That’s a lot to consider so let’s unpack this a bit.

Consider history. In October 1929, the stock market crashed. Many people on Wall Street suffered but Main Street was largely unaffected. The Hoover Administration got busy with some efforts to loosen credit but without success as credit markets slowly dried up. Throughout 1931, public sentiment toggled between pessimism and denial. Many people thought it was a temporary blip that would go away.

No one called it the Great Depression. That came much later.

By the election of 1932, enough people were concerned about the economic situation but the campaigns did not really focus entirely on that. The big issue was Prohibition. Hoover did not have a strong opinion but Franklin Delano Roosevelt spoke out loudly for repeal. His fiscal policy pushed frugality and balanced budgets, and he decried Hoover as a big spender.

FDR won of course. But before the inauguration, the economic environment became dramatically worse. A banking crisis developed, and FDR used emergency powers to impose a bank holiday and repeal the gold standard. As part of this, he imposed a ban on private gold ownership. It was enforced with fines and jail terms.

Central planning then ensued with massive fiscal stimulus, crazed agricultural policies that required digging up crops to create artificial shortages, and price and wage controls.

All of this unfolded over the course of four years, the first three of which were not at the time thought to be much of a crisis generally speaking. Today it is obvious that 1929 marked the beginning but that was not apparent at the time.

It is not discernible in our time that we are already in recession but that is due to some brittle statistical measures. If you extend the inflation numbers to include housing and interest, plus extra fees and shrinkflation, minus hedonic adjustments, and then adjust the output numbers by the result, you end up in a recession now.

Do you remember the two successive quarters of declining GDP in 2022? At the time, it was said that this was not a recession, even though every definition of recession was two declining quarters of GDP. It was said at the time that the data was not enough to declare it because labor markets were strong.

Trouble was that this too was an illusion. Most of the job gains were in fact in part-time jobs and multiple job holders, and those gains went to foreign-born workers and not natives. Overall, jobs held by native-born workers that are full-time are down relative to four years ago. No one in the mainstream press admitted this.

The jobs report that came out last week was the first glimpse of truth because it was brazenly awful, underperforming every prediction. It also chronicled major job losses in manufacturing and professional services. Those are hard-core recession signs that are likely going to worsen.

All this data will start to be revised next year as the conventional wisdom will change. It will be widely admitted that the economy is weaker than we previously supposed. This will happen regardless of who wins. For one winner, it will serve as an attack and for another winner, it will serve as pretext for extreme intervention like the promised price controls on rents and groceries.

Meanwhile, we will be revisiting the inflation problem. The Fed has already added $1.1 trillion to the money stock over the last 12 months plus lowered interest rates. The effect of this easing has not affected mortgage rates because investors are expecting higher rates in the future. The Fed can control overnight lending but the shape of the yield curve is determined on the bond market.

If major changes are proposed in terms of spending cuts, the bond market will freak out and the United States could repeat the experience of the UK just a few years ago. New prime minister Liz Truss was quickly hounded out of office on grounds that her spending cuts had spooked the bond markets.

