In essence, they’re suggesting that the damage is done, the investments are made, so they need to somehow generate a return on those investments before Trump pulls the plug on the mandates.

A report by Brady Knox over at Washington Examiner, commenting on a NY Times article, suggests car companies may ask President Trump to keep Joe Biden’s rules in place for now:

According to a report from the New York Times, the Biden administration’s actions to boost domestic EV manufacturing may have already set the auto industry past the point of no return. Following Biden’s initiatives, automakers have already invested billions of dollars in transitioning to electric vehicles. If Trump were to scrap the initiative, major automakers fear they could be undercut by smaller manufacturers producing cheaper, internal combustion engine cars.

Three of the country’s largest automakers, Ford, General Motors, and Stellantis, are already lobbying Trump against scrapping the rules.

Some had hoped that one of the biggest proponents of electric cars, Tesla CEO Elon Musk, would be able to sway Trump to keep those rules in place, but now, his priorities seem to be cutting regulations. He expressed opposition to the $7,500 tax credit for buyers of electric cars, saying he opposes all subsidies.

“In my view, we should end all government subsidies, including those for E.V.’s, oil and gas,” Musk said last week.

Musk’s calculation was more cynical in a July earnings call, speculating that the end of the subsidy would hurt Tesla somewhat, but hurt its competitors much more.

Is it worth keeping the mandates so the big three U.S. automakers can prevent smaller competitors from eating their lunch?

Nope, Not Worth It

As horrible as the situation is for major U.S. automakers, keeping the mandates in place would be far worse. Americans need relief far more than automakers right now. Getting the price of vehicles down to a manageable level is crucial if America is going to have any chance of recovering from the financial decimation we’ve felt for the last four years.

But there’s actually a good business reason for pulling the mandates immediately. The Biden-Harris regime forced automakers to try to usher in a future that was too far off, but that doesn’t mean OPTIONAL electric vehicle adoption isn’t part of the future.

The damage has been done by the mandates, but there have also been significant investments into research and development that can flourish if they’re allowed to transition without government interference. In other words, they can return to internal combustion engines as the primary driver for now to get their revenues back while reducing costs for American consumers. Simultaneously, they’ll be expanding on what they’ve built in EV infrastructure, albeit without mandates forcing the issue. They’ll be able to work at the speed of the market instead of the mandates.

It’s a sour consolation for the biggest automakers because it means they’ll have to wait years or even decades to realize benefits from their electric vehicle investments, but the long-term returns should be worth the wait… if they can survive long enough to see them.

Rather than using the current rules to stifle competition, they should hope that President Trump immediately sides with the free market and the consumers to allow enough short-term benefit for U.S. automakers to recover.

]]>“We’re seeing a tremendous amount of competition,” John Lawler, Ford vice chair and CFO, told journalists in a conference call. “In fact, S&P Global … said that there’s about 143 EVs in the pipeline right now for North America — and most of those are two-row and three-row SUVs.”

The news that Ford was scrapping its SUV EV came just a month after the company announced a manufacturing pivot at its plant in Oakville, Ontario. The plant, which had been earmarked for EV production, was shifting production to Ford’s F-series pickups, its flagship gas-powered trucks.

“The move,” the New York Times reported, “is the latest example of how automakers are pulling back on aggressive investment plans in response to the slowing growth of electric vehicle sales.”

The Cost Problem

Ford’s latest pullback from EVs is no surprise to people who’ve been paying attention to the EV market.

More than a year ago I pointed out that news outlets were reporting of EVs “piling up” at dealership lots because of low consumer demand, which ultimately prompted Ford to halve production of its popular F-150 Lightning, reducing output to about 1,600 vehicles per week.

The reality is both lawmakers and Washington and auto companies severely misjudged consumer demand for EVs, which has proven far lower than estimates had projected. There are many reasons for the low demand, but the primary reasons are concerns consumers have with EVs.

Price is one factor. Research in recent years has indicated that despite government subsidies, EVs typically cost on average between $5,000 and $10,000 more than a similar gas-powered vehicle. That EVs are more expensive than gas-powered cars may surprise few readers, but what’s less known is that the price gap is widening.

