You have to start with the most fundamental concept here: central planning doesn’t work. That’s the first principle. Central planning of shoes doesn’t work. Central planning of wheat doesn’t work, and central planning of (fake) money doesn’t work.

Central banks in general—and the Fed in particular—are on a mission impossible. They don’t know what the interest rate should be. Nobody does. That’s an exclusive function of a voluntary market of savers and borrowers.

A politburo can’t centrally plan interest rates any more than they can potatoes. They’re inevitably going to fail and cause significant damage.

It’s also important to remember central banks have NOTHING to do with the free market. They’re actually the antithesis of the free market. In Karl Marx’s Communist Manifesto, central banking is the 5th plank.

The lying media portrays central bankers as selfless bureaucrats who are just trying to save the economy. It’s a load of BS. Central bankers are the enemy of the average person.

Now, back to the rate hiking charade.

The Fed had embarked on one of the steepest rate hike cycles in history in 2022. They did so because price increases were spiraling out of control after the Fed inflated the money supply by around 40%—a staggering amount—amid the Covid mass psychosis starting in 2020.

In other words, they were forced to embark on this steep rate hike cycle to combat the inflation that they caused in the first place.

At the time, I knew they would never be able to tame inflation because of the skyrocketing federal debt load. If the Fed was able to raise interest rates to the point where it would actually defeat inflation, the rising interest expense on this exploding pile of debt would have bankrupted the US government.

The federal debt’s interest cost is already higher than the defense budget. Soon, it could exceed Social Security and other entitlements and become the number one item in the federal budget.

For context, the last time inflation was raging, Fed Chair Paul Volcker needed to raise interest rates above 17%. However, that was in the early 1980s, when the US debt-to-GDP ratio was around 30%. Today, it’s north of 123% and rising rapidly.

Today’s higher debt load and accompanying interest expense are why the Volcker option is not on the table. There’s no way the Fed could raise rates any near 17%. They barely took rates above 5% this time before capitulating—not even 1/3 of what Volcker did.

In short…

- The federal interest expense exceeded $1 trillion for the first time recently.

- The federal interest expense has recently exceeded national defense spending for the first time and is poised to become the largest item in the budget.

- The US government is now borrowing money to pay the interest on the money it has already borrowed.

Considering all of this, Fed Chair Powell’s recent announcement that the rate hike cycle is officially over shouldn’t have been a surprise. Now, we’re going back to monetary easing.

The Fed’s Propaganda Victory

The Fed and its apologists in the lying media are trying to gaslight you and tell you inflation has been defeated, which is absurd.

The Consumer Price Index (CPI) is the most politically manipulated statistic in all of government. That is saying something because a lot of government statistics are completely manipulated, but inflation, as measured by the CPI, is probably the most manipulated.

The CPI is a basket of prices trying to measure the average price changes for 340 million Americans. It’s an impossible task because every individual has a different price basket. Consider someone who lives in New York City compared to someone who lives in rural Montana. They have totally different price baskets.

Using the CPI as a measure of price increases for 340 million people is even more preposterous than taking the average temperature across 50 states in the US as a meaningful statistic to determine what clothes you should wear today.

Further, the government gets to cherry-pick what items go in the CPI basket and their weightings. It’s like letting a student grade his own paper.

In short, the CPI is a worthless statistic. It’s misleading government propaganda intended to conceal the government’s atrocious currency debasement. So, according to their own rigged CPI metric, has the Fed accomplished its inflation goal? Nope.

They didn’t even reach their totally arbitrary 2% CPI target before they declared a fake victory. By the way, targeting 2% inflation is a nonsensical concept. Inflation is poisonous at any level. Think of it like a bucket that continuously leaks 2% of the water it carries.

That’s the kind of outcome the clowns at the Fed are trying to engineer for the economy—but they couldn’t even do that.

In short, the Fed’s narrative that inflation has been defeated is so laughably ridiculous that the only explanation is deliberate deception.

Here’s a way to think of it.

Imagine you used to weigh 180 pounds in 2019. In 2020, you gained 10 pounds and are now 190 lbs. In 2021, you gained 25 pounds and are now 215 lbs. You tell concerned friends and family not to worry about your weight gain because it’s just “transitory.”

In 2022, you go on a diet but still gain 20 pounds. You are now 235 lbs. In 2023, you continue on your diet and gain 10 pounds. You are now 245 lbs. In 2024, you have gained 5 pounds so far and are now 250 lbs.

The rate at which you gain weight is down, but your weight has increased around 40%, from 180 lbs to 250 lbs. You now declare victory, end your diet, and go back to the lifestyle that caused the weight gain surge in the first place.

This is the same kind of “victory” the Fed is declaring with inflation and the money supply, which also grew around 40% over a similar period.

In short, they are gaslighting people and spewing propaganda. So, why are they attempting to deceive people? Nobody knows for sure except them.

But if I had to guess, they are desperately trying to conceal the massive economic destruction they have already caused and the coming destruction they will cause, which could be much worse than anything we’ve seen so far.

It could all go down soon… and it won’t be pretty. It will result in an enormous wealth transfer from savers to the parasitical class—politicians, central bankers, and those connected to them.

Unfortunately, there’s little any individual can practically do to change the course of these trends in motion.

The best you can and should do is to stay informed so that you can protect yourself in the best way possible and even profit from the situation.

That’s why I just released an urgent new PDF report with all the details.

It’s called The Most Dangerous Economic Crisis in 100 Years… the Top 3 Strategies You Need Right Now.

Click here to download it now.

]]>If Treasury markets can’t be reigned in, the Fed expands its balance sheet by buying those Treasury securities to add liquidity and stability. These “open market operations” are usually the “money printing” that people are talking about happening at the Fed. “QE” refers more specifically to operations where the Fed is buying other assets beyond just Treasury securities, as occurred in the 2008 crisis and during COVID. But the Treasury buying back its own issued debt is, in essence, QE by another name.

When interpreting Treasury yield data, remember that this market is being heavily manipulated by Yellen – she's conducting the Treasury versions of both Operation Twist and QE, w/ overreliance on short-term issuance and now buybacks; term premium is now virtually nonsensical: pic.twitter.com/RH8UixQOMK

— E.J. Antoni, Ph.D. (@RealEJAntoni) May 1, 2024

While this occurs outside the halls of the Federal Reserve itself, Treasury buybacks are merely a different way to print money from nothing. The US is running a deep, sustained fiscal deficit with no true debt ceiling — so the Treasury buys back its own securities by issuing new debt, which it creates out of thin air. With spending far exceeding revenue, higher interest rates plus more debt means that fiscal deficits accelerate. The short-term stimulative effect of this somewhat offsets the Fed’s tightened monetary policy but digs a deeper hole in the longer term.

One method the Treasury uses is to shorten the average duration of securities so that debts mature sooner. That means more short-term debt (like Treasury bills) versus long-term debt (like Treasury bonds). This encourages more capital flows into the banking sector and helps stave off instability. If it fails, the big banks still win: when smaller banks fail, they’re usually just absorbed by bigger ones where the profits are private but the losses are socialized. The “Too Big to Fail” club becomes even bigger and more powerful.