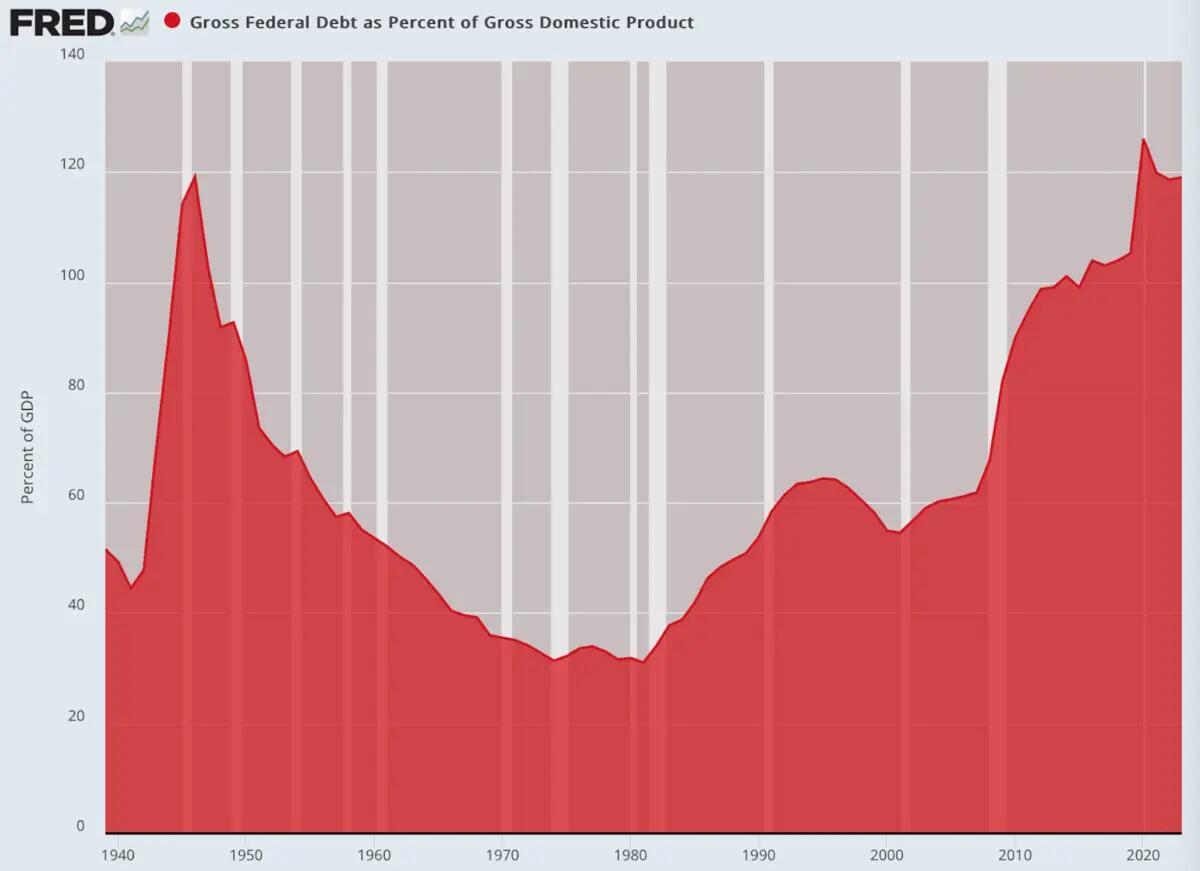

U.S. creditworthiness is already on a hair trigger as the debt pileup has reached astronomical levels. The entire purpose of this wild spending has been to balloon the GDP as much as possible to prevent a recession from being declared already. The debt-to-GDP level is now higher than it was in the Second World War, and getting worse by the day.

(Data: Federal Reserve Economic Data (FRED), St. Louis Fed; Chart: Jeffrey A. Tucker)

The easy solution is dramatic spending cuts but that won’t happen if the bond market starts panicking with quality downgrades. There are only two private institutions that grade U.S. bonds and both are subject to being muscled by political concerns. Such an event could easily overwhelm a new administration. The political people will go into overdrive and demand that the Fed accommodate the bond market, fueling more inflation.

I truly wish that none of this would happen but the truth is that economic forces are always and everywhere more powerful than political ones. There are structural problems alive in U.S. economic life today that are not easily solved by policies of any sort.

But in U.S. political culture, whatever takes place under one president’s watch is blamed on the officeholder regardless. That the circumstances have been created by the previous administration or have nothing to do with existing policy has no relevance in the political culture. That alone makes it nearly impossible for a sitting president to plead with the public for patience.

In 1981, Reagan did make a plea for patience, and lost a great deal of Congressional support in the midterm elections of 1982. He was fortunate that the economic recovery came in time for the 1984 election that granted him a second term. But that was a very close call, and that was also under conditions that were not as structurally dire as conditions today.

As a result, the new administration will encounter pressure to achieve the impossible: immediately improve American living standards without imposing any pain at all. Such a demand is impossible to grant. As a result, whatever happens in this election will likely be reversed in the midterms of 2026, meaning that we cannot count on any kind of policy consistency for many years to come.

Maybe I’m wrong. I hope so. But from what I’m looking at, I don’t see how a frank acknowledgement of current conditions can be put off for another year.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

]]>And yet, 59% of Americans falsely believe that the U.S. is currently in a recession, according to a recent survey of 2,000 adults by Affirm in June.

Citing higher costs and difficulty making ends meet, most respondents said they think a recession started roughly 15 months ago, in March 2023, and could last until July 2025, Affirm found.

CNBC would like for us to believe that it is “wrong” for Americans to be thinking this way. Even though millions upon millions of Americans are deeply hurting, we are just supposed to pretend that everything is sunshine and lollipops.

They can try to gaslight us all they want, but even the Federal Reserve is admitting that most of the population is “running low on disposable cash”…

Middle- and lower-income Americans are running low on disposable cash and are on track to have less than they were on pace to have before the COVID pandemic disrupted the economy, a study by the Federal Reserve Bank of San Francisco found.

Retailers such as Home Depot are extremely dependent on discretionary spending.

Needless to say, discretionary spending is way down right now, and Home Depot is openly admitting that people are not spending as much on home improvement projects as they once did…

Home Depot says consumers are feeling crummy about the economy, and they’re dishing out less on major home renovation projects.

The home improvement giant, a bellwether of consumer spending and the housing market, lowered its sales expectations for the year. It said customers were spending less on home improvement projects, pressured by higher interest rates and concerns that the economy is getting worse.

Home Depot’s business is closely tied to the housing market, and high interest rates are putting a brake on housing turnover and consumers financing larger projects.

When the economy is booming, Home Depot is usually swimming in cash. But when the economy is struggling, Home Depot really tends to struggle.

To me, this is one of the clearest indications yet of where the economy is heading.

Of course it isn’t just discretionary spending that is down.

