- Watch The JD Rucker Show every day to be truly informed.

The oddities in the US labor market continue.

Article by Tyler Durden at Zero Hedge.

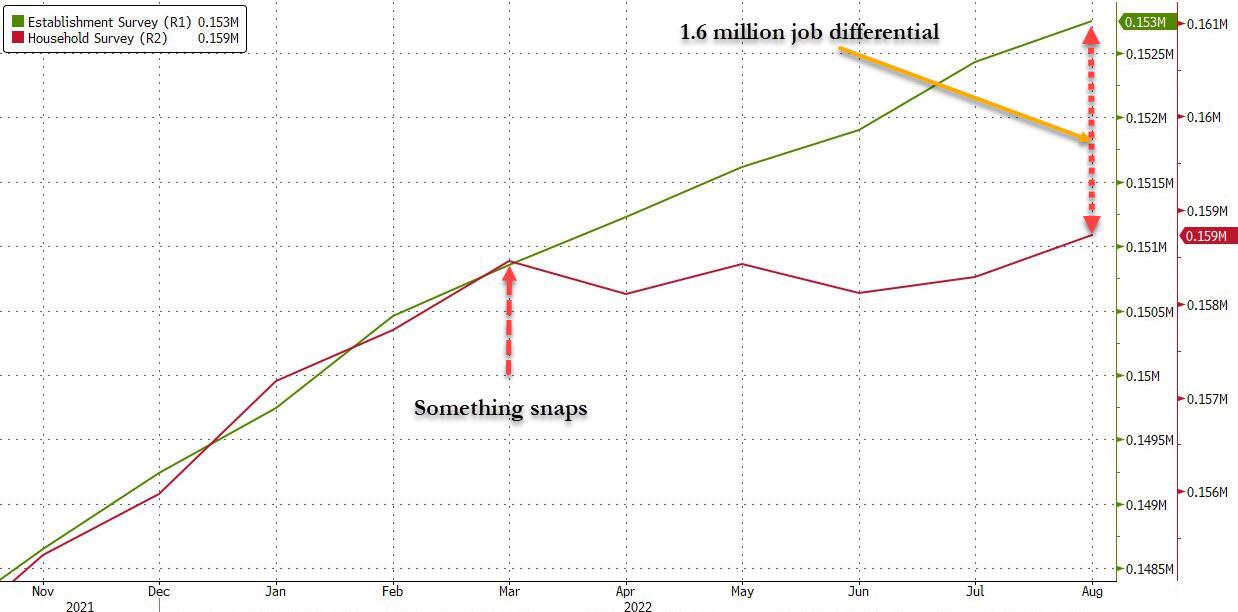

Recall one month ago we showed that a stark divergence had opened between the Household and Establishment surveys that make up the monthly jobs report, and since March the former was sliding while the latter was rising every single month. In addition to that, full-time jobs were plunging while multiple jobholders soared near all time highs.

Fast forward to today when the inconsistencies grow and in some cases have becoming downright grotesque.

