“As long as Hezbollah chooses the path of war, Israel has no choice, and Israel has every right, to remove this threat and return our citizens to their homes safely,” Netanyahu told the General Assembly, adding, “And that’s exactly what we’re doing.”

During his speech, Netanyahu showed world leaders two maps of the Middle East, pointing out the difference between a “blessing” and a “curse.”

“Now look at this second map,” he said, pointing out, “It’s a map of a curse. It’s a map of an arc of terror that Iran has created and imposed from the Indian Ocean to the Mediterranean.”

Netanyahu added: “There is no place in Iran that the long arm of Israel cannot reach – that’s true for the whole of the Middle East.”

Even with broadening war risks in the Middle East, the geopolitical risk premium in Brent crude has all but evaporated – overshadowed by economic slowdown fear in China and the US. Not even the China stimulus story earlier this week could ignite crude prices.

On Thursday, we noted the usual anonymous sources reporting by corporate media were back, and pressured Brent crude prices lower. The first report was published by Reuters earlier this month. In that report, journos cited anonymous sources that said OPEC+ was set to proceed with a production hike in October. Then an FT report on Thursday joined the anonymous-source-citing oil manipulation game with the news that the Saudis were ready to ditch the unofficial price target of $100 a barrel for crude.

Also, recent headlines surrounding a possible ceasefire in the Middle East have pressured oil prices. We must ask what exactly ‘the powers that be’ are afraid of?

Maybe Goldman analyst Lindsay Matcham’s note to clients this morning shows precisely what ‘the powers that be’ are afraid of…

“We’re continuing to keep a close eye on the conflict in the Middle East amid intensifying tensions between Hezbollah and Israel.”

Matcham added:

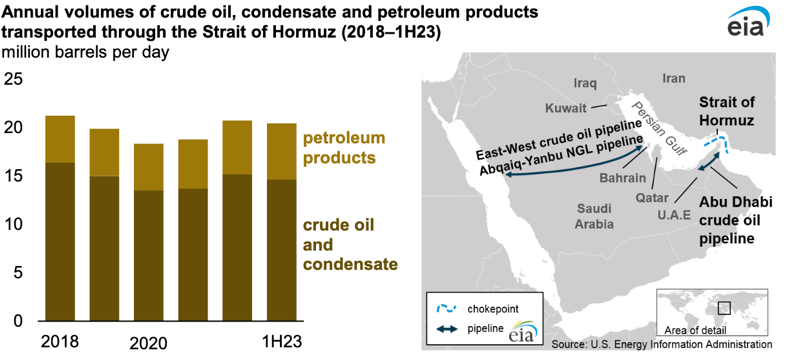

“We think further escalation in the conflict could have material market implications, especially if it involves a potential closure of the Strait of Hormuz, which would likely lead to a spike in oil prices here.”

Strait of Hormuz…

In a separate note, Goldman analyst Lina Thomas outlines four positive near-term drivers for crude markets:

- The easing in global policy.

- Inventories are still drawing.

- Positioning and valuation remain low.

- Oil markets are not pricing a significant risk of geopolitical disruptions.

Fast forward to noon today, Brent prices jumped to the mid-point of the $72 handle after IDF airstrikes targeted Hezbollah headquarters in Beirut.

Massive Israeli Airstrikes In Beirut Target Hezbollah HQ, Nasrallah https://t.co/uqp8T0VZyM

— zerohedge (@zerohedge) September 27, 2024

Broadening war risks come as speculators have placed record bearish bets in crude markets.

Brent prices hover around $72/bbl in late morning trading in the US.

The looming question for Brent traders is: When will the war risk premium return?

A potential IDF invasion of Lebanon could provoke Iran, although there are currently no signs of Tehran’s imminent closure of the Strait of Hormuz. Given the Israel-Hezbollah escalation in conflict to the end of the week, traders should monitor these events as traders hold record net-bearish bets on crude.

]]>Deterring a regional war has been a significant challenge for the Biden administration and will likely require restraint on Israel’s part. The US’ latest bombing campaign against dozens of Iran-backed militia targets across Yemen, Iraq, and Syria has only made the situation worse. At the same time, Houthi rebels continue causing chaos at a critical maritime chokepoint in the southern Red Sea.

There has been an escalation in the Middle East crisis. Navigating this very uncertain macroeconomic climate as the post-1945 economic order fractures – is giving way to a dangerous multi-polar world.