At this point, many Americans can’t even afford the basics. In fact, one recent survey discovered that 39 percent of Americans have actually skipped meals just so that they can make their rent or mortgage payments…

39% of Americans say they’ve skipped meals to make housing payments, per Clever Real Estate survey.

And among millennials, that figure rose to 44%. Among Baby Boomers, it was 20%.

Wow.

I had not seen that number before. That is just stunning.

In a desperate attempt to make ends meet, millions upon millions of us are racking up enormous credit card balances, and lots of people are now falling behind…

A growing number of borrowers are falling behind on their monthly credit card payments. Over the last year, roughly 9.1% of credit card balances transitioned into delinquency, the New York Fed reported for the second quarter of 2024. And more middle-income households anticipate struggling with debt payments in the coming months.

In particular, credit card accounts that were opened in 2021, 2022 and 2023 have particularly high rates of delinquency…

Overall delinquencies increased rapidly over the last few years because the credit cards originated in 2021, 2022, and 2023 have gone delinquent much more rapidly than credit cards originated in other years. About 8 percent of credit cards originated in 2016 became delinquent about four years after origination. Meanwhile, the 2021 vintage reached an 8 percent delinquency rate just after 2 years while the 2022 vintage reached 8 percent after less than two years and 2023 has followed 2022 closely so far.

Sadly, a lot more economic pain is on the way, because I am entirely convinced that the cost of living will continue to rise faster than paychecks do.

One recent survey found that the high cost of living is one of the biggest reasons why so many of us consider living in large cities such as Washington D.C., New York, Los Angeles and San Francisco to be undesirable…

The company found that the the nation’s capital, for the second year running, is the one Americans feel the largest distaste for.

According to the findings, 33 percent of respondents said it is one of the top five worst cities in the country, up from 20 percent last year.

65 percent of people said that a high cost of living makes a place undesirable, with New York, Los Angeles and San Francisco also ranking on the list of unfavorable places.

But it isn’t just our large cities that are being absolutely hammered by the current economic climate.

In some areas of the country, it literally looks like the next “Great Depression” has already hit.

For decades, the U.S. experienced an extended period of time when the standard of living was extraordinarily high.

But that was never enough.

We always had to have more, and so we piled up the largest mountain of government debt in the history of the world, the largest mountain of corporate debt in the history of the world, and the largest mountain of consumer debt in the history of the world.

Now those bubbles have started to burst, and as a result our entire system is at risk.

Economic conditions are not great now, but the truth is that what we are experiencing at this moment will be considered rip-roaring prosperity compared to what is eventually coming.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

]]>“Market turbulence always prompts people to seek the financial safe haven of physical precious metals, but this latest round of recession fears has been more pronounced than I’ve seen in years,” said Jonathan Rose, CEO of Genesis Gold Group. “They’re feeling the economic tremors and they’re wondering if the ‘big one’ is about to hit.”

Americans at or near retirement-age are watching their IRAs, 401(k) plans, and other retirement accounts getting decimated. What makes it doubly concerning is that rampant inflation is hitting them hard at the same time.

Genesis, a faith-driven Gold IRA company, helps Americans navigate the waters to rollover or transfer their current or past retirement accounts into one that is backed by physical precious metals. They make it possible for people to defer taxes and seamlessly move their life’s savings into the financial “higher ground” of gold and silver.

“Gold prices have gone up over 50% in the last two years alone and many are predicting it will spike in the coming years,” Rose continued. “But it’s silver that really has our interests piqued with some experts projecting even faster gains than gold.”

On top of recession and inflation, there are many who are concerned about the coming presidential election. It’s not just about whose policies will be guiding the economy in the years to come. It’s about the expected turmoil that could come regardless of who wins.

Genesis Gold Group offers a free, definitive gold guide that informs Americans about their retirement options. It highlights the benefits but also warns of the challenges of making this important financial move.

“I always say that an educated investor is the best investor,” Rose continued. “The more informed someone is about a Gold IRA, the more likely it is that they will work with us instead of someone else.”

Reach out to Genesis Gold Group today to learn how they can help protect your retirement accounts with physical precious metals.

]]>The panic that we witnessed on Friday was quite breathtaking, and many are concerned that it could bleed over into the new week. Investors are desperate for the Federal Reserve to cut interest rates, but so far the Fed has not moved.

On Friday, many were surprised when the employment numbers were much worse than anticipated…

U.S. job growth cooled sharply in July while the unemployment rate unexpectedly rose to the highest level in nearly three years.

The Labor Department on Friday reported that employers added 114,000 jobs in July, missing the 175,000 gain forecast by LSEG economists. The unemployment rate also unexpectedly inched higher to 4.3% against expectations that it would hold steady at 4.1%.

It marked the highest level for the jobless rate since October 2021.

Please keep in mind that the U.S. economy must produce at least 150,000 new jobs each month just to keep up with population growth. So even if we did add 114,000 jobs last month, we would still be losing ground.

