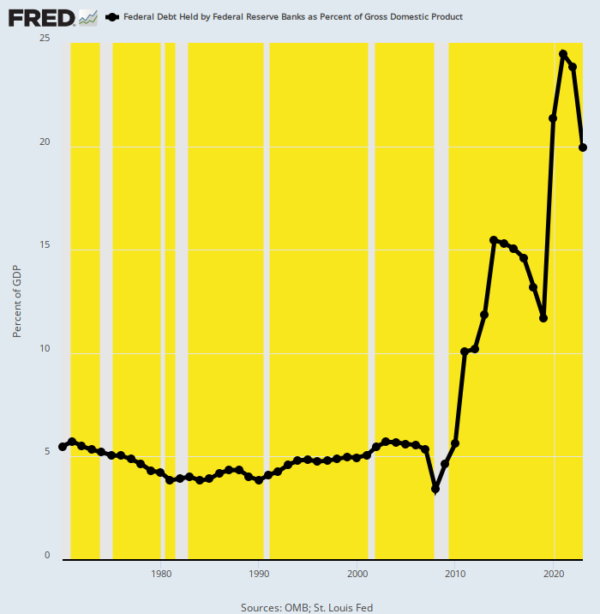

Of course, the sleepwalkers assume that there is an escape route via a restart of massive Fed monetization of the public debt. As the chart below shows, that is precisely what has delayed the day of reckoning for the past decade, as the Fed’s balance sheet erupted from a historical 5% of GDP to upwards of 25%.

Alas, old-fashioned sound-money folks long ago warned that such an experiment in boundless money printing was certain to fail. Both asset inflation on Wall Street and goods-and-services inflation on Main Street, they reminded, would eventually get out of hand.

This surely has happened. In spades. The days of US Treasury borrowing on the cheap and easy, therefore, are over and done. The current drift toward relentlessly rising real interest rates and falling real growth means that a financial train wreck lies directly ahead.

Unless…. Unless the electorate comes to its senses in the next eight months and sends the UniParty and its pathetic presidential candidates packing next November.

In short, there is no way out of the current fiscal calamity unless the Empire is brought home and crony capitalist domination of the agencies of government — and most especially the Fed — is decisively ended.

Public Debt Held by the Federal Reserve as a % of GDP, 1955 to 2023

Editor’s Note: The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming.

That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

]]>Over the past year, economist Daniel Lacalle has repeatedly warned that the United States is in the midst of a “private sector recession” and that official GDP measures are being propped up by government spending. The latest GDP numbers from the federal government strongly suggest he is right.

Today, the federal government’s Bureau of Economic Analysis released its revised estimate for GDP growth in the fourth quarter of 2023. According to the report, total GDP increased $334.5 billion (quarter over quarter) during the fourth quarter. That’s down from the third quarter’s quarter-over-quarter increase of $547.1 billion, but is nonetheless an ostensibly robust rate of growth.

Yet, if we compare GDP growth during the fourth quarter to growth in the total national debt, we find that the numbers don’t look quite so robust after all. While GDP may have grown by $334 billion during the period, the national debt grew by more than twice as much: $834 billion. In other words, for every dollar of GDP growth, the national debt grew by 2.7 dollars.

Moreover, this is the third quarter in a row during which debt growth has substantially outpaced GDP growth. During the third quarter, the federal debt grew $1.5 dollars for every dollar of GDP growth. During the first quarter, the debt grew 3.5 dollars for every dollar of GDP growth.

The fact that this has now happened three quarters in a row is notable as well. Over the past fifty years, it is rare to find debt growth exceeding GDP growth for more than two quarters in a row except during periods of economic weakness when the federal government relies on monetary expansion and federal spending to “stimulate” economic growth. For example, we find a three-quarter streak during the Great Recession and the years immediately afterward—when job growth was extremely weak. The same can also be seen in the quarters following the 2001 recession.

This isn’t shocking. If the federal government is trying to boost GDP numbers through “stimulus” it will both spend freely and expand the money supply as the central bank purchases Treasuries to avoid a surge in interest rates. (See more on how the central bank enables deficit spending.) The current reliance on federal deficit spending to keep up the appearance of GDP growth further backs up Lacalle’s theory that the United States is in the midst of both a public-sector expansion and a private-sector contraction. That is, the private sector is experiencing many recessionary trends, such as falling real wages, a decline in manufacturing, and growing bankruptcies. Meanwhile, however, government spending is booming, so sectors of the economy that are closely tied to government spending continue to expand. In aggregate, total GDP numbers thus show an increase, even as the private sector stagnates.

After all, it’s important to keep in mind that GDP measures include government spending, and will also include the consumption that results from additional government spending on welfare programs, weapons manufacturing, and more. As the federal government spends its deficit-financed dollars, the recipients of these dollars consume more, thus pushing up current GDP.