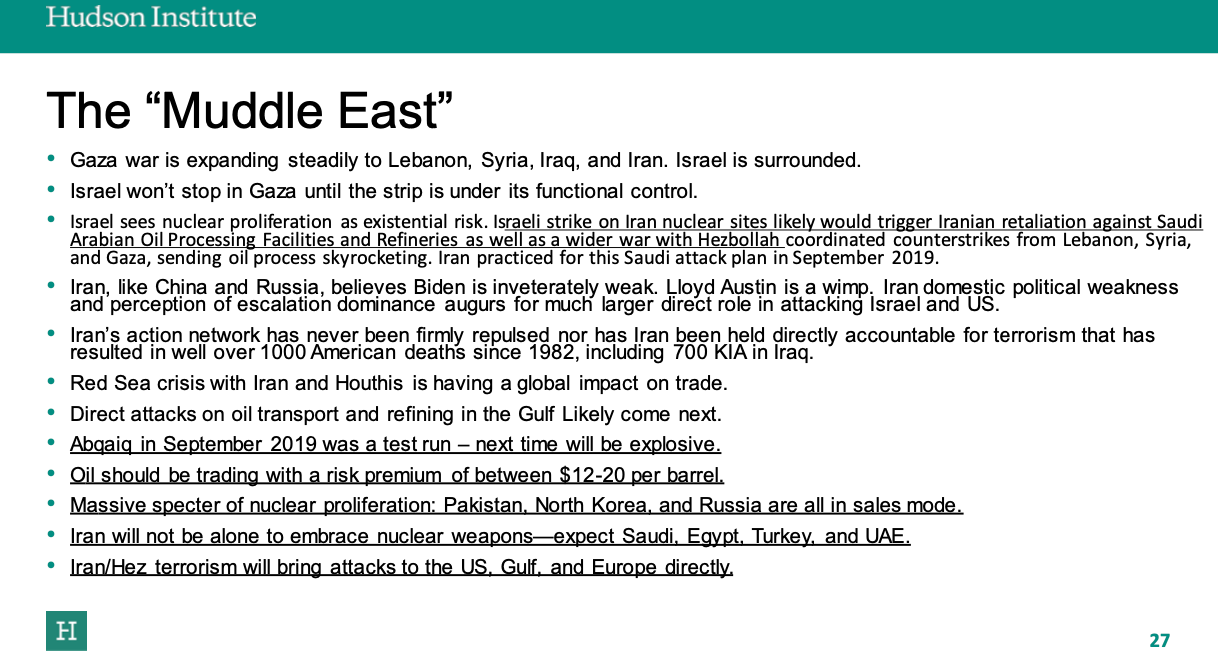

David Asher, a senior fellow at Hudson Institute and former investigator into Covid origins at the State Department, recently penned a note titled “Navigating the New World Disorder: Economic Faultlines, Fissures, Fractures, and Failures.”

In this note, Asher points to a world that is in crisis, similar to the 1920s/30s.

On slide three, the macro strategist labels five “looming supply shocks” for the global economy.

He asks: “Is this the end of the long economic growth cycle that has existed since 1947 or “just” a return to the 1970s?”

While China’s economy struggles to recover, Asher asks another question: “Is Global Trade Recovering or Not?”

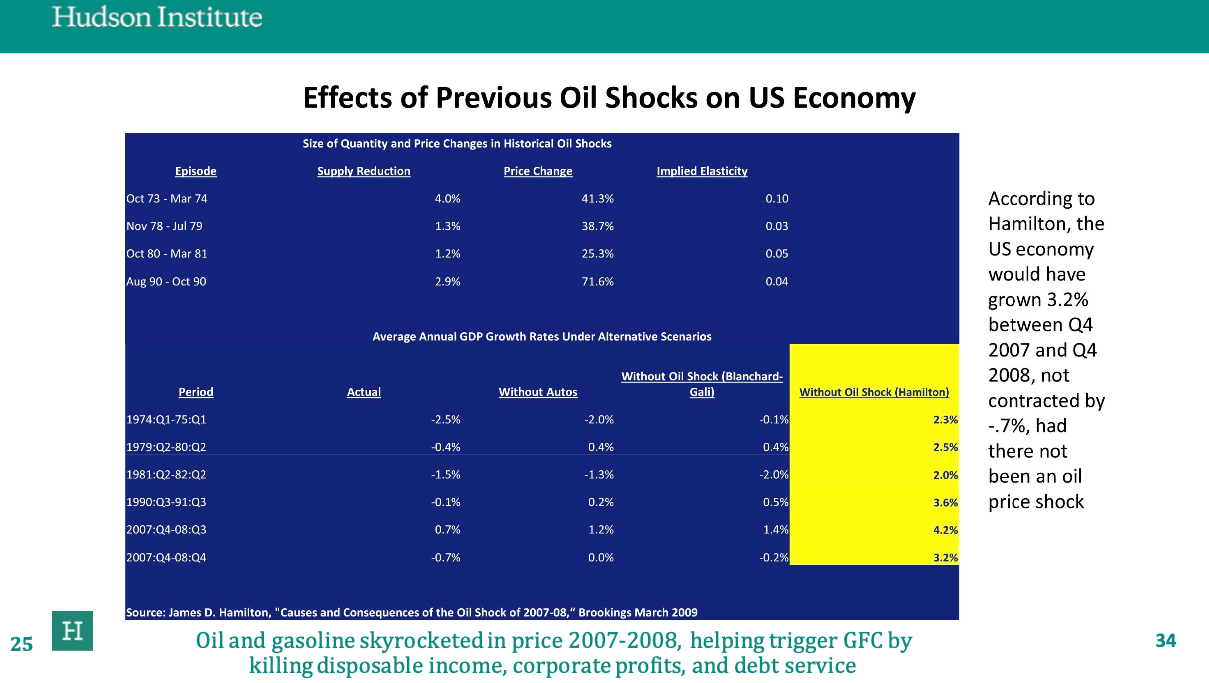

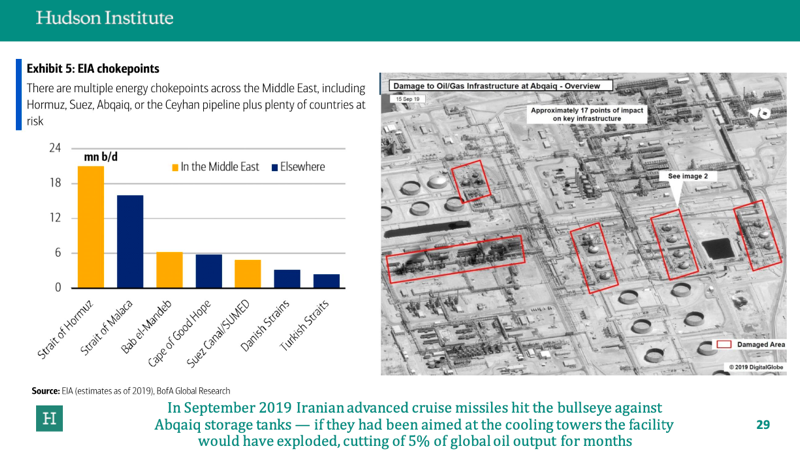

On slide nine, given the mounting risks in the Middle East. He said: “Global oil shock could trigger a crisis ala 2007-2008.”

He described a series of events that paint an awful gloomy outlook for the Middle East that have significant consequences for global markets.