“EV prices aren’t just going up; they are rising faster than inflation…faster than [internal combustion engine] vehicle prices” Ashley Nunes, a senior research associate at Harvard Law School, testified before Congress in 2023, noting that the inflation-adjusted average price of a new EV had risen to over $66,000 in 2022, compared to $44,000 in 2011.

The Charging Problem

Cost, however, isn’t the only concern of consumers.

An overwhelming percentage of Americans—77 percent, according to a 2023 survey led by the Associated Press-NORC Center for Public Affairs Research and the Energy Policy Institute at the University of Chicago—have concerns about how they would charge an EV if they bought one.

These concerns are not baseless. In February, the New York Times profiled a man Michael Puglia who had recently bought a Ford F-150 Lightning and said it was the “coolest” vehicle he’d ever owned.

“It’s unbelievably fast and responsive,” the Ann Arbor, Mich., anesthesiologist told reporter Neal E. Boudette. “The technology is amazing.”

The problem was the vehicle’s range. When the weather grew colder, Puglia found that the distance his vehicle could travel fell dramatically. His faith in the $79,000 truck dampened, and he found himself wondering if he should sell it.

“People say ‘range anxiety’ — it’s like it’s the driver’s fault,” Puglia told the Times. “But it’s not our fault. It’s actually they’re not telling us what the real range is. The truck says it’s 300 miles. I don’t think I’ve ever gotten that.”

The range problem of electric vehicles is exacerbated by another challenge facing EVs: a lack of charging stations. Nationwide, there was 68,475 private and public charging stations at the beginning of the year, according to the Department of Energy. That’s more than twice the number in 2020, but it’s still just a third of the number of gas stations and far below projections.

The range problem of electric vehicles is exacerbated by another challenge facing EVs: a lack of charging stations. Nationwide, there was 68,475 private and public charging stations at the beginning of the year, according to the Department of Energy. That’s more than twice the number in 2020, but it’s still just a third of the number of gas stations and far below projections.

One reason charging infrastructure has lagged is due to the federal government’s incompetence. Nearly three years ago, the U.S. Departments of Transportation and Energy announced a $5 billion spending effort to build fleets of charging stations to lead “an electric vehicle revolution.” As of the summer of 2024, just seven charging stations had been built.

“That is pathetic,” said US Sen. Jeff Merkley, a Democrat from Oregon. “We’re now three years into this … That is a vast administrative failure.”

Of Profits, and Losses

The decision of automakers to bet big on EV adoption was in some ways rational, in that they were responding to powers in Washington that were pressuring them and incentivizing them to expand electrical vehicle production. But the costs of listening to industry experts and politicians in Washington instead of consumers — and profits — have been severe.

In August 2023, NPR reported that Ford CEO Jim Farley was charging ahead with its ambitious EV expansion even though the company was “losing money on each EV it sells” and consumer demand for EVs was plummeting. Farley’s reasoning was that Ford was attracting new customers, but it was a costly endeavor. Ford reported a loss of $4.7 billion on EV sales in 2023, roughly $40,525 per vehicle sold.

“If the great mass of consumers dislike purple cars with green polka dots, then a society based on private property will not waste resources in the production of such odd cars,” wrote economist Robert Murphy. “Any eccentric producer who flouted the wishes of his customers and churned out vehicles to suit his idiosyncratic tastes, would soon go out of business.”

Murphy wrote these words more than twenty years ago, but in a sense they describe Ford’s business strategy. By producing mass amounts of pricey EVs that consumers didn’t want and selling them at a loss, Ford was in a sense cranking out green polka dotted cars. It was a losing strategy and path to going out of business.

Ford’s massive pullback from EVs is part of a broader return to economic reality. Companies flourish in a free market economy not by serving bureaucrats but consumers, the true “bosses.”

“They, by their buying and by their abstention from buying, decide who should own the capital and run the plants,” Mises wrote. “They determine what should be produced and in what quantity and quality. Their attitudes result either in profit or in loss for the enterpriser.”

Automakers bear responsibility for their decision, and paid the price in the form of losses. But this misallocation of resources likely could have been avoided if not for the federal government’s hamfisted attempts to coerce Americans into EVs, which included not just taxpayer-funded subsidies, but overt pressure from Washington and federal regulations designed to phase-out gas-powered cars.

Fortunately, the centrally planned EV revolution now appears dead in the water, or at least in full retreat. A spokesman for Kamala Harris recently told Axios the presidential candidate “does not support an electric vehicle mandate.”

