If the current administration remains in power, the Treasury’s own estimates predict an additional $16 trillion increase in debt by 2034, without accounting for any recession or slowdown in tax receipts. According to the Congressional Budget Office, Vice President Kamala Harris’ economic plan would add another $1.9 trillion to $2.2 trillion to the national debt.

The Harris campaign has not even bothered to discuss a plan to balance the budget. She just said that “efficiency” and the old fallacy of higher taxes on the rich would pay for the increase in spending—two things that have proven to do nothing to the ballooning debt and that do not even start to scratch the already unsustainable $2 trillion annual deficit.

This reckless increase in debt is happening in an economic growth period. However, if we adjust for government debt accumulation, 2021 to 2024 were the worst years of growth, adjusted for debt, since the 1930s.

In a recent article, economist Claudia Sahm stated that we shouldn’t worry about debt. “Debt is neither inherently good nor bad,” she wrote in an opinion column for Bloomberg back in January. “As such, the question is not what’s the right level of borrowing, but rather what’s the economic return on the borrowing or the societal goals it advances.”

She went on to say that “the government can easily service its debt because of its unlimited taxing authority and ability to issue more U.S. Treasury securities to repay maturing securities.”

Now you must worry. A lot.

Unproductive Borrowing ‘Inherently’ Bad

Let us start with the benign idea of “economic return on borrowing and societal goals.” The evidence from the United States indicates that the economic return is extremely low. Entitlement spending has not strengthened the economic growth path, and debt continues to rise faster than gross domestic product.

It’s true that debt is not inherently bad, but unproductive borrowing is. It’s a massive transfer of wealth from the productive sector to the bloated bureaucratic state.

Furthermore, the societal goals cannot be unlimited. The government must administer and not just add expenditures to previous expenditures, particularly when there is no realistic analysis of the success or failure of government programs.

The idea that a particular government program is beneficial is not enough to add it to the budget without reducing other expenses. Not even a benign view of government spending as Sahm’s can justify that every government expenditure item today is essential.

Furthermore, we must always understand that governments do not give money for free. They tax the productive sector and borrow, which means printing a currency that is constantly losing purchasing power. Therefore, the government is not advancing societal goals by borrowing without control. It is implementing a profoundly regressive policy that creates a dependent subclass and makes it increasingly difficult for the middle class to thrive.

Economic, Fiscal, and Inflationary Limits

It’s false that the government has “unlimited” taxing authority and the ability to issue more debt, i.e., print money.

The government has economic, fiscal, and inflationary limits: Economic, because constantly increasing taxation leads to stagnation and more debt; fiscal, because expenditures are consolidated and annualized, while tax receipts are cyclical; and inflationary, because the constant issuance of new currency, which is what happens when more debt is issued, leads to the loss of confidence in the currency and the erosion of its purchasing power.

If what Sahm states were true, the euro area and Japan would be examples of high growth and economic strength, but they are examples of stagnation, high debt, and rising social discontent.

The government does not set taxes to fund its incessant spending habits. Taxes should be set according to the economic reality of an economy. The fallacy of taxes on the rich and corporations does not even address the ballooning deficit and erodes economic growth and productive investment.

When someone tells you not to worry about record debt, you should be extremely concerned. When they say that the government has unlimited resources, they mean that you will pay by becoming poorer with more taxes, more inflation, lower growth, or all three at the same time.

When they tell you that $35 trillion of debt is peanuts compared with $142 trillion of American wealth, they are saying that the government will be pleased to absorb the wealth of the economy. You will pay.

Private Sector Isn’t an ATM

When they tell you that tax cuts are the problem, it comes from the perspective that the private sector is an ATM at the disposal of governments.

Tax cuts do not reduce revenues, just as tax hikes do not raise them forever. Tax cuts adjust the taxable base to the real economy in order to encourage more investment and growth.

Tax cuts are not a loss for the government. They are a win for the economy. It is simply a return of funds to those who have earned them. The idea that funds are better in the hands of the government than in the pockets of those who earned them is confiscatory.

It’s ludicrous to think that the government knows better than the private sector where and how to spend money. Additionally, it’s insane to believe that the government will not squander the funds and bloat the administrative costs.

Furthermore, it’s foolish to assume that corporations and the affluent will hoard unused funds. There’s no such thing as idle money. Capital markets and the private banking sector invest all of their earnings in a productive economy.

If Sahm is concerned about economic returns and social advancements, she should advocate for the private sector to retain a larger portion of the earned money, as it will allocate it to the most advantageous investments.

Inflation Is Regressive Form of Taxation

Inflation is a form of default, in which the government transfers its imbalances to those who receive their salaries in currency. This is the most regressive form of taxation, primarily affecting the poorest. When governments ignore the real demand for the money they issue, confidence in the currency disappears.

Developing countries do not issue debt in foreign currency because they are stupid, but because there is no international demand for their local currency.

Economists such as Sahm assume that the U.S. dollar will have eternal and unlimited demand, and, as such, the U.S. government can export inflation to the rest of the world through the loss of the purchasing power of the currency it issues.

However, global central banks are reducing their holdings of U.S. dollars (U.S. treasuries). International demand is declining, and the limits I mentioned before are already evident.

The U.S. is showing its economic limits, as evidenced by the significant slowdown despite a record deficit and government so-called stimulus. The U.S. is also demonstrating its fiscal limits as the government persists in raising taxes, resulting in significantly lower tax receipts than anticipated and an interest expense bill that has escalated to $3 billion daily.

Declining Purchasing Power of Dollar

Furthermore, the inflationary limit is evident due to a 20% increase in inflation over the past four years, a 30% increase in the cost of basic groceries, and persistent inflation, which is exemplified by the constant decline in the purchasing power of the U.S. dollar.

What Harris is doing as vice president and intends to continue doing if she becomes president is to continuously test the patience of the world and U.S. citizens when it comes to accepting a constantly depreciated purchasing power of the currency.

Saying that nothing will happen if debt continues to rise and deficits continue to drive government policy is, literally, like saying that an alcoholic should drink more vodka because cirrhosis has not killed him yet.

The dollar is the credit of the U.S. economy. If the U.S. government loses its credibility, domestic agents will begin to reduce their use of the dollar, while international agents will decline the currency due to its constant fiscal excess and its tendency to push the limits of global patience.

Thinking that the U.S. dollar will never lose its reserve currency status is simply reckless and ignores history.

Harris is threatening the dollar, and you should be very concerned when someone says that the government has unlimited taxation and printing resources. That means it has unlimited ways of making you poorer.

]]>The Treasury Department put fresh sanctions on Russia on Wednesday to stem the flow of money and goods that can fuel the country’s war against Ukraine, leading Russia to announce an immediate suspension of dollar trades on the Moscow Stock Exchange, according to Reuters. Russia’s continued pullback from the dollar is just the latest example of U.S. adversaries growing opposition to the current world reserve currency, and if the dollar is ever widely abandoned around the world, it could usher in huge levels of inflation and force the U.S. to deal with its mounting national debt, according to experts who spoke to the DCNF.

“If the Biden administration were intentionally trying to destroy the dollar, I’m not sure what they’d do differently,” E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF. “His spendthrift agenda has resulted in the dollar losing one-fifth of its value in less than four years, and his international policies have done even more harm by eroding the dollar’s reserve currency status. By freezing and then eventually stealing dollars owned by foreigners, Biden sent a clear message to the world that the dollar is no longer a safe asset.”

The Biden administration’s weaponization of the financial system against Russia has been particularly pronounced since the country launched its invasion of Ukraine in 2022, with the U.S. and its allies removing many Russian banks from the worldwide financial messaging system SWIFT and freezing hundreds of billions in Russian foreign reserves.

“A Rubicon was crossed in the form of policy choices made in the immediate aftermath of the Russian invasion of Ukraine in early 2022,” Peter Earle, economist at the American Institute for Economic Research, told the DCNF. “Those decisions included seizing hundreds of billions of dollars worth of Russian FX reserves (Russian holdings of US dollars) and ejecting most major Russian financial institutions out of the SWIFT messaging system.”

“In taking those actions, Russia was effectively kicked out of the U.S. dollar system,” Earle continued. “It was a turning point as it has put adversaries — and allies — of the United States on notice that the dollar, which has for seventy years been the default currency for international trade and settlement, can be weaponized, and thus that dependence upon the dollar comes with a heretofore unconsidered risk.”

The US, under Biden, has also continued to impose harsh sanctions on Iran in connection with the funding of terrorism. The Biden administration used $6 billion in seized assets in August 2023 as leverage for the exchange of five American prisoners.

Saudi Arabia became a full participant in Project mBridge, an effort dominated by China to create a central bank digital currency that could replace the dollar in the exchange of oil on the world stage, according to Reuters. The addition of Saudi Arabia to the program puts the project in the “minimum viable product” stage for wider use.

