The ADVANCE Act passed the Senate on Tuesday by a strong 88-2 bipartisan vote to the applause of pro-nuclear organizations who described the bill as a major step forward for America’s energy future. The bill is a first step toward freeing up a nuclear industry that has long been shackled, but it does not address some impediments the industry faces, according to nuclear energy experts.

The bill is designed to bring down the costs of nuclear licensing, create new opportunities for old industrial sites to eventually be converted to host reactors and give the Nuclear Regulatory Commission (NRC) more staffers and resources to execute their mission, according to the office of Republican West Virginia Sen. Shelley Moore Capito, a key architect of the bill. The bill is a welcomed development for the nuclear industry, which has struggled to expand for decades despite growing momentum — especially on the environmental left — to decarbonize the U.S. power system and wider economy.

Dems Who Shrieked About Climate Apocalypse Voted Against Bill Promoting Emissions-Free Nuclear Powerhttps://t.co/KWk0oN08HW

— Daily Caller (@DailyCaller) February 29, 2024

“This bipartisan legislative package ensures the U.S. maintains its leadership on the global stage and helps meet our climate and national energy security goals,” Maria Korsnick, president and chief executive officer at the Nuclear Energy Institute (NEI), said of the bill. “The passage of the ADVANCE Act allows us to bolster U.S. international competitiveness at this crucial junction, accelerate the domestic deployments of innovative advanced nuclear technologies, and modernize the oversight and licensing of the operating fleet of reactors.”

However, the bill is not a total victory for those hoping to see a speedy expansion of the technology’s footprint, as issues like the NRC’s general attitude of risk aversion and a lack of robust financial protection against cost overruns are not addressed directly by the legislation.

“The Nuclear Regulatory Commission has made recent progress to become more efficient while maintaining its focus on safety, but there is more work to be done,” Korsnick added. “The bill will support efforts to further modernize the NRC as it prepares to review an ever-increasing number of applications for subsequent license renewals, power uprates and next generation nuclear deployments.”

John Starkey, the director of public policy for the American Nuclear Society, told the DCNF that the bill is a “step in the right direction,” but probably will not be enough to singlehandedly usher in a nuclear renaissance.

“ANS applauds the long awaited passage of the ADVANCE Act. This bill provides common sense direction to enable the accelerated deployment of advanced nuclear reactors needed to meet the world’s clean energy goals,” Starkey told the DCNF. “The bill alone won’t open any floodgates, but it’s a necessary step in the right direction due to added workforce and the streamlined approach the NRC can take when regulating advanced reactors.”

While the NRC is set to get a boost from the new bill should it be signed into law, the institution is thought by some energy experts — including Dan Kish, a senior fellow at the Institute for Energy Research — to be too conservative and risk-averse in its approach to regulating the industry. Kish believes that the NRC has created a “regulatory morass” out of risk aversion over time that holds nuclear power back by significantly driving up costs, as he previously told the Daily Caller News Foundation.

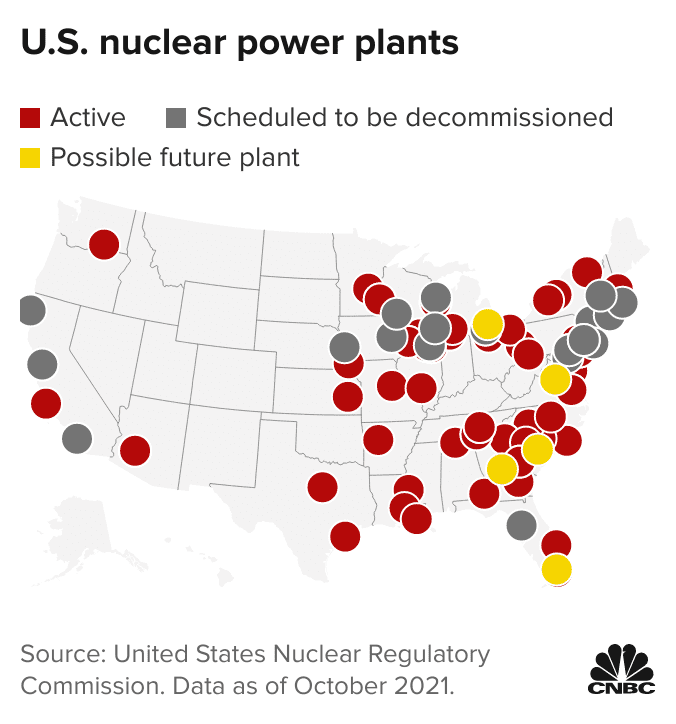

As of August 2023, there were 54 operational nuclear power plants and 93 commercial reactors in America, which together provide approximately 19% of America’s power, according to the U.S. Energy Information Administration (EIA). The average nuclear reactor is about 42 years old, while licensing rules limit their lifespans to an upper limit ranging from 40 to 80 years, according to EIA.