The general problem with this trend can be seen if we apply it to a private firm. Imagine, for instance, that a private firm managed to increase its production by a million dollars, but at the same time took on an additional $2.5 million in debt to buy new sports cars for its least productive employees. Even worse, this new debt is in addition to a huge existing debt load.

This sort of debt should never be confused with good debt, which is debt taken on to fund new capital goods. That could potentially increase productivity later on. Government debit never good debt, however, because it is taken on for purposes of immediate consumption—usually on social welfare benefits or on bombing faraway countries.

Unfortunately, as we find debt growth repeatedly top GDP growth, we are likely to see more of this phenomenon moving forward. The federal debt is now larger than the entire GDP of the United States, and the gap between debt and GDP in each year has now widened to more than six trillion dollars. As this trend continues, expect to see deficit spending play a larger and larger role in GDP.

]]>The McLean, Virginia-based bank announced it would acquire Discover Financial Services in a $35.3 billion all-stock transaction, The New York Times reported. The acquisition of Discover would give Capital One more market power due to Discover having a payments network of its own at the same time as credit card debt continues to mount for consumers, according to The Wall Street Journal.

The acquisition could face a major hurdle from federal regulators, The New York Times reported. The Comptroller of the Currency announced it wanted to slow down the process to approve mergers and acquisitions on Jan. 29.

$34.2 trillion in debt and Capital One is merging w/ Discover to combat a surge in loan nonperformance (defaults & delinquencies), but instead of giving taxpayers a break so they can pay down their record credit card balances, let's send more money we don't have overseas… pic.twitter.com/scxaIyZqXy

— E.J. Antoni, Ph.D. (@RealEJAntoni) February 19, 2024

“It is very difficult to imagine how federal regulators could allow Capital One to buy Discover given the requirement that mergers benefit the public as well as insiders,” National Community Reinvestment Coalition President and CEO Jesse Van Tol told The New York Times.

Discover shareholders will receive a 26% premium over the company’s closing stock price, getting a little less than 102 shares of Capital One stock for every 100 shares of Discover stock if regulators approve the acquisition.

The deal comes as Americans’ total household debt hit $17.5 trillion in the fourth quarter of 2023. Credit card delinquencies of 90 days or more rose to 6.36% at the end of 2023, while total credit card debt rose to $1.13 trillion, according to the Federal Reserve Bank of New York.

“Credit card and auto loan transitions into delinquency are still rising above pre-pandemic levels,” New York Fed advisor Wilbert van der Klaauw said in a statement. “This signals increased financial stress, especially among younger and lower-income households.”

Capital One and Discover did not immediately respond to the Daily Caller News Foundation’s request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>You may remember that the Biden administration expected a significant deficit reduction from its tax increases and the expected benefits of its Inflation Reduction Act.

What Americans got was a massive deficit and persistent inflation. According to Moody’s chief economist, Mark Zandi, the entire disinflation process seen in the past years comes from exogenous factors such as “fading fallout from the global pandemic on global supply chains and labor markets, and the Russian War in Ukraine and the impact on oil, food, and other commodity prices.” The complete disinflation trend follows the slump in money supply (M2), but the Consumer Price Index (CPI) should have fallen faster if deficit spending, which means more consumption of newly created currency, would have been under control. December was disappointing and higher than it should have been.

The United States annual CPI (+3.4%) came above estimates, proving that the recent bounce in money supply and rising deficit spending continue to erode the purchasing power of the currency and that the base effect generated too much optimism in the past two prints. Most prices rose in December, and only four items fell. In fact, despite a large decline in energy prices, annual services (+5.3%), shelter (+6.2%), and transportation services (+9.7%) continue to show the extent of the inflation problem.

The massive deficit means more taxes, more inflation, and lower growth in the future.

The Congressional Budget Office (CBO) expects an unsustainable path that still leaves a 5.0% deficit by 2027, growing every year to reach a massive 10.0% of GDP in 2053 due to a much faster growth in spending than in revenues. The enormous increase in debt will also lead to extremely poor growth, with real GDP rising much slower throughout the 2023–2053 period than it has, on average, “over the past 30 years.”

Deficits are not a tool for growth; they are tools for stagnation.

Deficits mean that the currency’s purchasing power will continue to vanish with money printing and that the real disposable income of Americans will be demolished with a combination of higher taxes and a weaker real value of their wages and deposit savings.

We must remember that, in Biden’s administration’s own estimates, the accumulated deficit will reach $14 trillion in the period to 2032.