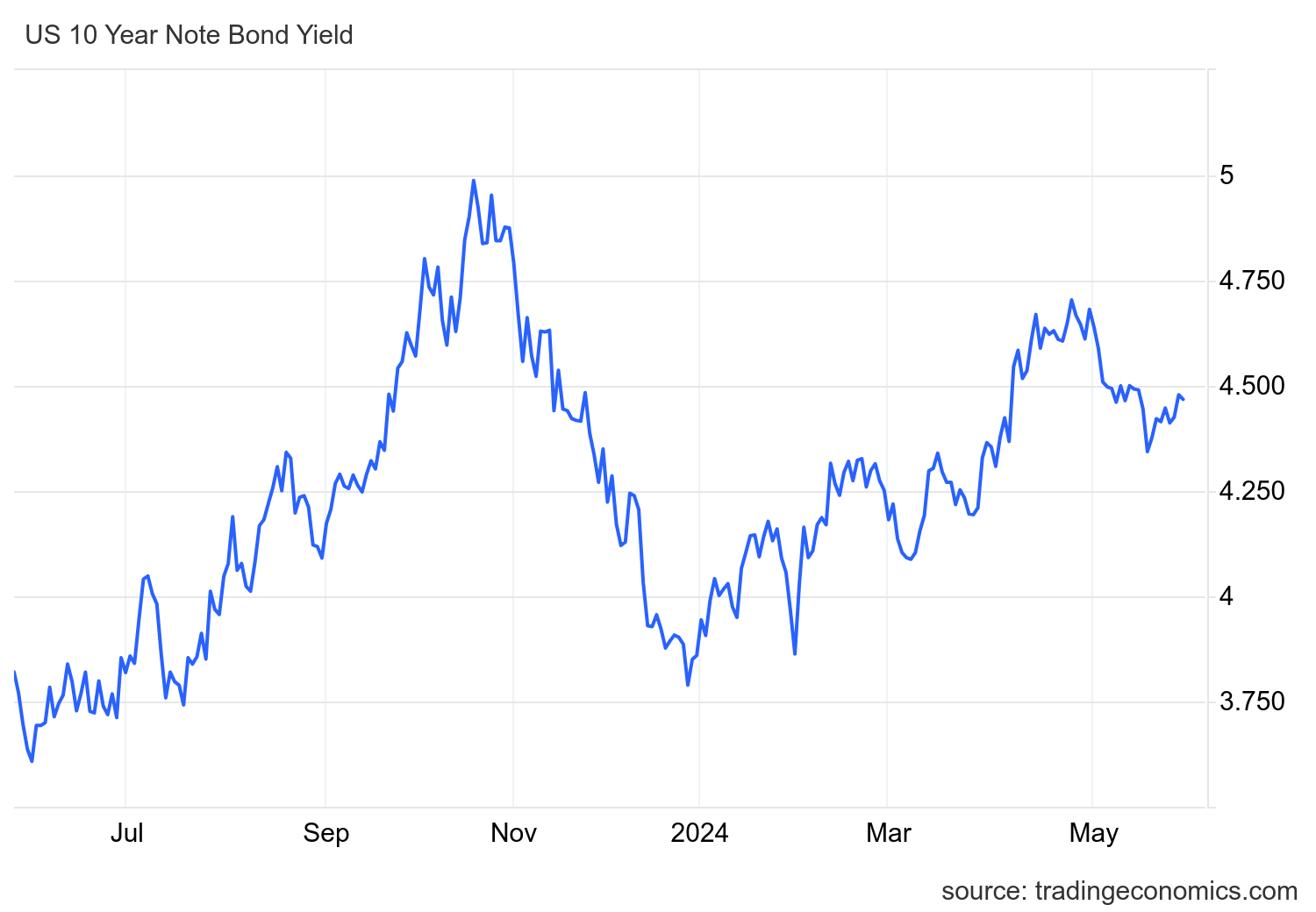

When the Treasury issues more short-term debt, it’s waging war on the Fed’s higher interest rate policy. Both the Treasury and Fed need to keep Treasury yields down, but tightened monetary policy encourages higher yields. If yields get too high, the bond market — and challenged industries like commercial real estate that rely on debt — are screwed. So while the Fed tightens, the Treasury must loosen. Yields have since gone down, but if inflationary pressures and other factors push them back past 5%, both the Fed and Treasury are trapped.

“Higher for longer” policy at the Fed is even more essential for holding back inflation as the Treasury injects liquidity into markets. If the Fed lowers rates now, the results of simultaneously expansionary monetary and fiscal policy will send consumer prices soaring.

So are the Fed and Treasury in opposition, or are they working together, one changing its policy to prevent a disaster caused by the policies of the other? The answer is complex, but the oversimplified version is that the two have locked the economy into a game of musical chairs where, eventually, the music is bound to stop.

The end result of the Treasury’s showdown with the Fed will still be out-of-control inflation. Both artificially contract and expand the money supply, and their policies have both created an inescapable trap. COVID QE is one big unexploded bomb that is sitting in the center of that trap. And even with the Fed holding off on interest rate cuts in the short term, the Treasury’s buybacks are QE by a different name. With too much inflationary pressure and not enough tools to stop it, the end result of all this fiscal and monetary tinkering will be a disaster for the dollar.

]]>President Biden called on Congress to pass legislation, sponsored by so-called moderate Senator Bob Casey of Pennsylvania, to crack down on companies that reduce the amount of a good in a package. Biden and his congressional allies and media apologists think that this will stop shrinkflation. They think this because they believe shrinkflation is caused by corporate greed. In fact, shrinkflation is a rational response to increased prices caused by the Federal Reserve’s dollar depreciation.

Businesses reduce the amount of a product sold as a means to cope with rising prices of materials needed to make their products without directly raising the price paid by consumers. Unless greed is the only human emotion that fluctuates with the Federal Reserve’s policies, the fact that shrinkflation only occurs when Federal Reserve policies cause major price inflation should show anyone willing to think logically about these issues that the Fed, not greedy businesses, causes shrinkflation.

Making shrinkflation a federal crime would force more businesses to increase their prices. This would give the American people a more accurate picture of how the Federal Reserve’s price inflation is affecting their standard of living. Shrinkflation is impossible to quantify. Shrinkflation’s existence indicates that the impact of inflation is well above the Consumer Price Index’s report of a 3.2 percent increase in prices over the past year. The Federal Reserve’s interest rates increases have not been as effective in fighting price inflation as the government’s manipulated statistics make it appear.

If Biden wanted to stop inflation, he would start by reducing federal spending and paring down the over 35 trillion dollars national debt. These steps would allow the Federal Reserve to reduce its efforts to monetize the federal debt in order to keep borrowing costs low.

Disappointingly, but not surprisingly, President Biden’s proposed fiscal year 2025 budget fails to cut spending. It also proposes the government borrow nearly two trillion dollars a year for the next decade. While congressional Republicans have declared President Biden’s “big spending budget” dead on arrival, the fact is that, with few exceptions, Republicans are just as addicted to welfare-warfare spending as their Democratic counterparts. Therefore, instead of fighting for real and substantial reductions in spending, most Republicans are happy to pretend that getting Biden and the Democrats to agree to a one or two percent reduction in the rate of spending growth addresses the problem with excessive spending.

The movement to shrink government must continue to grow. To achieve this government shrinking goal, Congress must cut spending. Congress must also pass the Audit the Fed legislation and legalize competing currencies such as Bitcoin and precious metals. Congress should also pass legislation forcing the government to live within its means by forbidding the Federal Reserve from purchasing federal debt instruments.

]]>Internal or external auditors occasionally comb through individual loans in a bank’s portfolio and make judgments as to whether those loans are worth what the bank says they are worth due to lower appraised values and other issues either particular to an individual property or the market as a whole. Bankers then, begrudgingly, set aside earnings for potential loan losses.

In the case of the real estate loans at New York Community Bank, loan examiners must have told senior management to increase the bank’s loan loss provision by 790 percent to $552 million. This balance sheet expense drove the fourth-quarter loss and caused the bank to cut its dividend.

