The Dow dropped 494.82 points, or 1.21%, to end at 40,347.97. At its session lows, the 30-stock index lost 744.22 points, or about 1.8%. The S&P 500 shed 1.37% to end at 5,446.68, while the Nasdaq Composite slipped 2.3% to 17,194.15. The Russell 2000 index, the small-cap benchmark that has rallied lately, dropped 3%.

Many still believe that the Fed will give us a rate cut in September.

But there are others that are concerned that “the Fed may not be acting quickly enough to keep America’s job market in good shape”…

The narrative on Wall Street is shifting.

Traders have long placed their bets on the Federal Reserve cutting rates in September, and Fed Chair Jerome Powell basically confirmed as much Wednesday.

That rate cut, expected in six weeks, was priced in to stocks, which have been rising over the past few months in hopes of a cut. Rate cuts tend to juice stocks, because they lower borrowing costs for businesses and can help boost profits.

But now, fear is starting to take hold, as concerns mount that the Fed may not be acting quickly enough to keep America’s job market in good shape.

Economist Claudia Sahm is one prominent expert that is deeply alarmed by the Fed’s lack of action.

Considering all of the troubling numbers that we have seen in recent days, she is wondering what they are waiting for…

If the Federal Reserve is starting to set the table for interest rate reductions, some parts of the market are getting impatient for dinner to be served.

“What is it they’re looking for?” Claudia Sahm, chief economist at New Century Advisors, said on CNBC just after the Fed concluded its meeting Wednesday. “The bar is getting set pretty high and that really doesn’t make a lot of sense. The Fed needs to start that process back gradually to normal, which means gradually reducing interest rates.”

DoubleLine CEO Jeffrey Gundlach is using even stronger language.

He says that the Fed is risking a recession by not making a move now…

DoubleLine CEO Jeffrey Gundlach also thinks the Fed is risking recession by holding a hard line on rates.

“That’s exactly what I think because I’ve been at this game for over 40 years, and it seems to happen every single time,” Gundlach said, speaking to CNBC’s Scott Wapner on “Closing Bell” on Wednesday. “All the other underlying aspects of employment data are not improving. They’re deteriorating. And so once it starts to get to that upper level, where they have to start cutting rates, it is going to be more than they think.”

Of course there are many numbers that seem to indicate that we may already be in the early stages of a new recession. For example, earlier today we learned that the ISM manufacturing index was in contraction territory once again last month…

The ISM (Institute for Supply Management) Manufacturing PMI registered 46.8% last month, indicating industry economic activity contracted at a faster rate when compared to June’s figure of 48.5%.

“After breaking a 16-month streak of contraction by expanding in March, the manufacturing sector has contracted the last four months,” says Timothy Fiore, chair of the ISM’s manufacturing business survey committee.

In addition, initial applications for unemployment benefits jumped to the highest level in about a year last week…

New economic data revealed that first-time applications for jobless benefits rose last week to an estimated 249,000 filings. That’s the highest tally since last August, according to the Labor Department. Meanwhile, continuing claims, filed by people who have received unemployment benefits for at least a week, jumped to 1.877 million. That’s the highest level since November 2021.

Sadly, a lot more layoffs are coming as thousands upon thousands of businesses get into very serious trouble all over the nation.

This week, we learned that a furniture retailer that had survived the Great Depression, the Great Recession and the COVID pandemic is closing all 380 of their stores and filing for bankruptcy…

A 120-year-old furniture chain will shutter all 380 stores after its parent company filed for bankruptcy — the latest brick-and-mortar business to buckle from high overhead costs and massive debt.

Badcock Home Furniture & More, which has stores throughout the South, announced a “going out of business” sale Tuesday.

The company was purchased last year by Conn’s, a Texas-based furniture retailer, which filed for bankruptcy last week.

After 120 years, this is how it ends.

Of course there are lots of other retailers that have also been going belly up this year…

Other furniture chains, including Bob’s Stores, Z Gallerie and Mitchell Gold + Bob Williams, filed for bankruptcy this year.

Overall, US retailers had announced the closure of almost 2,600 stores in 2024.