Forcing Americans into EVs was always a bad idea economically, but it now appears to be a bad idea politically, too.

That’s good news for Ford and American consumers.

]]>Ford vowed to stop participating in “external culture surveys,” such as the Human Rights Campaign’s [HRC] Corporate Equality Index, promised it does not “use hiring quotas or tie compensation to the achievement of specific diversity goals” and said it would not use quotas regarding “minority dealerships or suppliers,” according to an internal memo sent to employees and obtained by conservative activist Robby Starbuck. The company is “mindful that [its] employees and customers hold a wide range of beliefs.”

“In the past year, we have taken a fresh look at our policies and practices to ensure they support our values, drive business results, and take into account the current landscape,” Ford CEO Jim Farley wrote in the memo.

Ford confirmed to the Daily Caller News Foundation that the letter was authentic and shared with its global employee network.

Here is @Ford’s full statement I received this morning. Sanity is coming for corporate America. pic.twitter.com/sqoJ8KPGHT

— Robby Starbuck (@robbystarbuck) August 28, 2024

The decision comes after a variety of other major U.S. corporations have dialed back DEI efforts in recent months.

Home improvement retailer Lowe’s announced that it would stop participating in the HRC survey and would no longer sponsor parades or festivals. Motorcycle manufacturer Harley Davidson discontinued its DEI function as of April and recently announced it no longer operates under DEI guidelines, while Brown-Forman — parent company of Jack-Daniel’s— closed its corporate DEI page and announced it was eliminating supplier diversity targets.

American Airlines, BlackRock and JPMorgan Chase also shifted stance on the topic, revising their DEI language to be less race-based after being threatened with discrimination lawsuits.

An April 2023 Bud Light advertisement featuring transgender activist Dylan Mulvaney resulted in a boycott that cost the parent company up to $395 million in U.S. sales and resulted in the exit of two Anheuser-Busch marketing executives.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>A Ford spokesperson did not explain the reasons behind the quality check, but shipments of Lightnings have been halted since Feb. 9. Even with shipments paused, production of the Lightnings continues at the Rouge Electric Vehicle Center in Dearborn, Michigan.

“We expect to ramp up shipments in the coming weeks as we complete thorough launch quality checks to ensure these new F-150s meet our high standards and delight customers,” company spokeswoman Emma Bergg wrote in a statement.

Last month, Ford announced plans to slash the Lightning production in April “to achieve the optimal balance of production, sales growth and profitability.”

The automaker (and many others, like Mercedes Benz) is recalibrating its electric vehicle strategy as the Biden administration plans to downshift the EV transition as demand plummets.

Thousands of auto dealers nationwide recently warned the ‘climate change warriors’ in the White House: the 2030 EV push is backfiring.

“Currently, there are many excellent battery electric vehicles available for consumers to purchase. These vehicles are ideal for many people, and we believe their appeal will grow over time. The reality, however, is that electric vehicle demand today is not keeping up with the large influx of BEVs arriving at our dealerships prompted by the current regulations. BEVs are stacking up on our lots,” the dealers said.

They warned: “Already, electric vehicles are stacking up on our lots which is our best indicator of customer demand in the marketplace.”

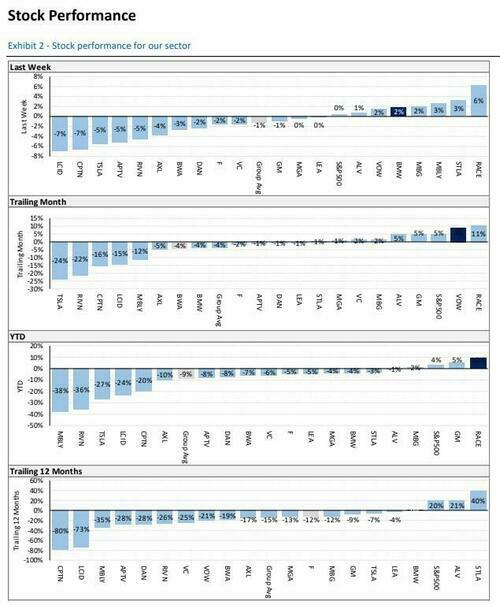

A recent note by RBC analyst Tom Narayan said the EV slowdown is far from over:

“Key takeaways thus far from earnings season are that the EV slowdown is not showing any evidence of an inflection, Level 4 autonomy headwinds continue to persist, and fears over supplier inventory overbuild are likely overblown.