“The bank reported a near $2 billion increase in criticized multifamily loans—debt with a probability of default,” wrote Suzannah Cavanagh for the Real Deal. “Of its $37 billion multifamily loan book, which comprises 44 percent of its total portfolio, 8 percent was marked criticized in the quarter.” The bank also reported a $42 million net charge-off—debt unlikely to be paid back—for an office loan on which the borrower stopped paying interest.

The bank’s chief financial officer John Pinto pooh-poohed the loan carnage, saying, “We had higher levels of substandard [loans] throughout the Financial Crisis, throughout the pandemic. The rise in substandard loans does not lead directly to specific losses.”

Hope Springs Eternal

Like the 2008 financial crisis, what happens in the US isn’t staying in the US. Tokyo-based Aozora Bank said losses in its US office’s loan portfolio will likely lead to a net loss for the year ending in March, the Wall Street Journal reports. Also, the private Swiss bank Julius Baer took a roughly $700 million provision on loans made to Austrian property landlord Signa Group. The bank said shutting down the unit was what made the loans, and the chief executive has resigned.

Jay Powell made no mention of the New York Community Bank’s news in his prepared remarks, and reporters didn’t ask him about the bank’s troubles during the Q and A. There were no questions concerning the Bank Term Funding Program that will be sunsetted March 11 despite having risen to record highs. According to the Wall Street Journal’s Andrew Ackerman, the popularity of the program was not because of new stresses on banks. But reportedly, “some banks had recently figured out a way to game the program by pocketing the difference between what they pay to borrow the funds and what they can earn from parking the funds at the central bank as overnight deposits.” On January 31, banks had borrowed more than $165 billion from the facility.

It’s doubtful there are no new stresses on banks. New York Community Bank is not an anomaly.

To that point, real estate investor Barry Sternlicht told a conference crowd…

We have a problem in real estate. In every sector of real estate, not just office, because of the 500 basis point increase in rates that was vertical. The office market has an existential crisis right now . . . it’s a $3 trillion dollar asset class that’s probably worth $1.8 trillion [now]. There’s $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is.

Sternlicht mentioned a project in New York that was purchased for $200 million that he thought was now worth just $30 million, encumbered by a $100 million loan.

Harold Bordwin, a principal at Keen-Summit Capital Partners LLC in New York, which specializes in renegotiating distressed properties, told Bloomberg, “Banks’ balance sheets aren’t accounting for the fact that there’s lots of real estate on there that’s not going to pay off at maturity.”

Bordwin went on to say, “Banks—community banks, regional banks—have been really slow to mark things to market because they didn’t have to, they were holding them to maturity. They are playing games with what is the real value of these assets” (emphasis added).

“The percentage of loans that banks have so far been reported as delinquent are a drop in the bucket compared to the defaults that will occur throughout 2024 and 2025,” David Aviram, principal at Maverick Real Estate Partners told Bloomberg. “Banks remain exposed to these significant risks, and the potential decline in interest rates in the next year won’t solve bank problems.”

The plan for the Bank Term Funding Program was hatched in haste over a weekend in March of last year in the wake of the Silicon Valley Bank and Signature Bank failures (Signature’s assets were purchased by New York Community Bank). To hide their embarrassment over banks using the facility for risk-free interest rate arbitrage, they say they are shutting the program down because there is no stress in the banking system.

There is stress aplenty in the banking world. As Murray Rothbard wrote in The Mystery of Banking, “Fractional reserve bank credit expansion is always shaky, for the more extensive its inflationary creation of new money, the more likely it will be to suffer contraction and subsequent deflation.”

While bankers and regulators have their heads in the sand, the contraction has already begun.

About the Author

Douglas French is President Emeritus of the Mises Institute, author of Early Speculative Bubbles & Increases in the Money Supply, and author of Walk Away: The Rise and Fall of the Home-Ownership Myth. He received his master’s degree in economics from UNLV, studying under both Professor Murray Rothbard and Professor Hans-Hermann Hoppe. His website is DouglasInVegas.com.

]]>It’s as if the Fed is asking the healthiest swimmers to don faulty life jackets first, in a bid to make them seem less alarming to those already struggling to stay afloat. Our guest commentator explains why this strategy, while intended to fortify the banking sector against future storms, would endanger all US banks.

The following article was originally published by the Mises Wire.

Last Thursday, Bloomberg reported that federal regulators are preparing a proposal to force US banks to utilize the Federal Reserve’s discount window in preparation for future bank crises. The aim, notes Katanga Johnson, is to remove the stigma around tapping into this financial lifeline, part of the continuing fallout from the failures of several significant regional banks last year.

This new policy is reminiscent of the Fed’s actions during the 2007 financial crisis, where financial authorities encouraged large banks to tap into the discount window, taking loans directly from the Federal Reserve, to make it easier for distressed banks to do the same. The hesitancy from financial institutions to tap into this source of liquidity is justified. If the public believes a bank needs support from the Fed, it is rational for depositors to flee the bank. The Fed’s explicit aim is to provide cover from at-risk banks, trying to hold off bank runs that are an inherent risk in our modern fractional reserve banking system.

By strong-arming healthy banks to comply, the Fed is escalating moral hazard and leaving customers more vulnerable. They are deliberately trying to remove a signal of institutional risk.

The regulator’s concerns about bank fragility are justified. The Fed’s low-interest rate environment meant financial institutions seeking low-risk assets bought up US treasuries with very low yields. As inflationary pressures forced rates upward, the market value of these bonds decreased in favor of new, higher-yield bonds. It was this pressure that sparked the failure of Silicon Valley Bank last year.

Additionally, the state of commercial real estate is a further stress for regional banks, which are responsible for 80 percent of such mortgages. In the previous low-interest rate environment, investors viewed commercial real estate as “a haven for investors in need of reliable returns.” Unfortunately, this same period experienced major changes in consumer behavior. Online shopping, remote work, and shared office space increased at the expense of traditional brick-and-mortar locations. Covid lockdowns only further amplified these trends.

As a result, commercial real estate debt is viewed as one of the most dangerous financial assets out there today, sitting right on the balance sheets of regional banks across the country.

These stresses have had a major impact not only on this latest policy from federal regulators but the depth of their response to last year’s failures. Following the failure of SVB, the Fed created the Bank Term Funding Program, which allowed banks and credit unions to borrow using US Treasuries and other assets as collateral. This emergency measure reflected fears of other banks being at risk. The Fed has signaled its willingness to let this program expire in March, with the aim of transitioning banks to increasing their use of the discount window.

While the actions of the Fed and financial regulators illustrate real concerns about the health of US banks, these same institutions have projected bullish optimism about the state of the economy in public. Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen have consistently described the US economy as “robust” over the last few months, a view not shared by the majority of Americans. Additionally, Powell proclaimed victory over inflation this past December, even while the Fed’s preferred measures remain well above their 2 percent target, in stark contrast to his previous statements about the necessity to aggressively tackle inflation at the risk of it becoming normalized.

The shadow of politics obviously can’t be decoupled from the rosy statements from government officials on the economy, particularly going into a presidential election year. Another motivation for projecting economic strength, however, is to re-arm the Federal Reserve’s policy arsenal. While the projections of Fed officials for rate cuts in 2024 have been packaged as reflecting the growing strength of the US economy, the reality is that the Fed desires the option to lower rates as a response to financial distress. The Fed has proven time and time again that if given the choice between forcing Americans to suffer from the consequences of inflation or bailing out the financial system, it will choose the latter.

With the 2024 election in full swing, Americans will be consistently bombarded with political lies and false promises, not just from politicians but from government agencies and the central bank. While we can expect another ten months of being told how strong the economy is, the actions being taken behind the scenes tell a very different story.