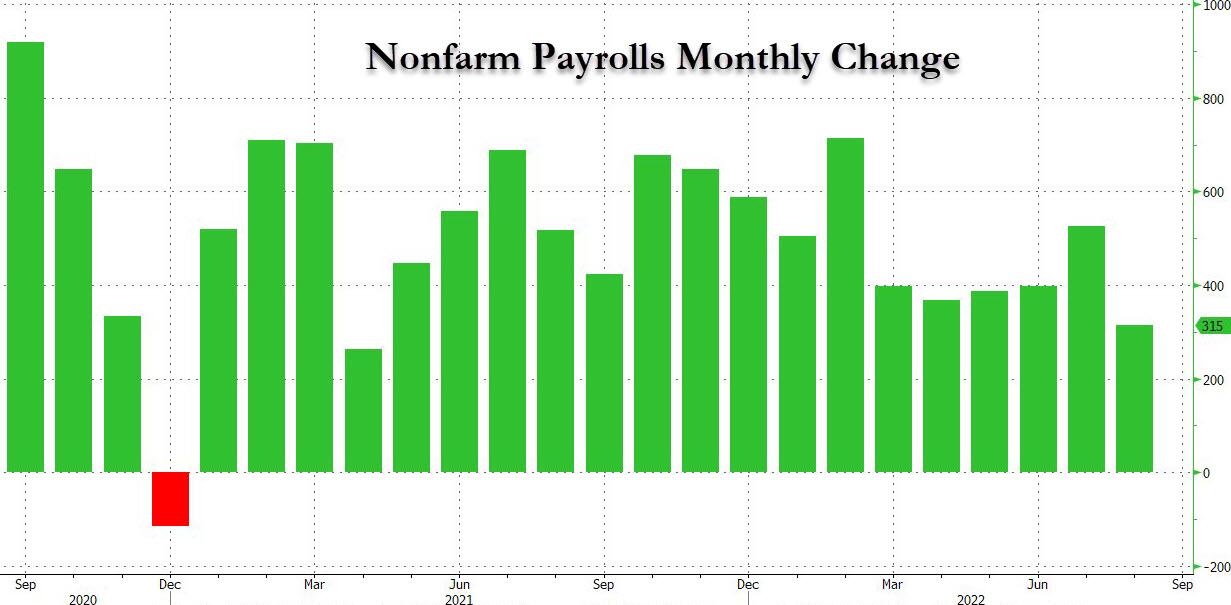

Consider the following: the closely followed establishment survey came in above expectations at 315K, yet it was well below last month’s 526K print, with June unexpectedly revised sharply lower by 105K from 398K to 293K…

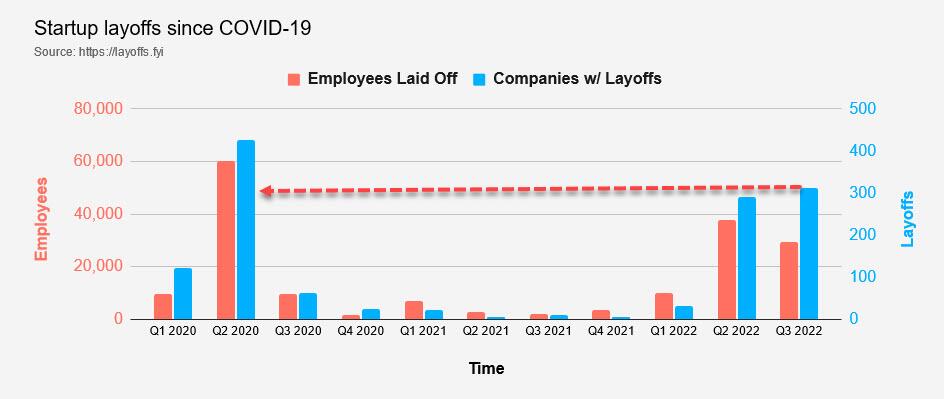

… revisions which will go toward reducing the huge gap that has grown between the Household and the Establishment survey, although not nearly enough and as Academy Securities’ strategist Peter Tchir writes, “look for more revisions as last month’s surprisingly good result wasn’t revised much.” Of course, there is a problem with the above: all of these numbers are complete bullshit, and to believe them, one has to disregard and ignore the mass layoffs announced by US corporations and tracked by handy third-party websites such as Layoffs which shows that in recent months and quarter, the US has been swept by near record layoffs, on part with those observed during the peak of the covid crisis!

And speaking of the gap between the Household and Establishment survey which we have been pounding the table on in recent months, it narrowed modestly thanks to a 442K jump in the number of employed workers (tracked by the Household survey) offsetting a more modest increase in employment, which rose 315K (tracked by Establishment survey). And while the rebound in the Household was long overdue, there is a long way to go as the following chart shows, demonstrating that the gap that opened in March has since grown to a whopping 1.6 million “workers” which may or may not exist anywhere besides the spreadsheet model of some BLS political activist.

Of course, there is a reason why the Household survey would want to take its time in catching up to the establishment survey: since the direct variable in the red line above is the number of employed workers, which in turn drive the number of unemployed workers and thus, the unemployment rate (as a function of the civilian labor force), any overly aggressive increases here will lead to a disproportionate increase in the unemployment rate. So Biden’s apparatchiks have to pick their poison.