“Russia’s suspension of trading in dollars on the Moscow exchange is just the latest domino to fall, and it won’t be the last,” Antoni told the DCNF. “As de-dollarization snowballs, foreigners won’t want dollars anymore, and they’ll start exchanging the currency for American goods and services. It’s no exaggeration to say that this will mean 70 years’ worth of trade deficits pouring back to our shores.”

Further de-dollarization, depending on the speed at which it occurs, could cause another surge of inflation, which has already wreaked havoc on the finances of average Americans under Biden, with prices rising 19.3% since January 2021. Inflation has failed to fall below 3% since it peaked under Biden at 9% in June 2022, most recently measuring 3.3% in May.

“If you think the last three years have had bad inflation, just wait until those trillions of dollars currently held by foreigners come home and start bidding up prices,” Antoni continued. “It will embolden our adversaries and impoverish Americans. We’re in the opening stages, and it’s unclear if there’s enough time to stop it.”

A group of countries posing themselves as an alternative to the U.S. and its’ allies in the G7, including Brazil, Russia, India, China and South Africa (BRICS), have expressed their opposition to the dollar as the global reserve currency. In June, Russia announced that it had begun the development of a payment platform that will allow BRICS countries to bypass the dollar, providing countries that fear the weaponization of the currency by the U.S. another avenue for foreign exchange, according to Business Insider.

“The dollar’s status as the dominant international reserve currency affords the US what Valery Giscard d’Estaing famously called an exorbitant privilege,” Desmond Lachman, a senior fellow at the American Enterprise Institute, told the DCNF. “By that, he meant that the US government could finance its budget deficit at relatively low interest rates by having the Fed print dollars that foreigners would hold. It also allowed the country to live beyond its means by consistently importing more goods and services than it exported. This is something that the US should not want to lose.”

The U.S. trade deficit widened to around $74.6 billion in April, the largest loss since October 2022. The federal government currently holds around $34.7 trillion in debt as of June 12, up from around $27.8 trillion when Biden first took office, according to the Treasury Department.

The Left is FURIOUS About Viral Joe Biden Wandering Video pic.twitter.com/witRcpoA0b

— DC Shorts (@theDCshorts) June 14, 2024

“If foreigners start selling dollars, we could have a dollar crisis in the sense that the dollar would get into a downward spiral,” Lachman told the DCNF. “That would be bad news for consumers in that it would tend to fuel inflation by substantially increasing our import costs.

“It would also lead to higher interest rates,” Lachman continued. “I do not expect that this will happen soon since the currencies of the dollar’s main competitors (the Euro, the Chinese renminbi, and the Japanese yen) all have serious problems of their own.”

The share of U.S. dollars in foreign exchange reserves has been gradually declining for the past several years, falling from over 70% in 2000 down to close to 55% in recent years, according to the International Monetary Fund.

“Global use of the dollar has been a major source of demand for US government securities — Treasury bills, bonds, and notes, as well as Agency paper,” Earle told the DCNF. “Falling demand for dollars would, in short order, translate to falling demand for those government issues, which would both restrict the amount of debt that could be sold and result in higher yields on the outstanding debt.

“With less of a market for US debt and presumably no less of an appetite for government spending, taxes would have to rise and/or inflation to be used to make ends meet,” Earle continued. “Both of those mean higher costs of living and consequently a declining quality of life.”

The White House did not respond to a request to comment from the DCNF.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>Those in the top one percent of the top one percent are pretty much able to do whatever they want, and the rest of us are pretty much powerless to stop them. Unfortunately, the gap between the ultra-wealthy elite and the rest of us just continues to get even larger.

Last year, the total wealth of the world’s millionaires reached a staggering 86.8 trillion dollars…

The world has never had so many rich people and their investments in soaring stock markets have made them wealthier than ever recorded, according to a study published on Wednesday.

The number of “high net worth individuals” (HNWI) — defined as people with liquid assets of at least $1 million — rose by 5.1 percent last year to 22.8 million, according to consulting firm Capgemini.

Their total wealth reached $86.8 trillion in 2023, a 4.7 percent increase from the previous year, according to the annual World Wealth Report.

Meanwhile, 5 billion people have gotten poorer since the start of the pandemic…

Since 2020, the richest five men in the world have doubled their fortunes. During the same period, almost 5 billion people globally have become poorer.

How much power do the hundreds of millions of people around the world that are living on less than two dollars a day have compared to the billionaires in the western world that are constantly making headlines?

The truth is that they run the world and the rest of us are just living in it.

Here in the United States, the colossal gap between CEO pay and worker pay got even larger last year…

Bosses have always made more money than workers. But the gap between CEOs and employees is growing.

The median CEO in the S&P 500 was paid 196 times as much as the median employee in 2023, according to an analysis by Equilar and The Associated Press.

That’s up from a ratio of 185 in 2022.

It would be a good thing if the rich were getting richer as long as everyone else was getting richer as well.

But instead, poverty is literally exploding all around us.

In 2020, there were approximately 140 homeless camps in Oakland, California.

Since that time, the city has closed 537 homeless camps, but there are still approximately 1,500 remaining all over the city…

Oakland officials passed a policy in 2020 to regulate homeless encampments when there were about 140 camps. The policy was created to prohibit encampments in specific areas of the city, including proximity to businesses, schools, playgrounds, traffic lanes, bike paths, housing and playgrounds.

Any encampments in those prohibited areas were supposed to be vacated, with the city offering shelter before evacuating the camp.

Since then, the city has closed 537 homeless camps with approximately 1,500 remaining, according to a city report.

I feel so bad for the law-abiding citizens that still live in Oakland. Conditions have become so precarious that one construction company actually “refused to finish its pothole paving job because it got ‘too dangerous’ for its workers”…

Frustrated Oakland residents are in the hole after a construction crew quit and refused to finish its pothole paving job because it got ‘too dangerous’ for its workers – as other businesses flee the Bay Area over the same concerns.

Residents in the Sobrante Park area in East Oakland said they weren’t even notified after the third-party general contractor decided to abandon the project before repaving the streets, leaving large potholes and dangerous loose gravel all over the neighborhood since mid-May.

If you still have a nice home and plenty of money, good for you. But you should understand that you are solidly in the minority at this point.

Of course our politicians care far more about the economic health of the elite than anyone else, because it is the elite that fund their campaigns. So even though just about all the rest of us have seen our standard of living go way down, in recent years there has been an all-out effort to prop up the stock market because that is where the elite have much of their wealth.

Today, the wealthiest 10 percent of all Americans own 93 percent of all the stocks. And the poorest 50 percent of all Americans own just 1 percent of all the stocks.

The stock market wealth that the entire bottom half of the country controls is basically just a rounding error compared to the enormous holdings of the elite. Unfortunately for the elite, it appears that trouble may be brewing for the financial markets…

The US stock market is shrinking, and investors are pulling their money out at a near-record pace as storm clouds gather over the US economy.

That means the titans of Wall Street may have to contend with choppy water as they cruise toward their Nantucket getaways this year.

In fact, Bank of America says that their customers have been pulling large amounts of money out of stocks for five consecutive weeks…

Bank of America analysts said on Tuesday that their clients have now been large net sellers of US stocks for five weeks in a row. Just last week, they sold off $5.7 billion more in stocks than they purchased, the highest outflow since last July.

Bank of America recorded the second largest sell-off of tech stocks in their history last week. And while one week does not a trend make, it does stand in stark contrast with the Magnificent Seven fervor that ensnared Wall Street mere months ago.

Whether it happens sooner or later, it is inevitable that America’s financial idols will come crashing down at some point.

But for most of the country, it feels like the economy has already crashed.

Our cost of living crisis has become exceedingly painful, our entire society is drowning in debt, and poverty and homelessness are exploding all around us.

Just about the only people that are still doing really well are those that are at the very top of the food chain.

When you hear that “the economy is booming”, those are the people they are talking about.

But just like all the rest of us, the elite will not be able to escape the period of tremendous global chaos that is ahead of us.

Like I said, money can buy you just about anything, but it cannot purchase a free pass from the day of reckoning that is rapidly approaching.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

]]>Readers ask me why the government would be interested in eroding the purchasing power of the currency they issue. It is remarkably simple.

Monetary inflation is the equivalent of an implicit default. It is a manifestation of the lack of solvency and credibility of the currency issuer.

Governments know that they can disguise their fiscal imbalances through the gradual reduction of the purchasing power of the currency and with this policy, they achieve two things: Inflation is a hidden transfer of wealth from deposit savers and real wages to the government; it is a disguised tax. Additionally, the government expropriates wealth from the private sector, making the productive part of the economy assume the default of the currency issuer by imposing the utilization of its currency by law as well as forcing economic agents to purchase its bonds via regulation. The entire financial system’s regulation is built on the false premise that the lowest-risk asset is the sovereign bond. This forces banks to accumulate currency—sovereign bonds—and regulation incentivizes state intervention and crowding out of the private sector by forcing through regulation to use zero to little capital to finance government entities and the public sector.