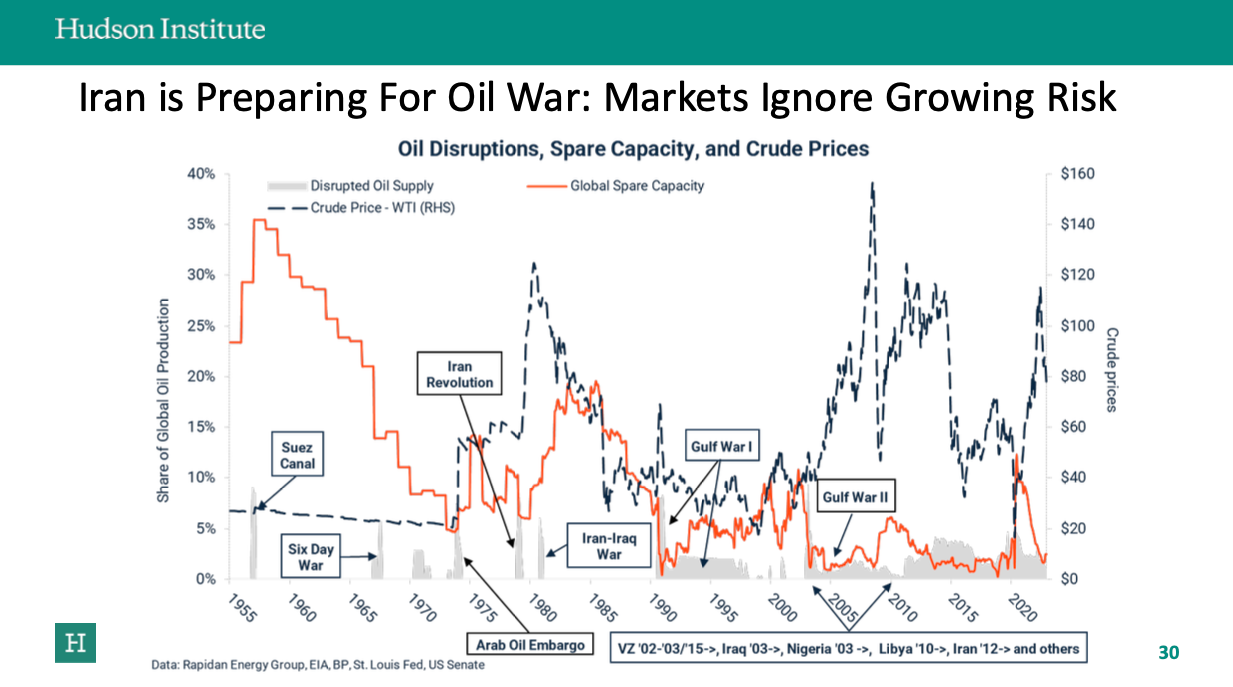

Slide thirty is titled: “Iran is Preparing For Oil War: Markets Ignore Growing Risk.”

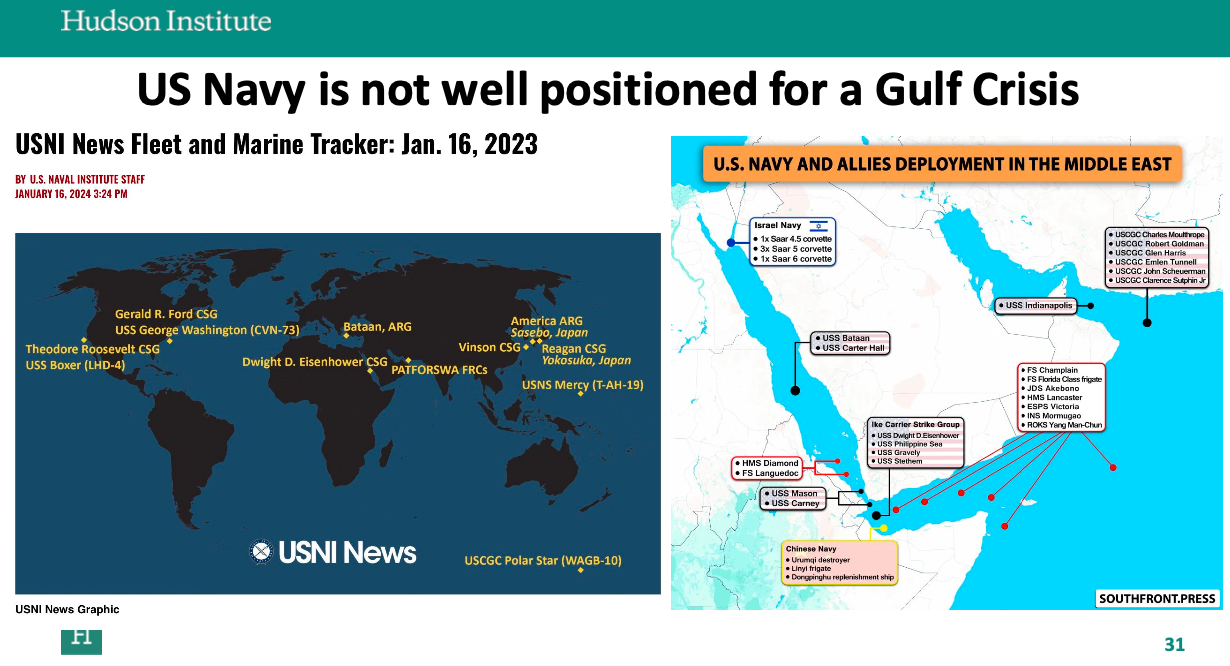

The next slide shows the US Navy needs to be better positioned in the Red Sea and Gulf area to respond to a major crisis. Not being prepared has been the theme so far with the failure of Biden’s Operation Prosperity Guardian to secure the critical Red Sea waterway.