If the U.S. economy really is in “good shape” like the mainstream media is insisting, then why is this happening?

In my opinion, we are experiencing the leading edge of an economic storm which will greatly intensify during the second half of 2024.

And the outlook for 2025 is absolutely dismal.

So what should you do about all of this?

In the short-term, protect your assets and build up a sizable emergency fund. No matter what happens, you are going to need to have enough money to pay your bills.

In the long-term, I am entirely convinced that we are going to experience the most painful period in our entire history.

Our leaders have been making incredibly bad decisions for decades, and now we have entered a time when the consequences of those decisions will become obvious to all of us.

Michael’s new book entitled “Chaos” is available in paperback and for the Kindle on Amazon.com, and you can subscribe to his Substack newsletter at michaeltsnyder.substack.com.

]]>We first pointed this out more than a year ago, and since then we have routinely repeated – again, again, and again – yet even though we made it abundantly clear what was happening…

Stunning statistic: there has been ZERO INCREASE in jobs for native-born workers in over five years, since July 2018! pic.twitter.com/mxdpmPHIbO

— zerohedge (@zerohedge) January 5, 2024

… going so far as to point out the specific immigration loophole illegals were using to work in the US for up to 5 years…

Why have all new jobs since 2018 gone to foreign-born workers (i.e. immigrants)? Because you can be an illegal immigrant in deportation proceedings (not to mention anyone seeking asylum) and get authorization to work in the US for up to 5 years, no questions asked. pic.twitter.com/VmhTBUM1I2

— zerohedge (@zerohedge) March 10, 2024

… and even fact-checking the senile, ballot-harvesting White House occupant on multiple occasions…

Fact-check:

1. Prices have never been higher and are starting to accelerate to the upside again

2. All the jobs created in the past year have been part time.

3. There has been zero job growth for native-born Americans since 2018; all jobs have gone to immigrants (mostly illegal… https://t.co/MeX7KhbaHl pic.twitter.com/OJI79p9oLp— zerohedge (@zerohedge) February 29, 2024

… we were shocked that the topic of most if not all US jobs going to illegals was still not “the biggest political talking point” of all.

How is this not the biggest political talking point right now: since October 2019, native-born US workers have lost 1.4 million jobs; over the same period foreign-born workers have gained 3 million jobs. pic.twitter.com/Z5HVWmQ24C

— zerohedge (@zerohedge) January 15, 2024

That’s about to change, however, because with just under 5 months left until the election, and with immigration by far the hottest political topic out there, others are finally starting to connect the dots we laid out more than a year ago.