Once we understand that inflation is a policy and that it is an implicit default of the issuer, we can comprehend why the traditional sixty-forty portfolio does not work.

Currency is debt and sovereign bonds are currency. When governments have exhausted their fiscal space, the crowding-out effect of the state on credit adds to the rising taxation levels to cripple the potential of the productive economy, the private sector, in favor of constantly rising government unfunded liabilities.

Economists warn of rising debt, which is correct, but we sometimes ignore the impact on currency purchasing power of unfunded liabilities. The United States’s debt is enormous at $34 trillion, and the public deficit is intolerable at nearly $2 trillion per year, but that is a drop in the bucket compared with the unfunded liabilities that will cripple the economy and erode the currency in the future.

The estimated unfunded Social Security and Medicare liability is $175.3 trillion (Financial Report of the United States Government, February 2024). Yes, that is 6.4 times the GDP of the United States. If you think that will be financed with taxes “on the rich,” you have a problem with mathematics.

The situation in the United States is not an exception. In countries like Spain, unfunded public pension liabilities exceed 500% of GDP. In the European Union, according to Eurostat, the average is close to 200% of GDP. And that is only unfunded pension liabilities. Eurostat does not analyze unfunded entitlement program liabilities.

This means that governments will continue to use the “tax the rich” false narrative to increase taxation on the middle class and impose the most regressive tax of all, inflation.

It is not a coincidence that central banks want to implement digital currencies as quickly as possible. Central Bank Digital currencies are surveillance disguised as money and a means of eliminating the limitations of the inflationary policies of the current quantitative easing programs. Central bankers are increasingly frustrated because the transmission mechanisms of monetary policy are not fully under their control. By eliminating the banking channel and thus the inflation backstop of credit demand, central banks and governments can try to eliminate the competition of independent forms of money through coercion and debase the currency at will to maintain and increase the size of the state in the economy.

Gold vs. bonds shows this perfectly. Gold has risen 89% in the past five years, compared to 85% for the S&P 500 and a disappointing 0.7% for the US aggregate bond index (as of May 17, 2024, according to Bloomberg).

Financial assets are reflecting the evidence of currency destruction. Equities and gold soar; bonds do nothing. It is the picture of governments using the fiat currency to disguise the credit solvency of the issuer.

Considering all this, gold is not expensive at all. It is exceedingly cheap. Central banks and policymakers know that there will be only one way to square the public accounts with trillions of dollars of unfunded liabilities. Repay those obligations with a worthless currency. Staying in cash is dangerous; accumulating government bonds is reckless; but rejecting gold is denying the reality of money.

]]>When times are tough, treasures change hands, the late Burt Blumert, once a gold dealer and Mises Institute Board Chairman, used to say. “Prices are high, and I need cash,” Branden Sabino, a thirty-year-old information technology worker said, adding that with the cost of rent, groceries, and car insurance rising, he doesn’t have any savings. He sold a gold necklace and a gold ring to King Gold and Pawn on Avenue 5 in Brooklyn. “People are using gold as an ATM they never had,” said store owner Gene Furman.

At King Gold, fifty-five-year-old Mirsa Vijil pawned a bracelet to pay her gas bill. “Gold is high,” she said, adding she’d never pawned her jewelry before but will do it again if she needs to.

Adrian Ash, director of research at online gold investment service BullionVault says there is twice as much selling as a year ago on BullionVault’s platform. “People are very happy to take this price.”

“It’s very busy and we are getting more calls than ever before about clients wanting to bring in their jewels,” Kahn said. “I’m telling the clients to bring them in now, as we are at unprecedented levels.”

So while there is plenty of liquidating to pay the bills, demand at the United States Mint is tepid, with sales in March the worst since 2019 for its American Eagle gold coin.

It turns out more than a few of those well-publicized Costco gold bar buyers are having trouble selling them. The bars, not being American Eagles or other similar gold coins, are not as liquid, given that the seller, Costco, will not buy them back. The Wall Street Journal reports, thirty-three-year old Adam Xi called five different gold dealers to get a price he would accept for the gold bar he bought at Costco in October.

He was offered $200 less by one dealer than the $2,000 he had paid. But he found a Philadelphia coin dealer near his home willing to pay $1,960, or twenty dollars under market price.

Mr. Xi has learned, or should have learned, that buying gold to turn a quick profit is a fantasy. His plan was to rack up credit-card points buying the gold and then quickly resell it for a profit.

Buyers can expect their gold to immediately lose around 5 percent of its value, according to Tom Graff, chief investment officer at the wealth advising company Facet. One pays a premium to buy and pays fees to sell. “You need a holding period that’s long enough to overwhelm that cost,” said Graff.

Luke Greib told the Wall Street Journal that he sold a one-ounce Credit Suisse bar on a Reddit page dedicated to trading precious metals to avoid taxes and fees. Buying physical gold is purchasing insurance against monetary mischief by the Federal Reserve, not to earn a profit via a quick flip.

Perhaps it’s hard to imagine currency destruction so devastating that your gold would serve as not only a store of value but a medium of exchange. Peter C. Earle explains in a piece for the American Institute for Economic Research, “During the peak of its 2008 hyperinflation, [Zimbabwe] experienced a catastrophic economic downturn, characterized by the issuance of billion—and trillion-dollar banknotes that were, despite their nominal enormity, virtually worthless.”

Dr. Earle writes that twenty-eight years of inflation “topped a total 231 million percent” and “the ZWD was demonetized in 2009.” The government is making its sixth attempt at a new currency, Zimbabwe gold (ZiG). “ZiG is there to stay forever,” said Vice President Constantino Chiwenga. “This bold step symbolizes government’s unwavering commitment to the de-dollarization program premised on fiscal discipline, monetary prudence and economic revitalization.”

Reportedly, ZiG “is backed by a basket of precious metals including about 2.5 tons of gold along with $100 million of foreign currency reserves held by the central bank.” As always, the Zimbabwe authorities are already blaming speculators for price increases. “Speculators should cease,” Chiwenga said. “Behave, or you get shut down or we lock you up.”

Dr. Earle has his doubts about whether the Zimbabwean authorities will maintain the ZiG backing with the required rigor. While he hopes for success, “Without fundamental changes guaranteeing private property protection, pro-market reforms, and safeguards against corruption, though, the ZiG is likely to retrace the unfortunate steps of its predecessors.”

The reason to buy and hold gold is just in case the Federal Reserve goes the way of Zimbabwe.

]]>Much of that cash as well as dollar denominated debt (physical and digital) ends up in the coffers of foreign central banks, international banks and investment firms where it is held as a hedge or used to adjust the exchange rates of other currencies for trade advantage. As much as one-half of the value of all U.S. currency is estimated to be circulating abroad.

World reserve status along with various debt instruments allowed the US government and the Fed to create tens of trillions of dollars in new currency after the 2008 credit crash, all while keeping inflation under control (sort of). The problem is that this system of stowing dollars overseas only lasts so long and eventually the consequences of overprinting come home to roost.

The Bretton Woods Agreement of 1944 established the framework for the rise of the US dollar and while the benefits are obvious, especially for the banks, there are numerous costs involved. Think of world reserve status as a “deal with the devil” – You get the fame, you get the fortune, you get the hot girlfriend and the sweet car, but one day the devil is coming to collect and when he does he’s going to take EVERYTHING, including your soul.

Unfortunately, I suspect the time is coming soon for the US and it may be in the form of a brand new Bretton Woods-like system that removes the dollar as world reserve and replaces it with a new digital basket structure. Global banks are essentially admitting to the plan for a complete overhaul of the dollar-based financial world and the creation of a CBDC-centric system built on “unified ledgers.”

There have been three recent developments all announced in succession that suggest the dollar’s replacement is imminent (before this decade is over).

The IMF’s XC Model – A Centralized Policy For CBDCs

The IMF’s XC platform was released as a theoretical model in November of 2022 and matches closely with their long discussed concept of a global Special Drawing Rights basket, only in this case it would tie together all CBDCs under one umbrella along with “legacy currencies.”

It’s promoted as a policy structure to make cross-border payments in CBDCs “easier” and this model is focused primarily on currency exchanges between governments and central banks. Of course, it places the IMF as the middle-man in terms of controlling the flow of digital transactions. The IMF suggests that the XC platform would make the transition from legacy currencies to CBDCs less complicated for the various nations involved.