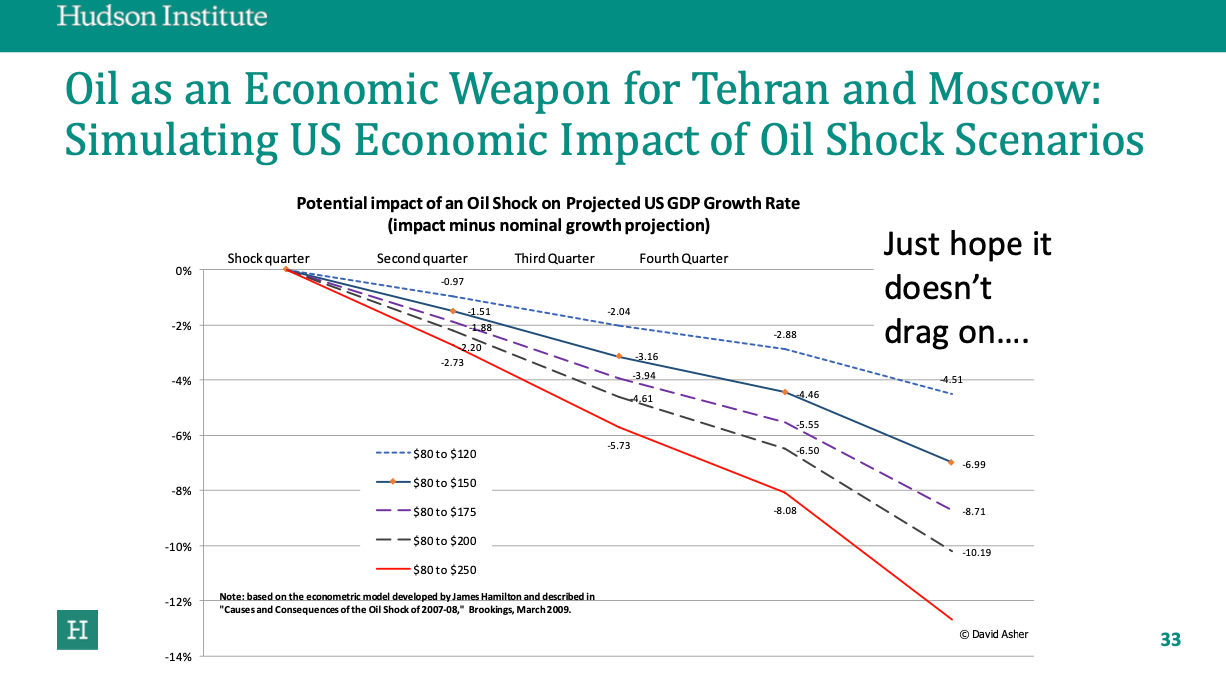

Could Tehran use oil as an economic weapon against the West?

Consider the economic impacts of previous oil shocks…

This is where readers need to pay attention: Imagine the scenario where Yemen’s Houthi rebels start targeting key oil facilities in Saudi Arabia.

Remember 2019?

Should a repeat of 2019 occur, then Brent crude prices could surge.

And this would cause a massive headache for Jerome Powell’s inflation fight.

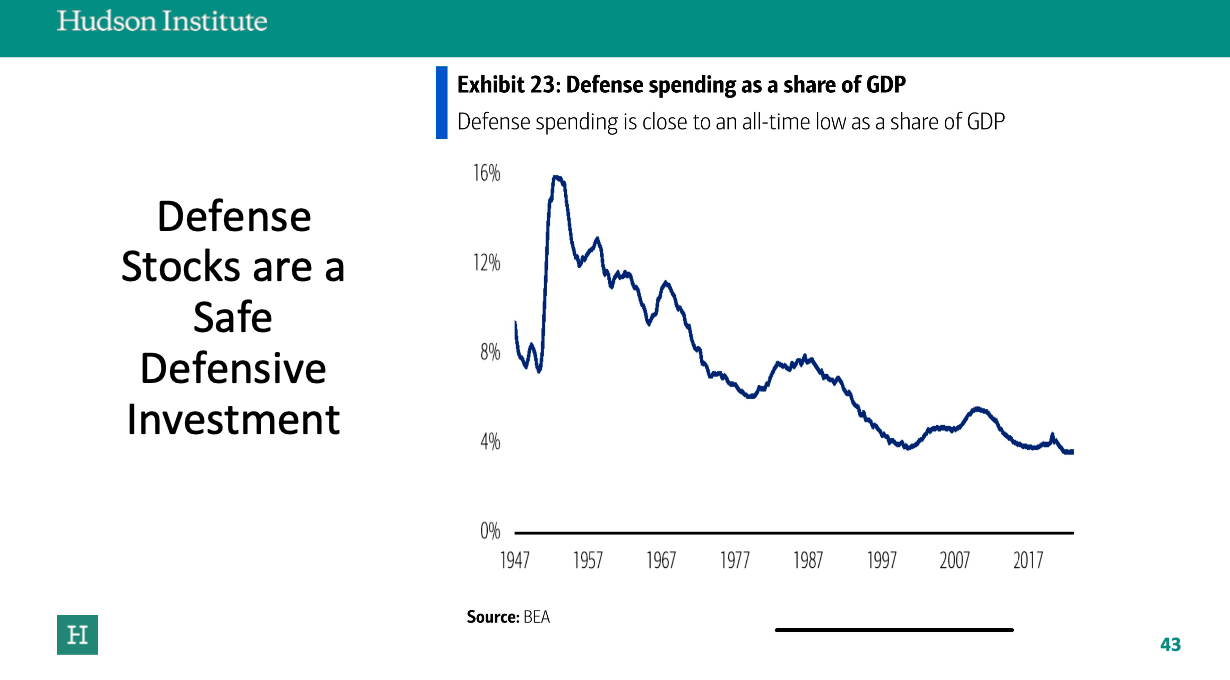

Given all this, are defense stocks a good buy?

The core theme of this note is America’s adversaries in the Middle East could weaponize energy to cause a financial shock. What is necessary for the US military is not just to be focused on the Red Sea chokepoint but also on Saudi’s energy infrastructure because crude prices could be one attack away from spiking over the $100 a barrel level.

There is good news: US crude production is at record highs. The bad news: radical climate change warriors in the White House have drained the SPR and crushed the ability to expand refining capacity.

A perfect storm of higher crude prices is brewing… All eyes on the Middle East.