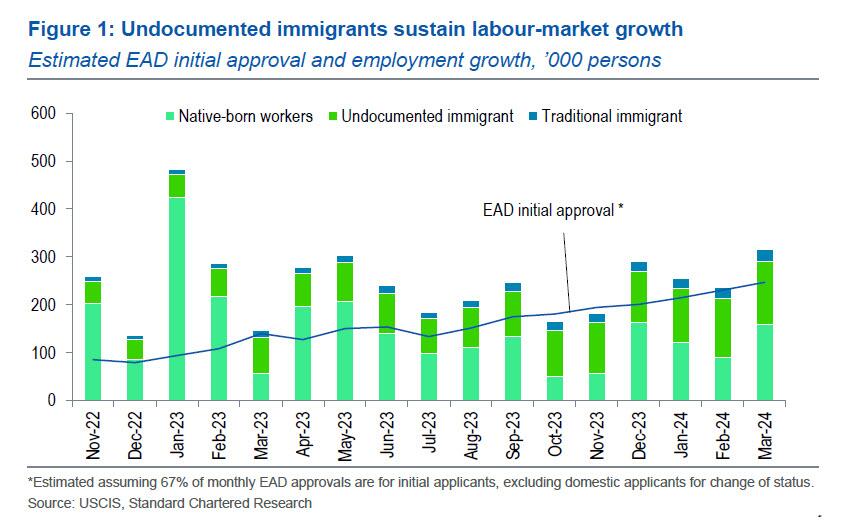

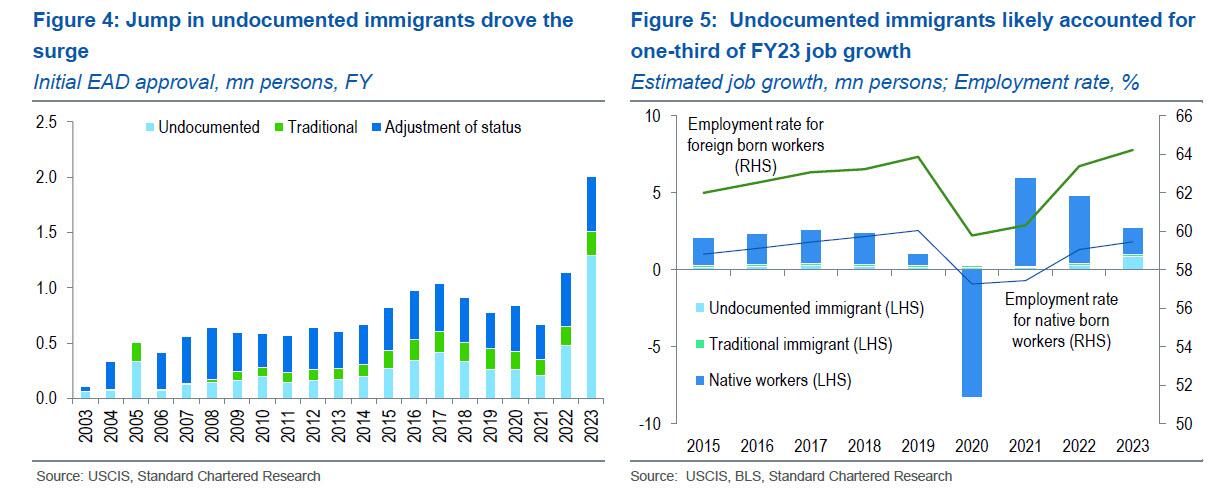

The first Wall Street analyst daring to point out that the employment emperor is naked, is Standard Chartered’s global head of macro, Steve Englander who in a note titled simply enough “Immigration leading to labor-market surge” (and available to pro subscribers in the usualk place), writes that according to his estimates “undocumented immigrants account for half of job growth in FY24 so far” (the actual number is far higher but we understand his initial conservatism), and adds that “asylum seekers and humanitarian parolees explain the surge in undocumented immigrants” before concluding that the continued rise in EAD approvals likely will extend strong employment growth in 2024. In other words, “strong employment growth” for American citizens, always was and remains a fabulation, and the only job growth in the US is for illegals, who will work for below minimum wage, which also explains why inflation hasn’t spiked in the past year as millions of illegals were hired.

Below we excerpt from the Englander note because we hope that more economists, strategists and politicians will read it and grasp what we have been saying for over a year.

Echoing what we have said for months, Englander writes that immigration, particularly illegal immigration, “is a political flashpoint that has also become an important factor in assessing economic performance. Detailed data from US Customs and Border Protection (CBP) and US Citizenship and Immigration Services (USCIS) suggest that half of non-farm payroll (NFP) growth to date for FY24 (started 1 October 2023) has been from undocumented immigrants who have received an Employment Authorization Document (EAD)” (he defines undocumented immigrants as those who entered the US through non-traditional immigration pathways, such as asylum seekers, parolees, and refugees).

The ability to track EAD issuance to undocumented workers is an advantage in estimating how much they have contributed to employment growth. NFP counts workers with an EAD just like any other. Using that data, it is easy to estimate that undocumented workers have added 109k jobs per month to NFP out of the average 231k increase so far in FY24.