As the IMF noted in a discussion on centralized ledgers in 2023:

“We could end up in a world where we have connected entities to some degree, but some entities and some countries that are excluded. And as a global and multilateral institution, we’re sort of aiming to, you know, provide a basic connectivity, a basic set of rules and governance that is truly multilateral and inclusive. So, I think that is—the ambition is to aim for innovation that is compatible with policy goals and that is inclusive relative to the broad membership of, say, the IMF.”

To translate, decentralized systems are bad. “Inclusivity” (collectivism) is good. And the IMF wants to work in tandem with other globalist institutions to be the facilitators (controllers) of that economic collectivism.

Bank For International Settlements Unified Ledger

Not more than a day after the IMF announced their XC platform goals, the BIS announced their plans for a unified ledger for all CBDCs called the ‘BIS Universal Ledger.’ The BIS specifically notes that the project is meant to “inspire trust in central bank digital currencies” while “overcoming the fragmentation of current tokenization efforts.”

While the IMF is focused on international policy control, the BIS is pursuing the technical aspects for the globalization of CBDCs. They make it clear in their white papers that a cashless society is in fact the end game and that digital transactions need to be monitored by a centralized entity in order to keep money “secure.” As the BIS argues in their extensive overview of Unified Ledgers:

- “Today, the monetary system stands at the cusp of another major leap. Following dematerialisation and digitalisation, the key development is tokenisation – the process of representing claims digitally on a programmable platform. This can be seen as the next logical step in digital recordkeeping and asset transfer.”

- “…The blueprint envisages these elements being brought together in a new type of financial market infrastructure (FMI) – a “unified ledger”. The full benefits of tokenisation could be harnessed in a unified ledger due to the settlement finality that comes from central bank money residing in the same venue as other claims. Leveraging trust in the central bank, a shared venue of this kind has great potential to enhance the monetary and financial system.

There are three major assertions made by the BIS in their program – First, the digitization of money is unavoidable and cash is going to disappear primarily because it makes moving money easier. Second, decentralized payment methods are unacceptable because they are “risky” and only central banks are qualified and “trustworthy” enough to mediate the exchange of money. Third, the use of Unified Ledgers is largely designed to track and trace and even investigate all CBDC transactions, for the public good, of course.

The BIS system deals far more in the realm of private transactions than the IMF example. It is the technical foundation for the centralization of all CBDCs, governed in part by the BIS and the IMF, and it is scheduled to go into wider use in the next two years. There are already multiple nations testing the BIS ledger today. It’s important to understand that whoever acts as the middle-man in the process of the global exchange of money is going to have all the power, over governments and over the populace.

If every movement of wealth is monitored, from the shift of billions between governments to the payment of a few dollars from an individual to a retailer, then every aspect of trade can be throttled on the whims of the observer.

SWIFT Cross Border Project – Another Way To Control The Behavior Of Countries

As we’ve seen with the attempt to use the SWIFT payment network as a bludgeon against Russia, there is an ulterior motive for globalists to have a high speed large scale monetary transaction hub. Again, this is all about centralization, and whoever controls the hub has the means to control trade…to a point.

Locking Russia out of SWIFT has done minimal damage to their economy exactly because there are alternative methods for transferring money to keep the flow of trade running. However, under a CBDC based global monetary umbrella, it would be impossible for any country to work outside the boundaries. It’s not only about the ease of shutting a nation out of the network, it’s also about having the power to immediately block the transfer of funds on the receiving end of the exchange.

Meaning, any funds from any Russian source could be tracked and cut off before they are allowed to get into the hands of, say, a recipient in China or India. Once all governments are completely under the thumb of a centralized monetary system, a centralized ledger and a centralized exchange hub, they will never be able to rebel and this control will trickle down to the general population.

I would also remind readers that the majority of nations are going right along with this program. China is most eager to join the global currency scheme. Russia is still part of the BIS, but their involvement in CBDCs is still unclear. The point is, don’t expect the BRICS to counteract the new monetary order, it’s not going to happen.

CBDCs Automatically Require The End Of The Dollar As World Reserve

So what do all these globalist projects with CBDCs have to do with the dollar and its venerated position as the world reserve currency? The bottom line is this: A unified CBDC system completely excludes the need or use-case for a world reserve currency. The Unified Ledger model takes all CBDCs and homogenizes them into a puddle of liquidity, each CBDC growing similar in characteristics over a short period of time.

The advantages of using the dollar disappear in this scenario and the value of currencies becomes relative to the middle-man. In other words, the IMF, BIS and other related institutions dictate the properties of CBDCs and thus there is no distinguishing aspect of any CBDC that makes one more valuable than the others.

Sure, some countries might be able to separate their currency to a point with superior production or superior technology, but the old model of having a big military as a way to ensure Forex and trade favors is dead. Eventually the globalists will make two predictable arguments:

- “A world reserve currency under the control of one nation is unfair and we as global bankers need to make the system “more equal.””

- “Why have a reserve currency at all when all transactions are moderated under our ledger anyway? The dollar is no longer any more easy to use for international trade than any other CBDC, right?”

Finally, the dollar has to die because it’s an integral part of the “old world” of material exchange. The globalists desire a cashless society because it is an easily controlled society. Think of the covid lockdowns and the attempts at vaccine passports – If they had a cashless system in place at that time, they would have gotten everything they wanted. Refuse to take the experimental vaccine? We’ll just shut off your digital accounts and you will starve.

This was even partially attempted (think Canadian trucker protests), but with physical cash there’s always a way around a digital embargo. Without physical cash you have no other options unless you plan to live completely off the land and barter goods and services (a way of life most people in the first world need a lot of time to get used to).

I believe that a sizable percentage of the American populace will go to war before they accept a cashless society, but in the meantime, there is still the inevitability of a dollar crash to deal with. Globalist organizations are pushing CBDCs to go active VERY quickly, and as this happens along with the centralized ledgers the traditional dollar will swiftly lose favor. This means that those trillions in greenbacks held overseas will start flooding back into America all at once causing an inflationary disaster well beyond what we are witnessing today.

As much as the economy has benefited from world reserve status in the past it will suffer equally as the dollar fades, only to be replaced by a framework even worse than fiat. That is, unless there’s a dramatic upheaval that removes the globalist order from the equation entirely…

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

]]>That was made clear when Tucker Carlson recently interviewed the Russian strongman President Vladimir Putin, who clearly articulated how the uniparty in Washington is destroying America’s greatest strategic and economic asset — her currency.

Last year, led by the chairman and ranking member of the relevant House and Senate committees, a bipartisan and bicameral bill was introduced that would hand another $300 billion to the Ukraine, this time in the form of the confiscated U.S. dollars owned by the Russian central bank and the Russian people.

There are now renewed calls for this measure as both the budget battle at home and the war in the Ukraine drag on.

Not during the Vietnam or Korean wars or at any point during the height of the Cold War did America do this to the Soviet Union. U.S. statesmen understood then, as our adversaries do now, that the dollar’s reserve currency status is among our most important global assets, both economically and strategically.

This steadfast principled commitment facilitated our post-war expansion of influence over global affairs and commerce, directed investment to the U.S., and kept inflation at bay by parking dollars as reserves the world over.

Eager to demolish this foundation of our global presence and dam that holds back inflation, the Washington uniparty is rallying behind the next step to gut the U.S. dollar.

We warned on this site before how Biden’s unprecedented freezing of U.S. dollars owned by a foreign central bank has fundamentally jeopardized the currency’s hard-won reserve status. In fact, it’s a main factor now driving dozens of countries away from what they see as a dangerous and unpredictable United States — countries now including France and Saudi Arabia.

Of course, China is eager to exploit these fears and welcome countries into its rapidly growing BRICS anti-dollar bloc.

After the Biden administration spent months scoffing at the mere hint of de-dollarization, Janet Yellen dropped a bombshell last year, casually admitting that not only is de-dollarization happening, but Americans should expect more – in her words, it’s “only natural” for countries to flee the dollar since the world is big.

In fact, countries are not fleeing the dollar because the world is big, they are fleeing because Biden made them question the U.S. dollar by using it as a political football where countries must grovel and obey Washington or risk having their national patrimony frozen.

Nations who disagree with Biden on abortion, homosexuality, fossil fuel use, etc. also run the risk of seeing their dollar reserves taken away. As if on cue, the Biden administration has threatened sanctions against countries with anti-sodomy laws such as Uganda.

This asset seizure bill would dramatically up the ante. If the U.S. is willing to not just freeze, but actually hand over a nation’s entire dollar reserves to another country, it confirms the worst fears of any country questioning whether they can count on the dollar or the U.S. at all.

As more nations lose confidence in the dollar, they will sell their dollars. If enough countries do this, those trillions will come flooding home to America — essentially 70 years of deficits pouring in almost all at once.

This tsunami could set off an inflation the likes of which we haven’t seen in a century. Imagine the last three years of price increases put on steroids, amphetamines and covered in nicotine patches.