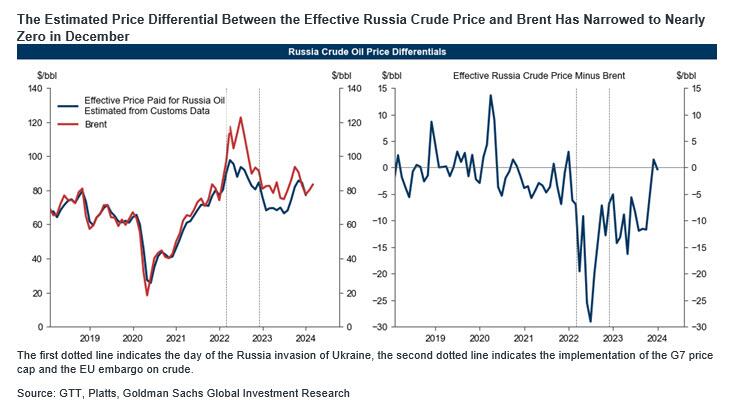

]]>Well, that’s no longer the case because in the two years since the start of the Ukraine conflict, it became apparent that Western sanctions were merely a theatrical publicity stunt as the alternative – strict enforcement – would have sent oil prices soaring and that would be unacceptable to a Biden administration terrified of losing the November elections if and when oil and gasoline prices surges.

And as fear of enforcement became a non-issue over time, so did the discount of Russian oil to Brent, which brings us to today, and Goldman’s “chart of the week” which illustrates the collapse in the discount on Russian crude oil close to zero relative to Brent, according to the bank’s estimates using the most recent customs data for December.

According to Goldman, which estimates the effective price of Russian crude paid by its trade partners using detailed customs data on import volumes and import payments for Russia crude, this drop in the price discount was primarily driven by the countries outside of the G7 coalition.

However, the discount has also narrowed for most of the buyers as Russian fleets were becoming more capable of operating under the G7 price cap.

The US Treasury’s recent decision to target Sovcomflot, Russia’s state-owned shipping company and fleet operator, comes against the backdrop of the drop in the effective discount late last year and the twin goals of US policymakers to “limiting Kremlin profits while promoting stable energy markets.”

It is also an admission that western attempts to prevent Putin from generating oil export revenues – critical in keeping the Russian war machine going – were either a failure, or merely a theatrical, virtue signaling sleight-of-hand from the beginning. And while the former is bad, the latter is far more disturbing as it suggests that the west has been willingly enabling Putin to sell oil and fund the war in Ukraine, the same war with Western nations are so vocally against.

Almost as if both Russia and the West are aligned in their (shared) goal of keeping the war in Ukraine going to its inevitable and dire, for Zelenskyy, conclusion; it also almost makes one wonder if the destruction of Ukraine – at the hands of Russia with the implicit enabling by the West – was a pre-planned exercise all along.

Full Goldman note available to pro subscribers in the usual place.

]]>The company’s CEO Aleksandr Dyukov revealed this information on the sidelines of the TNF Energy forum, which was held in the oil-rich Tyumen Region in Siberia.

The conventional practice of conducting international trade used to be done using major global currencies like the dollar and euro. This decision increasingly reflected a strategic move to align its trade practices more closely with the economic and geopolitical interests of Russia, as well as its significant energy ties with China.

According to Dyukov, the company has not experienced any problems withdrawing its export earnings in foreign currency since it started trading with the said currencies. It also receives its revenue from oil and petroleum products sales at short notice.

Meanwhile, despite a notable shift in other national currencies of a substantial portion of its export transactions, Dyukov mentioned that the Indian currency is still not being utilized in export settlements. “This decision underscores the company’s selective approach in transitioning away from traditional global currencies, taking into consideration the specific dynamics of its international trade relationships, Arabic business news agency MenaFN reported. “We don’t use rupees. We mainly use yuan and rubles. We have practically moved away from payments in dollars and euros,” the CEO said.

Also, Russia is not the only one moving to dethrone the USD. The China National Petroleum Corporation (CNPC) has agreed to switch payments for gas supplies to rubles (RUB) and renminbi (RMB) instead of dollars. According to Simon Watkins, former senior FX trader, financial journalist, and best-selling author, in the first phase of the new payments system, this will apply to Russian gas supplies to China via the ‘Power of Siberia’ eastern pipeline route that totals at minimum 38 billion cubic meters of gas per year (bcm/y).

“After that, further expansion of the new payments scheme will be rolled out. It is apposite to note at this point that although ongoing international sanctions against Russia over its invasion of Ukraine in February have provided the final impetus for this crucial change in payment methodology, it has been a core strategy of China’s from at least 2010 to challenge the U.S. dollar’s position as the world’s de facto reserve currency,” he said in an article he wrote on OilPrice.com.

He added that China has long regarded the position of its renminbi currency in the global league table of currencies as being a reflection of its own geopolitical and economic importance on the world stage. “As of 2022, the RMB’s share in the SDR mix has risen to 12.28 percent, which China still regards as not truly befitting its rising superpower status in the world,” he further pointed out. (Related: Dollar DEMISE: Yuan overtakes dollar in China’s cross-border payments.)

Bloomberg: Russia has advantages in the current global diesel shortage

The global energy market is faced with a shortage of diesel as refineries fail to make enough of the key industrial fuel, further exacerbated after OPEC+ heavyweights Saudi Arabia and Russia slashed production and exports of denser, more sulfurous crude used to produce diesel fuel vital for industry and transport. However, recent circumstances are making Russia the receiving end of all advantages.

The global diesel shortage, for example, is benefiting one of the nation’s key export crude blends, the Eastern Siberia-Pacific Ocean (ESPO), as it is being traded at a premium to global benchmark Brent, according to Bloomberg on Monday, citing unnamed market players. ESPO, which was named after the pipeline that carries it to export markets, climbed to a premium of about $0.50 a barrel to Brent on a delivered basis for October shipments to China, traders told the outlet. Brent crude was trading above $94 per barrel at the start of the week.

The Russian crude blend, which is especially suitable for diesel fuel production, saw its biggest price increase since the G7 and the European Union introduced a price cap on Russian oil and petroleum products. These “influential” economies were pushing to to cut Moscow’s energy revenues, according to Viktor Katona, lead crude analyst at energy analytics firm Kpler.