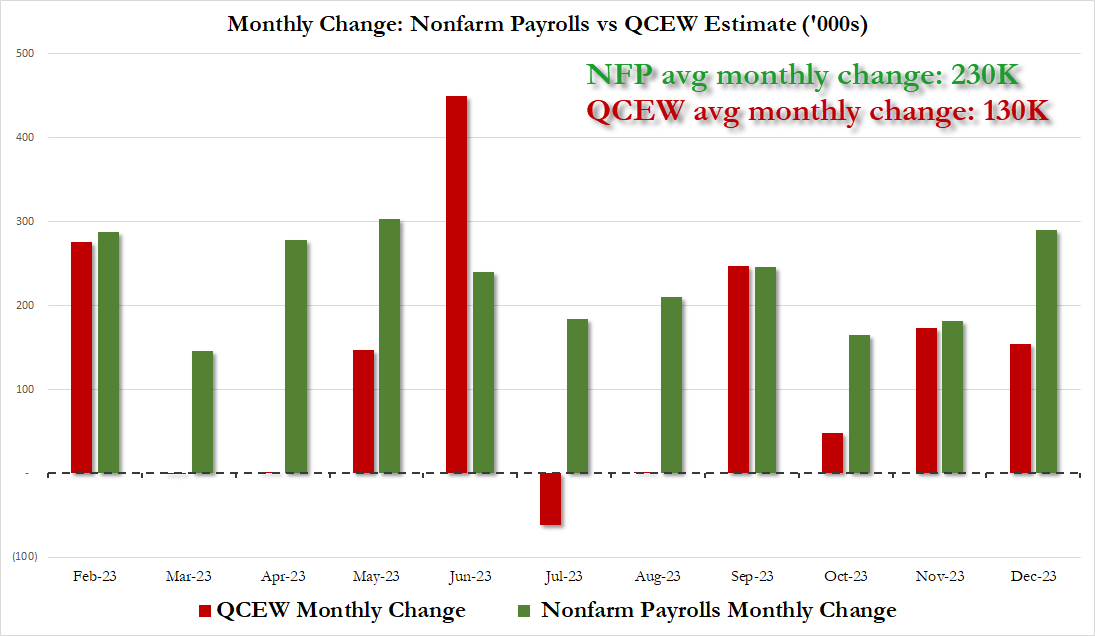

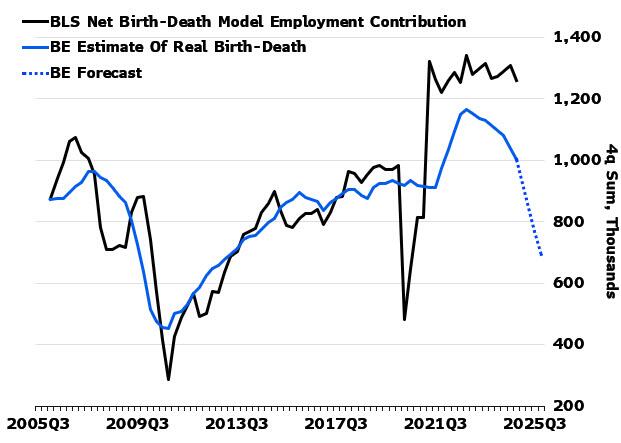

Which is staggering since last night we showed that about 100K monthly jobs are purely statistical distortions, and the real pace of job growth in the past year has been around 130K.

So if 100K jobs per month are fabricated birth/death artifacts (i.e., not real jobs but a statistically goalseeked fudge factor), and another 109K jobs per month are illegal aliens, that leaves just about 11K jobs for everyone else, i.e., law abiding Americans.

It also means that the labor market in the US has – for the past year – been an absolute catastrophe and harbinger of economic disaster (and is why last night we pointed out “The “Unexpected” Reason Why The Fed Will Rush To Cut Rates As Soon As Possible“).

But wait, as Englander himself admits, the 109K estimate of illegal aliens “may be an underestimate since undocumented immigrants often have limited access to benefits, so they may be heavily motivated to find employment. The GDP impact might be lower if these workers are less educated and face language barriers in the work force.”

Here, Englander – who did not do the Birth/Death analysis – writes that if one excludes these illegal immigrant workers, “NFP may be running at c.125k per month” and adds that “such a pace is not recession but is hardly boom time and represents a moderate underlying pace of labor demand. It should make the 231k FY24 pace of headline NFP less worrisome to the FOMC. FOMC participants might be less hawkish if the impact of undocumented immigrants on NFP was well estimated and understood.”