At a minimum, it’d be multiple years of double-digit inflation like we’re used to seeing in third world countries. At worst, it’d be a full-blown Weimar Republic replacing wallets with wheelbarrows for carrying around currency.

Such an economic catastrophe would, of course, take America off the world stage, not by choice but by necessity. The uniparty would have made their virtue-signaling gift to the Ukraine at the expense of America’s very standing as a world power.

The naïve calls for currency manipulation are a defiling of the dollar’s sanctity and an assault on people’s property rights. If the uniparty in Congress and the Biden administration push the issue much further, it will mean a long walk off a short pier into an ocean of misery for the American people.

E.J. Antoni is a public finance economist, and Peter St. Onge is the Mark A. Kolokotrones fellow in economic freedom, at The Heritage Foundation.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>At the meeting Siluanov met with Lan Fo’an, his Chinese counterpart, to discuss new ways to facilitate making trade payments in local currencies rather than the U.S. dollar as part of a long-term de-dollarization strategy that aims to unseat America from global trade dominance.

“We need to further develop financial cooperation within the BRICS countries,” Siluanov added. “Here we see opportunities … to develop a payments system that would be independent of the infrastructure, which does not always fully fulfill the goals of individual countries.”

“Therefore, the sustainable development of financial relations and settlements on the BRICS platform is important for us, and we believe that it is necessary to work out such issues, and today we will consider a number of them.”

(Related: Check out our earlier report about Russia’s upcoming plans to release a new BRICS currency to compete with the dollar – it should be ready by next summer, Russia says.)

The U.S. dollar won’t be king for much longer

Many BRICS partners are already making trades with local or alternative currencies after sanctions stemming from the war in Ukraine effectively cut Moscow off from the Western financial system.

Rather than kowtow to Western demands, Russia and its partners have instead been laying the groundwork for a new world order that will eventually cut off the West from global trade after the U.S. has been unseated as the global economic superpower.

Communist China is quickly rising to the top of the trade heap with all of its cheaply made junk, and Russia is helping it and the other BRICS member nations further dethrone the U.S. by encouraging financial transactions in other currencies.

“Ditching the dollar is the only sane thing to do to establish multi-polar prosperity for non-dollar nations,” wrote one commenter at RT in favor of Russia’s agenda.

“Ditching the dollar as fast as they can will liberate their economies,” wrote another.

“The U.S. dollar has become a weapon of mass destruction to the world,” suggested someone else. “Money should be a produce of labor, not debt labor.”

One idea for BRICS, as proposed by someone else who left a comment, is for member nations to use a basket system of only member-state currencies, all of which have to be backed by gold.

“And no member may use the U.S. dollar in their international trade,” this same person added. “I think this will work out well for BRICS and poorly for those who think that this will never happen … because it will (one day).”

“Previously, the world was using the U.S. dollar due to convenience and free will,” said another. “And now they will stop using it since it has been repeatedly weaponized.”

“The smart countries will not be swayed by any USA concessions or curveballs.”

Another wrote that ditching the dollar is a top priority. BRICS needs its own reserve currency and independent SWIFT system, as well as its own shipping, insurance and international lending mechanism in order to out-compete the dollar and complete the de-dollarization process.

“However, the goal must not be to completely ditch the dollar or euro, but to have an alternative because competition is the best because what if BRICS itself becomes arrogant with members?” this person added.

How much longer will the United States be top dog on the world stage? Learn more at Collapse.news.

Sound off about this story on our Economic Collapse Substack.

Sources for this article include:

]]>“Yes, it’s a good thing for stackers when the prices of gold and silver go up in dollars,” he told “Liberty and Finance” host Elijah K. Johnson on Dec. 5. “But the other way we need to look at it … is that the dollar is going down versus gold and silver in the long term.”

Inneco cited Venezuela as an example of this. The South American country’s fiat currency, the bolivar, became worthless when the gold trading faltered. “I think the same thing is [going to] happen to the dollar and all the other fiat currencies vis-a-vis gold and silver,” he added.

Meanwhile, Johnson remarked that people were seeing a new intra-day high for gold prices, surging above the $2,150 mark. Innecco said some friends told him about this development, but he advised them not to get too excited and to just stay level headed.

Innecco, a financial markets and macroeconomic analyst, said he had seen gold rise to $2,130 before going down to around $2,070 – its all-time high from 2020. Days before, it closed at $2,072, just above the 2020 spot price.

Johnson’s guest commented that while the price of gold fluctuates, its value hasn’t changed. In contrast, fiat currency changes because the central bank issues too much of it.

Greenback lost 98% of its value versus gold in 1971

Innecco also recounted how the dollar lost 98 percent of its value versus gold back in 1971, when former U.S. President Richard Nixon closed the gold window that year. He added that some people will trade gold for fiat money, something he called a completely different game.

Johnson meanwhile remarked that the volatility in the gold market has caused worry among people. In response, Innecco said key technical levels being breached in the last few years is the reason.

He also shared that based on a report about the Sharpe ratio of certain investments, gold was third on the list. In contrast, cryptocurrency was way low on the ranking. According to Investopedia, the Sharpe ratio “compares the return of an investment with the risk.”

“It’s actually a very, very stable if you want to call it investment. I think the top two were like long and short hedge fund portfolios or stuff that was really hedged,” said Inneco.

The analyst also warned that putting gold with the banks in exchange for fiat currency is a bad idea since it won’t be even legally owned by someone, essentially making it an unsecured loan. He also advised against having a lot of money in the bank, given the multiple bank failures that happened in March. According to Innecco, the latest Federal Deposit Insurance Corporation (FDIC) numbers weren’t very good when it came to the unrealized losses on securities.

He ultimately asked viewers whether they want to finance the current administration in the U.S. or the U.K., which has allowed migrants in. Keeping fiat currency in the bank means people are indirectly financing their own collapse.

Head over to GoldReport.news for more stories about gold and its link to fiat currency. Watch Mario Innecco discuss why the dollar is in trouble with the rising gold prices below.

This video is from the Liberty and Finance channel on Brighteon.com.

More related stories:

- Gold Newsletter: 2023 will be a bearish year for stocks and bonds, but a bullish one for precious metals.

- Gold price jumps to 8-month high, eventually settles above $1,900 level.

- Israel-Palestine war causes GOLD PRICES to RALLY as demand for safe haven investment increases amid chaos.

- The Health Ranger denounces DISHONEST and UNRELIABLE fiat currency banking system.

- Federal Reserve to print another $2 trillion in fake fiat funny money to bail out financial terrorists, further devaluing dollar.

Sources include:

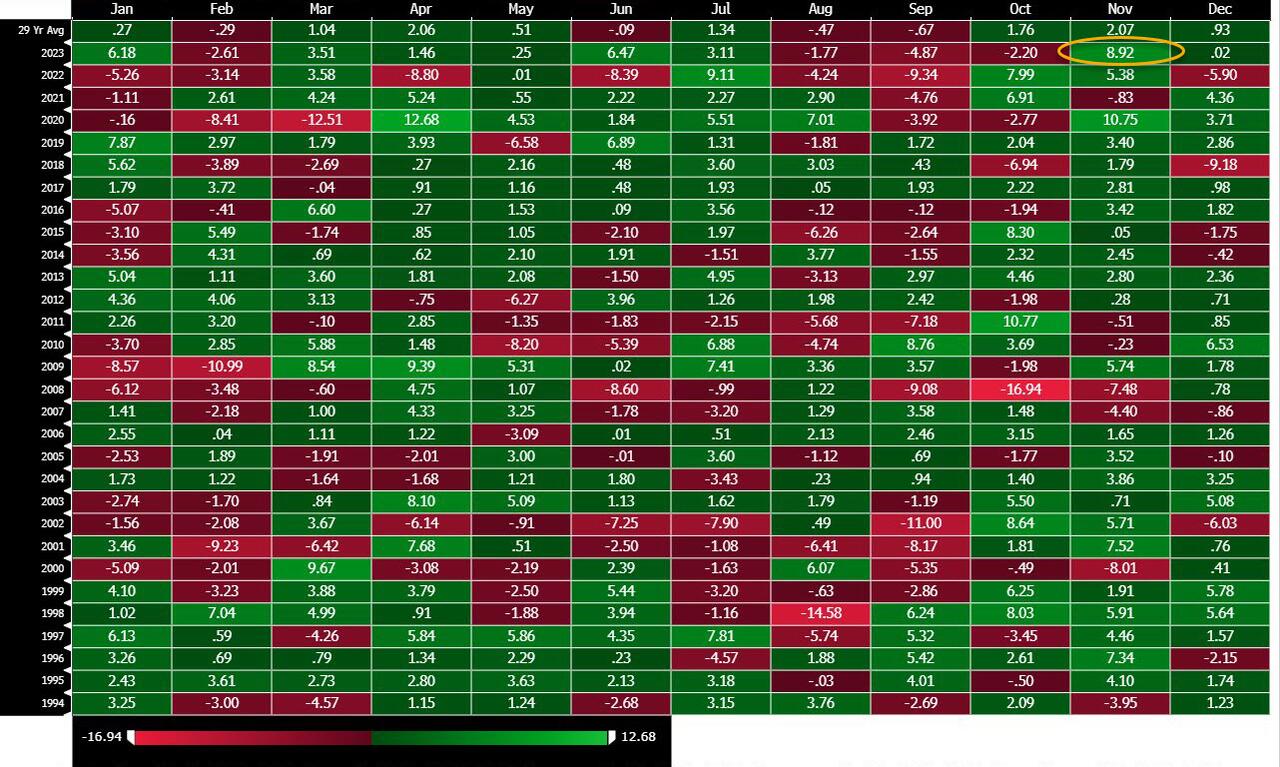

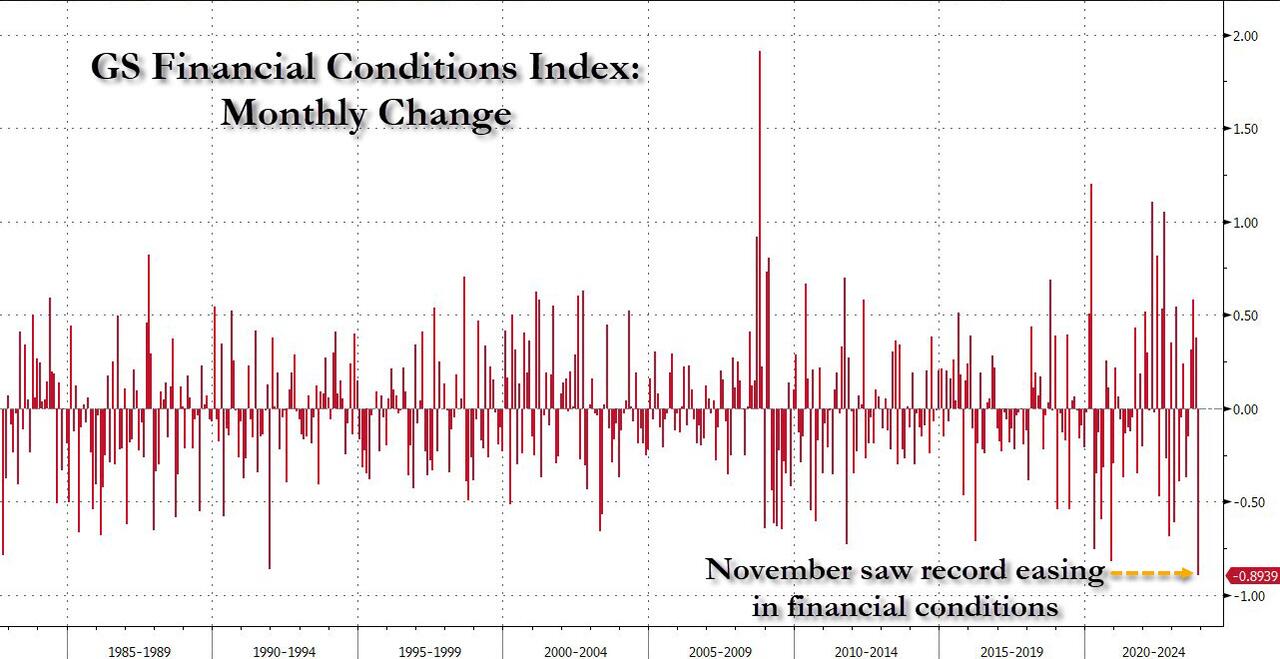

]]>… all eyes were on Jerome Powell today to see if the Fed chair would say something to stem the surging stock market tide following the month which saw the biggest easing in financial conditions on record, equivalent to nearly 4 rate cuts.

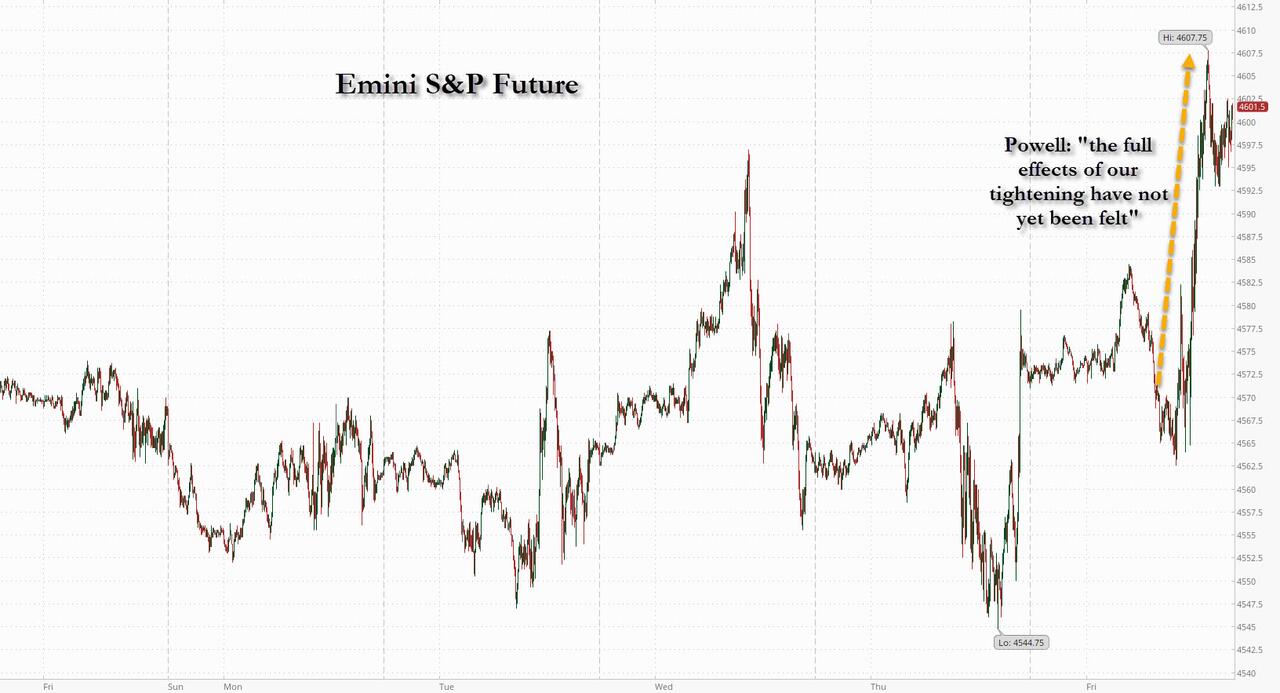

We got the answer shortly after 11am ET, when after what seemed to be otherwise balanced remarks with a dose of hawkish comments…

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.”

… offset by some clearly dovish statements…

“The strong actions we have taken have moved our policy rate well into restrictive territory, meaning that tight monetary policy is putting downward pressure on economic activity and inflation. Monetary policy is thought to affect economic conditions with a lag, and the full effects of our tightening have likely not yet been felt.”

… and generally sounding rather optimistic while answering student questions, saying that the US is on the path to 2% inflation without large job losses – i.e., a soft landing – which helped the market to convince itself that Powell had just given the green light for a continued market meltup (thanks to the blackout period, there will be no more Fed comments until the Dec 13 FOMC) as Bloomberg put it…

“Powell points to how the Fed’s past tightening moves will continue to have an impact on the economy — the full impact hasn’t been felt yet. If anybody thought the Fed wasn’t finished raising rates, his prepared remarks today sure put a fork in it. They are done.”