But the only reason why the official figure showed an addition of 114,000 jobs last month is because the birth/death model added 246,000 jobs to the final number…

Of course, we can’t possibly forget that every jobs number is highly manipulated and rigged, and July was no difference with the Birth/Death model adding a ridiculous 246K “statistical” jobs to the unadjusted print. Which it does not translate apples to apples, one can confidently say that the actual adjusted payrolls number would be far, far smaller had it not been for this ongoing fabrication.

It isn’t difficult to get a positive employment report every month when you are “adjusting” the final number by about a quarter of a million jobs that you just “assume” are being created somehow.

In any event, even if we take the government’s report at face value, the Sahm Rule has still been officially triggered…

That’s because the rise in unemployment triggered the so-called Sahm Rule, an indicator that is used to provide an early recession signal. The rule stipulates that a recession is likely when the three-month moving average of the jobless rate is at least a half-percentage point higher than the 12-month low.

Over the past three months, the unemployment rate has averaged 4.13%, which is 0.63 percentage points higher than the 3.5% rate recorded in July 2023. The Sahm Rule has successfully predicted every recession since 1970.

Even though this indicator has successfully predicted every single recession since 1970, Fed Chair Jerome Powell insists that it may not be correct this time around…

Fed Chair Jerome Powell responded to a question about the rule at a news conference Wednesday following the Fed’s decision to keep the key interest rate unchanged. “It’s not like an economic rule where it’s telling you something must happen.” He continued, “what we think we’re seeing is a normalizing labor market and we’re watching carefully to see if it turns out to be more.”

Unfortunately, it appears to be inevitable that the unemployment rate will go even higher because large companies all over America continue to shed workers. In fact, last week Intel announced that it will be “cutting 15% of its workforce”…

Months after the federal government gave Intel $8.5 billion in grants to help bring back chipmaking to the U.S., the company said it is cutting 15% of its workforce, which translates to around 17,000 jobs.

The tech company announced the job cuts as part of a massive cost-cutting and restructuring plan.

Of course Intel is far from alone.

Businesses from coast to coast have fallen on hard times, and business bankruptcy filings have risen by more than 40 percent during the past 12 months…

Over the past year, business bankruptcy filings are up 40.3 percent, and have now reached a number not seen since the second quarter of 2020, at the peak of lockdowns. American households are following along, with total bankruptcy filings up 16.2 percent in the past year, including 132,710 new filings in the second quarter of 2024 alone.

The last time business bankruptcy filings were this high was during the lockdowns in the early days of the COVID pandemic.

But we don’t have any lockdowns to blame the current wave of bankruptcies on.

What we are witnessing now is really quite scary.

Hordes of businesses are failing, and commercial real estate values have been crashing hard…

Brookfield owned Gas Company Tower in Downtown LA has plummeted over $400M in value

The skyscraper was recently valued at $214.5M

It was appraised at $632M just 3 years ago

This is a commercial real estate apocalypse

Right now, our banks are sitting on gigantic mountains of commercial real estate loans that have gone bad. For many of those banks, it is just a matter of time before they go belly up.

But don’t just take my word for it. Recently, a number of prominent experts have been warning that a tsunami of bank failures is on the way…

The echoes began in May.

Barry Sternlicht of Starwood Capital Group predicted a regional bank failure “every day or every week.”

Days later, Newmark Chair Howard Lutnick warned, “Every single weekend a regional bank is going to go bye-bye,” and predicted 500 to 1,000 failures in 2025 and 2026 — as did alternative lenders speaking at the same event. In June, PIMCO’s head of global private commercial real estate joined the chorus.

Yes, this is really happening.

A tremendous amount of financial chaos is in our future, and most people are going to be completely blindsided by it.

There is one thing that the Federal Reserve could do to mitigate the damage.

If the Fed started cutting interest rates immediately, that would certainly help.

But so far, the Fed has refused to budge.

We are being told that the Fed “might” give us a rate cut in September. That isn’t going to do the job.

We need help now, because major problems are already starting to erupt all around us.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

]]>(Zero Hedge)—The dismal US jobs report has ignited recession fears, with some major Wall Street banks forecasting at least three 25bps interest rate cuts this year, with the first one starting in September. Recessions typically reduce household incomes and alter diets.

One major issue with this consumer downturn is that households have already been financially crushed by elevated inflation and high interest rates over the last few years. A weakening labor market and a downshifting economy are just icing on the cake as the consumer has depleted personal savings and maxed out credit cards.

As previously noted, the United States Department of Agriculture recently reported beef prices at the supermarket reached a record high of $5.472 a pound in June. This one-way ticket up in prices has been primarily based on a shrinking US cattle herd to the smallest size in 73 years.

Besides the US main equity indexes getting blasted on Friday by recession fears, cattle futures in Chicago were rattled by the slowdown, sending contracts down as much as 4% – but still trading near record highs.

Fears over a “meat recession” are growing as traders see high prices and a consumer downturn as a perfect recipe for stoking demand destruction.