Of course, if the Std Chartered analyst were to factor for the true collapse in Birth-Death adjustments discussed yesterday by Bloomberg…

… the real number would be, well, zero!

While the political reason behind the propaganda misrepresentation of the US jobs market is simple: after all, in an election year it is imperative that the Biden economy be portrayed as glowingly as possible, even if it means lying about everything, the cascading consequences from this fabrication are staggering. As Englander concedes, “this added labor supply also may have shifted trend employment and GDP growth, making it hard to gauge whether a strong NFP or even GDP number reflects supply or demand. If supply is driving upside surprises, the takeaway is more optimism that inflation will slow. If demand, the opposite. Soft economic data should be seen through the lens of added labor supply, while strong data releases are ambiguous.”

Taking a closer look, such increased labor supply – from illegals – should put downward pressure on wage growth relative to a baseline with less immigration (documented or not). In measures such as average hourly earnings, the disinflationary impact would be two-fold:

- lower wages overall from an increase of labour supply relative to labour demand and

- a composition effect because the undocumented immigrants often work in low wage industries even with EADs.

However, this is likely to be a gradual process, so the low wage impact may not be immediately visible. In addition, insofar as these workers’ wages reflect relatively low productivity, the composition effect on wages will be offset by a composition effect on productivity – unit labour cost growth may be unchanged.

These observations notwithstanding, one can assume that the contribution of undocumented immigrants to employment is unlikely to change any time soon. Indeed, over the last 12 months an average of 280k undocumented immigrants per month have been encountered nationally, most whom can or will be eligible to work legally in coming months. The same methodology suggests that these workers contributed about one-third of FY23 employment growth.

It gets worse.

The Congressional Budget Office (CBO) estimated that in fiscal 2023 a further 860k individuals crossed the border without contact with US immigration authorities. While these people are not eligible for EADs they may still work off the books or with fake or borrowed documents. As such, their output and spending will show up in GDP, although it is unlikely that much if any of their “labor input” is captured. These, along with others (tourists who overstay visas, students whose visas have expired, etc.) are technically undocumented as well. But since few are eligible for EADs, it is unlikely that they are captured in any BLS survey.

In any event, Englander estimates that over 800k undocumented immigrants found jobs in FY23, and assumes that 64.2% of EAD recipients (the average for the foreign-born population) are working. However, the employment rate may well be higher since these are likely to be “very motivated” workers, since they are not generally eligible for unemployment insurance and other benefits, so work is a necessity for many.

Ssing this calculation, and since Nonfarm Payrolls grew 3.1 million in FY23, the 800k would represent more than 25% of NFP growth.

But what about those record numbers of multiple job-holders we have also discussed.

Ah yes, to address that Englander next calculates an augmented version of NFP that includes agricultural workers, self- and family-employed workers from the household survey (CPS), and subtracts multiple-job holders. By this measure employment grew 2.7 million (this is largely due to a rise in multiple-job holders, which are subtracted to avoid double counting). So far in FY24, on average over 170k undocumented immigrants have received EAD approvals every month and c.109k have found work based on employment rates. And since NFP has averaged 230k per month, these workers likely accounted for around half of job growth. Again, this number excludes the roughly 100k per month addition coming from birth/death calculation distortions which will soon be revised away as Bloomberg’s chief economist Anna Wong calculated, before concluding that “by the end of the year the printed level of nonfarm-payrolls for 2024 likely will overstate true employment by at least one million.”

Again, this means that when stripping away the 100K in statistical “jobs” from the 230K monthly payroll number, and then removing the 109K in illegal alien workers, the number of jobs added by ordinary, legal, native-born, Americans in the past year has been – more or less – zero.

We, for one, can’t wait for Joe Biden to explain how this was remotely possible during his upcoming debate with Trump in three weeks time.

Much more in the full must-read note – especially to those who will be prepping Donald Trump for his upcoming debate – from Englander available to pro subscribers in the usual place.

