- Watch The JD Rucker Show every day to be truly informed.

(Zero Hedge)—Two weeks after Rivian Automotive Inc. announced a disappointing production forecast and another round of job cuts, the company’s CEO revealed that the construction of a $5 billion factory in Georgia would be put on hold to reduce costs.

CEO RJ Scaringe unveiled a crossover EV called the R3. The new model will be priced lower than the R2 to increase affordability and boost sales.

Scaringe also surprised investors by announcing its new factory at the Georgia site east of Atlanta would be shelved.

“Rivian’s Georgia plant remains an extremely important part of its strategy to scale production of R2 and R3. The timing for resuming construction is expected to be later to focus its teams on the capital-efficient launch of R2 in Normal, Illinois,” the filing said.

The filing noted that the decision reduced capital expenditures for the automaker by $2.25 billion and “improved cash visibility.”

“Our Georgia site remains really important to us,” Scaringe said, adding, “It’s core to the scaling across all these vehicles, between R2, R3 and R3X. And we’re so appreciative of all the partnerships we’ve had there.”

No timetable was provided to investors about restarting work on the Georgia plant. Local governments have offered Rivian $1.5 billion in incentives to create thousands of jobs at the new plant.

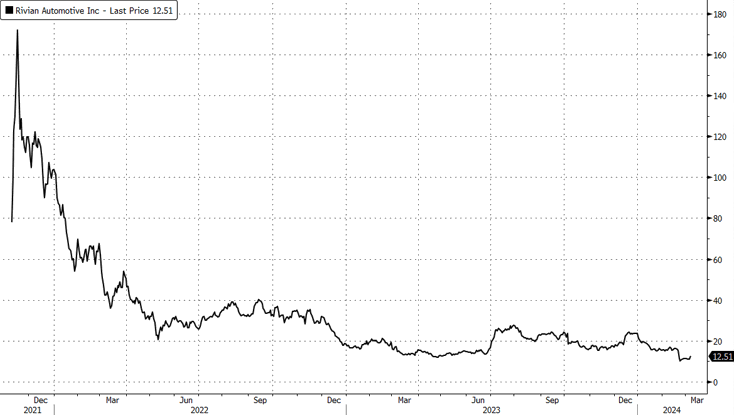

Rivian’s shares jumped more than 13% on Thursday. In premarket trading in New York on Friday, shares are flat. Year-to-date performance has been awful, down 47%.

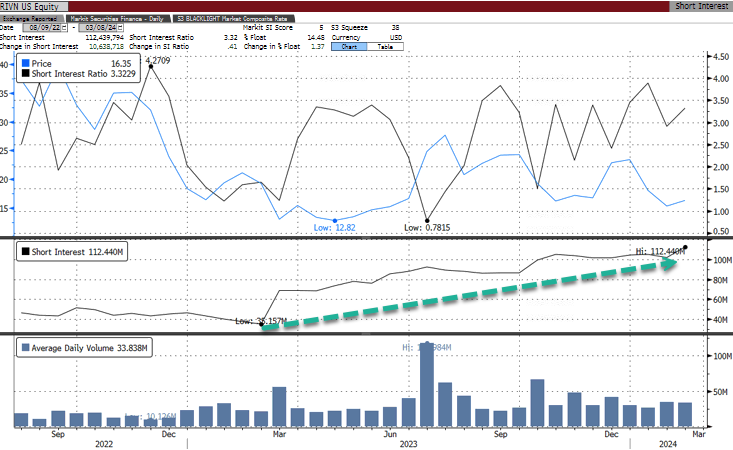

Short interest has surged in Rivian over the past year. Current data from Bloomberg shows 112.4 million shares short, or about 14.5% of the float is short.

Tom Narayan, an RBC Capital Markets analyst, warned in a note this week that Rivian’s financial implications of a lower-priced EV remain uncertain.

“Currently, R1 is losing money,” Narayan said, adding, “The critical question is how will Rivian be able to produce R2 profitably at the $45,000 price point?”

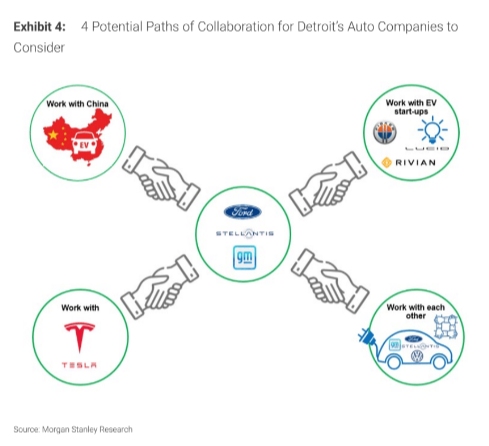

Last month, analyst Adam Jonas at Morgan Stanley penned a note titled “Can EV Slowdown Trigger Auto M&A Wave?”

“EV sentiment is extremely negative… and will eventually deteriorate further, in our view. Legacy OEMs must find a way to balance EV relevancy with capital discipline. Full OEM mergers are complex, politically sensitive and tough to execute. Could ‘merging’ EV projects be more reasonable?” Jonas said.

Consolidation is certainly a theme in the EV space this year.

It’s becoming increasingly clear that fiat currencies across the globe, including the U.S. Dollar, are under attack. Paper money is losing its value, translating into insane inflation and less value in our life’s savings.

Genesis Gold Group believes physical precious metals are an amazing option for those seeking to move their wealth or retirement to higher ground. Whether Central Bank Digital Currencies replace current fiat currencies or not, precious metals are poised to retain or even increase in value. This is why central banks and mega-asset managers like BlackRock are moving much of their holdings to precious metals.

As a Christian company, Genesis Gold Group has maintained a perfect 5 out of 5 rating with the Better Business Bureau. Their faith-driven values allow them to help Americans protect their life’s savings without the gimmicks used by most precious metals companies. Reach out to them today to see how they can streamline the rollover or transfer of your current and previous retirement accounts.