Here’s more from Bloomberg:

Cattle futures are dropping as a falling stock market prompts worries that consumers will pull back from high-priced beef. Sales of steak typically increase when equity markets rise and with stocks selling off after a weak US jobs report, prices for cattle are tracking the downturn.

Commodity research firm Hightower Report wrote in a note Friday, “There is no question the cattle market is sensitive to economic fears,” adding, “Consumer beef demand is in question.”

]]>The U.S. unemployment rate rose .2% to reach a near three-year high of 4.3% in July, with just 114,000 nonfarm payroll jobs being added, well below the 179,000 jobs added in June, according to the BLS. Meanwhile, the number of American workers employed part-time because their hours were reduced or they could not find full-time jobs increased by 346,000 to 4.6 million, raising the specter of recession, according to economists who spoke to the Daily Caller News Foundation.

“Employers have been shedding full-time jobs because of lackluster demand and increased uncertainty. This is a very common behavior by firms as the economy heads into recession,” E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF. “The Biden-Harris administration has turned the American labor market into a temp agency.”

All of the net job gains since Jun '23 have been part-time employment; while the economy hemorrhaged 1.1 million full-time jobs, part-time jobs rose 5.6%, b/c it's nothing more than a gig recovery at this point: pic.twitter.com/I93rtpVL6w

— E.J. Antoni, Ph.D. (@RealEJAntoni) August 2, 2024

Since June 2023, the U.S. has netted a loss of roughly 1.1 million full-time jobs, meaning all of the approximately 2.7 million jobs added over the past 13 months have been part-time, according to the the Federal Reserve Bank of St. Louis (FRED).

“I think this job’s report is showing us the toll of high inflation, the toll of interest rates that remain elevated to combat the inflation and the fact that consumers are largely tapped out as a result, as demonstrated by dramatically increased credit card debt,” Aaron Hedlund, director of research at the America First Policy Institute, told the DCNF.

Inflation sat at 3.0% year-over-year in June, well above the Federal Reserve’s 2% target, while prices have risen more than 20% since President Joe Biden took office in January 2021.

Average nominal hourly earnings for private nonfarm employees increased by 0.2% to $35.07 in July, an increase of 3.6% from a year prior, according to BLS data.

To combat elevated inflation, the Federal Open Market Committee (FOMC) kept the federal funds rate target range between 5.25% and 5.5% at its meeting Wednesday, marking the eighth meeting in a row where the FOMC has chosen not to adjust the rate.

High interest rates increase the cost of borrowing for consumers and businesses alike. Credit card delinquency rates reached their highest level since 2012 in the first quarter of 2024, with 2.59% of credit card balances more than 60 days overdue and total revolving balances hitting a record $628.6 billion.

Meanwhile, elevated inflation and interest rates have exhibited downward pressure on Americans’ bank accounts, with the personal savings rate falling to 3.4% in June, far from its peak of 32% during the COVID-19 pandemic, according to FRED.

The healthcare and government industries accounted for just over 63% of jobs added in July, with 55,000 and 17,000 jobs added respectively. In 2022, government sources accounted for just over 45% of healthcare spending, according to the Congressional Research Service.

On July 5th, the White House issued a press release claiming the Biden administration created a record 15.7 million jobs since entering office.

“Just like the incredible lie that inflation was ‘over 9%’ when Biden took office, the employment accomplishments they are attempting to take credit for are absurd as well,” Peter C. Earle, senior economist at the American Institute for Economic Research, told the DCNF.

The White House did not immediately respond to a request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>By extension, alternative economic predictions are usually well ahead of the curve – What we talk about might be labeled “doom mongering” or “conspiracy theory” today. In three years or less it will be treated as common knowledge and the mainstream “experts” will claim that they “saw it coming all along” while taking credit for financial calls they never made.

This has been a long running pattern and it’s something those of us in the alternative media have come to expect.

For my part, I warned for years about the threat of the impending stagflationary crisis which ultimately struck hard in the “post-pandemic” US. The establishment gatekeepers denied such a thing was possible. When it happened, they claimed it was “transitory.” Now, they argue that a soft landing is imminent and there’s nothing to fear from trillions in helicopter money being pumped into the system. They claim nothing of significance will change.

I also predicted that the Fed would create a Catch-22 scenario in which interest rates are raised into economic weakness while inflationary pressures expand. I suggested that the central bank would keep rates higher for far longer than mainstream analysts claimed. This is exactly what has happened. My position is simple – The Federal Reserve is a suicide bomber.

Who are you going to believe? Independent economists who have proven correct time and time again? Or, the Ivory Tower guys who have been consistently wrong? I’ll say this: If success in economics was actually based on merit and correct analysis, people like Paul Krugman or Janet Yellen would have been out of work a long time ago.

As for the ongoing narrative of a soft landing, the question I have to ask is HOW exactly they are going to make that happen? First, let’s clarify why central bankers are the problem (along with the governments they covertly influence)…

Central Banks Are At The Core Of Economic Troubles

There are only two logical reasons for central bank induced inflation: To hide the effects of a massive deflationary slowdown caused by too much debt, or, to deliberately trigger a currency collapse. Both motives could apply at the same time.