…. and what happened next was a violent repricing in easing odds, with March rate cut odds hitting a lifetime high of 80%, effectively doubling overnight and up from 10% just 5 days ago…

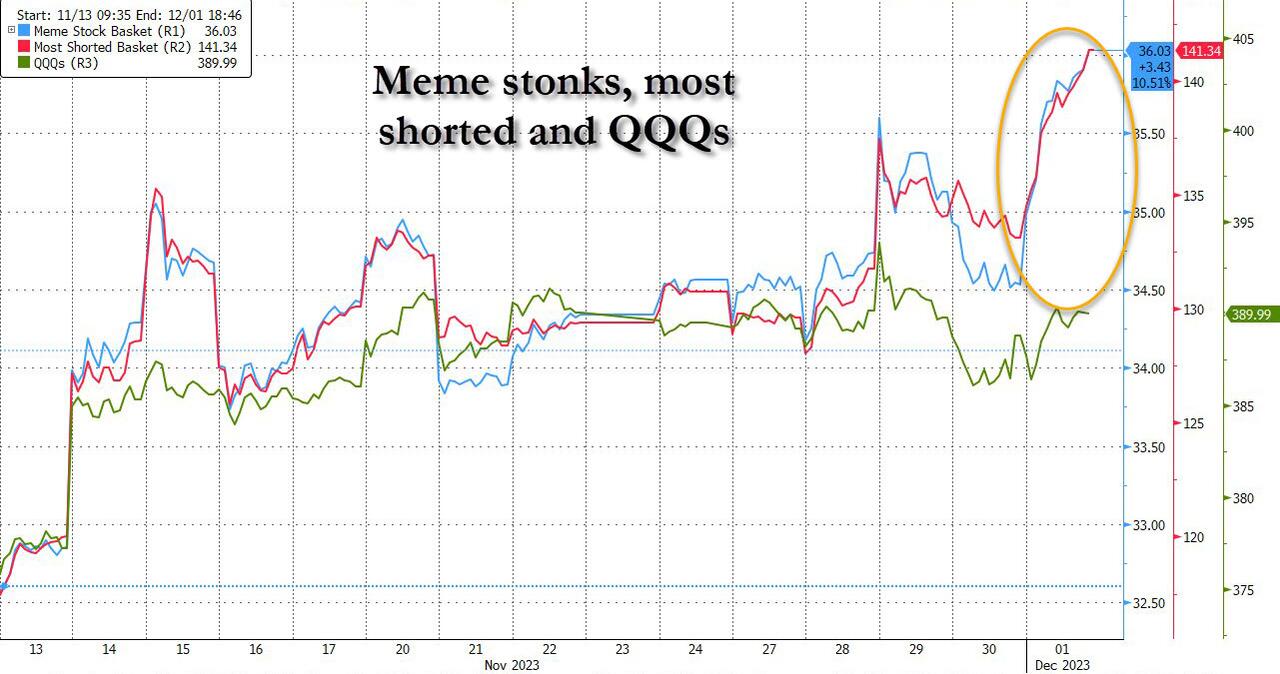

… which then immediately cascaded across assets and sent everything exploding higher, led by stocks which surged above 4,600 for the first time since the July FOMC (aka the “final rate hike”)…

… and one look below the surface reveals that this was indeed the QE trade: the Nasdaq barely rose while meme stonks and most shorted names exploded higher.

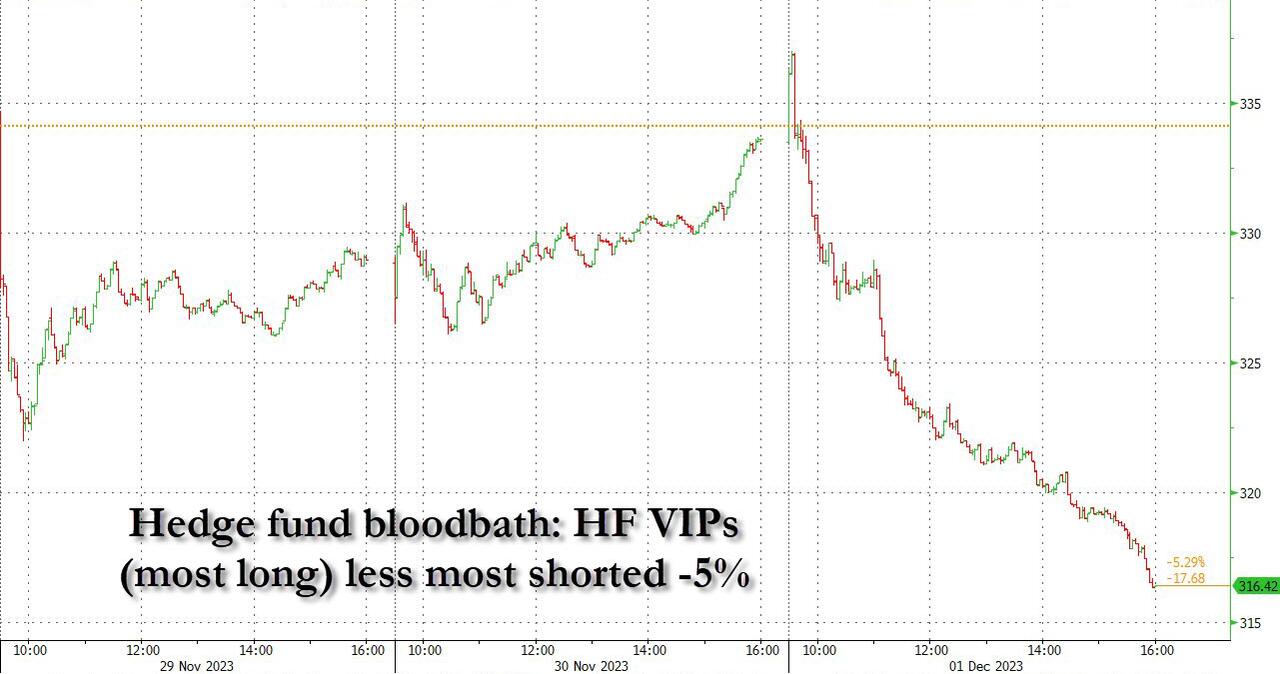

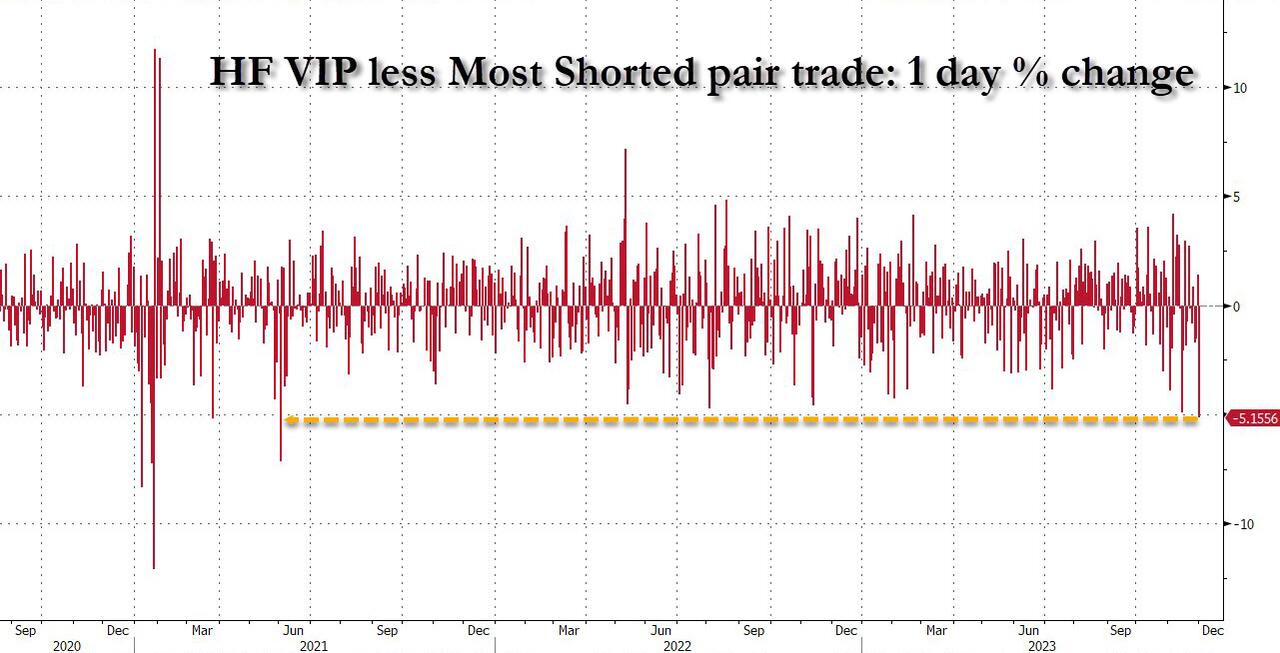

And yet, this eruption in the most shorted/hated names means that hedge funds actually had a catastrophic day: and indeed, looking at the HF VIP (most long) less most shorted basket pair trade we see a whopping 5% drop as many hedge funds were stopped out and margin called.

Putting today’s plunge in contact, this was the worst day for hedge funds since June 2021 and the second worst day since the covid crash!

Next, looking at the bond market, here too everything jumped but especially 2-Year TSYs, whose yields tumbled a whopping 12bps to 4.56%…

… and on course for the biggest weekly slide since the regional banking crisis in March, down almost 40bps.