Nuclear power capacity grew rapidly between roughly 1967 and 1997, but it has generally stayed flat since then, according to the EIA. Only a handful of new nuclear reactors have come online in the past twenty years, but nuclear generally remains a more reliable low-carbon source of power than solar and wind, an important consideration when taking stock of the Biden administration’s goals to decarbonize the U.S. power sector by 2035 and the overall economy by 2050.

Grid watchers have warned consistently that the nation’s grid may not be able to sustain considerable growth in electricity demand amid simultaneous retirement of reliable fossil fuel-fired generation and its replacement with intermittent solar and wind, for example. Hence, nuclear power may hold the keys to recognizing the decarbonized future Biden and his appointees are pursuing with aggressive regulation and spending.

EXCLUSIVE

from @mikeginsberg98

Members Of Congress Push Defense Department To Embrace Nuclear Energy https://t.co/KeYmwzHj6X

— Daily Caller (@DailyCaller) July 13, 2023

To that end, the Biden administration evidently recognizes the promise of nuclear power, and is making a big push to advance it.

The Biden administration signed onto a pledge at last year’s United Nations climate summit to triple nuclear energy capacity by 2050, and has also extended “billions and billions and billions” of dollars to spur a nuclear revival in the U.S., as Energy Secretary Jennifer Granholm said at a nuclear energy conference in June. On Monday, Granholm’s Department of Energy (DOE) announced $900 million in funding to advance deployment of next-generation small modular reactors.

Two of the most recent nuclear reactors to come online are Unit 3 and Unit 4 at the Alvin W. Vogtle Electric Generating Plant, a nuclear power plant located in Georgia. Those reactors finally came online after years of delays and billions of dollars of cost overruns, demonstrating the challenges that the complex nature of nuclear engineering and construction can pose.

Tim Echols, a commissioner on the Georgia Public Service Commission, also praised the bill, but he raised different issues than other energy sector experts who focused more on the role of the NRC. Echols was involved in getting the Vogtle projects over the finish line in his capacity as a commissioner for the entity regulating the state’s utilities.

“What I am most encouraged about with ADVANCE is the bipartisan support for nuclear. For too long, only Republican-run states have been interested in new nuclear — and those times seem to be coming to an end,” Echols told the DCNF. “While ADVANCE doesn’t have the federal financial backstop I have been asking for, which would protect against overruns caused by bankruptcies, it still is very positive. “Speeding up licensing will allow the technology to be deployed sooner — assuming you have states stepping forward with the courage to build new nuclear.”

The backstop that Echols describes would be some sort of federal bankruptcy protection, which would incentivize policymakers and developers to move forward with new projects because “building new nuclear power is still incredibly risky,” and utility commissioners across America may hesitate to do so without some protection against what we went through in Georgia.”

“Clearly, ADVANCE, and the recent White House efforts on behalf of nuclear energy represent a push to accelerate new nuclear deployment in the United States that we haven’t seen since I was a boy,” Echols told the DCNF.

The DOE did not respond immediately to a request for comment, and the NRC declined to comment because the legislation has yet to be signed into law.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>“There are a couple of nuclear power plants that we probably should, and can, turn back on,” Jigar Shah, director of the US Energy Department’s Loan Programs Office, told Bloomberg in an interview.

In March, Shah’s office approved a loan to Holtec International Corp. to reopen the Palisades nuclear plant in Michigan. This was a historical shift, and it was the first nuclear power plant to be reopened in the US, setting a precedent for atomic energy to make a triumphal comeback. The plant could begin producing power as early as the second half of 2025.

Shah said, “A lot of the other players that have a nuclear power plant that has recently shut down and could be turned back on are gaining that confidence to try.” He declined to give specifics about which plants were slated to reopen.