Central bankers don’t just facilitate this inflation at the behest of governments, they tell governments what to expect and what to promote to the public. Anyone that claims otherwise has an agenda. Central banks write their own policy and control their own mechanics. Governments have no say whatsoever in their operations, as Alan Greenspan once openly admitted.

The reality is, governments go begging hat in hand to central bankers and the banks decide whether or not to give them that sweet stimulus nectar. Politicians engage in collusion with central banks on a regular basis and they defer to bankers on an array of economic decisions. Economic advisers to the US president almost always include high level central bankers who then cycle right back into the Federal Reserve.

Central banks and their private international counterparts are in control, political leaders are simply pawns. Whenever there’s a crash the public focuses on government while the central banks fade into the background and avoid all scrutiny.

Inflation Addiction And The Ultimate Catch-22

Inflation for banks is a tool for fiscal change, but also social change. It’s not a coincidence that financial crisis events always lead to more centralization of global power into fewer and fewer hands; this is by design. Inflation allows the establishment to delay or initiate a crisis with greater precision.

An even more powerful tool is the WITHHOLDING of stimulus and cheap money once an economy is addicted to the flow of fiat.

I have been arguing for many years that central banks were constructing a situation in which the system is utterly dependent on fiat stimulus in order to maintain the illusion of growth. If the bankers return to lower rates and QE, inflation will continue to explode. If they stay with higher rates and a trickle of stimulus then a global crash is inevitable.

It’s one or the other, there is no soft landing when trillions in money creation are at play in such a short period of time. Central banks must return to near zero rates and QE if they hope to prevent a debt implosion. This might seem like a soft landing scenario at first, but when CPI ramps up (as it is starting to now at the mere mention of rate cuts) consumers will be hit even harder.

I’ll ask this question once again because I don’t think some people are getting it: What if their goal is to create a crash?

The Great Global Slowdown Has Already Started

In the past six months both the World Trade Organization and the World Banks released statements warning of an impending global slowdown. After an initial surge in exports and imports caused by massive pandemic stimulus measures, the effects of the helicopter money are now fading. By the end of 2024, global trade will register the slowest growth since the 1990s.

The UN also suggested growth deceleration was coming in the next year due to falling investments and subdued global trade. Keep in mind that the alternative media has been warning about this outcome for the past couple years at least as covid funding dried up. Globalist institutions are simply informing the public at the last minute; too little, too late.

The World Bank asserts that global trade is flatlining and international trade data supports this theory. China’s export market plunged by 7.5% in March, far more than expected and well below the 2.3% decline predicted by a major poll of mainstream economists by Reuters.

By the end of 2023 European exports declined by 8.8% compared to a year earlier and the union barely avoided a recession (according to official numbers). All hopes in Europe rest on the possibility of a steeper drop in inflation and central bank interest rate cuts. As I have been saying since 2021, don’t get too excited about banks lowering rates. It’s not going to happen at the pace that investors want, it’s not going to bring back QE anytime soon and when they do cut rates CPI will immediately spike once again causing panic among consumers.

I suspect that, after an initial rate cut event and an inflation resurgence, central banks will return to tightening with even higher rates in 2025.

In the US, a net importer of goods rather than a primary exporter, consumer volume has been in steep decline. Due to inflation, Americans are buying less goods while paying more money. And this is how inflation skews economic data. Higher prices on goods make retail sales look great, but in reality people are simply paying a higher price for the same amount of products (or less products).

Consumer credit data shows a steep decline in debt spending; credit card delinquency is at all time highs, APR is at all time highs and debt growth has collapsed in the past couple of months. Considering that the American consumer is a primary driver of global exports, it makes sense that international trade is now plummeting. Consumers are broke. The covid stimulus party is officially over and inflation is dragging the market down.

The IMF has recently noted the signs of global slowdown but, as usual, they argue that a “soft landing” is imminent. In other words, they claim there will be no serious repercussions for the economy. They do mention one interesting caveat in their analysis – The danger of global conflicts “derailing” the supposed recovery.

War leads to rising protectionism, the IMF says, and protectionism is a big no-no. In a world economy based on forced interdependency this is partially true, but the bigger picture is being ignored. The world economy should be built on redundancy, not interdependency. Interdependency creates weakness and the potential for dangerous domino effects. This is a fact that globalists would never willingly admit to.

For now, it appears that the global slowdown will become undeniable in the next six months, either right before the US elections in November, or right after. Central banks have chosen to create this Catch-22 and they are, for whatever reason, stalling the big drop. My theory? They have a scapegoat (or scapegoats) in mind and they’re waiting for the right time to unleash the next chaotic event. Covid is gone, so they’re going to need a war, multiple wars, or political conflict in the west and in many other parts of the world as a distraction.

Sound off about this article on the Economic Collapse Substack.

If you would like to support the work that Alt-Market does while also receiving content on advanced tactics for defeating the globalist agenda, subscribe to our exclusive newsletter The Wild Bunch Dispatch. Learn more about it HERE.