“[The] last time when ESPO was positive to Brent was back in November 2022,” said Katona. According to the analyst, along with private refineries, Chinese state processing plants have also boosted their purchases, taking up to seven more cargoes of October-loading ESPO than usual.

Visit DollarDemise.com for more news related to the crash of the U.S. dollar.

Sound off about this article on the Economic Collapse Substack.

Sources for this article include:

]]>If you have a gut feeling that very hard times are on the horizon, you are definitely not alone. As you will see below, a staggering 71 percent of all Americans currently believe that America is on the wrong track, and our economy is one of the biggest reasons why they feel this way. The following are 10 numbers which prove that the U.S. economy has hit a major pivot point…

#1 Consumer confidence was down more than expected this month…

The confidence of American consumers slipped this month, particularly about the future, as expectations persist that interest rates will remain elevated for an extended period.

The Conference Board, a business research group, said Tuesday that its consumer confidence index fell to 103 in September from 108.7 in August. Analysts were expecting a smaller decrease, to a reading of 105.

#2 The Conference Board’s index that measures future expectations has actually dropped below a level that historically signals “a recession within a year”…

Most troubling was the decline in the index measuring future expectations, which tumbled to 73.7 in September from 83.3 in August. Readings below 80 for future expectations historically signal a recession within a year.

#3 With mortgage rates at suffocating levels, sales of new homes in the U.S. fell 8.7 percent last month…

New home sales dropped in August from the month before, as mortgage rates topped 7% and rose to the highest levels in more than 20 years.

Sales of newly constructed homes fell 8.7% in August to a seasonally adjusted annual rate of 675,000 from a revised rate of 739,000 in July, according to a joint report from the US Department of Housing and Urban Development and the Census Bureau.

#4 A record high percentage of U.S. consumers are indicating that credit conditions are getting tighter…

American consumers are worried about access to credit amid persistently higher interest rates and tighter standards at banks, according to a New York Federal Reserve survey released Monday.

Respondents indicating that the ability to get loans, credit cards and mortgages is harder now than it was a year ago rose to nearly 60%, the highest level in a data series that goes back to June 2013. The results were part of the New York Fed’s Survey of Consumer Expectations for August.

#5 Credit card losses are increasing at the fastest pace in 30 years…

Credit card companies are racking up losses at the fastest pace in almost 30 years, outside of the Great Financial Crisis, according to Goldman Sachs.

Credit card losses bottomed in September 2021, and while initial increases were likely reversals from stimulus, they have been rapidly rising since the first quarter of 2022. Since that time, it’s an increasing rate of losses only seen in recent history during the recession of 2008.

It is far from over, the firm predicts.

#6 At this point, things are getting so bad that even the Federal Reserve is laying off about 300 workers…

At a time when mainstream economists and FOMC policymakers are betting the farm on a “soft landing” for the US economy, an unexpectedly hard signal was just issued by none other than the Fed itself: for the first time in over a decade, the US central bank announced it would cut about 300 people from its payroll this year, a rare reduction in headcount for an organization that has grown steadily since 2010 – after all, it takes if not a village (with its own police force), then certainly thousands of workers to come up with catastrophically wrong economic forecasts and to keep the money printer primed and ready to pump out a few trillion at a moment’s notice.The nu

#7 The number of bankruptcy cases in the United States has increased on a year over year basis for 13 months in a row…

Data released Tuesday showed that Americans filed more than 39,000 bankruptcy cases in Aug. 2023, an 18 percent increase from the same time last year.

The data released by Unusual Whales details how, along with personal bankruptcy filings, there were more than 41,600 new bankruptcy cases recorded in August, including for businesses. This marks the thirteenth consecutive month that bankruptcy filings have shown a year-over-year increase under the Biden administration’s embarrassing and dangerous economic policies.

#8 Goldman Sachs is warning that America’s strategic oil reserve has hit a 40 year low…

America’s emergency oil stockpile has plunged to 40-year lows. The shrinking Strategic Petroleum Reserve is limiting Washington’s ability to shield consumers from the fallout of Saudi Arabia’s aggressive supply cuts, according to Goldman Sachs.

“At this point, US energy policy has fewer bullets left. It has less levers left in its policy toolkit,” Daan Struyven, head of oil research at Goldman Sachs, told CNN in a phone interview.

That’s one reason Goldman Sachs expects oil prices to stay high, averaging $100 a barrel this time next year. Triple-digit oil would boost already-high prices at the pump, worsening inflation and potentially influencing the 2024 race for the White House.

#9 It is being projected that the price of oil could eventually reach 150 dollars a barrel. Needless to say, such a development would radically change our economic outlook…

That’s Doug Lawler, chief executive of Continental Resources, the shale-drilling giant controlled by billionaire Harold Hamm, telling Bloomberg News on Monday that crude prices are set to remain elevated and could press to the $120- to $150-a-barrel range without new production.

#10 A new NBC News poll has found that 71 percent of Americans believe that the country is on the wrong track…

The 71% of Americans in our latest NBC News poll saying the country is headed in the wrong direction is the eighth time in the last nine NBC News surveys dating back to Oct. 2021 when the wrong track has been above 70%.

And the one exception was in Sept. 2022, when it was 68%.

We have never before seen this level of sustained pessimism in the 30-year-plus history of the poll.

For more than a year, there has been speculation about when the next wave of our economic crisis would arrive.

Well, it appears that it is here.

The months ahead promise to be very challenging, and the long-term outlook is even worse.

2024 is certainly shaping up to be quite a year.

Economic conditions will be deteriorating just as we head into the most tumultuous election season that we have ever witnessed.

Stay safe out there, because things will soon start getting really crazy in this country.

Michael’s new book entitled “End Times” is now available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

]]>(Article cross-posted from Natural News)

America’s energy infrastructure and resources are in such disrepair, and refining capacity constantly declining, that any disruptions – this includes the smallest supply chain hiccup or delay – will send energy prices into a tailspin of wild and extreme volatility.

When the U.S. was still a relatively stable country with competent leaders at the helm, gas prices would remain pretty much stable year after year, save for the annual summer rush and busy holiday seasons. Today, gas can rise and fall sometimes 20 or 30 cents a day – and such volatility will only worsen the more our energy infrastructure and resources are dismantled.