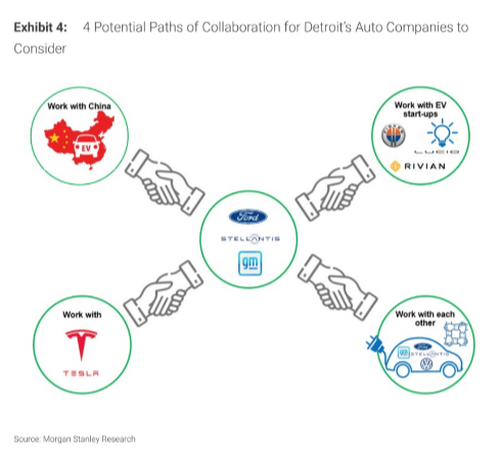

Analyst Adam Jonas at Morgan Stanley suggested consolidation is coming to the industry:

Given that Biden’s 2030 EV mandate is in full collapse, the downturn in the EV space will likely continue through the second half of this year.

]]>The plant marks a $3.5 billion investment in EV battery production and is estimated to create 2,500 jobs, Ford announced in February. The announced pause on construction precedes President Joe Biden’s scheduled visit to striking members of the United Auto Workers (UAW), whose grievances with Ford and other members of the “Big Three” manufacturers are largely attributable to Biden’s aggressive EV push.

It is unclear exactly why Ford has opted to pause construction, or whether the decision is in any way related to the ongoing UAW strike. The construction pause will go into effect Monday, Ford spokesman T.R. Reid told the DCNF.

Biden’s electric vehicle push might actually end up benefiting China https://t.co/y0yotHkeM4

— Daily Caller (@DailyCaller) April 11, 2023

“We’re pausing work and limiting spending on construction on the Marshall project until we’re confident about our ability to competitively operate the plant,” Reid told the DCNF. A “number of considerations” were involved in the company’s decision to halt construction, and there has not been “any final decision about the planned investment,” Reid added.

Ford planned to build technology it had licensed from Chinese battery company CATL at the Marshall plant, and the company is poised to reap considerable subsidies from the state and federal governments for the project.

Despite his pro-labor rhetoric and history, Biden’s multi-billion dollar push to have at least 50% of all new car sales be EVs by 2030 has attributed to the labor dispute, as the union is concerned that the less labor-intensive EVs taking up a much larger share of the market will ultimately disadvantage the workers it represents in the absence of protections in new contracts with the manufacturers.

Ford, like many other American manufacturers, has leaned into the administration’s EV push, taking advantage of Inflation Reduction Act (IRA) incentives, favorable loans and other programs that provide the corporations with billions of dollars to pursue the EV transition over the coming years. The company plans to invest over $50 billion in EVs globally through 2026 in order to develop breakthrough EV technology, and it also aims to manufacture EVs at a rate of 2 million per year by 2026, according to its website.

The White House and the UAW did not respond immediately to requests for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>Despite weeks of negotiations, the union was unable to come to an agreement over contract negotiations with General Motors, Ford, and Stellantis—known as the big three—before current contracts expired, prompting thousands of its members to walk out of three factories across the country in Missouri, Michigan, and Ohio.

The strikes are taking place at Ford’s Bronco assembly plant in Wayne, Michigan, GM’s mid-sized pickup truck assembly plant in Wentzville, Missouri, and Stellantis’s Jeep assembly plant in Toledo, Ohio.

It is unclear how long the strikes will last, however UAW—the largest union in the nation—has an $825 million strike fund that will compensate workers $500 a week while out on strike.

Video footage shared online showed some of the strikes began promptly after midnight, with dozens of workers taking to the streets and holding posters stating “end tiers” and “record profits, record contracts,” and chanting in support of the strikes and higher pay.

“This fight is our generation’s defining moment,” UAW said in a press release announcing the strike late Thursday. “Not just at the Big Three, but across the entire working class. We will stand up for ourselves. We will stand up for our families. We will stand up for our communities.”