]]>Disequilibrium in the Stages of Production

A recession is merely the name for economic dislocations. The stages of production are out of equilibrium. Resources have been allocated to the wrong end products or the wrong stages of production. Consumer preferences have changed, or resources have been allocated by political factors rather than market factors. It really doesn’t matter the cause because the solution is always the same. Get rid of any and all bottlenecks that hinder the reallocation of the factors of production to meet the legitimate desires of the market.

Increasing Private Purchasing Power

There is one huge problem—the welfare state. One, but not all, of the goals of the welfare state is to provide assistance to workers and even companies who find that their cash flow has slowed, as in the case of companies, or even stopped, as in the case of worker layoffs. Government-funded welfare is designed to provide temporary assistance. The problem is that other government outlays are not reduced. No, welfare spending has become “an entitlement” and is always added onto existing spending. This means that the government takes an even-larger bite out of the only economy that matters, the free market economy. Murray N. Rothbard explained that the only spending that matters is “private purchasing power.”

In Making Economic Sense, Rothbard says, “All government taxation and spending diminishes saving and consumption by genuine producers, for the benefit of a parasitic burden of consumption spending by nonproducers.”

He elaborates on the subject in his magnum opus, Man, Economy, and State with Power and Market: “In short, strictly, the government’s productivity is not simply zero, but negative, for it has imposed a loss in productivity upon society.”

Since increased government spending must, by definition, reduce “private purchasing power,” welfare spending hinders the ability of the economy to recover just when more “private purchasing power” is needed most. Resources that should have been reallocated to new products and services desired by the public are instead reduced, not increased! Not only that, but welfare payments tend to disincentivize businesses from taking actions needed to redeploy their capital and to reduce labor’s incentive and ability to relocate or acquire new skills.

End Welfare

The solution is simple but difficult to enact. End both corporate and individual welfare. What? Force businesses to close, and throw great portions of the population into destitution? This need not be the case. It is essential that barriers are removed from reallocating capital and labor to where they are needed most urgently.

Furthermore, just as capitalists must be responsible for the financial health of their companies by saving when times are good and always being sensitive to the needs of the market, labor needs to be just as responsible. Both capital and labor need to save for a rainy day. Capital needs to invest continuously into more-productive processes, and labor needs to invest in personal skills that will be needed in the future. Unfortunately, profits from successful companies are taxed away at a high rate, and labor is subject to propaganda that the state will provide. It is a recipe for long, long recessions. Compare the post–World War I Warren Harding depression with the Herbert Hoover/Franklin D. Roosevelt depression of ten years later. Few know about the Harding depression because it ended so quickly. Everyone has heard of the Hoover/Roosevelt Great Depression of the 1930s.

Harding reduced the federal budget. Hoover and Roosevelt increased the federal budget and placed increased regulatory barriers upon the free reallocation of capital and labor. Lord John Maynard Keynes added insult to injury by abandoning Say’s law that production must precede consumption, enshrining the myth of increasing aggregate demand via money printing, deficits be hanged!

]]>Home foreclosures are on the up across the US as Americans continue to battle against soaring interest rates and rising costs.

Last month, 37,679 properties had a foreclosure filing, according to fresh figures from real estate data provider ATTOM – up 10 percent from the month prior.

According to the pundits, that wasn’t supposed to happen. But it did.

Interestingly, Joe Biden’s home state of Delaware actually experienced the fastest increase in foreclosure filings last month.

Nevada was second, and that was due to the large number of foreclosure filings in Las Vegas…

Nevada’s position in the ranking is largely due to foreclosure filings in Las Vegas, where many people lost their jobs when tourism crashed during pandemic lockdowns.

According to ATTOM, Las Vegas had a foreclosure filing on one in every 1,923 housing units in January.

This is a really troubling sign.

When the economy is booming, Las Vegas is booming even more. But when hard times arrive, times are even harder in Las Vegas.

So let’s watch and see if this trend continues.

Meanwhile, it is also being reported that the number of completed foreclosures in the U.S. was up 13 percent compared to the previous month.

In Michigan, the number of completed foreclosures actually shot up by “a huge 200 percent”…

Michigan saw the fastest rise in completed foreclosures – up a huge 200 percent. This was largely down to high rates of foreclosure filings in Detroit.

I remember writing articles about how some homes in Detroit were literally selling for one dollar when things were at their worst.

Has another housing crash begun? We are certainly ripe for one. Thanks to painfully high interest rates, buying a home has become out of reach for most of the population.

Unless interest rates go down dramatically, home prices have got to fall, and that is going to cause all sorts of problems. Of course a horrifying commercial real estate crisis is already here.

Prices have crashed all over the nation, and now many office buildings that were once worth millions of dollars are simply being torn down. In fact, in Los Angeles there is a plan to tear down a very large office building in order to build just 30 EV charging stations…

This is absolutely crazy…

An owner of an office building in LA is seeking approval to tear down the building and construct 30 EV charging stations

I don’t know what’s crazier…this headline or seeing office properties drop 80-90% in just a few years

The commercial real estate recession (primarily office) has gone from scary to a meltdown in many cities across the US and it seems as though the damage is permanent

If we really are heading into a major economic slowdown, we would also expect retailers to be shutting down stores all over America, and that is precisely what we are witnessing right now.