Nuclear power is the largest single source of carbon-free electricity. Given onshoring trends, electrification of transportation and buildings, and, of course, as we’ve noted in “The Next AI Trade,” the proliferation of AI data centers will overload power grids nationwide unless a significant upgrade is seen.

We again highlighted the enormous investment opportunity early Monday titled “Everyone Is Piling Into The “Next AI Trade””, which lists companies powering up America for the digital age.

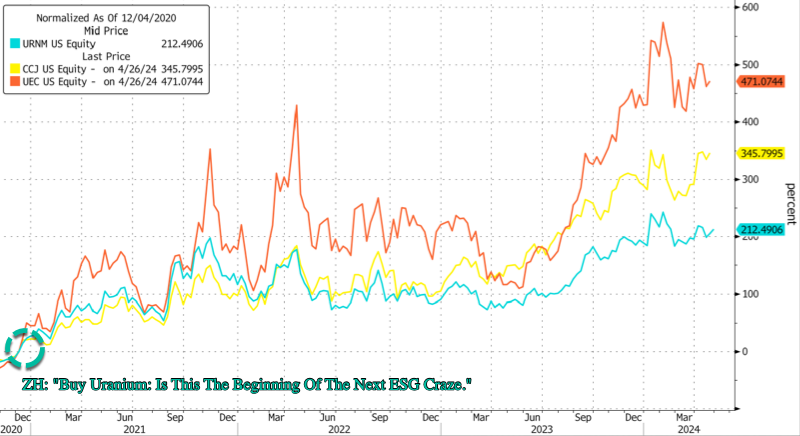

Nearly 3.5 years ago, we provided readers with a straightforward investment thesis: “Buy Uranium: Is This The Beginning Of The Next ESG Craze.” Back then, it became apparent to us that the resurrection of the nuclear power industry was imminent.

And the trend is only gaining steam as the revival of nuclear power plants will continue benefiting some of the largest uranium producers, such as Cameco. We told readers to buy uranium stocks, such as Cameco around the $10 handle – now it’s nearing $50 a share.

As a whole, uranium stocks have soared…

We’ll leave readers with recent comments from Patti Poppe, the chief executive officer of Pacific Gas & Electric.

Poppe told a Stanford University forum that nuclear power should continue to be part of California’s power generation mix as efforts to decarbonize the grid.

“Nuclear should be part of the future,” she said, noting that the state’s only nuclear power plant – Diablo Canyon – could be granted a license extension through the 2030s by the Nuclear Regulatory Commission.

So there it is: Nuclear is being revived at a time when the nation’s grid is nearing a major upgrade due to rising power demand.

]]>In recent years, Germany has been phasing out coal and nuclear energy in a way that has been described in German media as “not well coordinated with the European Union.” As a result, Germans are paying sky-high prices for energy that are completely unsustainable if the Germany economy is to stay afloat.

There are generally three main goals with effective energy policy: low prices, security of supply, and environmental protection with regard to carbon dioxide (CO2) emissions – the latter one is debatable, of course. Germany’s energy policy fails in all three categories.

Combined with the economic fallout of the Wuhan coronavirus (COVID-19) “pandemic,” Germany’s aggressively green energy agenda is wrecking the nation’s economy as various industries are forced to either pack up and leave or simply shut down.

Bayer, a massive German pharmaceutical giant, recently announced “massive job cuts” stemming from the economic problems that continue to plague the country. The company cited lacking business performance as the impetus.

Then there is Eisenwerk Hasenclever & Sohn, a 250-year-old German iron foundry that recently filed for insolvency. Eisenwerk Hasenclever & Sohn has long supplied well-known car manufacturers such as Audi, BMW, Daimler, Ford, and Porsche with parts, however it is no longer able to survive in the failing German economy.

“We can only speculate what happens next at this iron foundry. Will it be sold off in pieces and scattered abroad – leaving the region a rust belt?” asks Watts Up With That.

(Related: Earlier this year after Germany shut down its last three nuclear power plants, there was such a deficit of electricity throughout the county that Germany started buying nuclear power from nearby France.)

German machine builder Homag lays off 600 workers

Another German company that is shedding many of its employees is machine builder Homag, which announced the layoff of 600 workers worldwide, including around 35 at its Schopfloch, Baden-Württemberg-based headquarters.

