That has certainly been the case with US labor data, where as we first reported last month, every single monthly payrolls print in 2023 has been revised lower (see chart below), a 12-sigma probability and virtually impossible unless there was political pressure to massage the data higher initially and then revise it lower when nobody is looking.

But the BLS is not done: as we reported last week, besides the now traditional one-month lookback revisions the ridiculously high monthly payrolls prints accumulated over the past year will also be slowly but surely revised gradually lower at annual benchmark revisions for years to come. As Morgan Stanley chief US economist Ellen Zentner explained (full note available to pro subscribers)…

Payrolls get revised too, and we expect a downward revision. Payrolls have an annual benchmark revision that is published in February each year. The revision adjusts the level of payrolls through March of the prior year. For example, a new revision will be published in Feb-24, adjusting payroll levels from April-22 to Mar-23. And a preliminary estimation of the upcoming revision points to a decrease in payroll YoY% growth rates of -0.2pp.

But while downward payroll revisions under Bidenomics are as certain as death and taxes, what we wanted to discuss here are the just as striking downward revisions to US consumption which hit this morning alongside the comprehensive once every-five-years historical revisions to GDP. As a reminder:

Today’s release presents results from the comprehensive update of the National Economic Accounts (NEAs), which include the National Income and Product Accounts (NIPAs) and the Industry Economic Accounts (IEAs). The update includes revised statistics for GDP, GDP by industry, GDI, and their major components. Current-dollar measures of GDP and related components are revised from the first quarter of 2013 through the first quarter of 2023. GDI and selected income components are revised from the first quarter of 1979 through the first quarter of 2023.