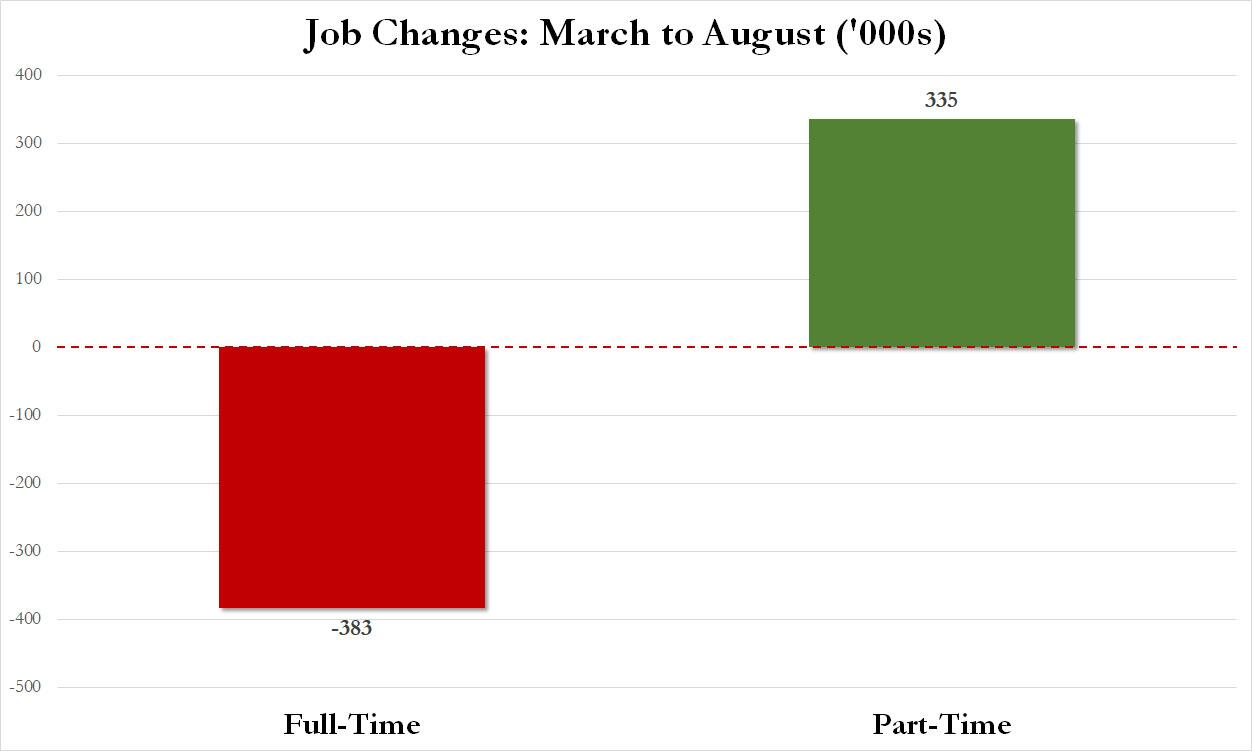

But wait, there’s more because digging deeper, we find that the latest (overdue) jump in Household Survey employment was entirely the result of rising part-time jobs, which surged by 413K in August, while full-time jobs declined by 242K.

More ominously, if one extends this data, we find that since March, the US has lost 383K higher paying full-time employees, while gaining 335K low-paid part-time employees. Again, this is a time period over which the Establishment survey claims – without a breakdown in job quality – that 1.9 million total jobs have been added.