]]>This new policy is reminiscent of the Fed’s actions during the 2007 financial crisis, where financial authorities encouraged large banks to tap into the discount window, taking loans directly from the Federal Reserve, to make it easier for distressed banks to do the same. The hesitancy from financial institutions to tap into this source of liquidity is justified. If the public believes a bank needs support from the Fed, it is rational for depositors to flee the bank. The Fed’s explicit aim is to provide cover from at-risk banks, trying to hold off bank runs that are an inherent risk in our modern fractional reserve banking system.

By strong-arming healthy banks to comply, the Fed is escalating moral hazard and leaving customers more vulnerable. They are deliberately trying to remove a signal of institutional risk.

The regulator’s concerns about bank fragility are justified. The Fed’s low-interest rate environment meant financial institutions seeking low-risk assets bought up US treasuries with very low yields. As inflationary pressures forced rates upward, the market value of these bonds decreased in favor of new, higher-yield bonds. It was this pressure that sparked the failure of Silicon Valley Bank last year.

Additionally, the state of commercial real estate is a further stress for regional banks, which are responsible for 80 percent of such mortgages. In the previous low-interest rate environment, investors viewed commercial real estate as “a haven for investors in need of reliable returns.” Unfortunately, this same period experienced major changes in consumer behavior. Online shopping, remote work, and shared office space increased at the expense of traditional brick-and-mortar locations. Covid lockdowns only further amplified these trends.

As a result, commercial real estate debt is viewed as one of the most dangerous financial assets out there today, sitting right on the balance sheets of regional banks across the country.

These stresses have had a major impact not only on this latest policy from federal regulators but the depth of their response to last year’s failures. Following the failure of SVB, the Fed created the Bank Term Funding Program, which allowed banks and credit unions to borrow using US Treasuries and other assets as collateral. This emergency measure reflected fears of other banks being at risk. The Fed has signaled its willingness to let this program expire in March, with the aim of transitioning banks to increasing their use of the discount window.

While the actions of the Fed and financial regulators illustrate real concerns about the health of US banks, these same institutions have projected bullish optimism about the state of the economy in public. Fed Chairman Jerome Powell and Treasury Secretary Janet Yellen have consistently described the US economy as “robust” over the last few months, a view not shared by the majority of Americans. Additionally, Powell proclaimed victory over inflation this past December, even while the Fed’s preferred measures remain well above their 2 percent target, in stark contrast to his previous statements about the necessity to aggressively tackle inflation at the risk of it becoming normalized.

The shadow of politics obviously can’t be decoupled from the rosy statements from government officials on the economy, particularly going into a presidential election year. Another motivation for projecting economic strength, however, is to re-arm the Federal Reserve’s policy arsenal. While the projections of Fed officials for rate cuts in 2024 have been packaged as reflecting the growing strength of the US economy, the reality is that the Fed desires the option to lower rates as a response to financial distress. The Fed has proven time and time again that if given the choice between forcing Americans to suffer from the consequences of inflation or bailing out the financial system, it will choose the latter.

With the 2024 election in full swing, Americans will be consistently bombarded with political lies and false promises, not just from politicians but from government agencies and the central bank. While we can expect another ten months of being told how strong the economy is, the actions being taken behind the scenes tell a very different story.

Sound off about this article on the Economic Collapse Substack.

About the Author

Tho is Editorial and Content Manager for the Mises Institute, and can assist with questions from the press. Prior to working for the Mises Institute, he served as Deputy Communications Director for the House Financial Services Committee. His articles have been featured in The Federalist, the Daily Caller, Business Insider, The Washington Times, and The Rush Limbaugh Show.

]]>Then, stocks fell at the beginning of the year when the release of the notes of the Federal Reserve Board’s last meeting suggested the Fed would not hurry rate cuts. The likelihood of a delay in cutting rates was further increased by a “positive” December Jobs report.

The jobs report did show unemployment remaining low and wages slightly increasing, but the news was not all positive. One of the report’s most troubling items is that a top source of increased wages is government. An increase in the salaries of government employees also increases government debt, which will have to be paid for by taxes. Since tax increases are unpopular, the government relies on the Federal Reserve to do the dirty work by purchasing federal debt instruments and thus creating more inflation. This inflation tax is the worst of all taxes because it is regressive and hidden.

If the Fed allowed interest rates to increase to anywhere near what they would likely be in a free market, interest rate payments on the federal debt would rise to a level causing a financial crisis. Even though the federal government will soon spend more on interest on the federal debt than on the Pentagon and the military-industrial complex, few in DC are serious about cutting spending. Federal debt increased by one trillion dollars from mid-September to the beginning of the new year. It is expected to increase by around another trillion dollars by the end of March! To put this in perspective, consider that the federal debt did not reach a trillion dollars until 1981 — almost two hundred years after the Constitution was ratified.

Continuing increases in federal debt and Federal Reserve created inflation will lead to economic crisis caused by a rejection of the dollar’s world reserve currency status. There is already resentment over the US government’s use of the dollar’s reserve status to support US sanctions This is why Russia and Iran recently signed a deal to trade in their own currencies rather than in dollars and Russia is no longer accepting dollars for its oil.

President Biden has kept his promise to refrain from criticizing the Fed’s conduct of monetary policy. In contrast, his predecessor regularly took to Twitter to lambaste the central bank. This means the Fed will likely try to help President Biden by trying to keep interest rates low enough to not increase unemployment yet high enough to not increase price inflation.

While Donald Trump is more likely than Joe Biden to challenge the deep state and neoconservative foreign policy, the truth is neither Biden nor Trump will seek to reduce spending. Unless a critical mass of Americans demand an end to the welfare-warfare state and the fiat money system, the soft landing sought by the Fed and the politicians will turn into a hard crash.

]]>Over the last month, loans outstanding in the Federal Reserve bank bailout program increased by $17.24 billion. It was the second month we’ve seen borrowing from the Bank Term Funding Program (BTFP) surge. And the pace of borrowing is increasing.

Between December 13 and December 20, the balance in the BTFP grew by $7.57 billion.

As of Dec. 20, the balance in the BTFP stood at just under $133.34 billion. It’s the largest balance since the program was created in March.

The increase in banks tapping into the BTF started in November. As you can see from the chart, borrowing had leveled off in August before the sudden spike in November. Keep in mind that banks were still tapping into the bailout even as the total balance in the program plateaued. Some banks were paying off loans as others borrowed.

This surge in bank bailout borrowing would seem to indicate more banks are struggling in this high interest rate environment, and the financial crisis that kicked off in March continues to boil under the surface.

But thanks to the Fed bailout, the crisis remains “out of sight, out of mind.”

WHAT IS THE BTFP?

After the collapse of Silicon Valley Bank and Signature Bank, the Fed created the BTFP, allowing banks to easily access capital “to help assure banks have the ability to meet the needs of all their depositors.”

The BTFP offers loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. Banks can borrow against their assets “at par” (face value).

According to a Federal Reserve statement, “the BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution’s need to quickly sell those securities in times of stress.”

The ability to borrow against the face value of their bond portfolios is a sweetheart deal for banks given the big drop in bond prices over the last year-plus.

Fed interest rate increases to fight price inflation decimated the bond market. (Bond prices and interest rates are inversely correlated. As bond prices fall, bond yields increase.) With interest rates rising so quickly, banks could not adjust their bond holdings. As a result, many banks have become undercapitalized on paper.

According to the FDCI, unrealized losses on securities climbed to $683.9 billion in Q3. That represented a 22.5% jump from the second quarter. Rising mortgage rates reducing the value of mortgage-backed securities drove the increase.

The BTFP gives banks a way out, or at least the opportunity to kick the can down the road for a year. Instead of selling bonds that have dropped in value at a big loss, banks can go to the Fed and borrow money at the bonds’ face value.