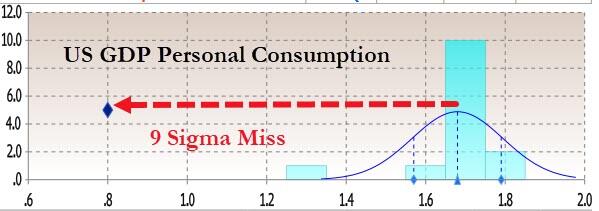

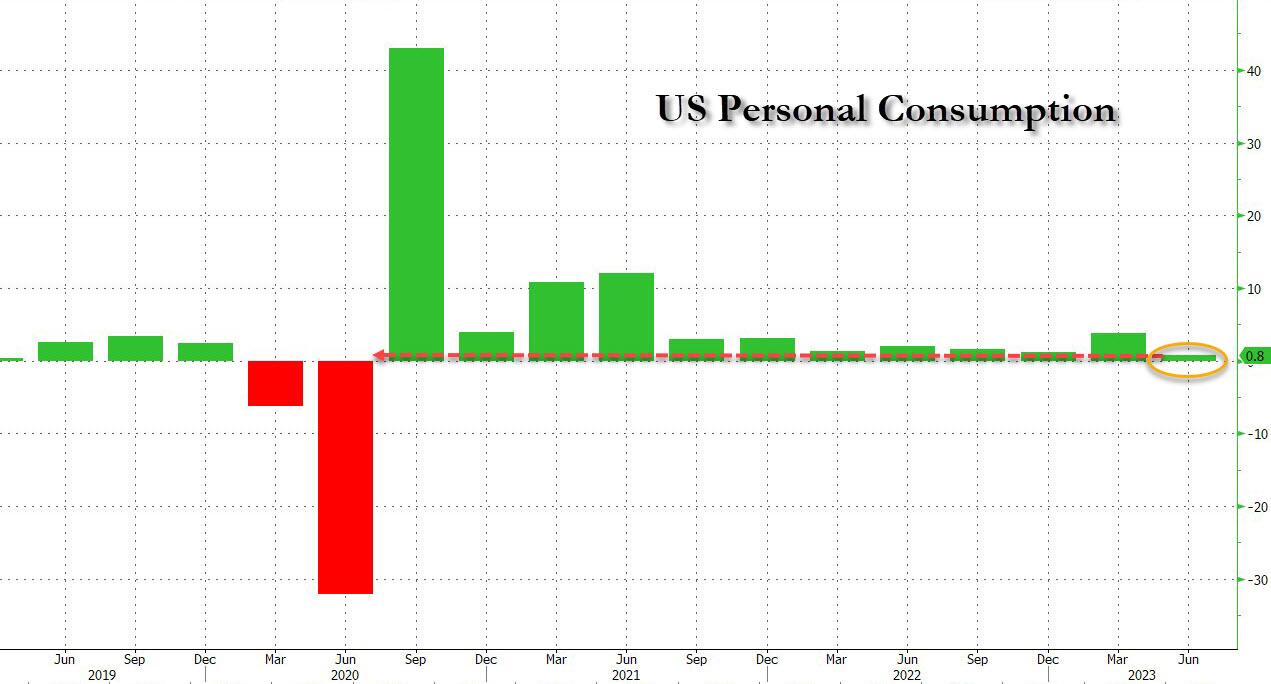

Earlier today we already noted the disaster that was Q2 Personal Consumption: instead of the 1.7% unchanged print from the second estimate of Q2 GDP, the final number was a dire 0.8%, a 9-sigma miss to estimates…

But what about other historical data? After all today’s revision impacted all data from Q1 2013? Therein, as the bard says, lies the rub.

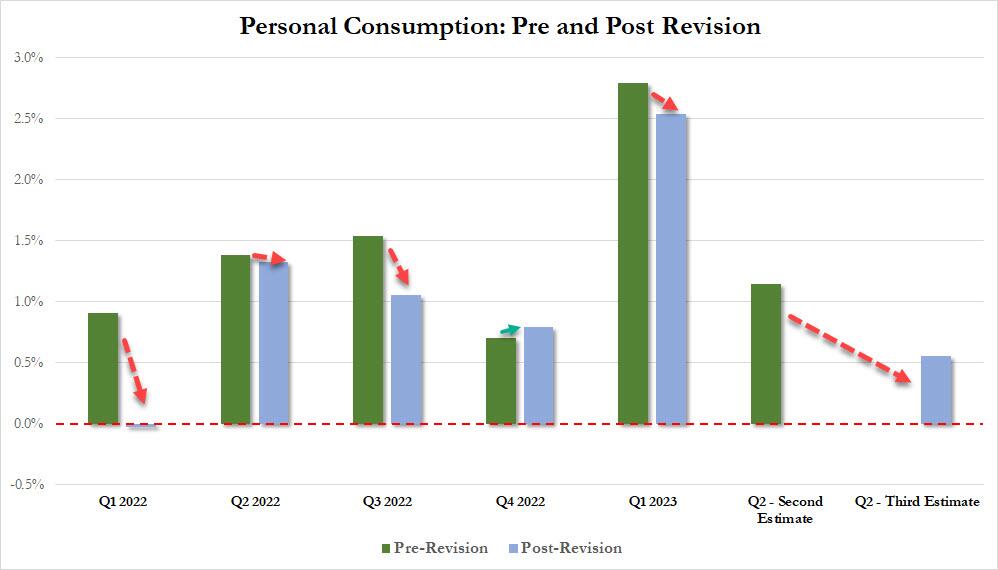

Let’s start with personal consumption, and compare the latest post-revision current data (link) with the most comprehensive pre-revision data as of last month (link). It should come as no surprise to anyone that with the (slight) exception of just Q4 2022, personal consumption in every single quarter since the start of 2022 – when the Fed aggressively started tightening and hiked rates by the most since Volcker – has been revised lower, and in some cases dramatically so.

Bloomberg also picks up on the GDP revision and looking at revisions to the historical data, writes that “the pandemic contraction is seen as being a bit less severe than previously thought: GDP is now reckoned to have dropped at a 28% annual clip in the second quarter of 2020, instead by 29.9%, as the government shut down swathes of the economy to fight the spread of the virus. But the recovery since then has been somewhat slower, according to the update. Growth last year was revised to 1.9% from 2.1%.” And of all GDP components, consumption was the weakest.