This unsustainable level of fiscal irresponsibility will also lead to more massive money printing. The Federal Reserve will have to lead with larger federal fiscal imbalances than seen in crisis times, even considering estimates that assume no recession or crisis. So, if a crisis hits, the situation will simply explode.

Considering all these elements, it is not difficult to think of a Fed balance sheet that rockets from an already elevated 29% of GDP to fifty percent, and it will still be lower than the ECB’s balance sheet!

Readers may think that monetization of debt will be an uncomfortable but necessary measure to reduce indebtedness. However, we should have learned by now that Federal Reserve monetization only makes governments more fiscally imprudent. Public debt continues to reach new record highs both in periods of monetary expansion and in periods of alleged contraction.

2023 proved that central banks’ policy was only restrictive in name, as net liquidity injections and anti-fragmentation programs continued. Policy was restrictive for the private sector, especially small and medium enterprises, and families, not for governments.

2024 will be even worse because the government will not count on rising receipts and a doped economic recovery. Therefore, deficits are likely to surprise negatively again, which means more taxes and lower potential growth disguised with a new set of liquidity injections.

What does this mean for savers? Your US dollars will be worth less, real wages will continue to show poor growth, and, after tax, disposable income will decline. The only way to protect yourself is to find alternative real reserves of value, from gold to bitcoin, which will offset the monetary destruction that is about to accelerate.

Leave your thoughts about this on the Economic Collapse Substack.

About the Author

Daniel Lacalle, PhD, economist and fund manager, is the author of the bestselling books Freedom or Equality (2020), Escape from the Central Bank Trap(2017), The Energy World Is Flat (2015), and Life in the Financial Markets(2014).

He is a professor of global economy at IE Business School in Madrid.

]]>That’s because the federal interest expense increases as interest rates rise. As the federal interest expense rises, so does the budget deficit. As the budget deficit increases, so does the currency debasement needed to finance it. Skyrocketing interest expense will have an enormous impact on the US budget.

Even according to the US government’s rosy projections, the interest expense on the federal debt will exceed $1 trillion for the first time in 2024… and it shows no sign of slowing down. On the contrary, it’s growing exponentially.