PAPERING OVER THE PROBLEM

The creation of the BTFP allowed the Federal Reserve to paper over the banking crisis its interest rate hikes created. But what happens when the loans come due?

In the first week of the BTFP, banks borrowed $11.9 billion from the program, along with more than $300 billion from the already-established Fed Discount Window.

The Discount Window requires banks to post collateral at face value and loans come with a relatively high interest rate and must post collateral at fair market value. While Discount Window borrowing surged in the weeks after the collapse of SVC and Signature Bank, the balances were quickly paid back down, and Discount Window borrowing returned to normal levels.

One would expect borrowing from a bailout program to slow down considerably once the crisis passed. But banks never stopped tapping into the BTFP. And borrowing suddenly accelerated in November.

Notably, the sudden spike in bailout borrowing happened even as the bond market rallied and bonds regained some of their value as the Fed eased off the rate hike accelerator. This ostensibly provided some relief on banks’ balance sheets.

Granted, the $133 billion outstanding appears insignificant compared to the $22.8 trillion in commercial bank assets held by the 4,100 commercial banks in the US. The fact that some troubled banks are still tapping into a bailout program nine months after the crisis doesn’t necessarily mean the banking system is on the verge of collapse. But while the bailouts might not be a fire, it’s at least smoke. There are still problems in the banking system bubbling under the surface.

This is a predictable consequence of the Fed raising interest rates to battle price inflation.

Artificially low interest rates and easy money are the mother’s milk of this bubble economy. With everybody from corporations, consumers, and the federal government buried in debt, this economy and the financial system simply can’t function long-term in a high interest rate environment. The banking crisis earlier this year was the first thing to break as a result of rising interest rates. Other things will follow. We’ve already seen some tremors in the commercial real estate market.

While you might be tempted to blame the Fed’s recent rate hikes for these issues, the real problem started years ago.

After the Great Recession, Federal Reserve policy intentionally incentivized borrowing to “stimulate” the economy. It cut rates to zero and launched three rounds of quantitative easing. After an unsuccessful attempt to normalize rates and shrink its balance sheet in 2018, the Fed doubled down on easy money policies during the pandemic. This monetary inflation inevitably led to price inflation. That forced the Fed to raise interest rates. The central bank appears to have cooled price inflation (for now), but it also broke the financial system.

In effect, the Fed managed to paper over the financial crisis with this bailout program. It basically slapped a bandaid on it. But it has not addressed the underlying issue – the impact of rising interest rates on an economy and financial system addicted to easy money.

And it’s only a matter of time before something else breaks.

]]>The Fed’s decision not to raise rates keeps the target range between 5.25% and 5.50%, marking the third meeting in a row where the Fed chose to not adjust the rate, according to an announcement from the Federal Reserve following a meeting by the Federal Open Market Committee (FOMC). The Fed also released its future projections of the economy and the federal funds rate, with FOMC members projecting rates will be lowered to a median of 4.6% by the end of 2024, indicating three interest rate cuts if the Fed sticks to its typical 0.25% change pattern.

“Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter,” the FOMC statement reads. “Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated…The Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.”

The last rate hike was at the committee’s meeting in July and was the 11th in a series of hikes starting in March 2022 in an effort to combat inflation, which peaked at 9.1% in June 2022.

“The Fed is unlikely to raise their interest rate targets any further in 2024,” Dr. Thomas Hogan, senior fellow at the American Institute for Economic Research, told the Daily Caller New Foundation. “The question is when they will start cutting rates. The median FOMC projection is that inflation (PCE inflation, not CPI) will fall to 2.5% in 2024 and that the fed funds rate will be cut to 5.1% by the end of 2024. If inflation appears to be coming down, then we should expect their economic projections to show lower projections for inflation and the fed funds rate, indicating they will begin cutting rates sooner than previously expected.”

Inflation decelerated slightly in November, with the consumer price index (CPI) rising 3.1% year-over-year compared to 3.2% in October, far above the Fed’s 2% target. Core CPI, which excludes energy and food, remained even more elevated at 4.0%, following significant recent deflation in the price of gasoline.

The economy showed strong growth in the third quarter of 2023, with gross domestic product rising 5.2% compared to just 2.1% in the second quarter. The U.S. job market continues to slow, with the economy adding 199,000 jobs in November, with around 47,000 of those jobs coming from the return of striking workers in the auto and motion picture and sound industries.

Top investment banks and asset managers are mixed in their forecasts for the U.S. economy in 2024, with strong growth but high inflation and slowing job numbers clouding recession predictions and complicating the Fed’s long-term goal to reduce inflation without triggering a recession.

“But even if the Fed does start cutting rates in 2024, it is unlikely to lower them by much,” Hogan told the DCNF. “The FOMC’s most recent projections show the FOMC keeping interest rates above 5% in 2024 and not getting below 4% until 2026.”

Sound off about this article on the Economic Collapse Substack.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

Image by Amanda via Flickr, CC BY 2.0 DEED.