]]>The U.S. economy’s annual growth rate slowed more than expected to 1.1% in the first quarter of 2023, according to GDP statistics released by the Bureau of Economic Analysis (BEA) on Thursday morning. The vast majority of the financial sector agrees the economy will continue facing difficulties this year as over a dozen large banks predicted poor growth or a recession, according to Politico.

“The U.S. economy is unwell, and it’s starting to show,” Chief Economist at EY-Parthenon Gregory Daco tweetedThursday morning.

Growth was 2.6% in the fourth quarter of 2022, and economists had expected 2% growth for the first quarter of 2023, according to The Wall Street Journal. “Today, we learned that the American economy remains strong, as it transitions to steady and stable growth,” Biden said in a statement on the GDP.

“We continue to expect economic growth to slow, and we are preparing for a range of scenarios,” Wells Fargo CEO Charlie Scharf said on a first-quarter earnings call on April 14.

Other financial executives are making comparable remarks during earnings calls as well, although few are forecasting a major economic downturn, according to Politico.

“Our research team continues to predict a shallow recession that will occur beginning in the quarter three of 2023,” Bank of America CEO Brian Moynihan said on a first-quarter earnings call on April 18.

Consumers experienced continuing inflation and rising interest rates, contributing to a decline in retail spending in February and March, according to the WSJ. Home sales and manufacturing output also decreased in March.

The Federal Reserve has been hiking interest rates in an effort to lower inflation and has raised them to a target range of 4.75-5%.

“I’ve never been more optimistic about America’s future,” Biden has repeatedly stated.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

]]>The widespread selling that we saw on Tuesday was more than just a little bit frightening. The Dow just kept plunging throughout the day, and the S&P 500 and the Nasdaq actually performed even worse than the Dow did…

The Dow Jones Industrial Average slid 1,276.37 points, or 3.94%, to close at 31,104.97. The S&P 500 dropped 4.32% to 3,932.69, and the Nasdaq Composite sank 5.16% to end the day at 11,633.57.

Just five stocks in the S&P 500 finished in positive territory. Tech stocks were hit particularly hard, with Facebook-parent Meta skidding 9.4% and chip giant Nvidia shedding 9.5%.

This was the worst day for stocks since the early days of the pandemic. But one bad day does not make a crisis.

Hopefully tomorrow will be better. But when you compare the current behavior of the stock market to how it behaved just prior to the crash of 2008, the similarities are astounding.

If you doubt this, just check out this chart.

It certainly isn’t going to take much to spark a massive rush for the exits. If a bad inflation number can cause the sort of stampede that we witnessed on Tuesday, what would happen if we received some really bad news?

Not that I am downplaying the severity of the inflation report. Consumer prices have now been going up for 27 months in a row, and what is happening to food is especially alarming…

The Consumer Price Index (CPI) report released today by the Bureau of Labor Statistics showed that prices on all items in the United States increased by 8.3 percent from August of 2021 to August of 2022, with the price of gasoline rising 25.6 percent, the price of electricity rising 15.8 percent and the price of food rising 11.4 percent.

The report indicated that the 11.4 percent year-to-year increase in the price of food was the highest in 43 years.

If you have been to the supermarket lately, you already know that food prices have risen to very painful levels.

And some of our most important staples such as milk, flour and eggs are leading the way…

Americans browsing the supermarket aisle will notice most food items are far more expensive than they were a year ago. Egg prices soared 39.8%, while flour got 23.3% more expensive. Milk rose 17% and the price of bread jumped 16.2%.

Meat and poultry also grew costlier. Chicken prices jumped 16.6%, while meats rose 6.7% and pork increased 6.8%. Fruits and vegetables together are up 9.4%.

The “experts” at the Fed don’t seem to understand that hiking interest rates won’t fix this.

We are in the early stages of a historic global food crisis that is going to be with us for a long time to come. The biggest reason why food prices are increasing so aggressively is because there simply isn’t enough supply.

So the Fed can try to hammer demand as much as it wants, but people are still going to have to buy food and hiking interest rates is not going to help us produce any additional food. If anything, higher rates may put a damper on food production.