Yet neither stocks, nor bonds, had quite as much fun as either “digital gold”, with Bitcoin briefly hitting a fresh 2023 high, briefly surging to $39,000 before easing back with Ether rising to $2100 …

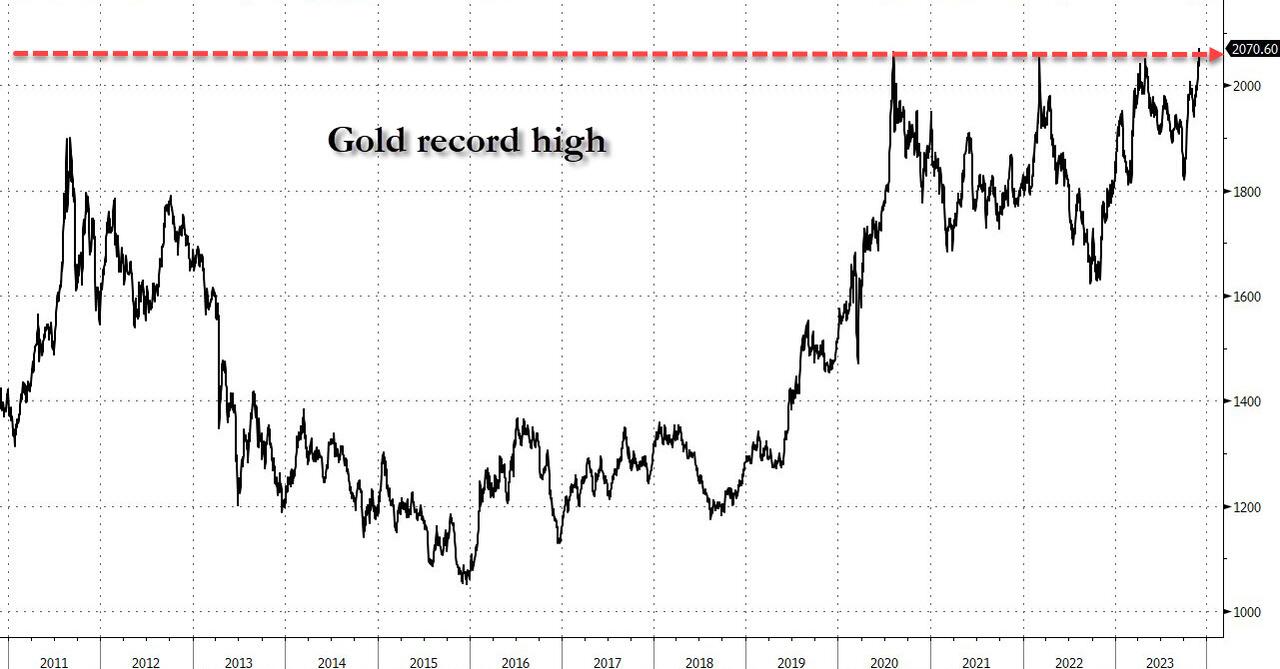

… but the biggest winner by far from today’s market conclusion that a renewed dollar destruction is on deck, was gold which briefly rose above its all time high of $2,075…

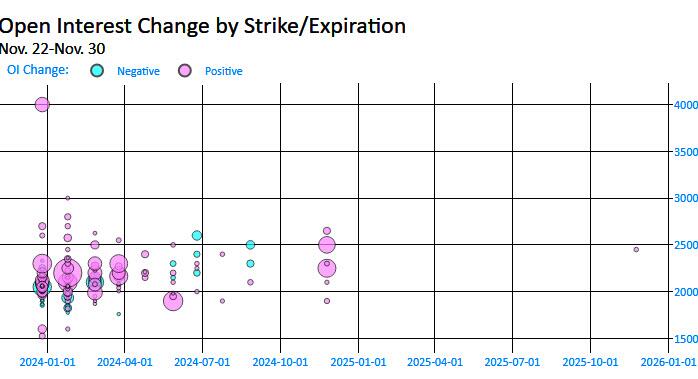

… and that’s just the start: now that a new record is in the history books, a frenzy of gold calls was bought, both for futures and the biggest ETF tied to the metal, and as shown in the chart below, the buildup of open interest between $2,000 and $2,500 has been relentless over the past week on growing optimism that rates are primed to decline. Next up for gold? $2500 or higher.

Yet not everyone had a great day: the dollar predictably tumbled, extending it losses for a third straight week, the longest streak since June, and comes after the dollar saw its worst month in a year this November.

One dollar pair trade where the convexity is especially high is USDJPY, which after soaring for much of the past year suddenly finds itself in a Wile E Coyote moment, trading just below the 100DMA. Should the selling persist, we may see the pair quickly tumble down to 140, or lower.

To be sure, not all the moves made sense: as Bloomberg noted, bonds have a better reason to rally than stocks, which have to factor in the growth concerns that underpin Powell’s remarks. Evidence is gathering that the economy is slowing and stocks will have to reconcile that with their bullish rate views. Today’s ISM Manufacturing data is case in point that the stagflationary slowing that started in October — and Bloomberg Economics says it’s observing typical early signs of recession — extended last month.

The ISM commentary was generally downbeat, equally split between companies hiring and others reducing their labor forces “a first since such comments have been tracked” according to Bloomberg.

But it gets worse: the latest update to the Atlanta GDPNOW tracker slipped to 1.2% from 1.8% yesterday and over 2% just last week.

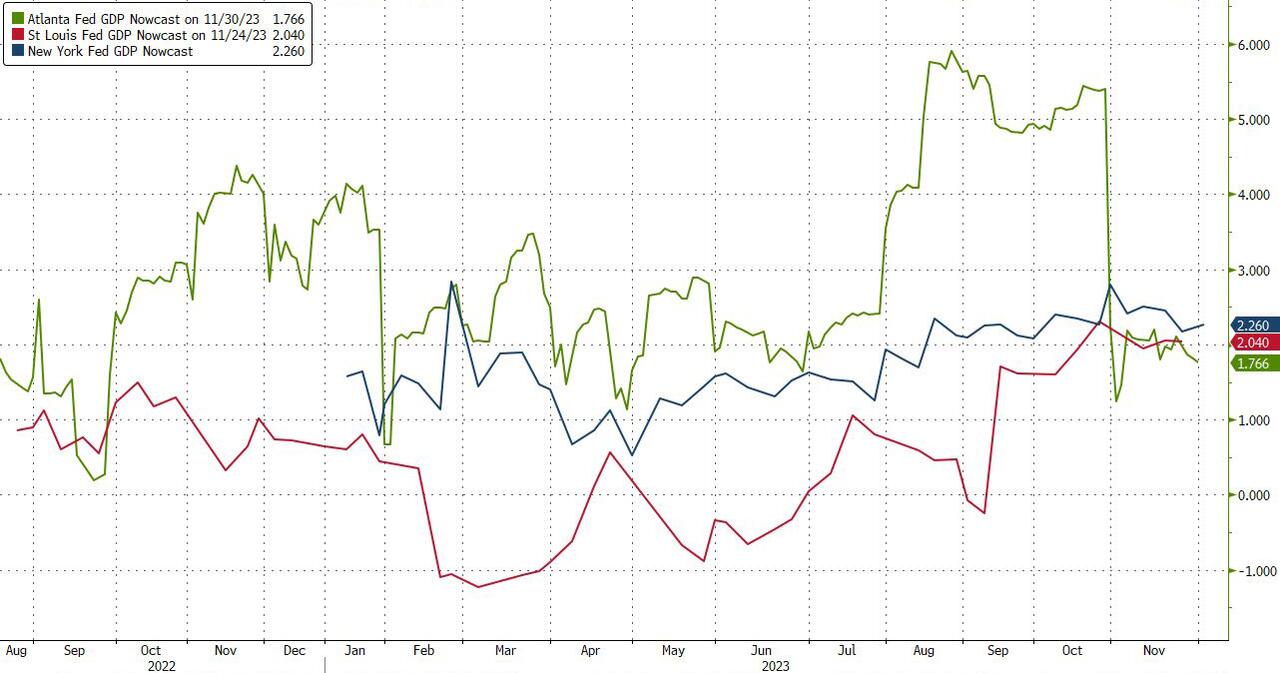

And after diverging for much of the year, all three regional Feds that do GDP nowcasts have converged on 2% – a far cry from the “5.2%” GDP print the Biden department of seasonal adjustments goalseeked last month.

Bottom line: the onus is now on the payrolls report next week to further guide markets into next year. The continued rise in ongoing jobless claims pose a risk that unemployment could rise further. But so far, this isn’t a consensus view, with economists projecting the unemployment rate to stay unchanged at 3.9% (and more see a 3.8% rate than 4%).

And while that may only add more fuel to the rate-cut speculation, at some point the softening in economic data will have to be squared with its impact on profits. As a reminder, while much of the interval between the last rate hike and the first rate cut is favorable for risk assets, the weeks right before the cut usually send stocks anywhere between 10% and 30% lower as the market realizes just why the Fed is panicking.

However, judging by today’s action, we still have some time before that particular rude awakening kicks in.

]]>