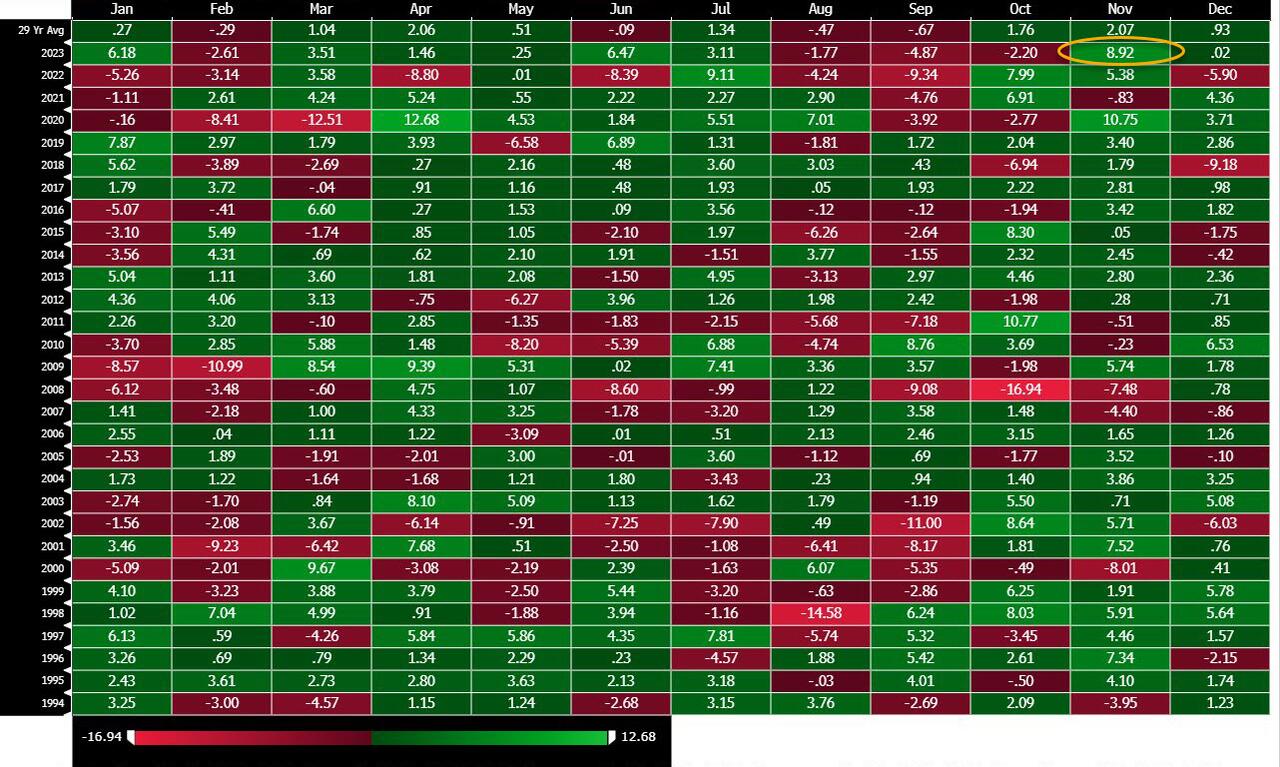

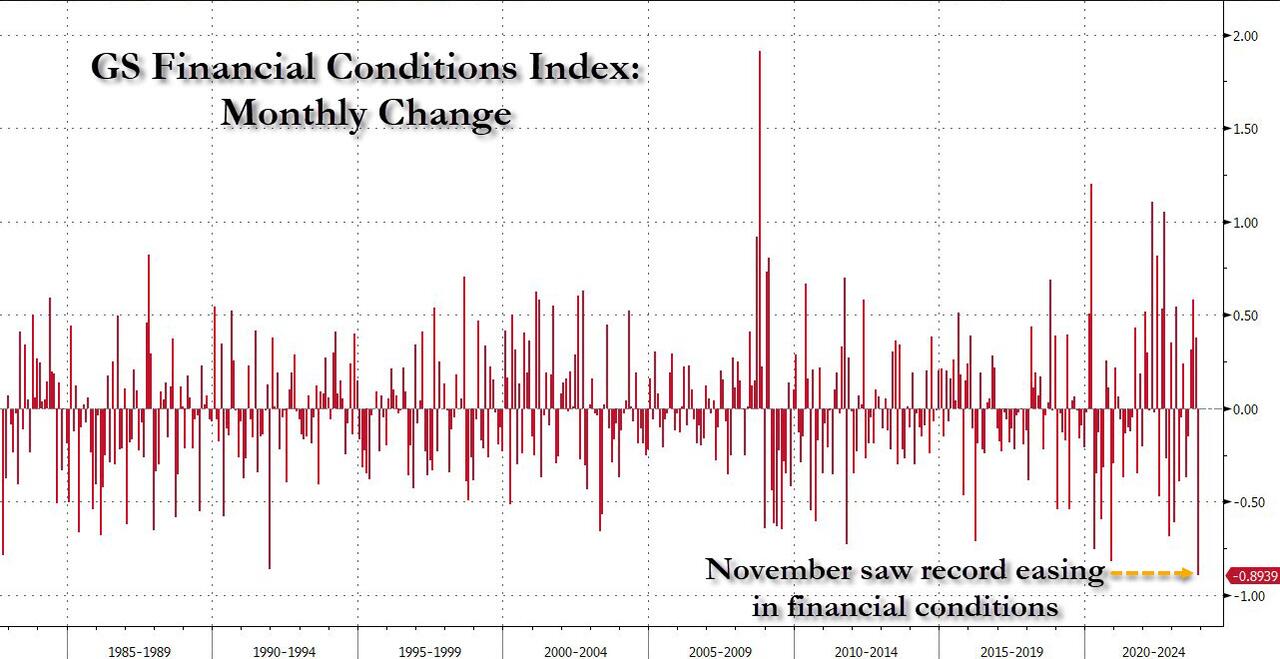

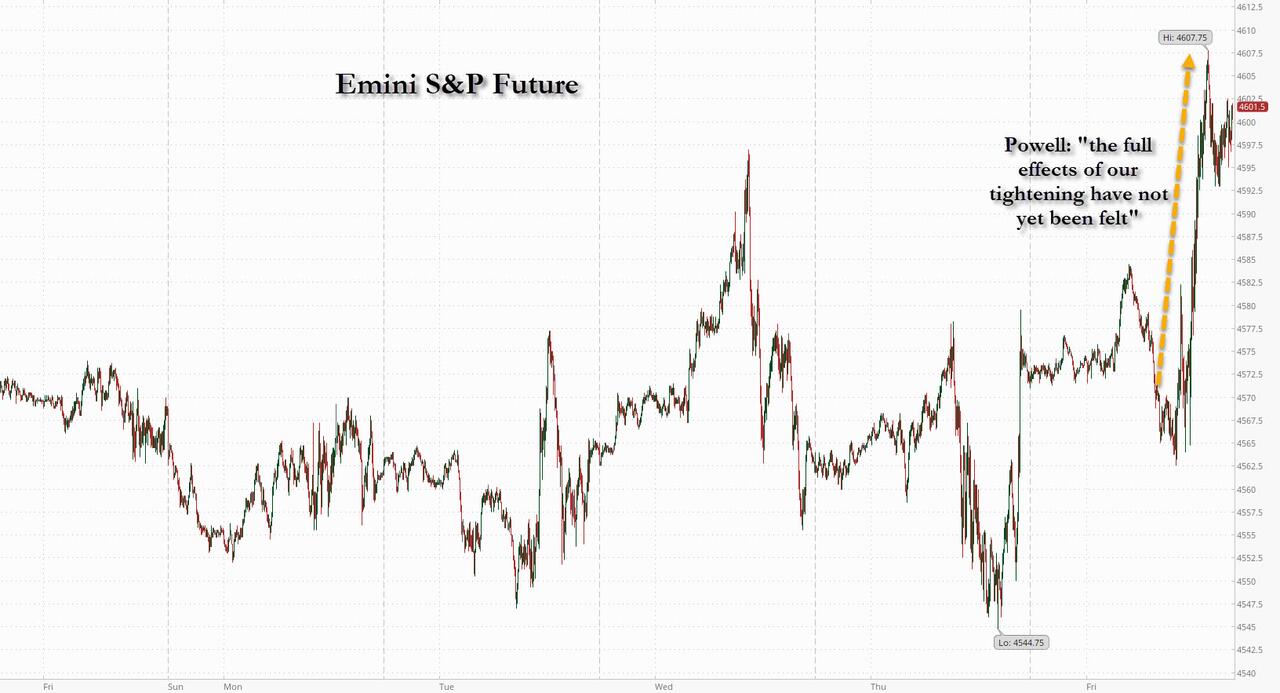

]]>… all eyes were on Jerome Powell today to see if the Fed chair would say something to stem the surging stock market tide following the month which saw the biggest easing in financial conditions on record, equivalent to nearly 4 rate cuts.

We got the answer shortly after 11am ET, when after what seemed to be otherwise balanced remarks with a dose of hawkish comments…

“It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.”

… offset by some clearly dovish statements…

“The strong actions we have taken have moved our policy rate well into restrictive territory, meaning that tight monetary policy is putting downward pressure on economic activity and inflation. Monetary policy is thought to affect economic conditions with a lag, and the full effects of our tightening have likely not yet been felt.”

… and generally sounding rather optimistic while answering student questions, saying that the US is on the path to 2% inflation without large job losses – i.e., a soft landing – which helped the market to convince itself that Powell had just given the green light for a continued market meltup (thanks to the blackout period, there will be no more Fed comments until the Dec 13 FOMC) as Bloomberg put it…

“Powell points to how the Fed’s past tightening moves will continue to have an impact on the economy — the full impact hasn’t been felt yet. If anybody thought the Fed wasn’t finished raising rates, his prepared remarks today sure put a fork in it. They are done.”