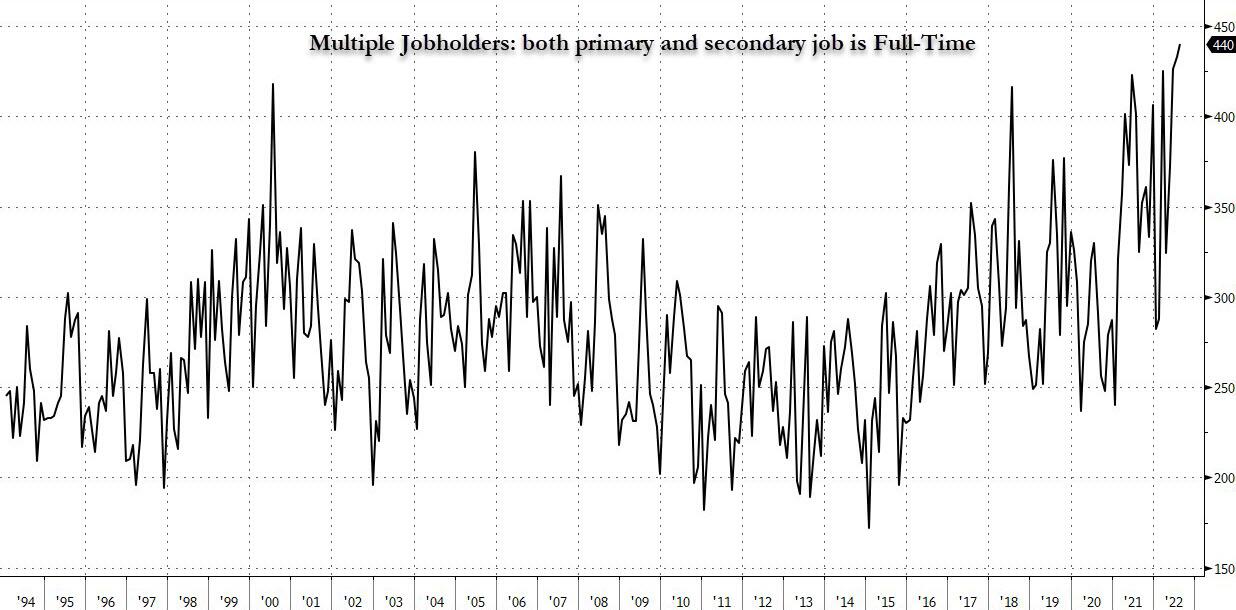

And even more remarkable: the number of multiple jobholders whose primary and secondary jobs are both full-time just hit another record high! Hardly the sign of a strong job market, one where people can afford to quit jobs at will.

So what’s going on here? The simple answer: Fewer people working, but more people working more than one job, a rotation which picked up in earnest some time in March and which has only been captured by the Household survey.

And since the Establishment survey is far slower to pick up on the nuances in employment composition, while the Household Survey has gone nowhere since March (which has benefited the low unemployment rate), the BLS data engineers have been busy goalseeking the Establishment Survey (perhaps with the occasional nudge from the White House especially now that the economy is in a technical recession) to make it appear as if the economy is growing strongly, when in reality all they are doing is applying the same erroneous seasonal adjustment factor that gave such a wrong perspective of the labor market in the aftermath of the covid pandemic (until it was all adjusted away a year ago). In other words, while the labor market is already cracking, it will take the BLS several months of veering away from reality before the government bureaucrats accept and admit what is truly taking place.

We expect that “realization” to take place a few hours after the midterms, because the last thing the Biden administration can afford is admit the labor market is collapsing at a time when true inflation – the one tracking items most people spend their money on – is not 8.5% but is over 30%…

Inflation for items most people spend majority of their income on 👇 8,5% wouldn’t be that bad. (Charles Schwab) pic.twitter.com/pWQs5OApDF

— Michael A. Arouet (@MichaelAArouet) August 11, 2022

Five Things New “Preppers” Forget When Getting Ready for Bad Times Ahead

The preparedness community is growing faster than it has in decades. Even during peak times such as Y2K, the economic downturn of 2008, and Covid, the vast majority of Americans made sure they had plenty of toilet paper but didn’t really stockpile anything else.

Things have changed. There’s a growing anxiety in this presidential election year that has prompted more Americans to get prepared for crazy events in the future. Some of it is being driven by fearmongers, but there are valid concerns with the economy, food supply, pharmaceuticals, the energy grid, and mass rioting that have pushed average Americans into “prepper” mode.

There are degrees of preparedness. One does not have to be a full-blown “doomsday prepper” living off-grid in a secure Montana bunker in order to be ahead of the curve. In many ways, preparedness isn’t about being able to perfectly handle every conceivable situation. It’s about being less dependent on government for as long as possible. Those who have proper “preps” will not be waiting for FEMA to distribute emergency supplies to the desperate masses.

Below are five things people new to preparedness (and sometimes even those with experience) often forget as they get ready. All five are common sense notions that do not rely on doomsday in order to be useful. It may be nice to own a tank during the apocalypse but there’s not much you can do with it until things get really crazy. The recommendations below can have places in the lives of average Americans whether doomsday comes or not.

Note: The information provided by this publication or any related communications is for informational purposes only and should not be considered as financial advice. We do not provide personalized investment, financial, or legal advice.

Secured Wealth

Whether in the bank or held in a retirement account, most Americans feel that their life’s savings is relatively secure. At least they did until the last couple of years when de-banking, geopolitical turmoil, and the threat of Central Bank Digital Currencies reared their ugly heads.

It behooves Americans to diversify their holdings. If there’s a triggering event or series of events that cripple the financial systems or devalue the U.S. Dollar, wealth can evaporate quickly. To hedge against potential turmoil, many Americans are looking in two directions: Crypto and physical precious metals.

There are huge advantages to cryptocurrencies, but there are also inherent risks because “virtual” money can become challenging to spend. Add in the push by central banks and governments to regulate or even replace cryptocurrencies with their own versions they control and the risks amplify. There’s nothing wrong with cryptocurrencies today but things can change rapidly.