“The market is overly sensitive to any unexpected supply disruption anywhere,” says Frederic Lasserre, the global head of research at the Gunvor Group, one of the world’s largest independent commodities trading houses. “Everyone knows there’s no plan B. We have no stocks, and we have no excess capacity anywhere.”

Russell Hardy, the CEO of Vitol, another energy and commodities company, agrees. He told the media that during the Wuhan coronavirus (COVID-19) “pandemic,” many refineries closed, leaving Western markets with a perpetual lack of sufficient oil products.

(Related: If Biden does not get his way in forcing his “green” agenda on America, there is a chance he might declare a “climate emergency” and seize COVID-like dictatorial powers.)

Tired of high energy prices? Blame Biden and the rest of the uni-party

Where Biden’s actions – or rather, non-actions – come into play involves his regime’s relentless antagonism towards the earth-based “fossil” fuel industry. Every chance it gets, the Biden regime chips away at our energy infrastructure while pushing far-fetched “green” alternatives that do not even hold a candle to what oil and gas provide for a vibrant economy.

It is almost as if Biden and his cronies are trying to crash the nation by depriving us all of the oil and gas we need to keep our homes heated and cooled, our trains, planes and automobiles running, and our food growing and making it to the grocery store.

Right now, prices at the gas pump are at their highest seasonal level in more than 10 years. Part of this massive inflation is being blamed on, get this: “extreme heat.” Any excuse except for the truth will do, eh?

As for diesel, the fuel that “powers global industry,” to quote Zero Hedge, this critical form of gas is even more expensive than unleaded. And just like with gas, there are no stockpiles of diesel in case anything goes wrong – and you can be sure that eventually something major will go wrong, probably right on time, that brings Western commerce to a grinding halt.

To make matters even worse, it is becoming increasingly more expensive to pay for oil and gas refining. What few refineries even remain are running at full capacity, the highest capacity at which they can safely run, and it is still becoming prohibitively more impossible to produce energy that people can actually afford to buy.

According to Sri Paravaikkarasu, director of market analysis at Phillips 66, the refining industry is “crying out” for fresh investment, especially as oil demand continues to grow in China and other Asian countries that, unlike the West, are expanding their fossil fuel use rather than trying to switch to solar panels, wind turbines, and wishful thinking.

The latest news about the Biden regime’s animosity towards earth-based fuels that bring prosperity and abundance can be found at GreenTyranny.news.

Sources for this article include:

]]>Distillate inventories, which include heating oil, were about 15% below the five-year average as of late August, according to the U.S. Energy Information Administration. A chilly winter could drive heating bills up for Americans this winter, especially as higher demand from European countries and OPEC+ production cuts take hold in international markets, Reuters reported.

“We are living barrel to barrel and there is just no room for errors in the system,” Phil Flynn, analyst for the Price Futures Group, said, according to Reuters. “If we get a cold winter, there are going to be significant price shocks.”

American refiners have not built up large inventories of the distillate-rich varieties of oil in advance of the seasonal demand increase, driven by Americans looking to stay warm in their homes, according to Reuters. A central factor in this development is the lack of abundant supply of medium and heavy- grade crude oil that tend to be distillate-rich.

Meanwhile, OPEC+ has cut its production, and the U.S. has exported much of its excess supply to European allies as they grapple with the fallout from sanctioning Russia after it invaded Ukraine in February 2022, according to Reuters.

Indicating the market’s sensitivity, U.S. diesel futures temporarily spiked to a seven-month high on Aug. 25 following a fire at Marathon Petroleum’s 596,000 barrel per day (bpd) refining facility in Garyville, Louisiana, the third largest of its kind in the country, according to Reuters. Several large refining facilities are also scheduled to go offline temporarily for maintenance throughout the fall, which could remove 2 million bpd form the country’s 18.1 million bpd overall output, Robert Yawger, an analyst for Mizuho, told Reuters.

The White House did not respond immediately to a request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>(Article cross-posted from Natural News)

Just the other day, in fact, India reportedly purchased an order of oil using rupees instead of Federal Reserve Notes, which are still – but not for much longer – the primary foundation of global trade, especially for earth-based “fossil” fuels like oil.

According to reports, the United Arab Emirates (UAE) signed an agreement allowing not just India but all the rest of the BRICS members to buy and sell oil in rupees, which is really bad news for the U.S. economy.

For now, the U.S. dollar is still the global reserve currency, meaning it is the standard currency used for trading important commodities. This is systematically changing, though, and America’s politicians seem to be asleep at the wheel when it comes to protecting American interests in this regard.

(Related: According to Russian President Vladimir Putin, the global de-dollarization process is “gaining momentum” – and once complete, it will be “irreversible,” he says.)

China signs $582.3 billion worth of global currency settlement agreements that will exclusively use YUAN, not dollars, to trade

Indian Oil, a prominent energy company in India, purchased one million barrels of oil from the state-owned Abu Dhabi National Oil Company, following the lead of the UAE itself which back in March purchased 65,000 tons of liquefied natural gas (LNG) from Chinese oil and gas company China National Offshore Oil Corporation using the Chinese yuan currency.

It would seem as though the rest of the world has had enough of U.S. currency dominance. Since the Federal Reserve is printing dollars into absurdity, diluting the currency and rendering it worthless, the rest of the world is switching to other currencies instead.

The media and your favorite politicians will never tell you the true cause of all the inflation we are seeing, by the way, which is a result of many decades’ worth of corporate socialism and bailouts, as well as Wall Street corruption.

As the dollar continues to lose dominance abroad, expect a lot of blame game taking place. The Republicans will blame the Democrats for inflation and the always-rising deficit while Democrats will blame Republicans. Meanwhile, neither wing of the uni-party will identify the true snake: the money-changers and their private central banking scam.

Either way, the U.S. dollar is on the way out, and most Americans seem to be none the wiser as they gorge themselves on mindless entertainment, LGBT perversion, social media “influencers,” and all the rest of the bread and circuses that the money masters are dangling in front of people to distract from the soon-coming collapse.