…. and what happened next was a violent repricing in easing odds, with March rate cut odds hitting a lifetime high of 80%, effectively doubling overnight and up from 10% just 5 days ago…

… which then immediately cascaded across assets and sent everything exploding higher, led by stocks which surged above 4,600 for the first time since the July FOMC (aka the “final rate hike”)…

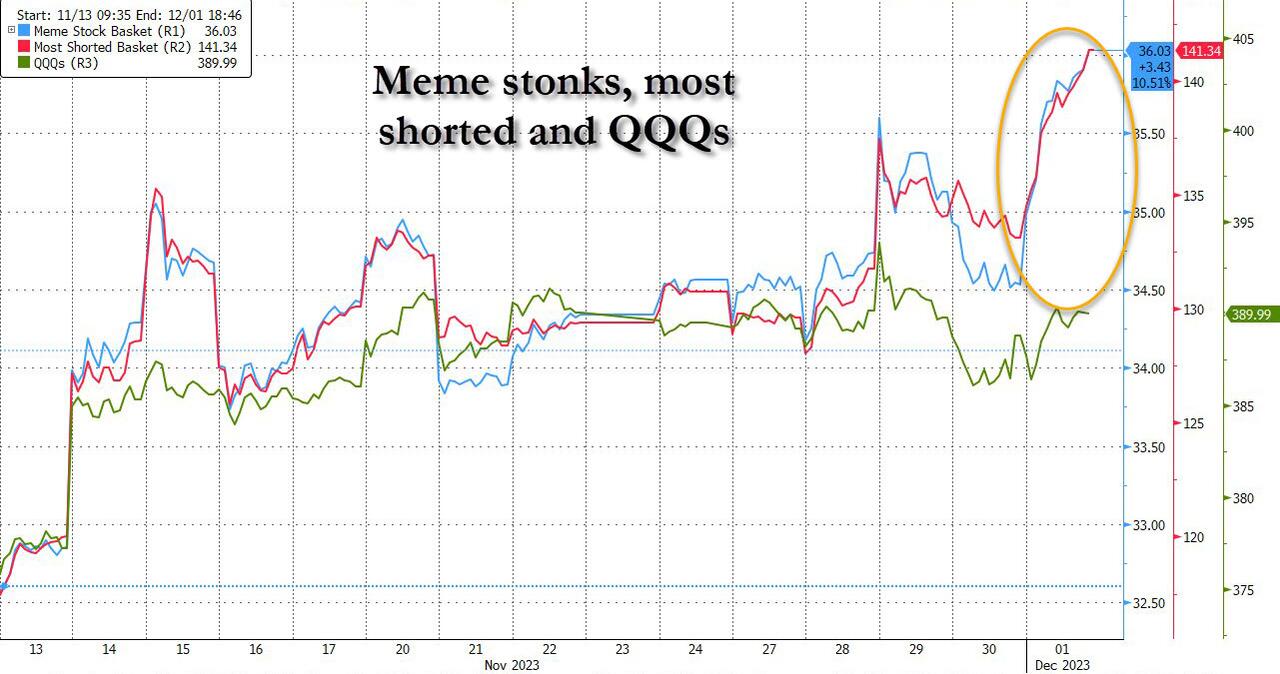

… and one look below the surface reveals that this was indeed the QE trade: the Nasdaq barely rose while meme stonks and most shorted names exploded higher.

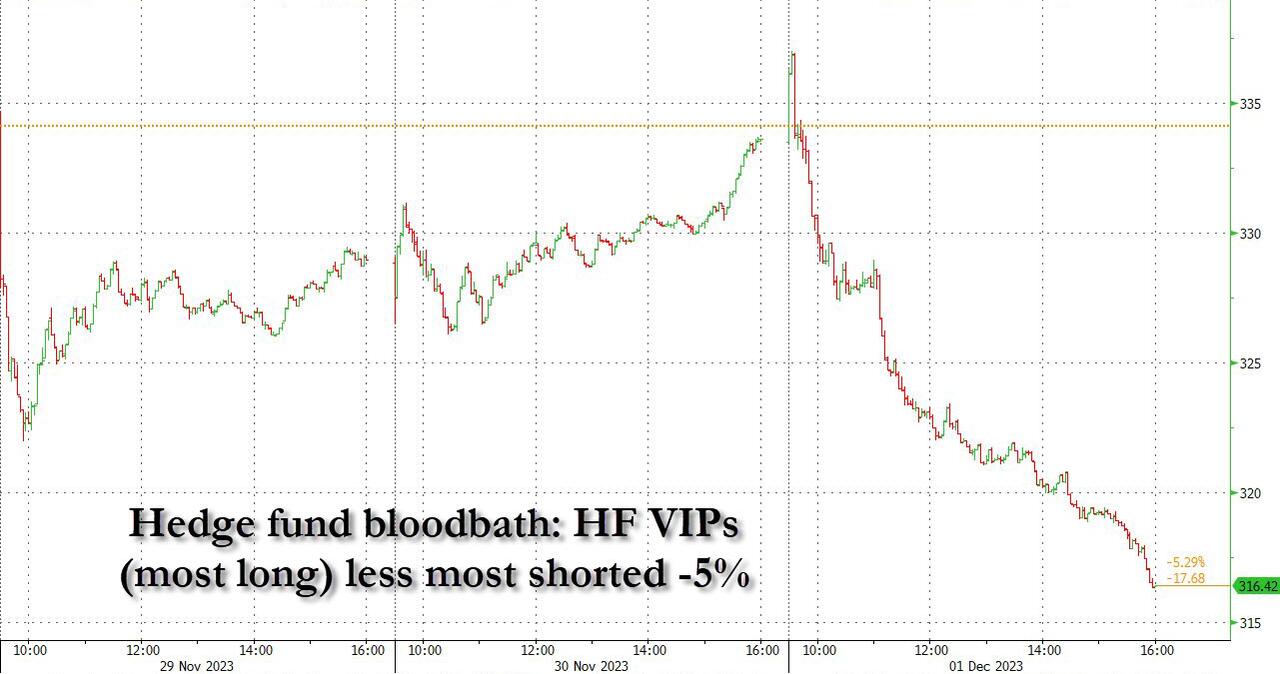

And yet, this eruption in the most shorted/hated names means that hedge funds actually had a catastrophic day: and indeed, looking at the HF VIP (most long) less most shorted basket pair trade we see a whopping 5% drop as many hedge funds were stopped out and margin called.

Putting today’s plunge in contact, this was the worst day for hedge funds since June 2021 and the second worst day since the covid crash!

Next, looking at the bond market, here too everything jumped but especially 2-Year TSYs, whose yields tumbled a whopping 12bps to 4.56%…

… and on course for the biggest weekly slide since the regional banking crisis in March, down almost 40bps.

Yet neither stocks, nor bonds, had quite as much fun as either “digital gold”, with Bitcoin briefly hitting a fresh 2023 high, briefly surging to $39,000 before easing back with Ether rising to $2100 …