So not only was the Fed hiking at a time when personal consumption would grow much less period to period than previously expected, but the US economy was generally weaker than previously expected (as discussed here).

There’s more.

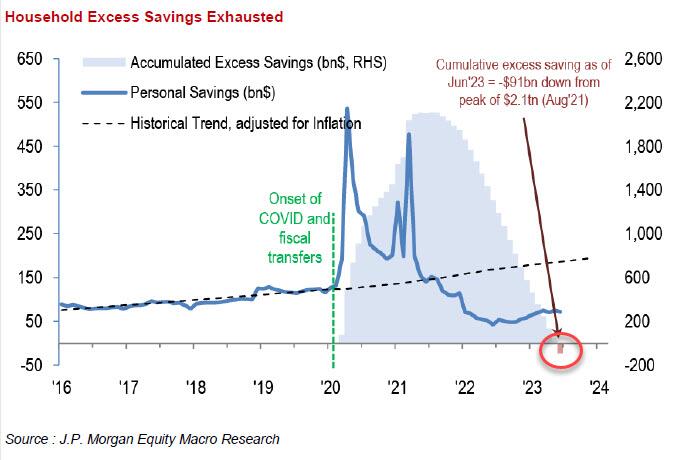

When looking at the composition of the US household’s income statement – the summary of economic accounts – we find just what we had expected: US savings were in fact far lower than previously expected.

In the latest negative revision, US households saved $1.1 trillion less than previously thought over the past six years…

… and indeed as the BEA chart below shows, Americans stashed away an average 8.3% of their disposable income annually from 2017 through 2022, down from a previously estimated 9.4%.

The reduction stems from an accounting adjustment that lowered personal income from mutual funds and real estate investment trusts. Additionally, as Bloomberg notes, much of the reduction in personal savings seen in the revised data occurred prior to the pandemic, so its implications for how much extra cash Americans may feel they still have now is not clear cut.

Whatever the reason for the statistical adjustment, however, one can say goodbye to even the faintest speculation that US households have any excess savings left… why they don’t, of course, because even when using the previous methodology which artificially inflated total savings, JPM calculated that excess savings had already run out…

… which means that if Q3 GDP was bad and consumption was “revised” sharply lower (odd how economic data is never revised higher under Joe BIden), Q4 – when savings are virtually non-existant – and where we also get the i) return of student loan payments; ii) the UAW strike; iii) the government shutdown and iv) oil at almost $100 and gasoline at one year highs, is about to fall off a cliff.

]]>The U.S. economy’s annual growth rate slowed more than expected to 1.1% in the first quarter of 2023, according to GDP statistics released by the Bureau of Economic Analysis (BEA) on Thursday morning. The vast majority of the financial sector agrees the economy will continue facing difficulties this year as over a dozen large banks predicted poor growth or a recession, according to Politico.

“The U.S. economy is unwell, and it’s starting to show,” Chief Economist at EY-Parthenon Gregory Daco tweetedThursday morning.

Growth was 2.6% in the fourth quarter of 2022, and economists had expected 2% growth for the first quarter of 2023, according to The Wall Street Journal. “Today, we learned that the American economy remains strong, as it transitions to steady and stable growth,” Biden said in a statement on the GDP.

“We continue to expect economic growth to slow, and we are preparing for a range of scenarios,” Wells Fargo CEO Charlie Scharf said on a first-quarter earnings call on April 14.

Other financial executives are making comparable remarks during earnings calls as well, although few are forecasting a major economic downturn, according to Politico.

“Our research team continues to predict a shallow recession that will occur beginning in the quarter three of 2023,” Bank of America CEO Brian Moynihan said on a first-quarter earnings call on April 18.

Consumers experienced continuing inflation and rising interest rates, contributing to a decline in retail spending in February and March, according to the WSJ. Home sales and manufacturing output also decreased in March.

The Federal Reserve has been hiking interest rates in an effort to lower inflation and has raised them to a target range of 4.75-5%.

“I’ve never been more optimistic about America’s future,” Biden has repeatedly stated.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>