According to reports, declining demand for its products is the reason why Homag is shedding workers. The goal is to save around 25 million euros next year, and around 50 million euros annually in 2025 and beyond.

“Despite the demand for woodworking machines in many branches of industry, the company expects the coming year to be challenging due to unexpectedly weak order figures,” reports explain.

While this story focuses on Germany, Europe’s largest economy is a bellwether of sorts for the rest of the world. As of late, we have been reporting on many U.S.-based companies that are laying off workers as well, and for many of the same reasons.

The global, Western-led economy would seem to be in its final death throes. We have yet to completely fall over the cliff, but such a fate is quickly coming into view as inflation soars across all sectors and new wars brew on multiple fronts, including in Ukraine and the Middle East.

“There are no optimistic economic signals in sight. Energy prices, inflation and catastrophic economic policies are rapidly sinking the German economic battleship and prosperity,” contends Watts Up With That.

One of the few companies that seems to be doing things right is Toyota, which resisted the electric vehicle (EV) hype and carefully treaded into even the hybrid market with caution. As a result, the car company reported record-breaking profit, in large part due to the sale of hybrids, which it now sells more of than any other automaker out there.

The latest news about the destruction of the West at the hands of the globalists can be found at Globalism.news.

Sources for this article include:

]]>To put that in perspective, if you earned $1 a second 24/7/365—about $31 million per year—it would take you 158,550 YEARS to make $5 trillion. $5 trillion is an almost unfathomable amount of money.

However, even with that astronomical financial support, the world still depends on hydrocarbons for 84% of its energy needs—down only 2% since governments started binge spending on renewables 20 years ago.

That’s all according to Mark Mills in a report from the Manhattan Institute, who concludes that:

“The lessons of the recent decade make it clear that solar, wind, and battery technologies cannot be surged in times of need, are neither inherently ‘clean’ nor even independent of hydrocarbons, and are not cheap.”

With all that in mind, it should be clear that so-called renewables—more accurately, unreliables—have been a giant flop. They are not viable for baseload power—even with $5 trillion in subsidies and two decades of trying. Today, using wind and solar for mass power generation is an artificial political solution that would not have been chosen on a genuinely free market for energy.

Wind and solar power might be useful in specific situations. Still, it’s ridiculous to think they can provide reliable baseload power for an advanced industrial economy. It’s like trying to force a square peg into a round hole.

Nonetheless, governments, the media, academia, and celebrities flippantly push for an imminent energy “transition” as if it’s preordained.

It’s shocking and depressing so many adults think they can magically change the underlying economics, chemistry, engineering constraints, and physics of energy production to suit their childish fantasies and political agendas.

Unreliables—i.e., renewables—will not replace hydrocarbons anytime soon and will certainly not bring about energy security… despite what many “serious” people believe. When it comes to reliable baseload power, most of humanity has only three choices:

- hydrocarbons—coal, oil, and gas

- nuclear power

- abandon modern civilization for a pre-industrial standard of living.

Aside from friendly aliens delivering a magical new energy technology, most places have no other alternatives.

So, with Western governments intent on going green, sanctioning large energy exporters (Russia, Iran, Venezuela), and shunning hydrocarbons in general (ESG, windfall profits taxes, limiting exploration, burdensome regulations), it boils down to a simple choice.

They can either embrace nuclear energy—which has zero carbon emissions—or give up reliable electricity. I suspect it won’t be long before Western governments turn to nuclear energy in a big way for two reasons.

- Rising hydrocarbon prices.

- Concerns about energy security.

Rising Hydrocarbon Prices

First, a necessary clarification. Sloppy, vague words lead to sloppy, vague thinking. The term “fossil fuels” is an excellent example of this.

When the average person hears “fossil fuels,” they think of a dirty technology that belongs in the 1800s. Many believe they are burning dead dinosaurs to power their cars. They also think fossil fuels will run out soon and destroy the planet within a decade.

None of these absurd things are true, but many people believe them. Using misleading and vague language plays a large role.

I suggest expunging “fossil fuels” from your vocabulary in favor of hydrocarbons—a much better and more precise word.

A hydrocarbon is a molecule made up of carbon and hydrogen atoms. These molecules are the building blocks of many different substances, including energy sources like coal, oil, and gas. These energy sources have been the backbone of the global economy for decades, providing power for industries, transportation, and homes.