Back in May, by the way, communist China signed a $582.3 billion deal covering an extensive variety of currency settlement agreements. Once again, instead of the U.S. dollar, those more than half-a-trillion-dollars’ worth of agreements will exclusively use the yuan, rather than the dollar, to trade.

“The UAE is one of the countries that inked the deal with the Asian giant along with Russia, Venezuela, Oman, Bahrain, Qatar, Kuwait and Saudi Arabia,” reports explain.

Keep in mind as well that at the recent BRICS summit in Johannesburg, membership to the BRICS alliance was extended to six additional countries, which would increase its membership ranks from five nations to 11.

How much longer will the U.S. dollar, which is backed by absolutely nothing, remain the official global reserve currency? Learn more about what is soon to come at Collapse.news.

Sound off about this development on our Economic Collapse Sustack.

Sources for this article include:

]]>The shock caused by lower global oil output is threatening to undermine U.S. energy stability and send prices at the pump soaring over the next few weeks and months. With the relationship between America and OPEC nations deteriorating, our geopolitical leverage is weakening, and the Saudis are seeing this situation as a perfect opportunity to strengthen their dominance in the global scenario.

Saudi Arabia and a handful of OPEC+ nations have been announcing significant cuts in their oil production this year. The Saudis and Russia, the world’s biggest oil exporters, deepened oil cuts earlier this month, sending prices higher for a third time this year. Saudi Arabia said it would extend its voluntary oil output cut while Russian Deputy Prime Minister Alexander Novak said Moscow would cut its oil exports by 500,000 barrels per day in August.

Similarly, Algeria said it would cut oil output by an extra 20,000 barrels from Aug. 1-31. The coming cut will be on top of a 48,000 barrel reduction decided in April, it said. The move was swiftly followed by Libyan Oil Minister Mohamed Oun. In all, the coalition, which pumps around 40% of the world’s crude oil, already has in place cuts of 3.66 million barrels per day, amounting to 3.6% of global demand.

OPEC leaders continue to point to an uncertain demand outlook as the catalyst for their decision. Moreover, many officials in Riyadh, the Saudi capital, were reportedly frustrated that U.S. Energy Secretary Jennifer Granholm recently said that it would be “difficult” for the United States to refill its Strategic Petroleum Reserve this year.

In January, the administration said it would boost its domestic reserves when oil dropped below around $70 a barrel, as it did for a brief period after the failure of Silicon Valley Bank. However, that opportunity was missed, and now U.S. supplies are rapidly shrinking.

The combination of a recession, the crisis in the banking sector and the reopening of the Chinese economy is making most analysts project a significant decline in global oil supply this year and next, after many decades of underinvestment to build new capacity. The latest production cut means that a tighter market and higher oil prices will arrive sooner than previously expected. That may be a disastrous scenario for America, but for the Saudis, spiking oil prices could more than compensate for lower sales, boosting OPEC revenues.

The price of oil on global markets is a major driver of gasoline prices in America, so as the price of oil goes up, gasoline prices will follow, and we should start bracing for a repeat of what happened last year when oil prices surged, sending the national average price for gasoline to a record of as much as $5 per gallon.

This summer, prices remained at the $3.50 average per gallon, bringing some relief to Americans after several months of rising inflation. But these lower costs didn’t come as a result of higher inventories. Instead, they were caused by political decisions amid the growing disapproval of the administration in recent polls.

Our national reserves have been depleted, and higher oil prices will make it even harder for us to rebuild domestic inventories. While other economic superpowers have become more independent, now more than ever, the U.S. is relying on other nations for resources, and that will come at a very expensive price for all of us.

Article and video via Epic Economist.

]]>Ocasio-Cortez currently serves as the ranking member of the Energy and Mineral Resources Subcommittee, establishing her as a prime candidate to head the committee and take steps to advance a progressive climate agenda in the event Democrats take control of the House, according to E&E News. The New York congresswoman recently reintroduced the Green New Deal — which has been harshly criticized as radical and expensive by Republicans since she first introduced it in 2019 — as progressive allies Rep. Ro Khanna of California and Sen. Edward Markey of Massachusetts introduced an accompanying health care package, dubbed the Green New Deal for Health.

“A lot of our victories have already begun, for example, by breaking off some of the pieces [of the Green New Deal] and incorporating it in different areas of must-pass legislation including the Inflation Reduction Act,” Ocasio-Cortez told the outlet. Her office, alongside that of Democratic Sen. Ed Markey of Massachusetts, maintains an ongoing document that tracks the ways in which the Inflation Reduction Act and Bipartisan Infrastructure Law have implemented core tenets of the Green New Deal.

Thanks to the Inflation Reduction Act, President Joe Biden’s signature climate law, the U.S. is expected to undergo a significant drawdown in coal-fired power even as China continues to aggressively bring new coal plants online. Analysts at Goldman Sachs now estimate that the bill will cost roughly $1.2 trillion in subsidies for green energy projects over the next ten years, more than three times the government’s initial estimated cost of $370 billion.

Rep. Jamaal Bowman of New York — the ranking member of the House Science, Space and Technology Subcommittee — told the outlet that he never believed that what was once a fringe element in the Democratic Party “would ever become inside-baseball people.” A Democratic takeover of the House in 2024 would see Bowman, as well as other climate-focused progressives like Rep. Cori Bush of Missouri and Khanna, in high-ranking positions alongside Ocasio-Cortez, E&E News reported.

“The key to Congress is you just have to win, and then you have to stick around a bit,” Khanna, the former chair of the House Oversight and Reform Subcommittee on the Environment, told E&E News. “And the more progressive classes we get, and the more progressives stick it out in the House, the more power we’ll build.”

If she chaired the Energy and Mineral Resources Subcommittee, Ocasio-Cortez would have oversight powers over energy production, mining and drilling on federal lands. The Biden administration has in recent months taken sweeping action to block mining and drilling projects, while simultaneously encouraging conservation efforts on federal lands.

The office of Rep. Ocasio-Cortez did not immediately respond to a request for comment from the Daily Caller News Foundation.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>