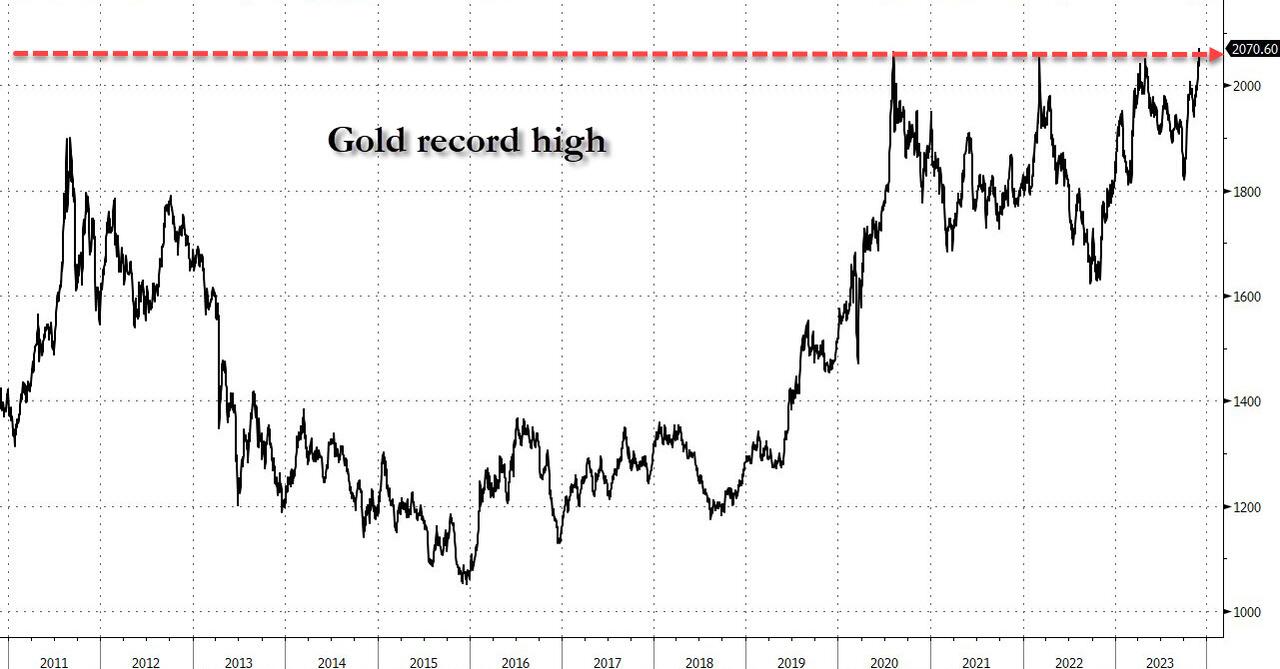

… but the biggest winner by far from today’s market conclusion that a renewed dollar destruction is on deck, was gold which briefly rose above its all time high of $2,075…

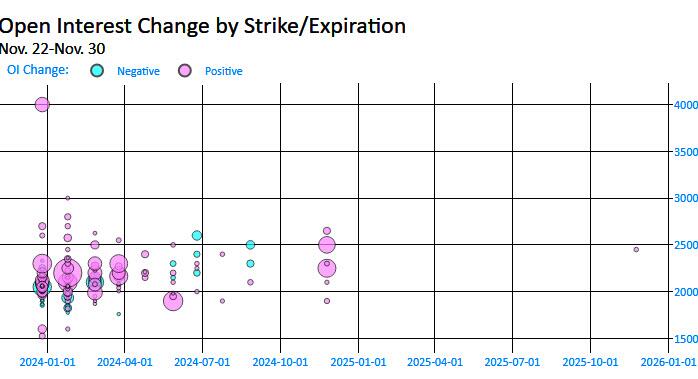

… and that’s just the start: now that a new record is in the history books, a frenzy of gold calls was bought, both for futures and the biggest ETF tied to the metal, and as shown in the chart below, the buildup of open interest between $2,000 and $2,500 has been relentless over the past week on growing optimism that rates are primed to decline. Next up for gold? $2500 or higher.

Yet not everyone had a great day: the dollar predictably tumbled, extending it losses for a third straight week, the longest streak since June, and comes after the dollar saw its worst month in a year this November.

One dollar pair trade where the convexity is especially high is USDJPY, which after soaring for much of the past year suddenly finds itself in a Wile E Coyote moment, trading just below the 100DMA. Should the selling persist, we may see the pair quickly tumble down to 140, or lower.

To be sure, not all the moves made sense: as Bloomberg noted, bonds have a better reason to rally than stocks, which have to factor in the growth concerns that underpin Powell’s remarks. Evidence is gathering that the economy is slowing and stocks will have to reconcile that with their bullish rate views. Today’s ISM Manufacturing data is case in point that the stagflationary slowing that started in October — and Bloomberg Economics says it’s observing typical early signs of recession — extended last month.

The ISM commentary was generally downbeat, equally split between companies hiring and others reducing their labor forces “a first since such comments have been tracked” according to Bloomberg.

But it gets worse: the latest update to the Atlanta GDPNOW tracker slipped to 1.2% from 1.8% yesterday and over 2% just last week.

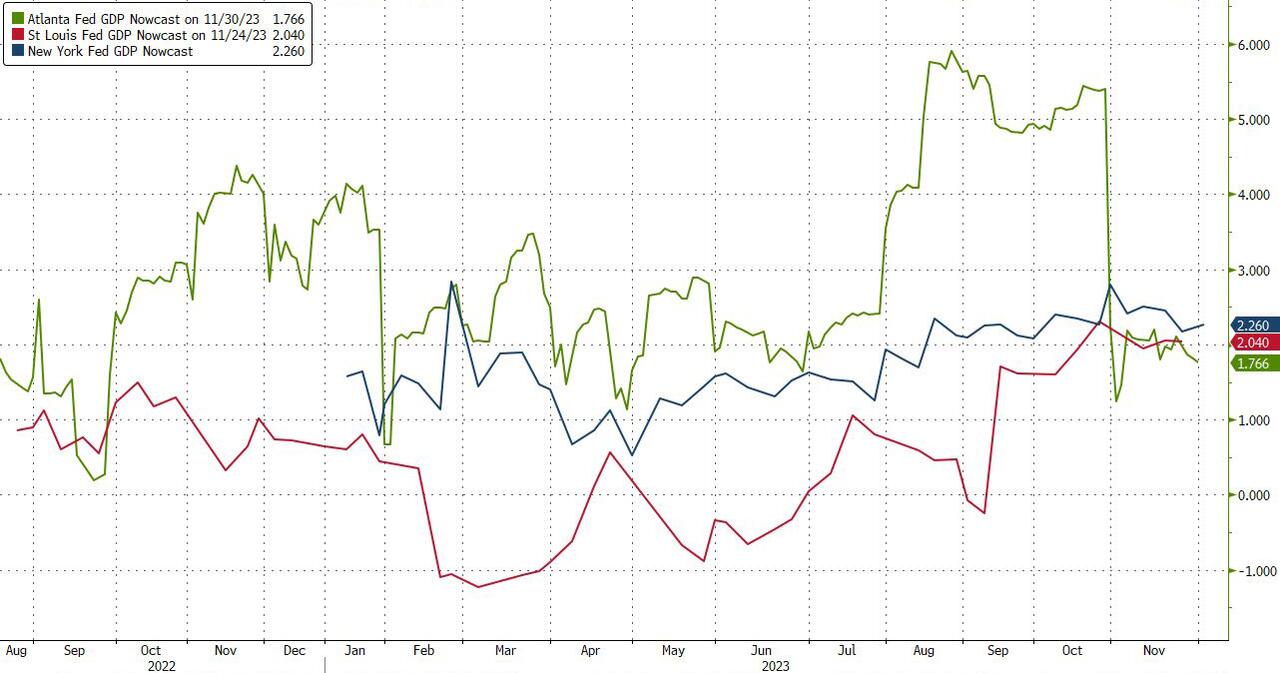

And after diverging for much of the year, all three regional Feds that do GDP nowcasts have converged on 2% – a far cry from the “5.2%” GDP print the Biden department of seasonal adjustments goalseeked last month.

Bottom line: the onus is now on the payrolls report next week to further guide markets into next year. The continued rise in ongoing jobless claims pose a risk that unemployment could rise further. But so far, this isn’t a consensus view, with economists projecting the unemployment rate to stay unchanged at 3.9% (and more see a 3.8% rate than 4%).

And while that may only add more fuel to the rate-cut speculation, at some point the softening in economic data will have to be squared with its impact on profits. As a reminder, while much of the interval between the last rate hike and the first rate cut is favorable for risk assets, the weeks right before the cut usually send stocks anywhere between 10% and 30% lower as the market realizes just why the Fed is panicking.

However, judging by today’s action, we still have some time before that particular rude awakening kicks in.

]]>