Incredibly, even Walmart reduced the number of stores that it operates by 102 last year…

Walmart last year closed 23 stores across the US, eight of which were in Illinois, it emerged this week

Overall, its total number of stores fell by 102, from 4,717 in January 2023 to 4,615 a year later.

That’s because in addition to the 23 closures, Walmart sold a combined 79 Moosejaw and Bonobos locations after selling the two retailers.

If even Walmart sees a need to batten down the hatches, that is a really bad sign. On top of everything else, large employers continue to conduct mass layoffs from coast to coast.

Last week, many were saddened to hear that Vice Media Group is laying off hundreds of workers as it continues to spiral toward oblivion…

Vice Media Group plans to lay off hundreds of employees and stop publishing on its flagship news website, the company’s chief executive said in a memo to employees Thursday — a stunning setback for a digital media pioneer that ascended to cultural prominence more than a decade ago.

“It is no longer cost-effective for us to distribute our digital content the way we have done previously,” Vice CEO Bruce Dixon said in the memo, which was seen by NBC News. Vice Media did not immediately respond to emails requesting comment on Thursday’s news.

Everyone knew that Vice was in dire straits, and so those layoffs are not exactly a shock.

But why has Google suddenly decided to give the axe to thousands of workers?…

Google has initiated significant layoffs across its various teams, including the Voice Assistant, hardware, engineering and ad sales teams, marking a continuation of the tech industry’s trend towards reducing workforce expenses. The layoffs have affected hundreds of employees within the Voice Assistant unit; hardware teams responsible for Pixel, Nest and Fitbit products; and a considerable portion of the augmented reality (AR) team. This move is part of Google’s broader effort to streamline operations and align resources with its most significant product priorities.

According to The Verge, the total number is in the thousands. This comes at a time when Google parent, Alphabet Inc., reported record profits in late January. The company reported $20.4 billion in net income in Q4.

Google is one of the most successful companies in the entire world, and they are swimming in cash.

If they feel the need to ruthlessly cut workers, what kind of sign is that for the rest of the economy?

Sadly, the truth is that it has become quite apparent that big trouble is ahead.

2024 is going to be such an important turning point for the economy, and it is also going to be such an important turning point for the nation as a whole.

The state of the economy will certainly be a central issue during the upcoming election season, but there are no easy answers for the problems that we are now facing.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can check out his new Substack newsletter right here.

]]>The recipe for GDP growth is a recipe for disaster

The big factor driving the GDP was the increase in government spending. Well, where’s the government getting this money? It’s borrowing it! That’s not a recipe for economic growth — that’s a recipe for disaster!”

Spending increases caused massive increases in national debt and liabilities.

The US national debt currently stands at $34.1 trillion. Total unfunded liabilities tower in the hundreds of trillions, mostly from Social Security and Medicare.

Peter states that this used to be a priority, but is no longer:

Back in the 1980s, 1990s we were still pretending we were going to do something about entitlements —about Social Security, about Medicare, that there was going to be some effort to fix the problem before it blew up… Nobody at this point believes that we’re going to do anything about stopping the bomb from going off. In fact, it’s already gone off. We’ve already passed the point.”

Social Security is officially broke

Social Security trust funds are now liquidating their treasury holdings, putting a massive net drain on the US treasury.

And it’s getting worse:

[The] drain is getting bigger every day as more people retire whether voluntarily or involuntarily and more people just drop out of the labor force and stop paying taxes.”

Peter explains that many roles are being replaced by AI and automation tools, which don’t help the Social Security fund:

They’re not going to be paying Social Security taxes. Computer programs don’t have to pay into FICA. This this is going to get bigger but given the fact that we have this huge hole in Social Security, we’re bleeding — we’ve got a massive deficit that’s running out of control.”

Peter projects a total depletion of Social Security reserves within the next few years.

Making matters worse, manufacturing has been in recession

This confounds the administration’s narrative of a healthy economy:

They keep talking about a “Manufacturing Renaissance.” They got the “r” right, except it’s a recession instead of a renaissance.”

The Fed Philly Manufacturing Index has been negative for 18 out of the past 20 months, a manufacturing dark age.

This all begs the question:

How can you talk about a great economy? How healthy can the economy be when a vitally important part, the goods-producing sector, has been in a recession for almost two years?”

There are signs of higher inflation to come

Peter points out that just this week, oil prices rose $5 a barrel and the M2 money supply increased a whopping $100 billion, a significant expansion.

Plus, the Fed won’t deny voters anything this election year.

Peter concludes:

]]>I’m correct that inflation is going to be picking up, it’s going to be weakening the economy. We could see a more meaningful turnaround. Maybe we’ll even get the government to come back and officially acknowledge that we’re in a recession.”