As for physical precious metals, many Americans pay cash to keep plenty on hand in their safe. Rolling over or transferring retirement accounts into self-directed IRAs is also a popular option, but there are caveats. It can often take weeks or even months to get the gold and silver shipped if the owner chooses to close their account. This is why Genesis Gold Group stands out. Their relationship with the depositories allows for rapid closure and shipping, often in less than 10 days from the time the account holder makes their move. This can come in handy if things appear to be heading south.

Lots of Potable Water

One of the biggest shocks that hit new preppers is understanding how much potable water they need in order to survive. Experts claim one gallon of water per person per day is necessary. Even the most conservative estimates put it at over half-a-gallon. That means that for a family of four, they’ll need around 120 gallons of water to survive for a month if the taps turn off and the stores empty out.

Being near a fresh water source, whether it’s a river, lake, or well, is a best practice among experienced preppers. It’s necessary to have a water filter as well, even if the taps are still working. Many refuse to drink tap water even when there is no emergency. Berkey was our previous favorite but they’re under attack from regulators so the Alexapure systems are solid replacements.

For those in the city or away from fresh water sources, storage is the best option. This can be challenging because proper water storage containers take up a lot of room and are difficult to move if the need arises. For “bug in” situations, having a larger container that stores hundreds or even thousands of gallons is better than stacking 1-5 gallon containers. Unfortunately, they won’t be easily transportable and they can cost a lot to install.

Water is critical. If chaos erupts and water infrastructure is compromised, having a large backup supply can be lifesaving.

Pharmaceuticals and Medical Supplies

There are multiple threats specific to the medical supply chain. With Chinese and Indian imports accounting for over 90% of pharmaceutical ingredients in the United States, deteriorating relations could make it impossible to get the medicines and antibiotics many of us need.

Stocking up many prescription medications can be hard. Doctors generally do not like to prescribe large batches of drugs even if they are shelf-stable for extended periods of time. It is a best practice to ask your doctor if they can prescribe a larger amount. Today, some are sympathetic to concerns about pharmacies running out or becoming inaccessible. Tell them your concerns. It’s worth a shot. The worst they can do is say no.

If your doctor is unwilling to help you stock up on medicines, then Jase Medical is a good alternative. Through telehealth, they can prescribe daily meds or antibiotics that are shipped to your door. As proponents of medical freedom, they empathize with those who want to have enough medical supplies on hand in case things go wrong.

Energy Sources

The vast majority of Americans are locked into the grid. This has proven to be a massive liability when the grid goes down. Unfortunately, there are no inexpensive remedies.

Those living off-grid had to either spend a lot of money or effort (or both) to get their alternative energy sources like solar set up. For those who do not want to go so far, it’s still a best practice to have backup power sources. Diesel generators and portable solar panels are the two most popular, and while they’re not inexpensive they are not out of reach of most Americans who are concerned about being without power for extended periods of time.

Natural gas is another necessity for many, but that’s far more challenging to replace. Having alternatives for heating and cooking that can be powered if gas and electric grids go down is important. Have a backup for items that require power such as manual can openers. If you’re stuck eating canned foods for a while and all you have is an electric opener, you’ll have problems.

Don’t Forget the Protein

When most think about “prepping,” they think about their food supply. More Americans are turning to gardening and homesteading as ways to produce their own food. Others are working with local farmers and ranchers to purchase directly from the sources. This is a good idea whether doomsday comes or not, but it’s particularly important if the food supply chain is broken.

Most grocery stores have about one to two weeks worth of food, as do most American households. Grocers rely heavily on truckers to receive their ongoing shipments. In a crisis, the current process can fail. It behooves Americans for multiple reasons to localize their food purchases as much as possible.

Long-term storage is another popular option. Canned foods, MREs, and freeze dried meals are selling out quickly even as prices rise. But one component that is conspicuously absent in shelf-stable food is high-quality protein. Most survival food companies offer low quality “protein buckets” or cans of meat, but they are often barely edible.

Prepper All-Naturals offers premium cuts of steak that have been cooked sous vide and freeze dried to give them a 25-year shelf life. They offer Ribeye, NY Strip, and Tenderloin among others.

Having buckets of beans and rice is a good start, but keeping a solid supply of high-quality protein isn’t just healthier. It can help a family maintain normalcy through crises.

Prepare Without Fear

With all the challenges we face as Americans today, it can be emotionally draining. Citizens are scared and there’s nothing irrational about their concerns. Being prepared and making lifestyle changes to secure necessities can go a long way toward overcoming the fears that plague us. We should hope and pray for the best but prepare for the worst. And if the worst does come, then knowing we did what we could to be ready for it will help us face those challenges with confidence.