UAW represents some 150,000 workers at General Motors, Ford, and Stellantis, however approximately 12,700 workers will be taking part in the strike, UAW President Shawn Fain said at a press conference Thursday night; 3,600 at GM, 3,300 at Ford, and 5,800 at Stellantis.

“Leading into the final hours of the strike deadline, we’ve been working hard trying to reach a deal for economic and social justice for our members. We have been firm. We are committed to winning an agreement with the big three that reflects the incredible sacrifice and contributions UAW members have made to these companies,” Mr. Fain said.

The strikes are expected to have significant business and economic implications. According to Anderson Economic Group (AEG), a work stoppage of 10 days could result in a total economic loss of more than $5 billion. The strike also has the potential to lead to higher car prices amid lower inventories, according to AEG.

Strikes Will Have ‘Wide-Ranging Consequences’

Meanwhile, the plants involved in the strikes are also critical to the three automakers’ productions. Some of their most profitable vehicles include the Ford Bronco, Jeep Wrangler, and Chevrolet Colorado pickup truck.

A full strike at each of the automakers could see losses of around $400 million to $500 million per week assuming all production was lost, Deutsche Bank has estimated.

Despite weeks of negotiations, union members and the big three have failed to reach an agreement over pay, enhanced benefits, and pensions.

The union has proposed a four-year contract with 40 percent pay increases, a reduced 32-hour work week, the elimination of compensation tiers, a restoration of cost-of-living adjustments, and the restoration of traditional pensions, among other items.

The automakers, which have all recorded record or near-record profits, have so far declined to meet that rise, instead offering 20 percent without key benefits demanded by the union, citing concerns that such pay hikes could effectively put them out of business.

Hours before the deadline passed, Ford said it had bargained “in good faith” in an effort to avoid a strike, which the company said “could have wide-ranging consequences for our business and the economy.”

The company said the last offer it submitted to the union was “historically generous, with large wage increases, cost of living adjustments, more paid time off, additional retirement contributions, and more.”

“Unfortunately, the UAW’s counterproposal tonight showed little movement from the union’s initial demands submitted Aug. 3. If implemented, the proposal would more than double Ford’s current UAW-related labor costs, which are already significantly higher than the labor costs of Tesla, Toyota, and other foreign-owned automakers in the United States that utilize non-union-represented labor,” the company said.

Ford said it remains “absolutely committed to reaching an agreement that rewards our employees and protects Ford’s ability to invest in the future as we move through industry-wide transformation.”

Union Prepared to ‘Go All Out’

General Motors said it was “disappointed by the UAW leadership’s actions.”

“Despite the unprecedented economic package GM put on the table, including historic wage increases and manufacturing commitments. We will continue to bargain in good faith with the union to reach an agreement as quickly as possible for the benefit of our team members, customers, suppliers, and communities across the U.S. In the meantime, our priority is the safety of our workforce,” the automaker said in a statement Thursday.

Stellantis has not yet commented on the strikes. The Epoch Times has contacted a Stellantis spokesperson for comment.

The “stand-up strikes”—effectively staggered strikes across the various automakers’ factories—are a nod to the historic “sit-down” strikes UAW members held in the 1930s, and avoid a full walkout.

UAW President Mr. Fain said during Thursday’s press conference that the strategy will “keep the companies guessing,” and give its national negotiators “maximum leverage and flexibility in bargaining.”

However, Mr. Fain warned that the UAW will go “all out” if it needs to, adding that “everything is on the table.”

He also clarified that workers who have not yet been called to join the strike will continue to work under the expired contract.

Speaking to reporters outside the Ford facility in Wayne minutes after the strike began Thursday, the union head criticized the three companies for allegedly failing to negotiate in good faith.

“They waited until the last week to want to get down to business, shame on them,” he said. Mr. Fain also said he believes it is a complete “joke” that the companies have suggested the strikes may bankrupt them.

“The cost of labor that goes into a vehicle is 5 percent of the vehicle, they could double our wages and they could not raise the price of vehicles and they could still make billions of dollars, it is a lie like everything else that comes out of their mouths.”

The union head also hinted that more strikes could take place at further facilities if the three companies are unable to meet the union’s demands.

The last time there was a UAW strike was in 2019 when the union went on strike for six weeks against General Motors. It cost the automaker $3.6 billion.

]]>