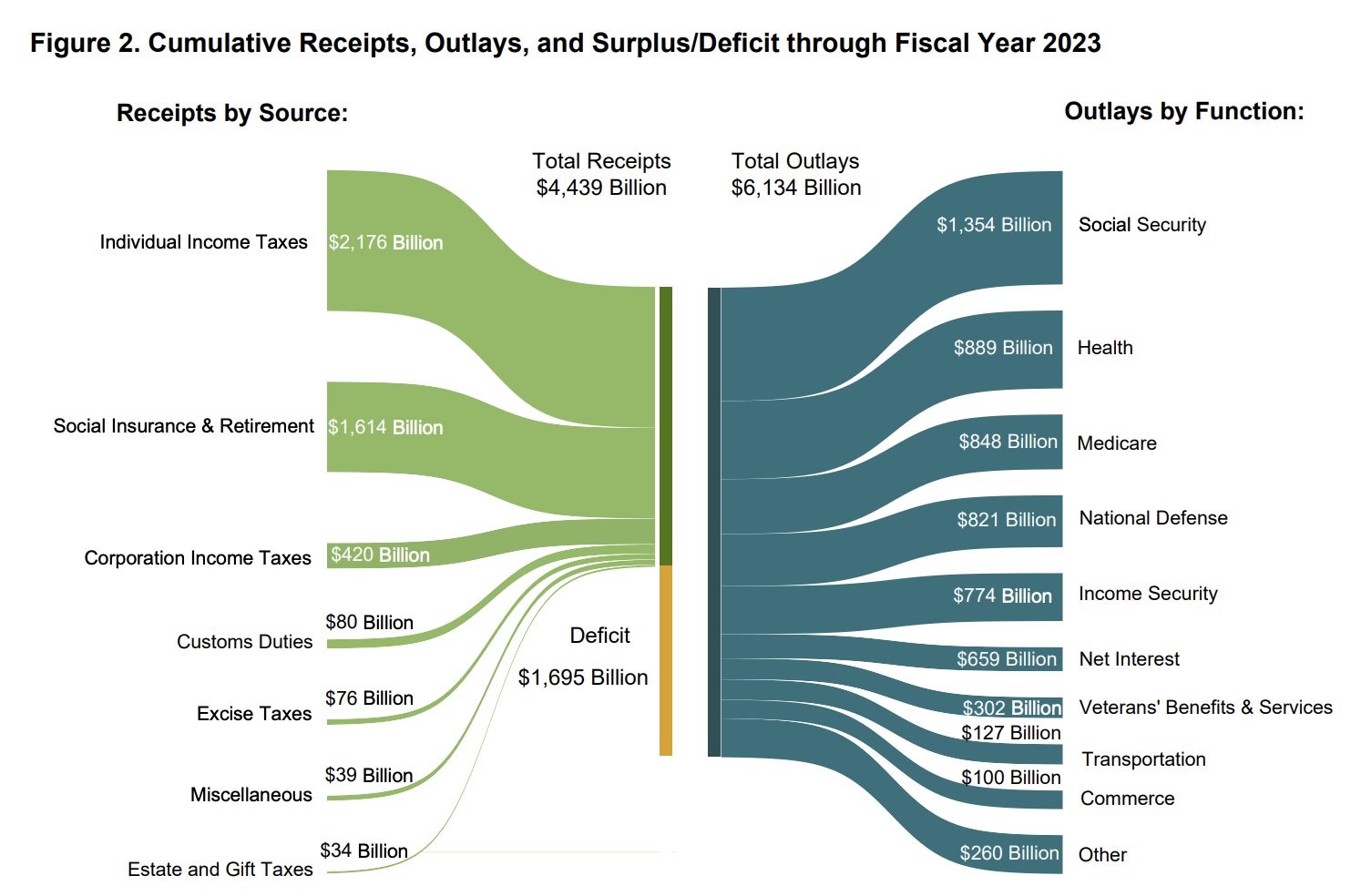

First, it’s essential to understand the basics of the US federal budget. Let’s zoom out and look at the largest components of the US federal budget from the latest available data in the chart below.

The biggest expenditures for the US government are so-called entitlements. It’s not likely any politician will cut these. On the contrary, I expect them to continue to grow.

With the most precarious geopolitical situation since World War 2, so-called “National Defense” seems unlikely to be cut. Instead, military spending is all but certain to increase. Income Security is a catch-all category for different types of welfare. That’s unlikely to be cut too.

Unless it becomes politically acceptable to cut things like Social Security, military spending, and welfare, efforts to make a dent in expenditures won’t be meaningful. Further, interest expense (Net Interest above) is set to explode higher.

The US government projects that the federal interest expense will exceed $1 trillion in 2024 for the first time. That means the interest expense will exceed defense and everything else in the budget except for Social Security, which it will also likely exceed soon.

As the cost of debt service is taking up a larger portion of the budget, there is less for other expenditures. That means the government has to borrow increasingly larger amounts to maintain basic functions. However, it’s worse than issuing more debt to cover Social Security and the military.

The US government is now borrowing money to pay interest on the federal debt, which has a compounding effect as the federal debt and interest expense grow exponentially.

I suspect we are close to the inflection point where it gets out of control. 2024 could be the year that it becomes evident the US is trapped in a debt spiral.

Here’s the bottom line with the budget. The most significant expenditures have nowhere to go but up. But don’t count on increased revenue to offset these increases. Even if tax rates went to 100%, it would not be enough to stop the deficits—and the debt needed to finance them—from growing.

The US government is out of options. Therefore, the question is not whether it will default but how. When faced with a choice, politicians always choose the most expedient option. In this case, that means issuing more debt rather than making tough budget decisions or explicitly defaulting.

There is a big problem with that, though. As the amount of debt skyrockets, the interest rate rises to entice buyers and holders.

Allowing interest rates to rise high enough to entice natural buyers would bankrupt the US government because of the higher interest costs, which are set to become the largest item in the budget.

So, I would not expect the Fed to raise interest rates much more. In fact, they have already paused the rate hikes and are signaling a pivot to easing again, likely for this exact reason.

That means the Fed has effectively given up on bringing price inflation down even though the year-over-year change in the CPI remains above 4%, more than double the Fed’s target of 2%.

In other words, even with their own crooked statistics and rigged game, the Fed has failed even to come close to their inflation target. It’s a massive failure. Bloomberg is already hailing it “The Great Monetary Pivot of 2024.”

It’s crucial to understand that by surrendering to inflation, the Fed is returning to the same policies that caused prices to rise in the first place.

So, if higher interest rates are off the table and cannot entice more natural buyers, who will finance these growing multi-trillion dollar budget deficits? The only entity capable is the Federal Reserve, which buys Treasuries with dollars it creates out of thin air.

]]>That’s why I am convinced extreme currency debasement is the inevitable outcome.

All the rest is noise.

The US government’s only practical option is ever-increasing currency debasement… and it could devastate most people.

I suspect it will all go down soon… and it won’t be pretty.

It will result in an enormous wealth transfer from savers and regular people to the parasitic class—politicians, central bankers, and those connected to them.

Countless millions throughout history were wiped out financially—or worse—because they failed to see the correct Big Picture as their governments went bankrupt.

Don’t be one of them.

That’s exactly why I just released an urgent new report with all the details, including what you must do to prepare.

It’s called The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now.