- Watch The JD Rucker Show every day to be truly informed.

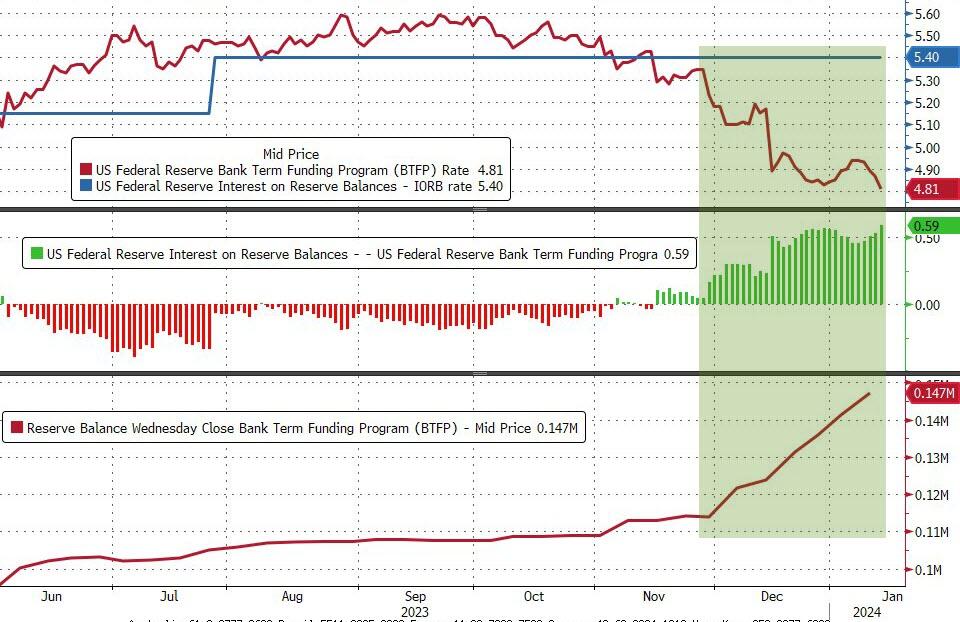

(Zero Hedge)—Bank reserves at The Fed rose considerably last week expanding The Fed’s balance sheet by the most since the SVB crisis last March – as usage of The Fed’s BTFP bank-bailout facility pushed to a new record high (amid increasing arbitrage flows).

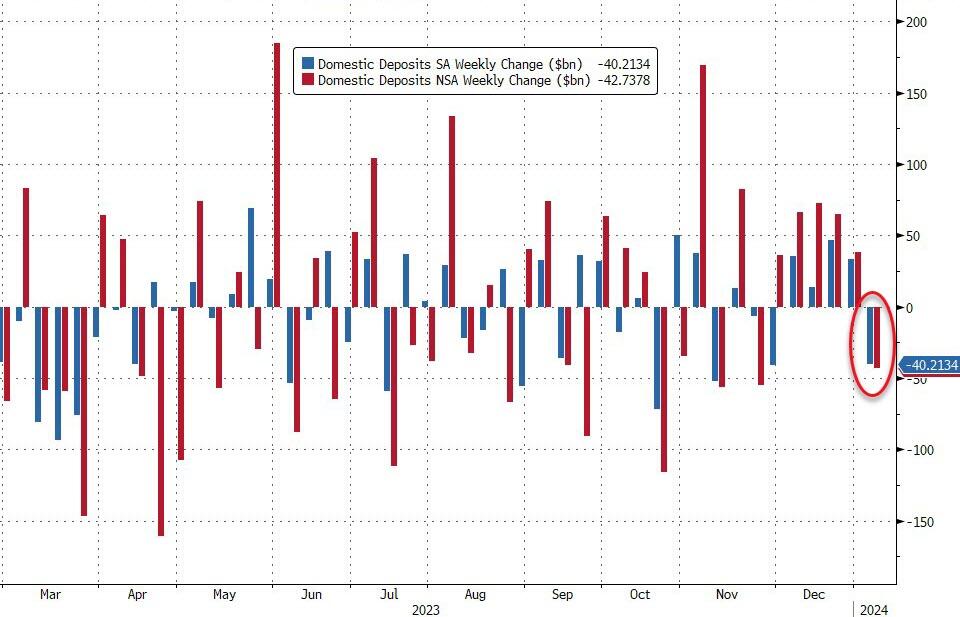

But, after four straight weeks of inflows, seasonally-adjusted bank deposits saw $23.3BN outflows in the first week of 2024…

And, on a non-seasonally-adjusted basis, deposits also saw an outflow (-$33.7BN) after five weeks in a row of inflows (NSA)…

Which means that while money-market funds hit a new record high, bank deposits did pull back a little (despite the drain in RRP filling the liquidity gap)…

Excluding foreign bank flows, domestic banks saw deposit outflows of just over $40BN (SA and NSA) – the first in 5 weeks…

Large banks dominated that deposit outflow (Large -$39.9BN, Small -$347MN)…

On the other side of the ledger, Large bank loan volumes tumbled (-$16.6BN) for the 5th week in row (small bank loan volume rose $4.3BN)…

The Fed’s reverse repo facility is draining fast (faster each week), getting closer and closer to zero…

…at which point reserves get yanked, which mean huge deposit flight.

And the embarrassing surge in usage of The Fed’s BTFP for free-money-arbitrage…

…will make it hard for The Fed to defend leaving the facility open after March when its “temporary” nature is supposed to expire.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

Which means, as we pointed out earlier in the week, “March will be lit”…

March will be lit:

1. Reverse repo ends

2. BTFP expires

3. Fed cuts (allegedly)

4. QT ends (allegedly)— zerohedge (@zerohedge) January 8, 2024

Because without the help of The Fed’s BTFP, the regional banking crisis is back bigly (red line), and large bank cash needs a home – green line – like picking up a small bank from the FDIC…

And now you know why The Fed will cut rates in March – no matter what jobs or inflation is doing.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.