Modern civilization has only two choices for baseload power—hydrocarbons or nuclear. I believe hydrocarbon prices will rise substantially in the months ahead, making nuclear—the only practical alternative—even more attractive than it already is.

There are four powerful trends that I think will push hydrocarbon prices higher.

- Trend—The End of the Petrodollar System: The US government will soon lose its ability to print money to buy energy—an incredible privilege no other country has. That will have significant consequences for oil prices.

- Trend—Rampant Currency Debasement: Governments worldwide have no choice but to engage in ever-increasing currency debasement. 2023 could be the year it reaches a crescendo.

- Trend—Carbon Hysteria and Under-Investment: Governments have redirected trillions in capital away from nuclear and hydrocarbons and sent it to wind and solar. Further, ESG madness, “net zero” goals, and other unfavorable government policies have led to a massive under-investment in hydrocarbons. I expect the carbon hysteria will cause tighter supplies and higher prices.

- Trend—Geopolitical Turmoil: The conflict between Russia (the 2nd largest oil exporter) and Ukraine has no end in sight. Tensions with Iran could explode at any moment. As a result, geopolitical turmoil could easily escalate, causing hydrocarbon supply disruptions out of Russia and the Middle East.

These are four powerful trends pushing for shortages and significantly higher hydrocarbon prices.

When hydrocarbons become expensive, the world looks to alternatives. And there is only one: nuclear.

Energy Security

Having secure access to energy, which is essential for any economy and any country’s stability, is paramount. That’s why energy security is national security.

Without energy security, any country is in a vulnerable position. No sovereign nation can tolerate being at the mercy of someone else for something as crucial as energy.

Unsurprisingly, many governments inevitably turn to nuclear to help ensure their access to reliable energy. That’s because a small amount of uranium can produce tremendous energy in a nuclear power plant.

According to the Nuclear Energy Institute, a one-inch tall uranium pellet can produce as much electricity as one ton of coal, 149 gallons of oil, and 17,000 cubic feet of natural gas.

It’s impractical for countries without domestic hydrocarbon supplies to stockpile several years’ worth of coal, oil, or gas. On the hand, it is practical for countries to stockpile five years’ worth of uranium for nuclear power plants.

Take Japan, for example. Japan is the world’s third-largest economy. Before the Fukushima disaster, nuclear power plants produced around 30% of Japanese electricity. After Fukushima, Japan shut down all of its nuclear reactors.

Japan shuttered its nuclear power plants despite a government policy that requires it to stockpile at least five years’ worth of energy supplies. This policy dates back to the early 1970s when a large regional war in the Middle East disrupted energy supplies and rocked Japan, which lacks its own energy resources.

Uranium is the only feasible way for Japan to meet the terms of this policy. It’s impractical for Tokyo to stockpile five years’ worth of coal, oil, or gas.

Japan has made an emergency exception to this policy because of Fukushima. But without energy security, it’s in a vulnerable position concerning its historical rival China. That is especially true if geopolitical turmoil in the Middle East or Eastern Europe disrupts oil and gas supplies.

It would be ironic to see Japan suffer from another oil shock during the period in which it suspended the very policy to protect it from one. That should incentivize Japan not to delay restarting its nuclear reactors.

In fact, Japan has recently made a dramatic pivot towards nuclear power because it has finally realized there is no alternative for it to meet its energy security needs.

Tokyo has started reactivating its nuclear reactors and implementing pro-nuclear policies.

While Japanese restarts are an important factor determining the market balance, it is not the only one. Even if the Japanese demand for uranium never returns, the 150 new reactors in China could create enormous new demand that will more than offset it over the longer term.

Here’s the bottom line with uranium.

I wouldn’t be surprised to see hydrocarbon prices spike amid a geopolitical crisis, which would be a catalyst for much higher uranium prices.

Regardless, hydrocarbon prices are set to soar for the other reasons I mentioned above. As a result, I expect Western countries will soon become desperate for energy security.

They’ll eventually realize—as Japan did—that nuclear power is the only solution. And when they do, it will turbocharge the uranium bull market that is already underway.

With multiple crises unfolding right now, the next big move could happen imminently. That’s why I just released an urgent PDF report, it’s called: The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now. It details how it could all unfold soon… and what you can do about it. Click here to download the PDF now.

Article cross-posted from International Man.

]]>