This is a totally different environment from the early 1980s, and those that believe that higher rates will tame inflation like they did back then are just being delusional.

But just like we saw back in 2008, higher rates will crush the U.S. housing market and the economy as a whole.

During a recent interview, billionaire John Catsimatidis asked the Federal Reserve to stop raising rates because if we stay on the path that we are on it will “destroy the rest of the country”…

So I call upon the Federal Reserve…If we keep raising interest rates, we’re going to destroy the rest of the country.

Somebody has to stand up and say it doesn’t have to happen. And they’re going to destroy the rest of the country. And there is a recession, it could turn into a depression.

Are you willing to go through an economic depression just to get the inflation rate back down to acceptable levels?

If not, that is too bad, because the Federal Reserve is not accountable to you.

And we are already starting to see signs that higher rates are having a really negative impact on hiring plans…

Based on the latest data from U.S. small businesses (SMBs), the demand for labor has declined again, with nearly two out of every three (63%) putting their hiring on hold because they can’t afford to add staff, and 10% of that group is laying off workers.

This decline is quite significant, as it’s 18% higher than it was in July (at just 45%). Beyond that, the percentage reducing their staff jumped 6% to 10% this month from just 4% in July.

Just like in 2008, vast numbers of Americans will lose their jobs in the months ahead.

Are you sure that your job is secure?

Economic conditions are rapidly deteriorating all around us, and our short-term problems could get a whole lot worse if 100,000 railroad workers decide to initiate a work stoppage on Friday…

President Biden and senior administration officials are working with others in the transportation industry, including truckers, shippers, and air freight, for “contingency plans” if a rail shutdown materializes at the end of the week, a White House official told Bloomberg.

The administration is trying to understand what supply chains could be disrupted the most — and how to utilize other forms of transportation to ensure commodities and consumer goods continue to flow across the country.

More than 100,000 railroad workers could walk off the job on Friday if freight-rail companies and unions don’t reach labor agreements.

Let us hope that such a work stoppage can be avoided.

But even if it can, there is no short-term hope on the horizon.

Our current crop of leaders is the worst in all of U.S. history, and they have us on a path that leads to national economic suicide.

So many of us have been pleading with Fed officials to stop raising rates, because higher rates will absolutely cripple our economy.

Unfortunately, they don’t really care what any of us think, and they have made it quite clear that more extremely foolish rate hikes are dead ahead.

I would encourage you to brace yourself for a full-blown national economic meltdown, because that is precisely where the Fed’s policies will take us.

***It is finally here! Michael’s new book entitled “7 Year Apocalypse” is now available in paperback and for the Kindle on Amazon.***

About the Author: My name is Michael and my brand new book entitled “7 Year Apocalypse” is now available on Amazon.com. In addition to my new book I have written five other books that are available on Amazon.com including “Lost Prophecies Of The Future Of America”, “The Beginning Of The End”, “Get Prepared Now”, and “Living A Life That Really Matters”. (#CommissionsEarned) When you purchase any of these books you help to support the work that I am doing, and one way that you can really help is by sending digital copies as gifts through Amazon to family and friends. Time is short, and I need help getting these warnings into the hands of as many people as possible.

I have published thousands of articles on The Economic Collapse Blog, End Of The American Dream and The Most Important News, and the articles that I publish on those sites are republished on dozens of other prominent websites all over the globe. I always freely and happily allow others to republish my articles on their own websites, but I also ask that they include this “About the Author” section with each article. The material contained in this article is for general information purposes only, and readers should consult licensed professionals before making any legal, business, financial or health decisions.

I encourage you to follow me on social media on Facebook and Twitter, and any way that you can share these articles with others is a great help. These are such troubled times, and people need hope. John 3:16 tells us about the hope that God has given us through Jesus Christ: “For God so loved the world, that he gave his only begotten Son, that whosoever believeth in him should not perish, but have everlasting life.” If you have not already done so, I strongly urge you to ask Jesus to be your Lord and Savior today.

Article cross-posted from The Economic Collapse Blog.

]]>