- Watch The JD Rucker Show every day to be truly informed.

(Zero Hedge)—Remember when, in the immediate aftermath of the Ukraine war, Russian oil immediately traded down to a discount of as much as 30% below spot Brent as the entire western world suddenly found itself locked out of access to the most valuable Russian export (which also meant that China and India were the only natural buyers left) and the price of Russian oil had to reflect the explicit plunge in demand?

Well, that’s no longer the case because in the two years since the start of the Ukraine conflict, it became apparent that Western sanctions were merely a theatrical publicity stunt as the alternative – strict enforcement – would have sent oil prices soaring and that would be unacceptable to a Biden administration terrified of losing the November elections if and when oil and gasoline prices surges.

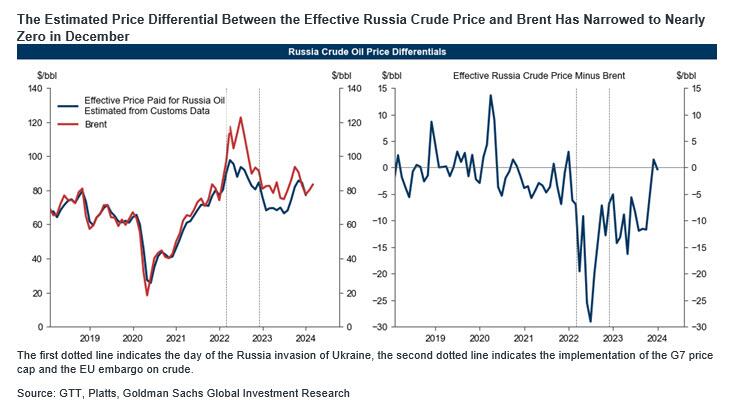

And as fear of enforcement became a non-issue over time, so did the discount of Russian oil to Brent, which brings us to today, and Goldman’s “chart of the week” which illustrates the collapse in the discount on Russian crude oil close to zero relative to Brent, according to the bank’s estimates using the most recent customs data for December.

According to Goldman, which estimates the effective price of Russian crude paid by its trade partners using detailed customs data on import volumes and import payments for Russia crude, this drop in the price discount was primarily driven by the countries outside of the G7 coalition.

However, the discount has also narrowed for most of the buyers as Russian fleets were becoming more capable of operating under the G7 price cap.

The US Treasury’s recent decision to target Sovcomflot, Russia’s state-owned shipping company and fleet operator, comes against the backdrop of the drop in the effective discount late last year and the twin goals of US policymakers to “limiting Kremlin profits while promoting stable energy markets.”

It is also an admission that western attempts to prevent Putin from generating oil export revenues – critical in keeping the Russian war machine going – were either a failure, or merely a theatrical, virtue signaling sleight-of-hand from the beginning. And while the former is bad, the latter is far more disturbing as it suggests that the west has been willingly enabling Putin to sell oil and fund the war in Ukraine, the same war with Western nations are so vocally against.

Almost as if both Russia and the West are aligned in their (shared) goal of keeping the war in Ukraine going to its inevitable and dire, for Zelenskyy, conclusion; it also almost makes one wonder if the destruction of Ukraine – at the hands of Russia with the implicit enabling by the West – was a pre-planned exercise all along.

Full Goldman note available to pro subscribers in the usual place.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.